Firstwave Cloud Technology (FCT) - Earnings Inflexion Point for International has Arrived

I wish I was writing this note a year ago, however optimism and reality work on different timelines. Nonetheless, given the opportunity at the doorstep, we think investors should revisit the opportunity that is Firstwave (FCT). Firstwave has recently had their cloud security platform technology globally validated, first by CISCO, then yesterday NTT Data UK. In a nutshell, FCT’s platform enables clients to move their data/security from an on-premise environment into a cloud environment. The market opportunity is enormous. If they execute well, the revenue can move from ~$10m to $40m in a relatively short space of time. The market cap at $0.30 is $75m. For comparison Nasdaq listed ZScaler (ZS.NAS US$6.0B Market Cap), just filed US$63m Revenue, forecasting total revenue of $268 to $272 million for Fiscal 2019. They trade on an eye-watering PE, over 200x’s FY21 on consensus numbers, such is the interest in this space. Can FCT close this gap?

Background

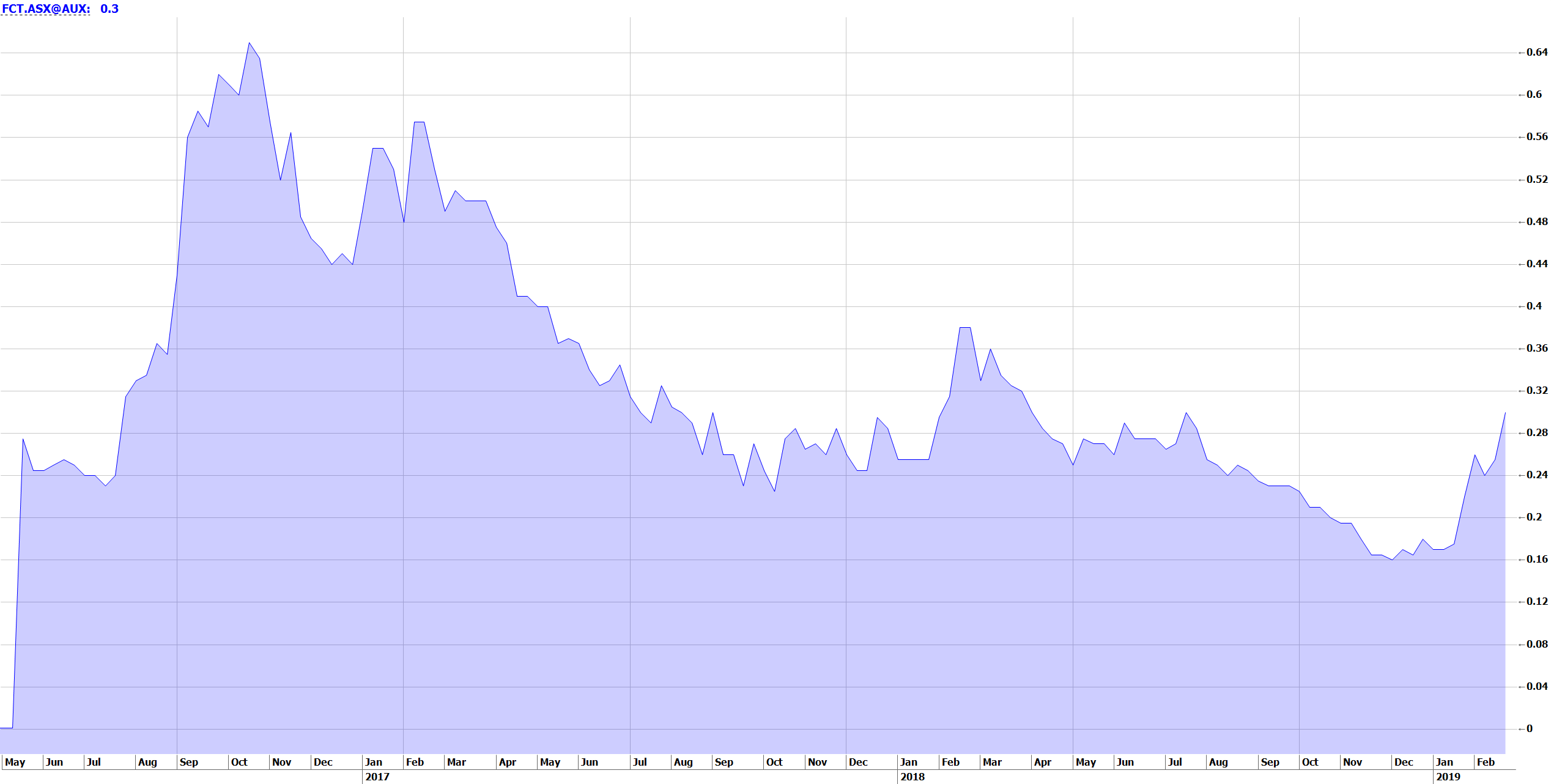

Optimism about the size of the INTL opportunity was priced in not long after listing, the stock ran to a 69c high soon after the 20c listing. A delay in delivering on INTL, and a succession of capital raises, are reflected in the price since then. Management changes were made, and the company has continued to resource its INTL strategy. Initially, it listed with Telstra as its cornerstone client. The IP originally developed within the Telstra labs project, so it has large company DNA and scalability. Along the way, the company has also struggled to articulate how its tech fits into the security landscape, and how they will exploit the opportunity. They are much better now (see the latest investor presentation). This has meant the share register is still wide open, under-owned with one institution on (Alium announced substantial today)

