Floating rate notes could be the answer to bruised fixed income portfolios

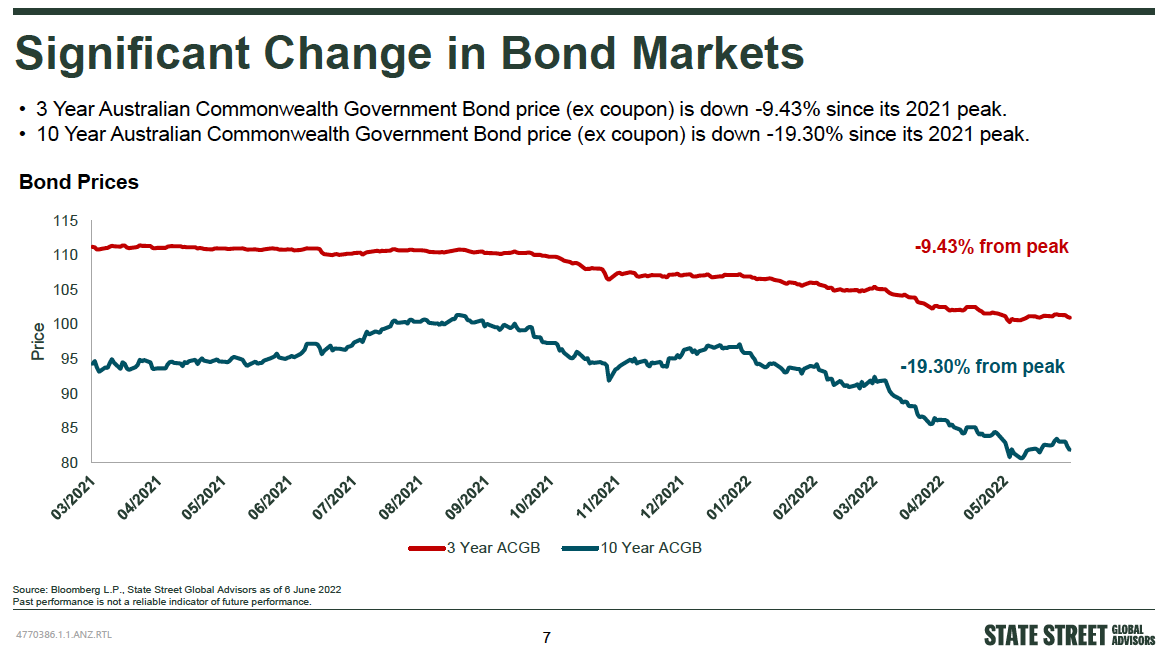

Positioning your defensive allocation to absorb inflation is easier said than done. As inflation rises, the fixed-rate bonds that typically dominate defensive allocations get sold off, and the value of the bond portfolios dives. 3 year Aussie government bonds (ex coupon) are down 9.43% from their peak, while 10 year Aussie government bonds (ex coupon) are down 19.30% from their peak.

