Finding growth amid structural changes

Reporting season is stressful, but it also serves as a reminder of the importance of stepping back to reflect on broader themes shaping the world around us.

One topic increasingly dominating conversations is artificial intelligence (AI) and its far-reaching implications—not just for businesses and markets, but also for the next generation entering the workforce.

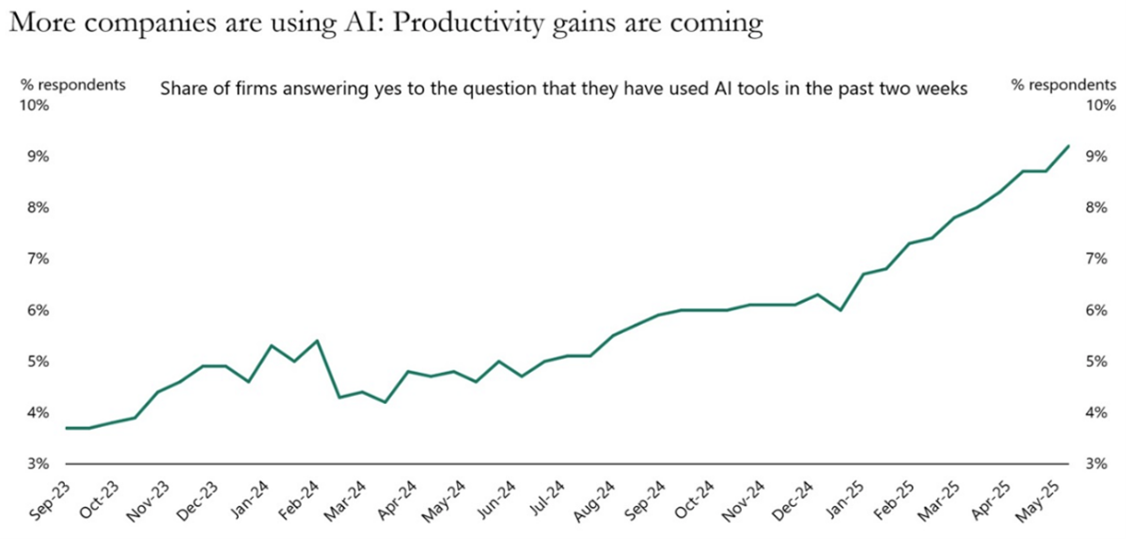

As the next great leap in productivity takes hold, the potential for business owners is huge as savings are made, economic moats are strengthened, and markets are expanded. Productivity gains should also accelerate along with AI usage. Consequently, identifying those who might benefit and increase their returns is likely to offer a rich seam of Future Quality ideas. And the changes have only just begun.

Chart 1: Share of firms answering yes regarding use of AI tools in the past two weeks

Source: US Census Bureau Business Trends and Outlook Survey, May 2025.

AI is already impacting the job market

Prominent industry leaders have said it plainly: we’re entering a period of tremendous change, some of which will have a profound impact at both the corporate and societal levels.

"AI will lead to significant cost savings and efficiency improvements, but it will also result in job displacement." – Satya Nadella, CEO of Microsoft.

Recent research on the graduate recruitment market indicates a near collapse in white-collar graduate opportunities in areas such as accountancy and consulting. The deployment of technology has already automated the first few rounds of graduate selection; box ticking for the employer (and consequently the candidate) has never been more important. Getting to the interview stage seems an achievement in itself.

