Economists are idiots!

As a long-time card-carrying member of the economics fraternity I don’t say this lightly: economists are idiots. Worse still, the forecasts made by the economics community collectively are directly influencing policy decisions at the Federal Reserve, which risk deepening the already likely recession in 1H 2023.

Many readers may need little other proof that economists are idiots other than casual observation. The proof, though, comes not only through their collective inability to first detect the inflation shock of the past two years in advance; it is that they have yet to acknowledge that the source of the inflation shock has rapidly reversed.

Of course, this is not the first time that economists have collectively failed to detect important economic events in advance, and it certainly won’t be the last. However, in a quirk of fate, global monetary policy has arguably never been more influenced by the collective forecasts of private sector forecasters than they are today.

The rationale for this increased influence is not because the Fed is actively engaging with more economists. It is because the Fed quietly changed how it decided to implement monetary policy in 3Q 2020. This calibration of monetary policy to a new model of long run inflation gives excessive weight to the forecasts of professional economists.

The champion of this change in monetary policy implementation was Richard Clarida, then Vice Chairman of the Federal Reserve and who acted as the economic policy wonk for its non-economist Chair Powell. Now, there is nothing inherently wrong with trying to build a better mouse trap to gauge the vast and varying quality of inflation expectation survey points.

Indeed, we noted the shift by the Fed to embrace this new inflation expectation model at the time and we puzzled over the decision to only show the output of this model on a quarterly basis and with a lag (so we replicated the model and converted to a monthly model). As soon as Clarida signalled the new framework, inflation expectations commenced rising steadily. This became a key plank in our forecast for early and sustained Fed rate hikes.

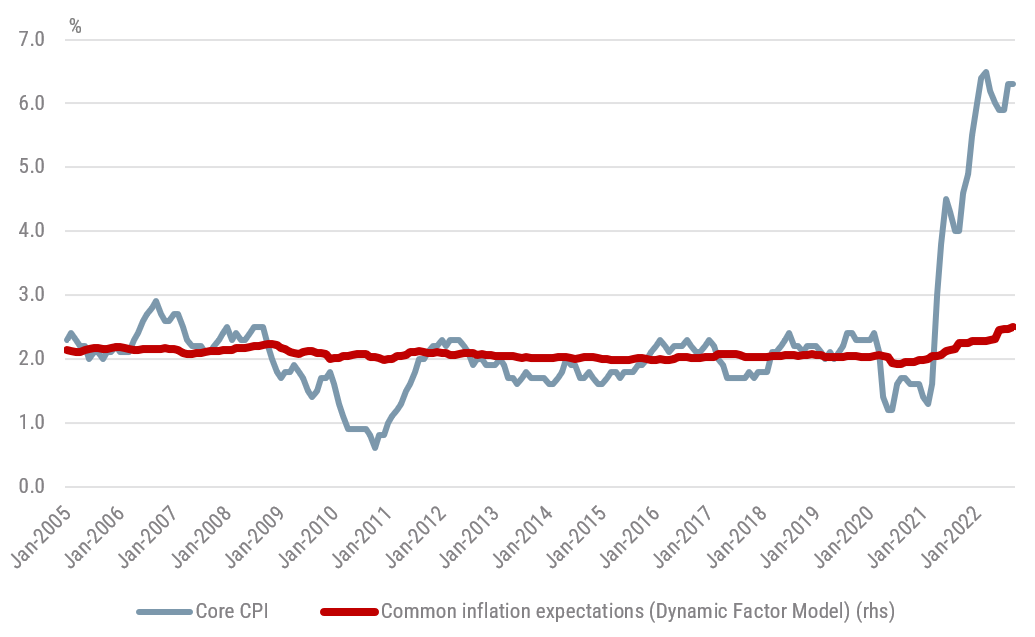

Chart 1: USA: Common Inflation Expectations and Core Inflation

Source: Yarra, Nov 2022.

The Fed’s official Common Inflation Expectations (CIE) model is currently only estimated up to the June quarter of 2022. As Chart 1 shows, it’s more than likely that when the Fed publishes their next update that their CIE model will rise again, and this has no doubt helped reinforce the hawkish rhetoric that has come from all Fed officials in recent weeks. The idea here is that the Fed is still so worried by the rise in inflation expectations becoming embedded that they will commit to an ongoing series of rate rises in the coming months.