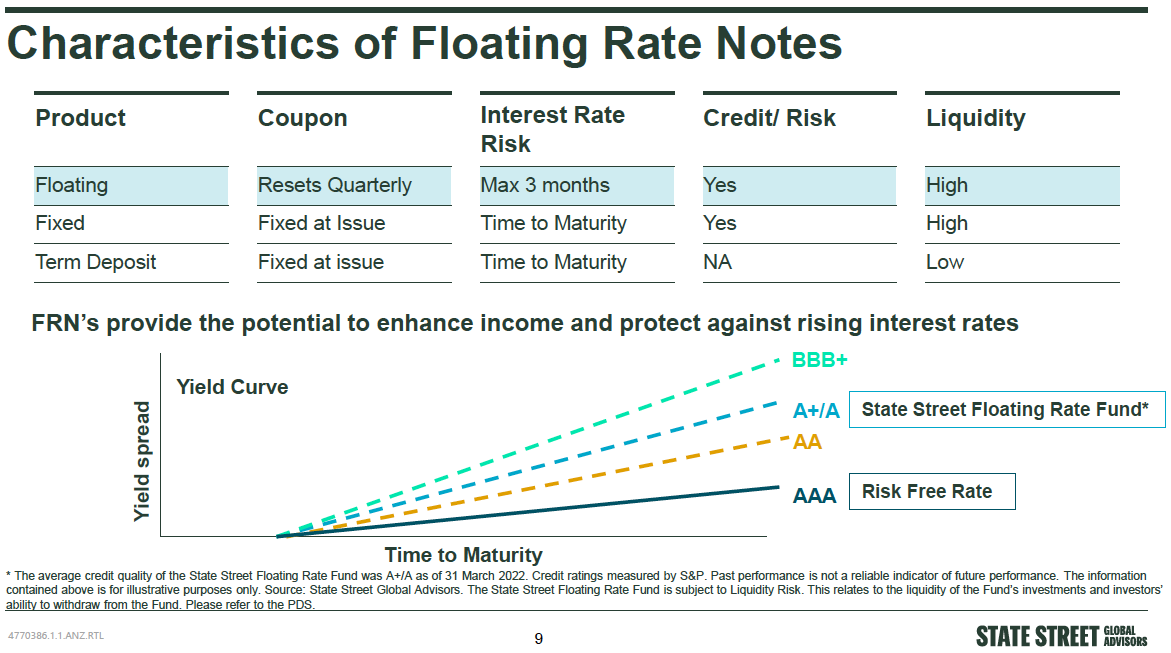

Traditional bonds have coupon payments that are set at issue to market, and if the yield curve sells off (rates rise) then the price of the bond will decrease commensurately. Floating rate bonds, by contrast, have coupon payments that move in line with interest rates.

In this edition of Fund in Focus, we look at floating rate bonds - and why they make a lot of sense as inflation rises and bonds sell off. In addition to offering higher income than cash, they also offer a high degree of liquidity which is particularly important during volatile markets.

Read or watch below to find out why floating rate notes make sense in today's market.

Edited transcript

Good afternoon. My name is Simon Mullumby and I run the Aussie dollar cash and bond portfolios at State Street Global Advisors in Sydney. I'm here to talk to you about inflation and inflationary pressures in the market. And in particular, our floating rate portfolio could potentially fit into a defensive mix within an asset universe.

The State Street Global Advisor cash team runs on any given day hundreds of billions of dollars in senior unsecured bank debt exposure. And to that end, we have our own credit team. And this credit team is primarily focused on the liquidity and the capital preservation of banks and bank names that we purchase for our portfolios globally.

The floating rate portfolio is a senior unsecured bank portfolio only. As suggested at the start there's a lot of talk about inflation in the market at the moment, deservedly, so.