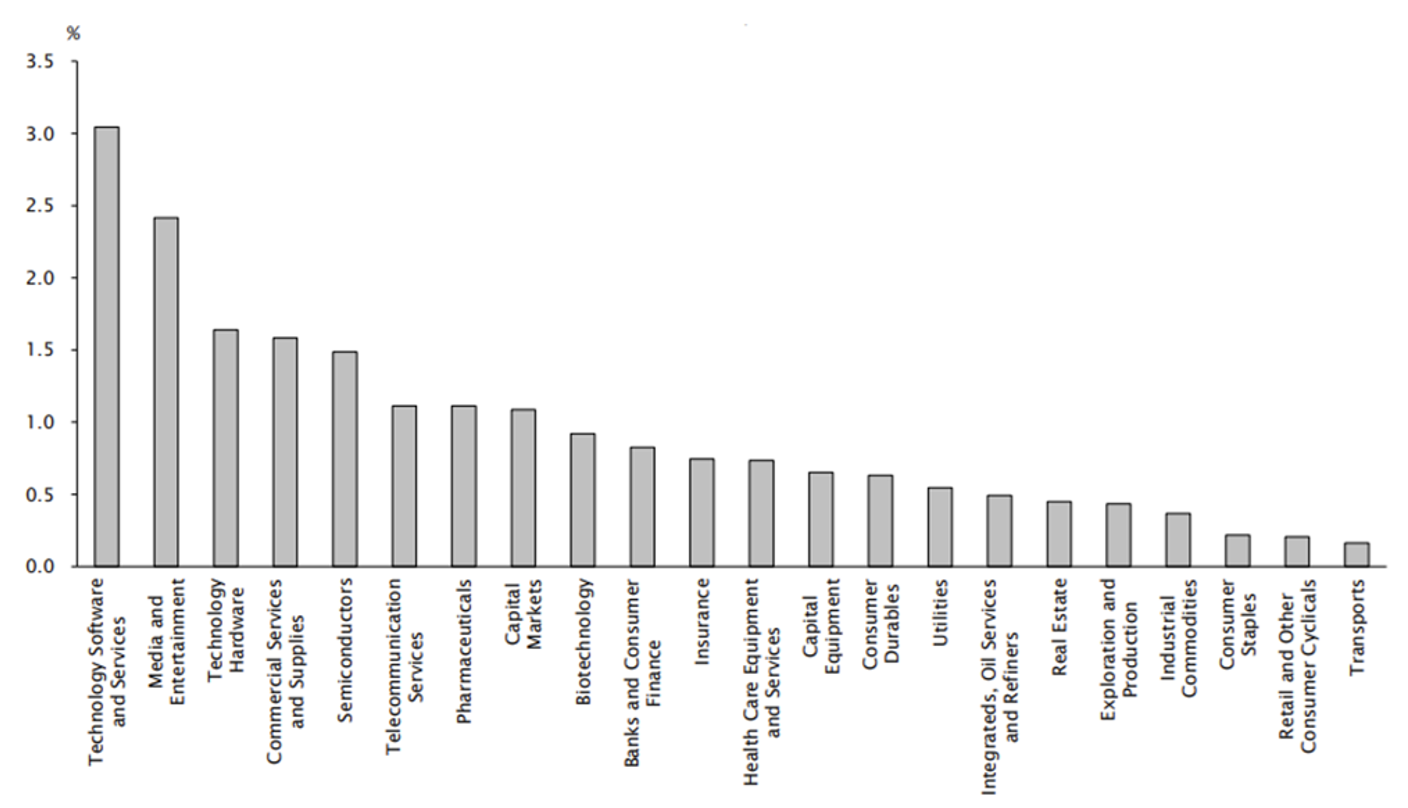

A recent study by Empirical Research Partners (Chart 2) looks at the heaviest users of US AI startup company Anthropic’s large language models (LLMs). Not surprisingly, the technology, pharmaceuticals and financial services sectors are heavy users of this technology.

Chart 2: Share of GenAI queries per one million workers by sector – May 2025

The potential for higher returns can already be seen with hyperscalers such as Amazon (NASDAQ: AMZN), Microsoft (NASDAQ: MSFT) and Meta (NASDAQ: META), suggesting their AI operations can lead to significant labour savings. Their reach expands well beyond their own businesses as they partner with domain experts such as Genpact (NASDAQ: G) to deliver the industry-specific solutions that only a specialist can offer. Each of these companies are held in the portfolio, and identifying the companies that can benefit from AI in the future is likely to yield valuable Future Quality ideas.

While this AI-related trend might be beneficial for shareholders, the current and pending impact on the job market across a range of industries is a concern shared by many, suggesting graduates need to expand their search for employment.

Where can growth be found?

By 2050 (only 24.5 years away), the number of people over the age of 60 in the world is expected to double to 2.1 billion. This change in demographics indicates a significant growth opportunity in “serving” that age bracket. It also supports our team’s long-standing overweight position in the healthcare sector, through companies such as Encompass (NASDAQ: EHC), the leading provider of in-home rehabilitation services in the US. Care services, in various forms, will continue to grow and much of these services will be performed by humans

AI can now easily outperform humans in complex reasoning tasks, such as playing poker and chess or solving problems. However, when it comes to operating in the real world, and doing a task that humans find easy, such as tying the laces on shoes, AI still has significant difficulties.

