Credit Corp: a cut above its peers

Credit Corp (ASX:CCP) is the first cab off the rank this reporting season. And what a company to start with.

It's the kind of company that lets its investors sleep soundly at night, secure in the knowledge that its solid growth is helmed by experienced, measured leadership.

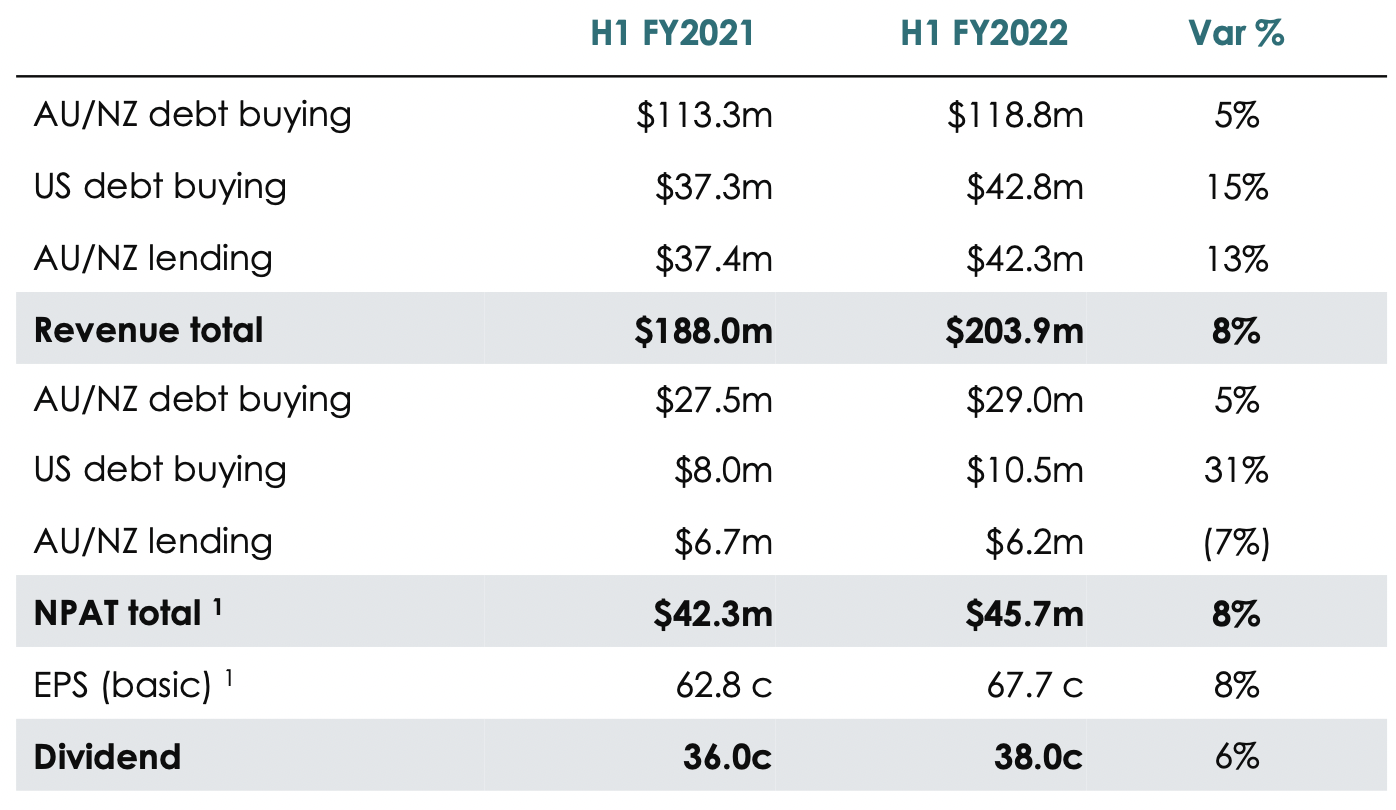

H1 highlights include an 8% increase in net profit after tax (NPAT) to $45.7 million, and 9% growth in the consumer loan book over the half to $200 million.

In this Q&A, James Delaney from Sage Capital explains why CCP is such an attractive proposition.

Without giving too much away, a lot of it boils down to conservative guidance and clean accounting - both hallmarks of strong, transparent leadership.

We'll also cover initial impressions, whether it's a Buy, Hold or Sell, and the outlook.