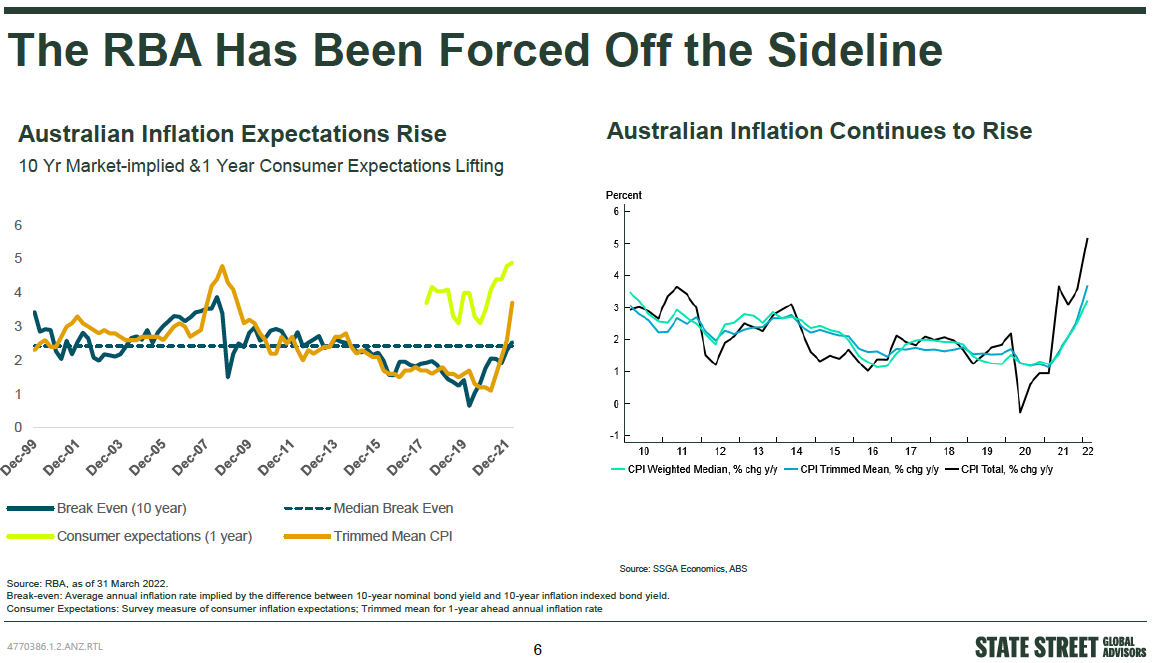

But there's also central bank action globally, the Reserve Bank of Australia included who, as we speak front-ending, they are really starting to move interest rates higher in the short part of the curve and the official cash rates to try and preempt extended inflationary pressures.

The RBA, inflation, rates, and the impact on yields

The Reserve Bank of Australia is explicitly an inflation-targeting bank. So the 50 basis point increase we saw recently and the 25 we saw last month has pushed the official cash rate just shy of 1%. And if you look at market pricing at the moment, they've got nearly 4% priced by this time next year.

So that lends itself to yield curves that have been selling off and will continue to sell off, which could again be a potential trade for floating rate funds that have very short interest rate duration.

The salient point here before we get into floating rate notes is that most bond indices globally over the last 10 years have doubled their duration. So duration is a measure of risk. And if you look at the composite bond portfolio, the Bloomberg composite bond portfolio in Aussie dollars, its duration over the last 10 years have gone - for argument's sake - from three and a half years to 5.8 years.

That's effectively a doubling of the risk you are carrying, which means that when yield curves sell off and they have been selling off, you do see quite substantial losses in your bond portfolio.

So with the extension of duration in a lot of bond indices over the last decade, then specifically you have to look at what's happening to yield curves and what impact that has had on the risk or the duration of portfolios over the last three to four months.

