Does the average stock outperform cash? No

Ellerston Capital

The title almost seems nonsensical – of course we know the stock market does better than cash through time, so let’s start with a question: What is the average annual return for US equities over 90 years? OK, got that in your head? Now what do you think the average stock return is over 90 years?

If you said 7%, for the first one you would be spot on. If you said the most frequent outcome was a loss of 100% of your capital for the second question, you were right.

This is what is called the positive skew that exists in equity markets: most of the gains that come from holding equities come from a very small subset of stocks. Positive skew occurs when the median falls below the average. People’s wealth and incomes have this distribution for example, skewed by a few billionaires.

A paper by Bessembinder shows that 58% of stocks have lifetime holding period returns less than the one month T-Bills (cash) and less than half are even positive. The average lifespan of a US equity is just over seven years.

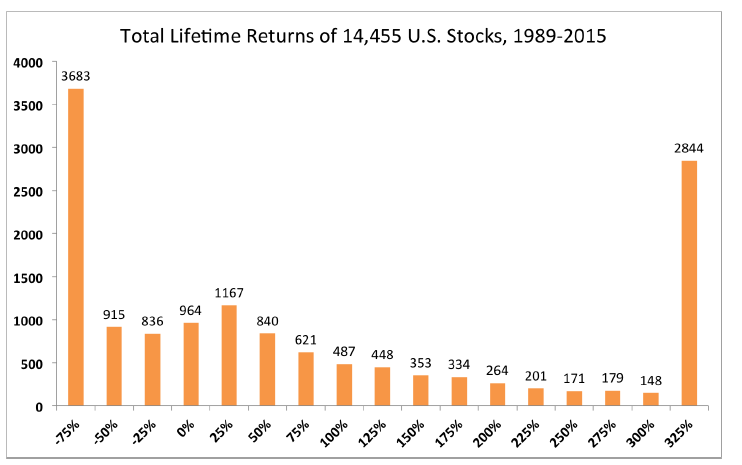

On the other side, the skew is incredible. Of the 26,000 stocks listed in the US since 1926, 86 stocks generated over 50% of the total return. The next top 1000 generated all the excess returns over cash, while the remaining matched cash. The chart below is from a similar study, but only since 1989, and gives you a graphical sense:

(Source: Heaton, Polson, Witte: Why Indexing works)

So what does this mean for equity investing? Well, it has some quite stark outcomes that are not good for active managers or allocators. Amongst active managers, in response to passive investing pressures, it is popular to create high conviction funds to enable the manager to focus only on their top picks and get them away from “benchmark hugging” to pursue their best ideas. Which all sounds great in theory but it’s a deductive fallacy.

Heaton, Polson, and Witte distill the statistical argument into a straightforward five-page paper that uses a simple illustration of why this skew is so bad for high conviction active managers. Simply, they are unlikely to end up with one of the few winners in their portfolio.

Say you have five poker chips, four worth $10 and one worth $100. The five chips have an average value of $28, but what if you reach into the bag and pull out two chips over and over? That’s roughly how mutual funds approach stocks, with managers picking portfolios that are subsets of the broader group.

The issue is, the majority of selections will fail to snag the $100 chip. Mathematically, there is an average value of $56 across the 10 two-chip combinations—the problem is, 6 of 10 times you’ll grab a pair with a sum of $20. The same thing happens with stocks chosen from a benchmark with a positive skew.

A lot has been written about fees being the main drag on performance, but I am yet to see anyone write about positive skew issues in manager selection. Even the most ardent active manager must find it somewhat ironic that the industry’s response to passive investing has only succeeded in making the problem of perception of underperformance at the aggregate level worse!

For individual investors, it suggests that they are better off putting their money into an index than selecting their own “high conviction” stock portfolios, though that in itself is hardly new news – we already know that individuals overtrade; attempt to market time; and exhibit disposition effects.

For asset allocators, it suggests that choosing a manager is even more difficult than first thought – after all they are most likely to find a manager in 2/3’s of our example rather than the 1/3.

For money managers, it suggests pivoting away from conviction investing and returning to diversification and getting rid of this fad of “high active share”. AQR has already written on the futility of active share. These findings would suggest that good stock pickers would have more success if they focused on market neutral investing rather than long versus benchmark investing (though that would require most long investors to move beyond their current skill set).

Lastly, given I run an active fund, how do we approach this? Our fund runs a barbell approach of choosing active stocks where we have conviction, and investing the rest in versions of an index. We also run market neutral and short positions within the portfolio. This negates a large part of the positive skew issue. I’d suggest that you may see more of this type of investing emerge through time.

For more information and additional insights from Morphic Asset Management, please click here

Chad co-founded Morphic Asset Management in 2012. As a stock picker Chad is also a generalist but has strong regional knowledge of Europe and the Americas. He has also been awarded the CFA Charter.

Expertise

Chad co-founded Morphic Asset Management in 2012. As a stock picker Chad is also a generalist but has strong regional knowledge of Europe and the Americas. He has also been awarded the CFA Charter.