Energy asset upgrade should drive value creation for investors

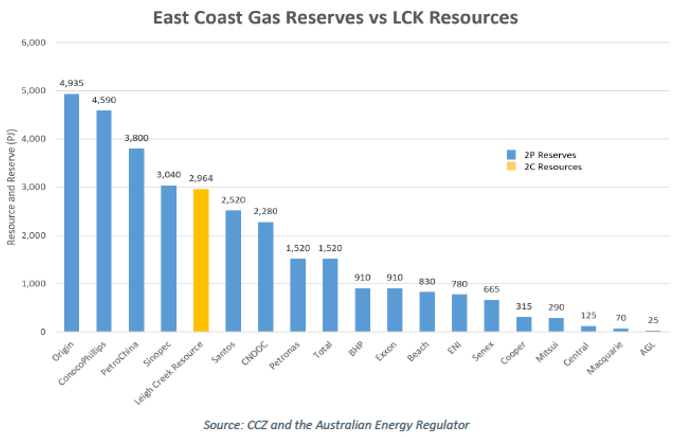

Leigh Creek is an energy company that is in the process of upgrading its very large syngas 2C Resource of 2,964PJ in South Australia, which represents 7.8% of Australian East Coast Gas resources, to a 2P Reserve. This upgrade to 2P should occur in the next month or so, now that the company has successfully demonstrated its safety and commerciality through a trial operation.

The company uses Underground Coal Gasification (UCG) to extract gas from coal. The gas can generate electricity, be sold as natural gas via a pipeline, or be used to create urea for fertiliser. Given Australia’s well publicised issues with high gas prices, and the need to provide employment and reliable power generation in South Australia, both Labor and Liberal South Australian governments have been highly supportive.

The bar chart below puts the size of this resource in perspective. If even only half of the 2C resource is certified as 2P, it will be one of the top 10 reserves in eastern Australia.

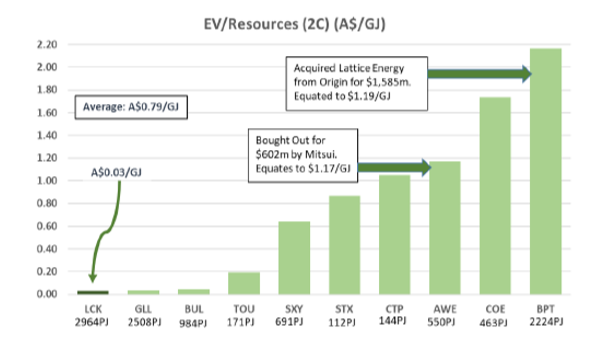

To date, the market has been sceptical of LCK’s ability to successfully prove up and commercialise its reserves because of the misadventures of the now delisted Linc Energy (ASX: LNC) at its Chinchilla UCG operation in Queensland. This scepticism is demonstrated in the next chart, which compares the price/GJ of EV/Resource for ASX listed peers (Attributable 2C Energy Resources).

Source: CCZ, company announcements

Our average entry price into LCK is about 17c per share which is where it was at the time that chart was created. It closed the month at 21c per share.

We expect a jump in the share price from here, when a substantial proportion of its 2C resources get upgraded to 2P, and we are optimistic that they will given the energy content and flow rates reported.

However, we see the value for shareholders only being fully realised when LCK is able to announce a formal partnership of some sort to commercialise the deposit. There is certainly plenty of interest at this early stage. The company reports that it recently invited expressions of interest (EOI) from parties for up to 50PJ per annum to be produced from Leigh Creek. As a result the Company has received over a dozen formal responses from several of Australia’s largest gas retailers and users. LCK states that it will continue these discussions on an ongoing basis and will advise the market accordingly of any material developments.

Never miss an update

Stay up to date with the latest news from Monash Investors Limited by hitting the 'follow' button below and you'll be notified every time I post a wire.

Want to learn more about pre-ipo and microcap investing? Hit the 'contact' button to get in touch with us or visit our website for further infomation.

1 stock mentioned

1 contributor mentioned