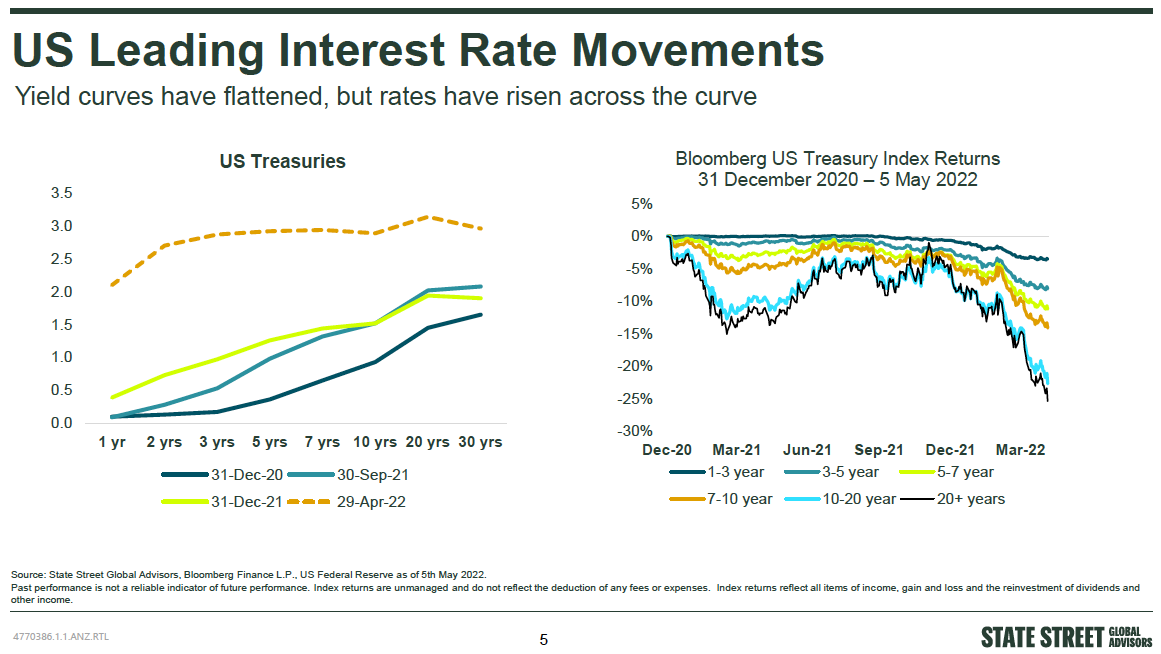

To put it, frankly, the selloff in US yields has been staggering and the losses across the curve have been substantial. And you have to also acknowledge that the Aussie market will follow where US yields are going.

We're in a similar situation, although inflation in the US and in Canada and in New Zealand, and England is much higher than what is expected and priced in Australia.

The Australian yield curve does follow the direction of US curves. And you can see on the right-hand side of this chart, that losses have been sustained across the curve in the United States as inflation is priced.

With Aussie yields, following US yields selling off, it's, in particular being driven by the inflationary pressures in the Australian market. As I said earlier, the RBA is explicitly an inflation-targeting bank.

And their comfort zone for inflation is between 2 to 3%. With the first-rate rise last month, Governor Lowe said he anticipates inflation to be at 6%, by the end of the year, that's headline inflation. And many market participants are saying that it's actually going to be higher than that.

That's why we're seeing such rapid and active rate rises from the Reserve Bank of Australia.

There has been a significant selloff in bonds year to date, and it's hard to see that stopping or abating at any point soon.

So as the yield curve continues to price inflation, as the yield curve continues to price a higher cash rate, yields do sell off, and you can see that both in the threes and the tens year to date and from their highs mid-last year, some of the losses have been substantial. We're talking between 5 and 20%.

That's excluding the coupon or the interest payment, but your clean price on the bond has suffered substantial losses. Again, this could be alleviated or subsided by putting some money into floating-rate notes, we believe because they have such a short interest rate duration.

Duration, the coupon, bonds, and the power of floating rate notes

Duration is a measure of risk as I said earlier, and with inflation being priced on the upside, it is potentially a good switch for a defensive portfolio to move from fixed to floating. And to give you the characteristics of a floating rate note as per its name, the coupon floats over the short BBSW curve.

The coupon - the interest rate of the note - will reset every three months. In a bond, the reason it's called fixed income is the coupon is set at issue. And if you are carrying a very low-interest payment on a bond, and if the yield curve sells off, the price of that bond will decrease commensurately.

However, on a floating rate note, the coupon adjusts every quarter. So you don't see that price action on the downside as yield curves start to sell-off. You do, however, see decreases in price on floating rate notes as spread duration moves, but that again is a different level of risk.

What would I also like to point out here is that floating rate notes offer very good liquidity in both volatile markets and stable markets.

Term deposits, which some of our competitors will always put into portfolios and do suggest that go into portfolios, they're illiquid. And we don't really like purchasing illiquid investments for any of our rates portfolios.

Floating rate funds: A closer look

The floating rate fund that I said at the start we're actually going to talk about is a very conservative senior unsecured bank debt portfolio that targets between 1-1.5% over the RBA official cash rate, that's annually.

Every name that goes into the portfolio is monitored and approved by the SSGA credit team. And it is an ESG-aware portfolio.

When I say aware, it's not an ESG portfolio, but we do implement and run a filter over the top that utilises the SSGA R-Factor. That "R" is the responsibility factor and any bank that is deemed underperformed, or a laggard is not permitted to go into the portfolio. So it's an ESG-aware style approach.