Source: Credit Corp

Initial impressions

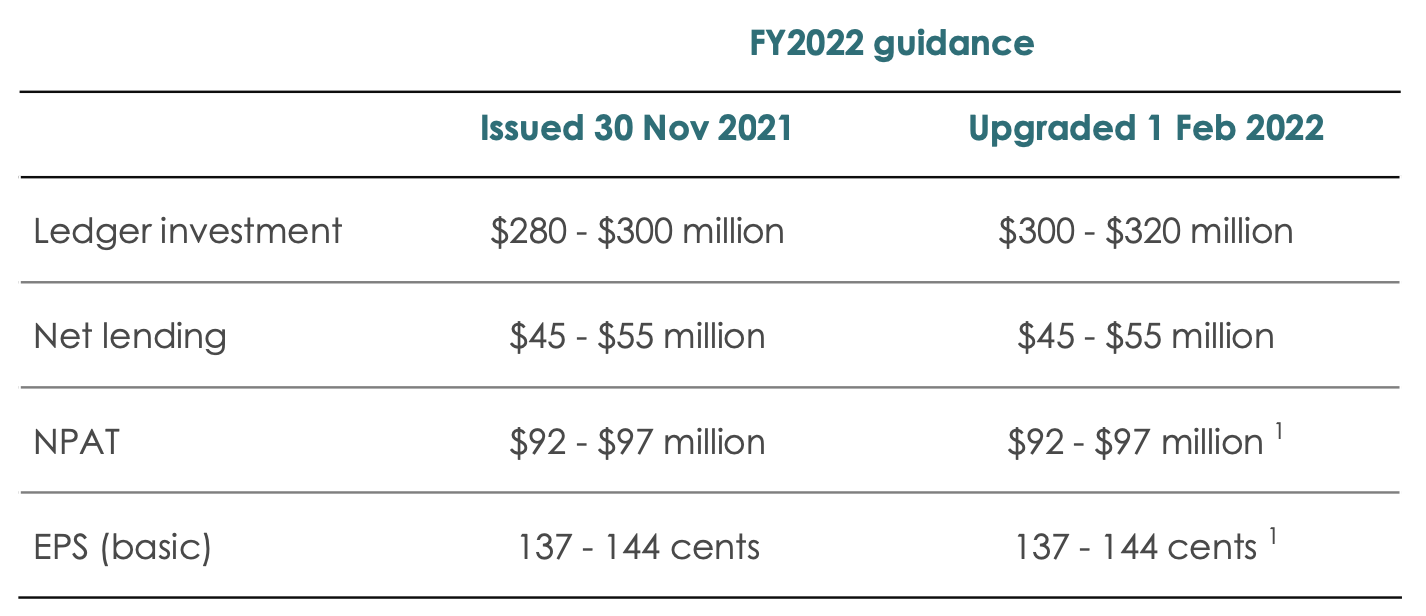

This is a strong result for a business that is tracking to the top end of its November NPAT guidance, which it had upgraded just a few months ago. They further upgraded their purchase debt ledger guidance which will flow through to the bottom line in FY23 and FY24. The net debt result was very strong.

The guidance itself does look a bit conservative to me.

They’re annualising their debt-book acquisition, which will have a strong impact in the second half, and they’re forecasting a $4 million second-half swing in their consumer lending division. Adding that gets you $8 million added in first-half profit which gets you well over the top end of the guidance.

I’d be looking for an NPAT over $100 million for the full year, versus their current guidance of $92 to $97 million.

Source: Credit Corp

How did the market react to the results?

It was a small rally, it went up by 3% today, and that’s probably a reasonable reaction given it’s been up 10% versus the market over the last month. I think what the market will look for is further deployment of capital and further acquisition of debt ledgers.

Any curveballs from the result that investors should be aware of?

They’re usually very clean results from Credit Corp. The thing that took us by surprise was the bounce back in credit demand, with the consumer lending book in particular.

The stimulus and super withdrawal affects suppressed willingness to take out new credit card debt and personal loan debt, but this has now dissipated – particularly in November and December.

So that step up in lending is where Credit Corp takes an ultra conservative approach. It decreases profit as soon as the loan is taken by Credit Corp. So, the higher lending growth actually impacted underlying profit growth, suppressing what was still a pretty strong result.

Is it a buy, hold or sell?

It’s a Buy from us. Credit Corp have a great record of disciplined reinvestment. They’re currently net cash with plenty of capacity on the balance sheet. Management have a great long-term track record and very clear long-term incentives that have a return on equity hurdle.

We see them as very strong stewards of shareholder capital, and that’s why we hold a position.

Another factor that’s important to us is the cleanliness of their accounts, which makes them very easy to follow what they’re doing and believe the story. Peers in the space have run into trouble utilising aggressive accounting to temporarily boost short-term profit.

And some of these peers Credit Corp has been able to buy books off over the last 12-24 months for very attractive prices.

What are your expectations for the company and industry, and how is Credit Corp positioned relative to its peers?

We’ve seen two slow years in the US and Australian consumer credit markets, and this is starting to rebound as stimulus measures are waned and now credit is being consumed. You’re starting to see increases in credit card balances and over time this leads to more bad debt sold. So the addressable market is likely to expand over the next few years, and the potential for them to deploy capital into the next few years looks very interesting to us.

Their peers are shadows of what they were pre-COVID. A lot of them got into trouble with their aggressive accounting, and have sold books to Credit Corp.

In the US, Credit Corp were a small fish in a large pond, and already that’s changing quite quickly.

1 stock mentioned