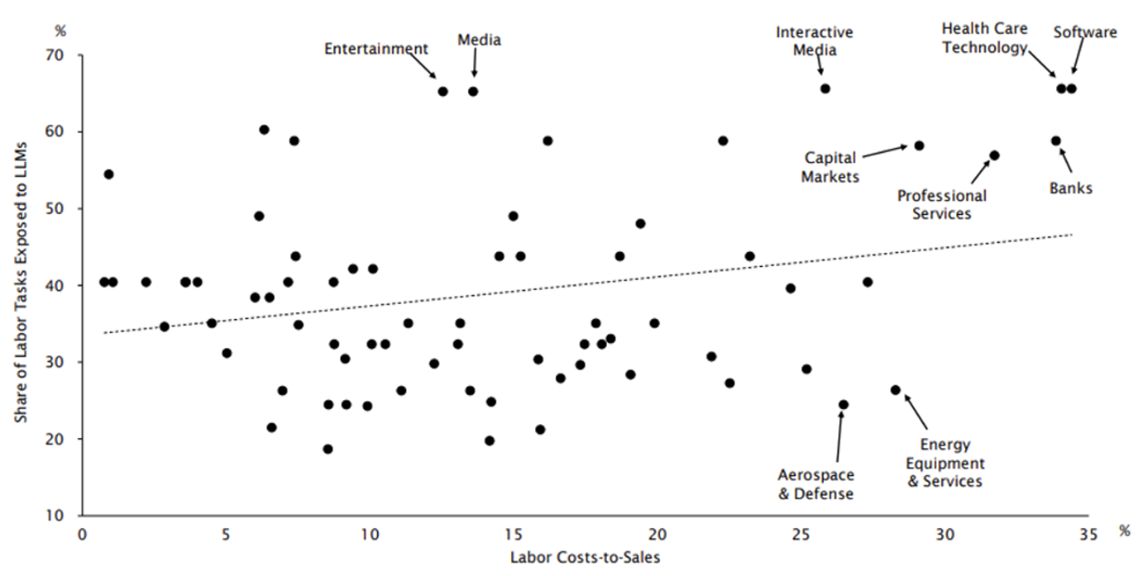

Empirical Research Partners has further explored AI’s potential impact by mapping AI tasks per industry against labour costs as a function of sales. The implication here is that high AI use, when combined with high labour costs, will provide the right ingredients for significant cost savings and hence higher economic returns. One conclusion taken from Chart 3 is that industries such as aerospace and defence or energy services are less susceptible—in the short term at least—to displacement of labour by AI. Intuitively, this makes sense.

Chart 3: Share of labour tasks that are exposed to LLM versus labour costs to sales

Source: Empirical Research Partners Analysis. Eloundou, T., Manning, S., Mishkin, P., and Daniel Rock, 2023. “GPTs are GPTs: An early look at the labour market impact potential of large language models.” Working Paper.

Another dominant topic this year has been aerospace and defence. The moral debate on having any defence capability is never far from Scottish headlines due to the naval base on the west coast of Scotland that supports the UK’s submarine-launched ballistic Trident missile system. Reflecting on ancient history, it becomes evident that nations and city states frequently obliterated their rivals; as they say, “the rest is history”. In the long run, defending your shores appears to be a good idea and unfortunately that is seemingly more applicable today than it has been in the last 50 years.

There are many inadvertent benefits from heavy defence spending, many of which have been highlighted by historian Margaret MacMillan, a Canadian of Scottish lineage. In her publication “How Conflict Shaped Us”, MacMillan reminds us that peace, like success, has few worthwhile lessons. The historian explains that “so many of our advances in science and technology—the jet engine, transistors, computers—came about because they were needed in wartime.”

AI is vital to national economic and security interests as it has the potential to alter the global balance of power. It could shift global economic competition by dominating key industries, be weaponised for military and ideological purposes, and force national AI technologies and standards on other countries. The first nation to reach artificial general intelligence and artificial superhuman intelligence could control AI supremacy.

“Successful nations will turn resources into competitive advantages—and in this AI age, the critical resources are compute, data, energy and talent” – OpenAI's EU Economic Blueprint, January 2025.

AI requires immense amounts of data, computing power, energy, capital and talent. This has prompted many nations to focus on their “Sovereign AI” capabilities, creating an urgent scramble to expand digital infrastructure, set up domestic semiconductor supply chains and ensure access to cheap, reliable energy sources. In January 2025, US President Donald Trump announced the Stargate Project, which is a venture backed by OpenAI, Oracle, SoftBank and the UAE's MGX that plans to invest USD 500 billion on AI infrastructure in the US over the next four years. The European Union launched its InvestAI initiative, earmarking EUR 200 billion for AI investments, while France announced EUR 109 billion in AI investments from domestic and foreign private sources. The Bank of China recently revealed a CNY 1 trillion (approximately USD 130 billion) investment in AI infrastructure. By now everyone is waking up to the fact that Trump has normalised unilateral action.