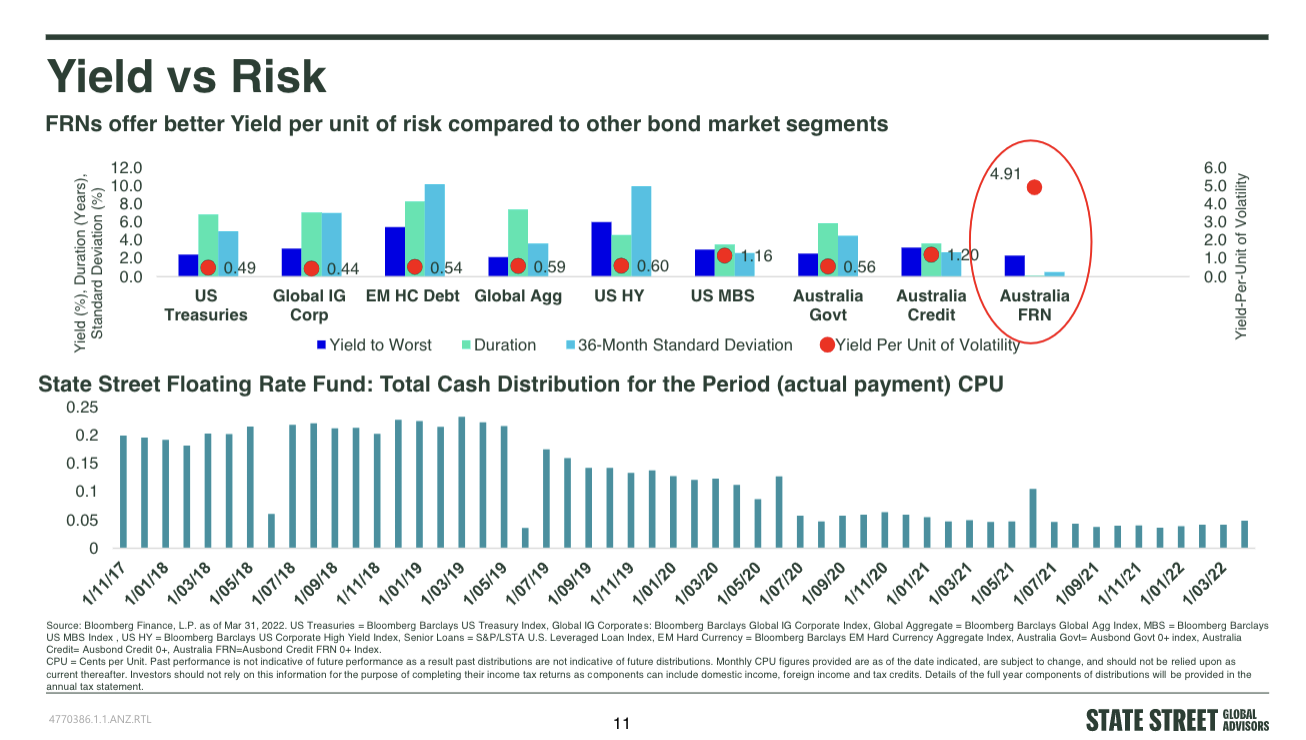

Yield versus risk

This is the poignant part that the market is talking about at the moment in that with the sell-off in yields with bonds facing quite extreme losses over the last three to four months, the risk, the interest rate duration of a floating rate note portfolio is very minor.

You haven't seen the losses in floating-rate notes that you have seen in fixed-income bonds. Again, there is spread duration, that's a risk in a floating rate note, but the interest rate risk of the note is very limited.

And you can see on slide above, that the risk-return characteristics as graphed here by our strategy team are very palatable for floating rate notes, versus some of the other indices, the fixed income indices that potentially could be in some defensive portfolios.

You can also see at the bottom of that slide, that the income stream from the floating rate portfolio is distributed monthly. Again, that's very palatable for some investors to have an income stream that is paying you a coupon monthly: Within a fixed income portfolio, this is where you start talking about percentages of what should be in floating, what should be in fixed.