Revenue

I will stick to the company’s own target to grow revenue from FY18 ~$8m to $50m in FY19-21. The company will need to invest $15m in the delivery process. They forecast an EBITDA Margin of ~20% ($10m after amortising the $15m overhead). Given the background of the company, the management is particularly cautious with guiding the market. However, NTT Data is forecast at $8m-$10m (ARR annualised recurring revenue), and CISCO has a number of Proof of Value trials underway (final process before contract). If these CISCO trials convert, it is not unreasonable for them to be much larger than FCT’s entire Telstra revenue piece. It would be disappointing if the CISCO relationship did not deliver $10-20m in the next 12 months. The market will have to sit-up and take notice of a company that grows its ARR from around $6m to A$25-30m in the space of 12-18 months. Telstra is the gorilla in the room in terms of Australian clients, and FCT has that validation. However, Telstra is dwarfed by the CISCO/NTT client book.

Technology Validation

Understanding what FCT does, how its platform enables clients to move from a secure on-premise environment to a cloud environment (with the associated benefits) is complex. Another way to think about it is CISCO has done significant technical due diligence, to the point they are now white labelling the platform, launching globally, and clients are paying to trial the platform. This process has been going on since prior to listing in 2016 and explains the initial optimism. Once CISCO validated, others are quickly noticing and looking to exploit, thus NTT UK occurred relatively quickly afterwards. Also, let’s not ignore that they also announced in February the SHELT Global partnership which covers the Middle East and African markets. I feel the market glossed over this, perhaps because of locations, but in talking with participants they feel that this also has significant revenue potential (FCT saying first Revenue Q4FY19).

Cash Burn

The company has already invested $25m to get to this stage. Cash burn has outstripped revenue, and this explains the 3 top-up capital raises the company has made (23c, 22c, and 14c). The company is open about what it will require to fund the INTL expansion. What is interesting in the response to the 4C query to the ASX this week is, the company says,

“In addition to a capital raise, the Company is working towards improving its payment terms with a large customer which involves an annual prepayment. If this initiative is finalised, Q3 FY19 will be operating cash flow positive.”

In effect, they are indicating they may be able to bring forward revenue to increase cash. This may give the share price some breathing space, and allow the market focus to be on revenue, not the issue of being cum raise. So watch for this closely if it eventuates.

ZScaler – The best comparable

One of the best Nasdaq floats in 2018, ZScaler (ZS.NAS - US49.43 Mkt CAP $6.008B) is a comparable company to FCT. More advanced in its delivery, and revenue growth is impressive. Nonetheless, the market is paying a huge price for this growth. At the FQ1 update, Morgan Stanley had FY21e consensus EPS at $0.16. Let’s double that and make US$0.32. That places ZS on 154x’s FY21. If FCT rapidly moves through $30m in ARR, the business has significant fixed cost leverage to those earnings. It will also be a US$ growth business, with high recurring revenue that is extremely sticky, which trades on a high multiple here as well.

Summary View

After a long wait, this company is at its inflexion point. Technology validation is now leading to significant jumps in revenue, and that is the beginning of the real journey. It is under-owned by institutions, and largely uncovered by any research. The new management (due to history) is extremely cautious in their communication to the market and it should be “under promise and over deliver” story. The market size is huge and growing. The company will continue to invest in its expansion (a further $15m over FY19-21), so that may come from financing, equity raises, or other options, but we need to be aware of that spend.

Important Disclosure.

The author owns shares in FCT (since pre-IPO). Wentworth has been the lead advisor for FCT at its pre-IPO and IPO raises for which Wentworth was paid fees. Wentworth Corporate Finance has an ongoing relationship with FCT for which it is paid fees.

Important Note - This note is not a recommendation or advice to buy or sell FCT shares mentioned. FCT shares should be considered very speculative, high-risk, and volatile. There are significant risks inherent in early-stage technology companies that are not yet profitable, and risks that are not discussed in this note. You should always seek professional advice before considering any share purchase or sale. Please read the disclaimer in full below. This is a desk trading note, and not a research document, and the view of the authors only.

This communication has been issued by Wentworth Global Securities Pty Ltd ("WGS") (ABN: 96 155 409 653) (AFSL: 422 477). WGS is a wholly owned by Wentworth Global Capital Partners Pty Ltd ACN 155 398 333(“WGCP”).

Not research: This communication has been prepared by the at Sales and Trading team within the "Securities Division" of Wentworth Global Capital Partners (WGCP). It is not a research report and is not intended as such. This publication is intended solely for information purposes of WGCP's Wholesale, Sophisticated and Professional Investors as defined by the Corporations Act 2001 (Cth) or the equivalent in each respective Jurisdiction.

Because this document has been prepared without consideration of any specific clients investment objectives, financial situation or needs, your financial advisor should be consulted before any investment decision is made.

Wentworth Securities does not accept any responsibility to inform you of any matter that subsequently comes to its notice, which may affect any of the information contained in this document.

This communication is not intended for US recipients and you should not forward this material into the United States or to any U.S. Persons. If you are a U.S. Person you are required to notify us immediately.

Although we believe that the information which this document contains is accurate and reliable as at the date of publishing, Wentworth Global Securities Pty Limited have not independently verified information contained in this document which is derived from publicly available sources.

Disclosure of interest. “WGS” may or has received fees, commissions and brokerage by acting as corporate advisor or broker for Companies described in this communication. WGS and its employees may hold an interest in financial products described in this communication and may benefit from an increase in the price or value of them.

2 topics

1 stock mentioned