“This infrastructure will secure American leadership in AI… This project will not only support the re-industrialization of the United States but also provide a strategic capability to protect the national security of America and its allies” – OpenAI: Announcing the Stargate Project, January 2025.

For many, Trump’s second term is a final wake-up call that they have not done enough to defend themselves. European defence spending is estimated to increase by at least USD 250 billion annually if the continent is to reach its revised target of 3.5% of GDP. The Kiel Institute argues that Europe-wide GDP will be boosted by as much as 0.9% to 1.5% if spending on defence rises to the 3.5% target.

AI, defence and energy and the role of nuclear power

The nuclear energy sector is experiencing a renaissance driven by a powerful convergence of supportive government policies, the voracious and rapidly escalating energy demands of the digital age (particularly from AI), and significant technological advancements across a spectrum of reactor designs. Nuclear power, in its various forms, is increasingly being recognised as an indispensable energy source.

To address some understandable concerns about nuclear energy, it is important to recognise that the field has undergone a profound transformation. Today’s advanced reactor designs are a world away from the technology of the past, incorporating decades of research and development focused squarely on enhancing safety and efficiency. Many new designs are significantly smaller. Instead of relying on complex interventions, the new designs utilise concepts such as passive safety systems that harness natural forces like gravity and convection to prevent overheating and accidents.

Recent proposed US policy shifts are creating a more favourable environment for nuclear energy. A pivotal development is the series of Executive Orders (EOs) issued by the Trump administration in May 2025, outlining an ambitious vision to quadruple US nuclear capacity from approximately 100 GW to 400 GW by 2050. These directives mandate sweeping reforms, including compelling the Nuclear Regulatory Commission to expedite licensing reviews (e.g., setting an 18-month target for new reactor applications), overhauling Department of Energy reactor testing protocols and significantly bolstering the domestic nuclear fuel cycle. Furthermore, the EOs prioritise the deployment of advanced reactors for national security purposes and to power energy-intensive sectors such as AI data centres.

Meta’s recent 20-year power purchase agreement with Constellation Energy (NYSE: CEG) to procure 100% of electricity output from the nuclear plant operator’s site in Illinois highlights the scale of Meta’s long-term demand for nuclear power. This strategic move by a tech giant underscores a broader trend, with companies like Amazon, Google (NASDAQ: GOOGL) and Microsoft also actively investing in – or exploring – nuclear power solutions to meet their sustainability goals and immense energy needs.