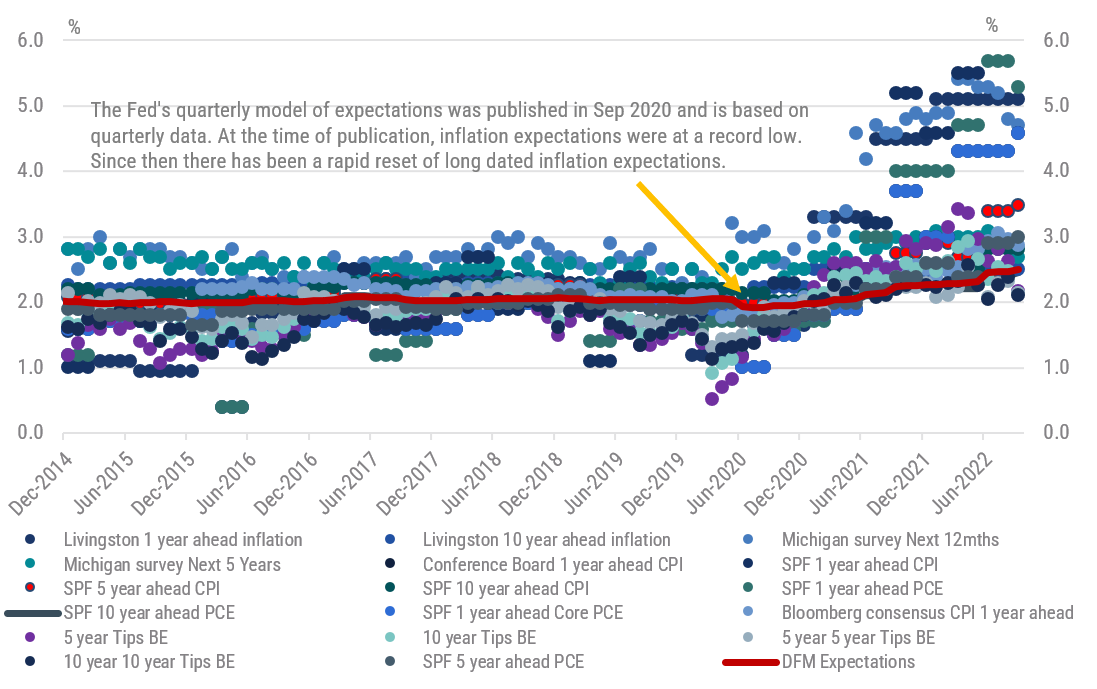

There are many data points that are collated in the CIE model and Chart 2 provides an update of our original model. The red line (DFM Expectations) is Yarra’s replication of the Fed’s CIE model, updated to the most recent available data. At first glance it’s still concerning that there are lots of dots above the red line, suggesting the risks to long run inflation expectations are skewed higher in coming months.

Chart 2: USA: Common inflation expectations (Dynamic factor model)

Source: Yarra, Nov 2022.

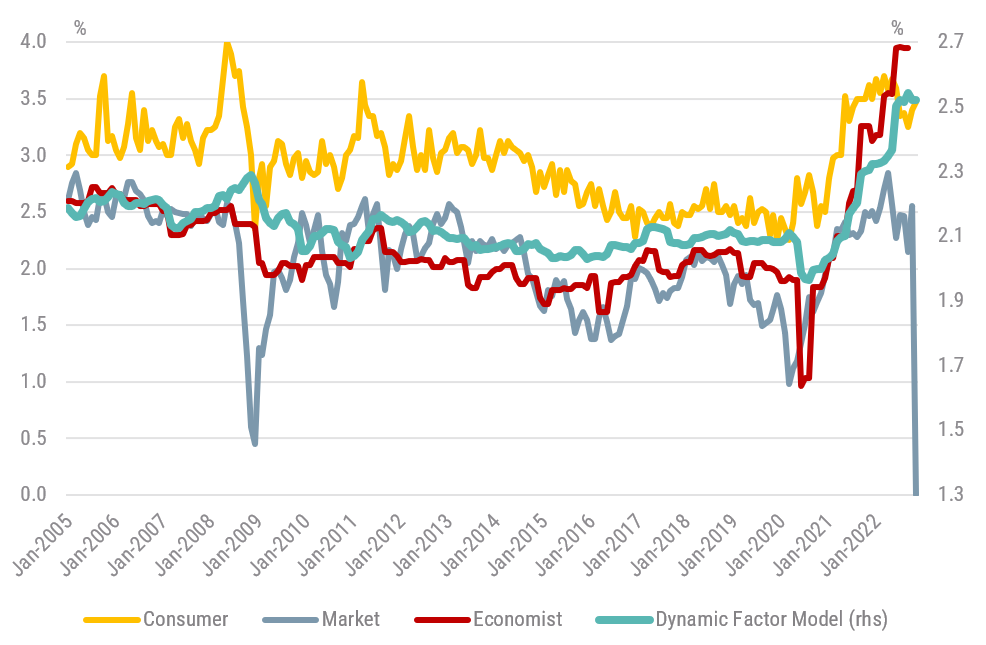

However, if we split data into the broad sources of the inflation expectations – consumer, financial markets and economists – we start to see a different picture. Chart 3 shows that consumer and financial market average inflation expectations have already commenced a significant decline in long run inflation expectations.

Chart 3: USA: Common Inflation Expectations (Consumers, Markets & Economists)

Source: Yarra, Nov 2022.

So why is it that the common inflation expectation estimate, shown on the right-hand side of chart 3, has not peaked? The answer is simply because the Fed’s model gives a higher weight to inflation expectations over longer term horizons since the design of the CIE model provides a bias to the 10-year projections from the survey of professional forecasters(1).

In a knife fight to determine who is correct most often, I think most would conclude that the bond market has highly motivated participants constantly looking for signs on the direction of future inflation and focused on cashflow constrained consumers at the coal face of inflation who are acutely attuned to shifts in prices.

