ETF Shares offers investors new ways to access the best US tech and growth stocks

Australia's fast-growing exchange traded fund (ETF) industry has its first new challenger entrant in more than 10 years as ETF Shares launches its first three funds for investors.

The firm's co-founder and chief investment officer David Tuckwell says that competition among ETF providers in Australia is relatively limited and gives him a chance to shake-up the market by bringing new products to investors.

"What we're about is trying to offer new index ETFs that aren't currently available to Australian consumers," says Tuckwell.

"Most inflows into index ETFs in Australia go into international equity ETFs and within that, one way or another, about 80% to 90% of that money goes into the US share market. So that's the logic behind us going to the US ETF route, as we believe there's strong evidence of more demand there."

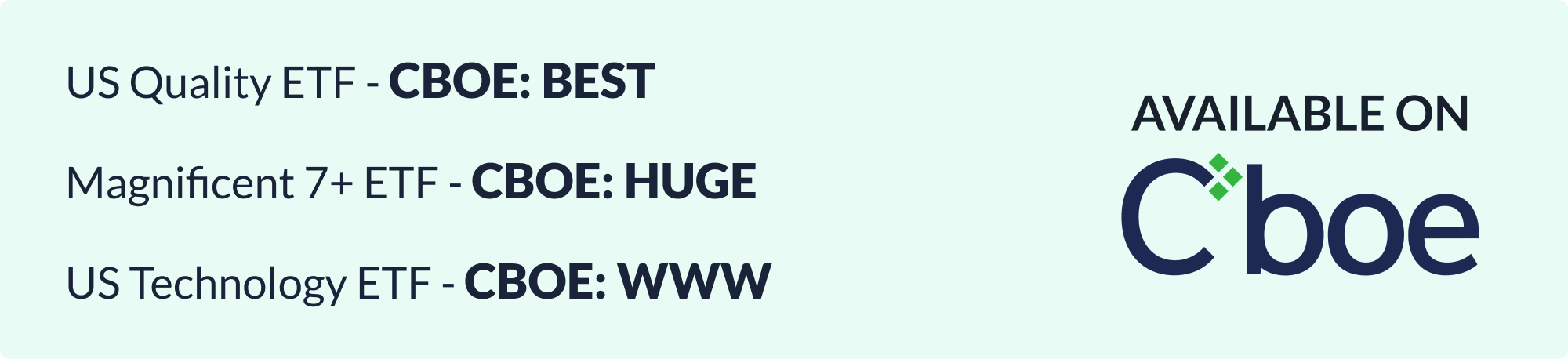

Three new funds on CBOE

So far, ETF Shares has three new funds it offers to investors that can be bought on the CBOE exchange and plans to bring more to market soon.

One fund trades under the ticker HUGE and it tracks the performance of the top 10 stocks on the Nasdaq 100 by market cap.

"Now these companies have been responsible for pretty much the guts of the EPS [earnings per share] growth in the US and around the world for the past five to ten years," says Tuckwell.

"And that product is really there for those people that think the Magnificent 7 story is going to carry on into the future."

The second product boasts the ticker BEST and aims to own the top 100 US companies by free cash flow growth metrics. "The quality investing approach is very popular with Australians, as Warren Buffett popularised it," says Tuckwell.

"So while there's a lot of popular index and quality ETFs, there's not one on just the US, which we thought was a little strange given the evidence of demand. So that's what that one's about."

The third fund trades under the ticker WWW and tracks the leading US tech companies for pure play exposure to what has been traditionally the market's strongest growth sector.

"US tech has the highest margins of any sector in the world, the revenue growth has been higher than any other sector as well. And those two things together, higher margins, more revenue growth has translated directly into stronger profit growth," says Tuckwell.

Future plans

As to what's ahead, Tuckwell says to expect more new products soon as ETF Shares aims to take its share of an industry that's estimated to have grown at a compound 31% over the past five years.

Tuckwell adds that ETF Shares may soon launch an income orientated bond fund for retail investors to give them low-cost exposure to a part of markets that's traditionally been reserved for professional investors.

"So without wishing to give away too much, that's an area where we will be," says Tuckwell.

A new wave of ETFs

ETF Shares was founded in 2024 by a group of seasoned ETF professionals. They provide new and innovative investment approaches that help Australian investors and their advisers manage their wealth. To learn more, visit the ETF Shares website.

Time Codes

00:35 - Tuckwell's ETF journey

00:57 - What ETF Shares will offer investors

1:34 - Get invested in the best US stocks

3.43 - ETF Shares' strategy

4.44 - The future of ETF investing

5:45 - New ETF products coming to market

.png)

.png)

.png)

1 topic

3 stocks mentioned

3 funds mentioned

1 contributor mentioned

.jpg)

.jpg)