Consequences for Future Quality investing

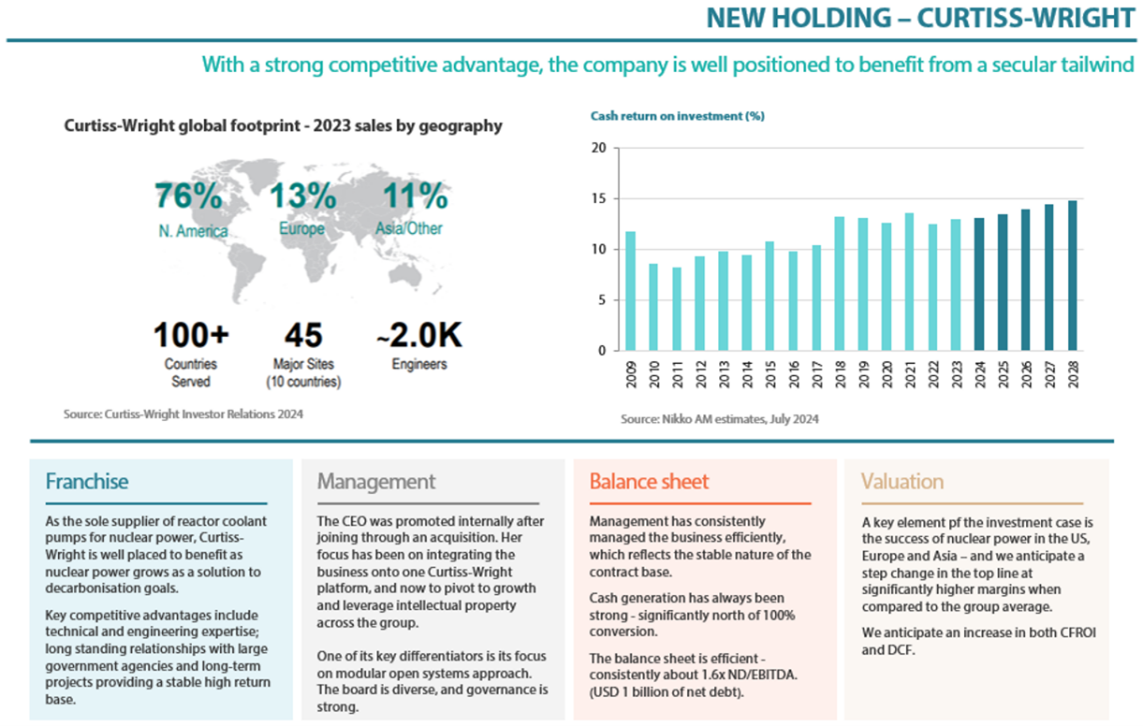

We have held Curtiss-Wright (NASDAQ: CW) for over a year. Curtiss-Wright is a company that designs, manufactures and services highly engineered products and systems for various industries, including the aerospace, defence and nuclear sectors. The company has a long tradition of providing state-of-the-art, reliable solutions in the defence and nuclear sectors.

The nuclear industry has been hollowed out over the last 50 years, leaving fewer companies with the specialist skills to deliver the required growth over the next few decades. Curtiss-Wright’s nuclear business offers significantly higher margins compared to the group average, which may lead to rising returns. Moreover, the future market potential significantly surpasses recent historical figures. Outside of nuclear, over 50% of Curtiss-Wright’s business is in the defence industry, with the company selling robotics, sensors, unmanned drones and actuation systems.

These products and services are expected to be in heavy demand for the next decade and beyond as economies readjust their defence spending (see Appendix 1). Growth is harder to find in today’s low-growth world. However, tailwinds, such as those generated by nuclear power, are expected to deliver rising returns for years to come and alpha may follow.

Appendix 1: The Future Quality case for Curtiss-Wright

Curtiss-Wright is a significant presence in the commercial nuclear power industry, playing a supportive role since the first US nuclear plant went into operation in Shippingport, Pennsylvania, in 1957. The company is the sole supplier of reactor coolant pumps for nuclear power in the US, serving both large reactors and small modular reactors (SMRs). This ensures it is well-placed to benefit from the increasing adoption of nuclear power globally.

Furthermore, the company stands to benefit from the multiple plant upgrades that will likely be required to extend the current nuclear capabilities in the US and other developed western economies. Such demand is expected to arise as operating licenses are extended beyond the original 40-year design lifespan of the plants.

Curtiss-Wright also supplies the world's most advanced reactor coolant pump for Westinghouse’s AP1000, one of the safest and most economical nuclear plant designs available. This plant design is likely to win significant business across eastern Europe as nations such as Poland expand their nuclear power capabilities.

The US boasts a vibrant ecosystem of SMR developers, with companies like Westinghouse (AP300 PWR), X-energy (Xe-100 high-temperature gas-cooled reactor) and TerraPower (Natrium sodium-cooled fast reactor) naming Curtis-Wright as a supplier. Additionally, Hitachi, which is also held in the strategy, is involved in the GE Hitachi Nuclear Energy SMR development.

Conclusion

As always, we are focused on finding ideas that are supported by the four pillars of Future Quality investing: (i) franchise quality, (ii) integrity of management, (iii) balance sheet strength and (iv) valuation. We seek companies in growing markets or with technology or services that will lead to greater market share, leading to increasing cashflow returns on investment. We expect AI, energy and defence to continue providing attractive investment ideas given the structural changes anticipated in these industries.

For graduates, there are still reasons for hope. The future job market will probably favour those who can work alongside AI and leverage the technology to be more productive while focusing on the interpersonal, creative, and strategic aspects that machines cannot replicate.

"AI will not replace humans, but those who use AI will replace those who don’t” – Ginni Rometty, Former CEO of IBM.

"The future of AI is not about replacing humans, it’s about augmenting human capabilities” – Sundar Pichai, CEO of Google.

While certain jobs may vanish, new opportunities may open for those with the right mix of technical savvy and human skills. Graduates and companies that understand the potential of AI as a tool rather than just a threat are expected to be well-positioned to thrive in what is undeniably a structural evolution of the job market.

The Yarra Global Share Fund is invested in the Nikko AM Global Equity Fund, which is managed by the Global Equity Team of Nikko Asset Management Europe.

1 topic

8 stocks mentioned

1 fund mentioned

.jpg)

.jpg)