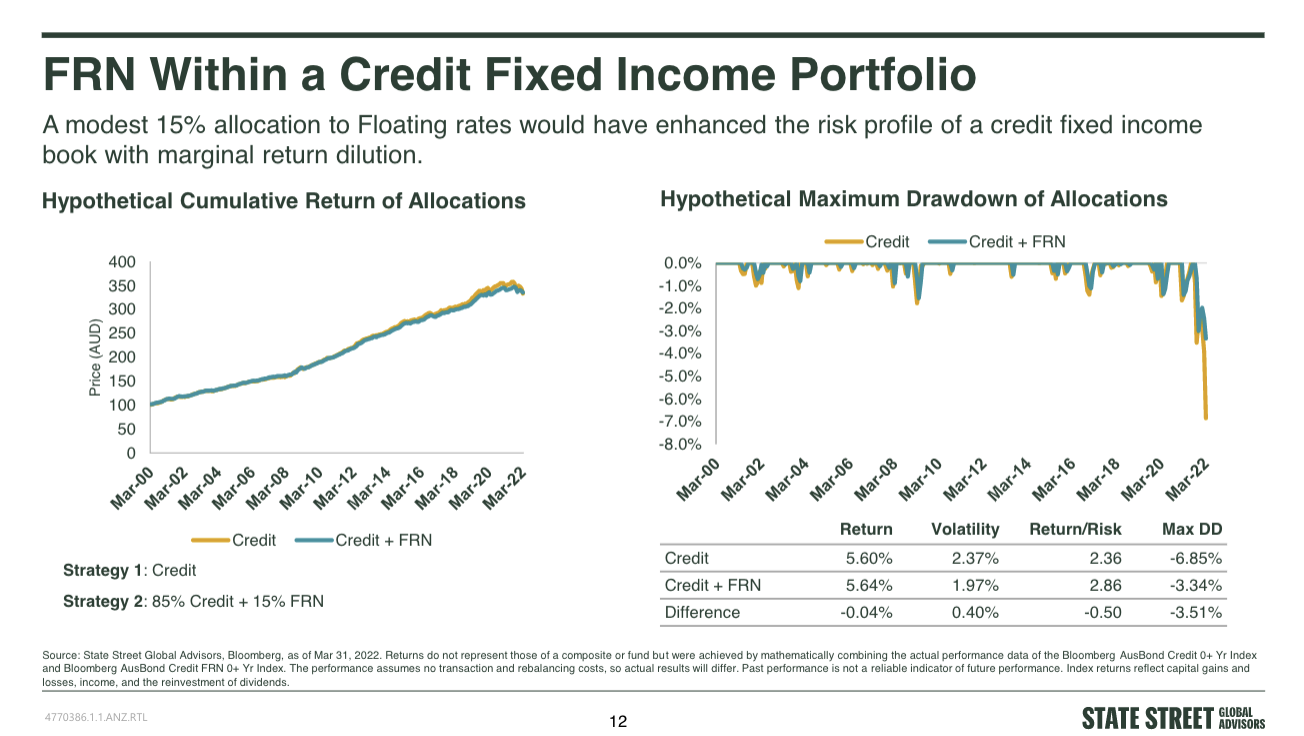

And you can see here from the number of charts that by even just reducing a credit portfolio, fixed portfolio by 15% and increasing your exposure to floating rate notes, the tune of 15% that the risk or the volatility, the deviance of the portfolio is markedly reduced whilst also giving you a marginally better return.

So again, it's all about reducing the volatility and the duration risk of a portfolio, which can be accomplished by adding floating-rate notes to a defensive portfolio.

