Small caps to be cautious of

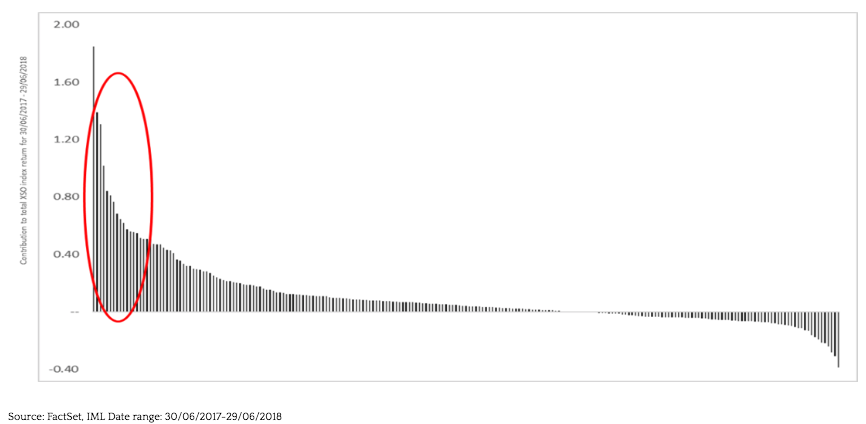

A quick recap of the last twelve months. In January this year we highlighted how the strong performance in the Small Caps sector had been led by a very narrow number of stocks over the preceding six months. We have seen a continuation of this trend over the second half of 2018 - but with increased volatility. For Financial Year 2018 the Small Ordinaries Index gained +24%... a significant return by any measure! This however, is not representative of the performance of the broad range of small cap stocks, as just 20 stocks delivered 60% of these gains - as depicted in Chart 1 below. By contrast the median stock in the index returned a more pedestrian - but not unreasonable +9% for the year.

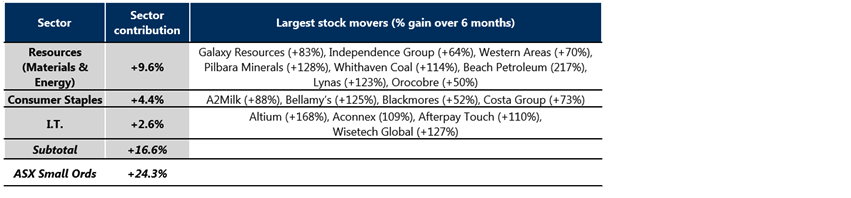

These “top 20 hot stocks” that drove the Small Ords returns over the last 12 months are essentially companies that are broadly exposed to three themes which seem to have really captured many investors’ imagination over the last 12 months – they are stocks exposed to the Chinese ‘Daigou’ distribution channel, Resource stocks exposed to the emerging battery technology theme and emerging technology companies.

Chart 1. Dispersion of returns in the Small caps market in FY18

Taken on a sector basis, three of the ten GICS sectors of which these stocks belong to contributed close to 70% of the total return of the index last year, which is itself fairly extraordinary. These sectors were the Resources, Consumer Staples and IT sectors containing “the top 20 hot stocks” mentioned above – as shown in the table below:

Why does IML remain cautious?

The rapid price appreciation of these stocks is well ahead of the earnings growth recorded by these companies. This sees them trading on very full multiples and certainly well ahead of what a prudent investor like IML would pay. To justify the prices of listed Lithium stocks today one would require a very favourable Lithium price for an extended period of time – something which we believe is an overly optimistic assumption given the amount of supply of lithium coming on stream in the next few years.

IML has maintained a considered and consistent approach in its focus on valuation and quality. For example, the share price volatility of a stock like Wisetech, in the 6 months to June highlights the risk of investing in companies where the share price has risen rapidly and above what is justified by fundamentals. After the release of its half year result in February, Wisetech fell over 50% after reporting a softer than expected result - only to then rally again above the previous high to reach a peak of $18. Such price movements suggest that sentiment rather than fundamentals is dictating the direction of these types of companies’ share prices. Wisetech is reviewed as a case study in the next page to demonstrate the extraordinary optimism surrounding the company’s future prospects.