Economists, however, have different incentives. The time spent by professional economists actually building, updating and analysing inflation models in truth represents a tiny percentage of their time. Most surveyed economists are in practice part financial market journalist, part marketing executive, and part strategist/portfolio manager.

The objective of the financial market economist is to formulate a view of how the world will evolve, communicate and defend that view – even if some of the incoming data is challenging that view – until the evidence is so overwhelming that they move to a different view of the world. This may be sub-optimal, but it is the reality. I should know, I’ve been doing it for over 25 years!

There is clear inertia in their forecasting, with herding behaviour to other economists’ views and a tendency to shadow the central bank economic forecasts (partly under the assumption of information asymmetry given that the central banks are vastly better resourced and notionally spend most of their time thinking about inflation).

Financial market economists can also be shameless chameleons. I know of no other profession that will pass themselves off as health experts amid a pandemic, political analysts in the lead up to an election, tax professionals in the lead up to a Budget, valuation experts amid a market crash and, of course, military experts amid a global conflict.

The point of all this preamble is to make the point that surveys of professional economists will not provide a lead on the consumer or financial markets when it comes to detecting major shifts in expectations. It is in this sense that economists are idiots. However, if a central bank chooses to calibrate its actions by giving a higher weight to economist surveys, then it makes them something worse than idiots.

The recent release of the Fed minutes for September reveals the FOMC believes inflation expectations are relatively high but ‘well anchored’. Perversely, though, they are forecasting virtually zero growth in 2022, years of future sub-trend economic growth and a rise in the unemployment rate consistent with recession. Yet they have lifted their inflation forecasts and, worse, declared the risks to their inflation forecasts remain skewed to the upside.

What the FOMC should have noted was that inflation expectations have clearly peaked, inflation risks are clearly skewed to the downside and the sharp tightening of financial conditions via higher bond yields, wider corporate bond yields, weaker equity markets and booming US$ has made the need for further rate tightening redundant.

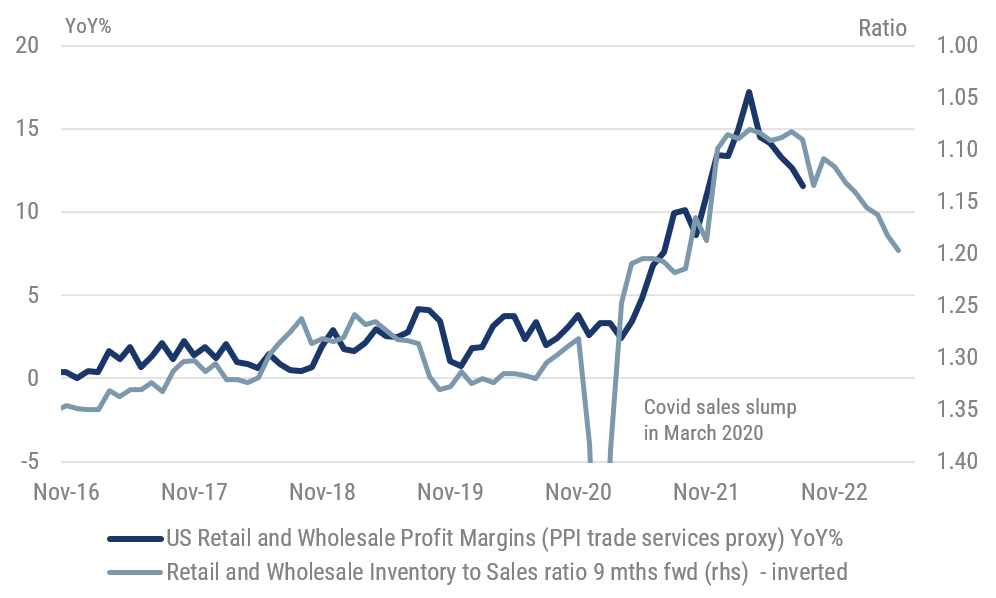

It is beyond me just how the Fed could have missed acknowledging that commodity prices have declined 35% from the peak and freight rates are back near long run averages. Similarly, evidence abounds that US supply chain blockages have been cleared, and nowcasts of US domestic data suggest three consecutive quarters of stall speed domestic demand growth has occurred and leading indicators suggest greater growth challenges lie ahead. While the Fed has finally noted that excessive inventories will likely result in a bout of discounting in coming quarters (refer Chart 4), it’s not clear that they remotely understand just how disinflationary this process will become in a flat demand environment.

Chart 4: Profit Margins and Supply Chain Shortages

Source: Yarra, Nov 2022.

Collectively, financial markets and consumers have proven to be more alert to the signal of easing inflationary pressures whilst the economics profession has been relegated to facing the wall in the Dunce’s corner.

If economists are indeed relative idiots when it comes to forecasting inflation, then in gauging the all-important direction of inflation expectations, the Fed’s decision to ascribe more weight to the forecasts of professional economists makes the FOMC worse.

Never miss an insight

Stay up to date with all my latest macroeconomic insights by hitting the follow button below and you'll be notified every time I post a wire.