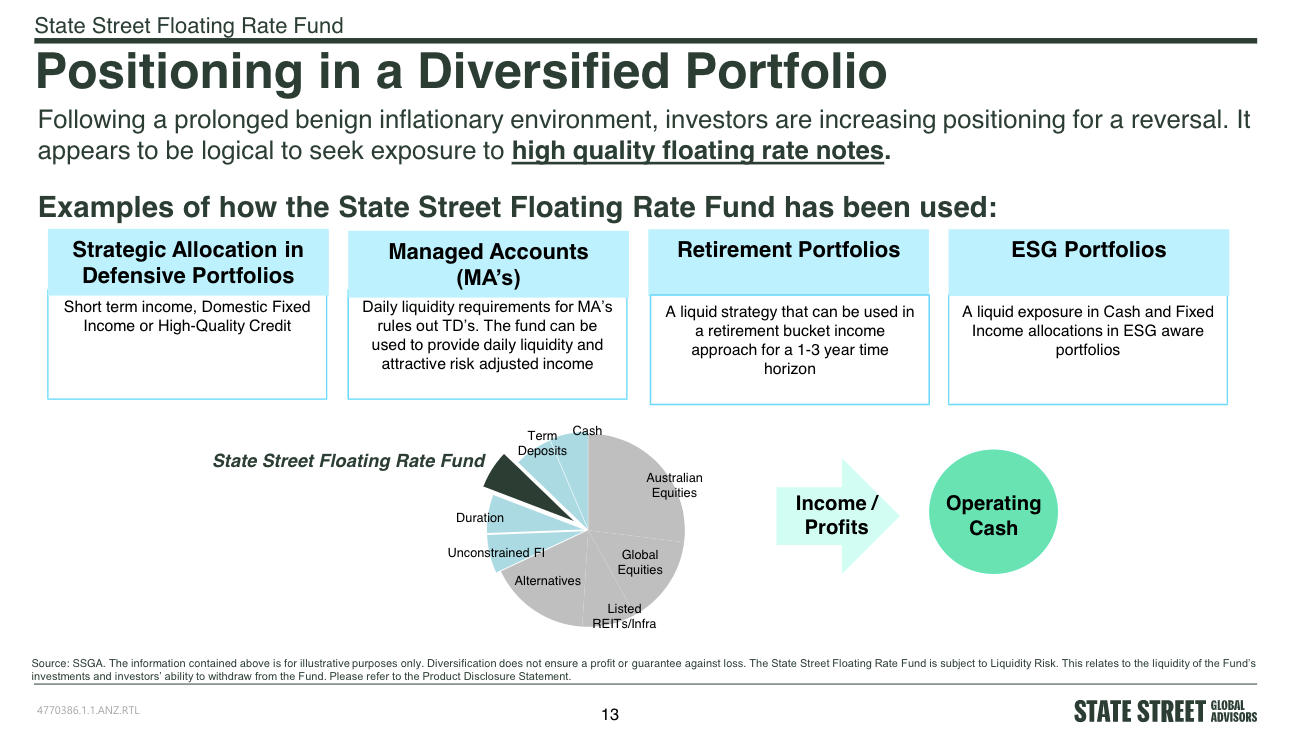

And on that not - positioning into a diversified portfolio. Well, it's all about mitigating risks, and in this sort of environment where you can achieve a much higher coupon and a monthly return stream from a floating rate note, as opposed to a fixed income bond as a fixed coupon, we would argue that it does work very well as a strategic allocation.

It will also work well for those that are looking for some form of monthly income stream. And I did also make reference to the fact that it utilises an R-Factor, which is an SSGA proprietary responsibility factor that we filter every bank name with that goes into the portfolio.

The floating rate note portfolio that we manage at SSGA in Sydney is made up of senior unsecured bank debt only. Every name within that portfolio is monitored and approved by the SSGA credit team. And it purchases only Aussie dollar assets.

We deliberately do not buy nor want offshore assets that are then swapped back into Aussie dollars. It is a very transparent portfolio. And every name, as I said, is monitored and approved by the SSGA credit team.

It distributes its income monthly. It has a very high average credit rating. And as the bank bill curve continues to sell off and price more official cash rate increases from the RBA, the coupon of this portfolio will commensurately also ratchet up because these notes reset every three months.

On that note, if there is any more information you require, please go to www.ssga.com, or you can contact the team at managedfunds@ssga.com. Thank you.

Learn more

We actively seek to invest in interest-bearing investments of high credit quality, rather than investing in a predetermined basket of securities such as an index. For further information on the Floating Rate Fund, please visit our website.

1 topic

1 fund mentioned