Growth remains expensive

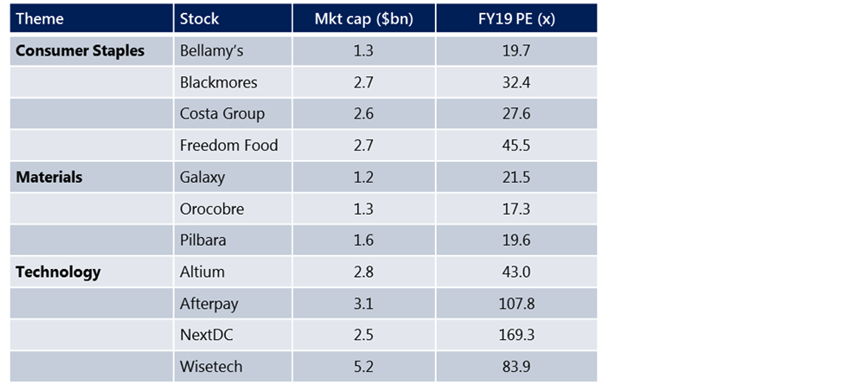

The pursuit of growth at any cost seems unabated at present, with the divergence between growth and the price investors are willing to pay for that growth widening. As a result, the Small Cap Index now trades at over 19x current earnings, and an average dividend yield of only 2.9%. This indicates that a large part of the index gains has come from multiple expansion more than earnings growth. In summary, investors have bid up stocks with positive earnings or revenue momentum well in advance of the earnings growth they have delivered to date.

Conversely and in contrast to the Small Ords index, the IML Smaller Companies portfolio is very much focused with a discipline around valuation - as shown in the table below which compares the PE and dividend yield of the IML Smaller Companies Fund to that of the Small Ords Index.

Chart 2. Small cap investors continue to pay more for less growth

Emerging Tech Case Study:

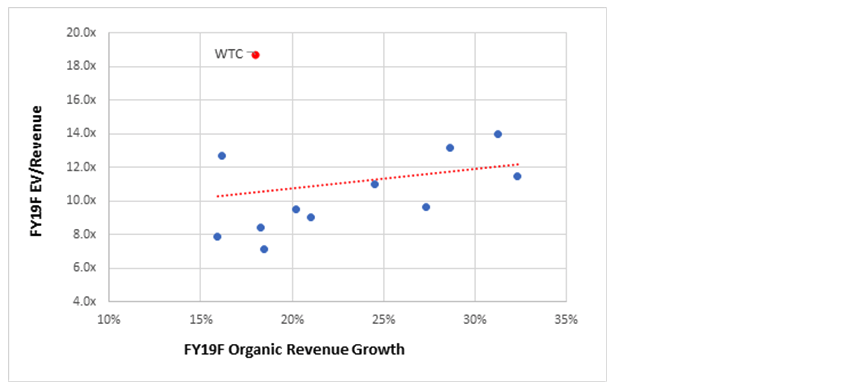

Wisetech - the most expensive SaaS stock in the world!

After listing in April 2016 at $3.35 a share Wisetech (WTC), a global software company that provides logistics companies with software that helps automate the process of freight forwarding, has seen its share price appreciate +460%. However, this return has been well in advance of the earnings growth that the company has delivered with profits growing from $14.2m in FY16 to an expected $40m in FY18e, an increase of +285%. At the current share price of $17, Wisetech trades on a PE of 125 times FY18 earnings (or 84 times FY19)!

The demand for Wisetech on the ASX has seen this company re-rate so significantly that at current levels it is the most expensive SaaS company in the world, as measured by its Enterprise Value to Revenue multiple of 18 times (after listing on 6 times).

In contrast, the US peer set has re-rated over this time from 7 times to 10 times. Wisetech has effectively re-rated 200%, despite declining organic revenue growth, with acquisitions having delivered an increasingly large part of the revenue growth.

Chart 3. WTC FY19F EV/Sales vs global SaaS peers

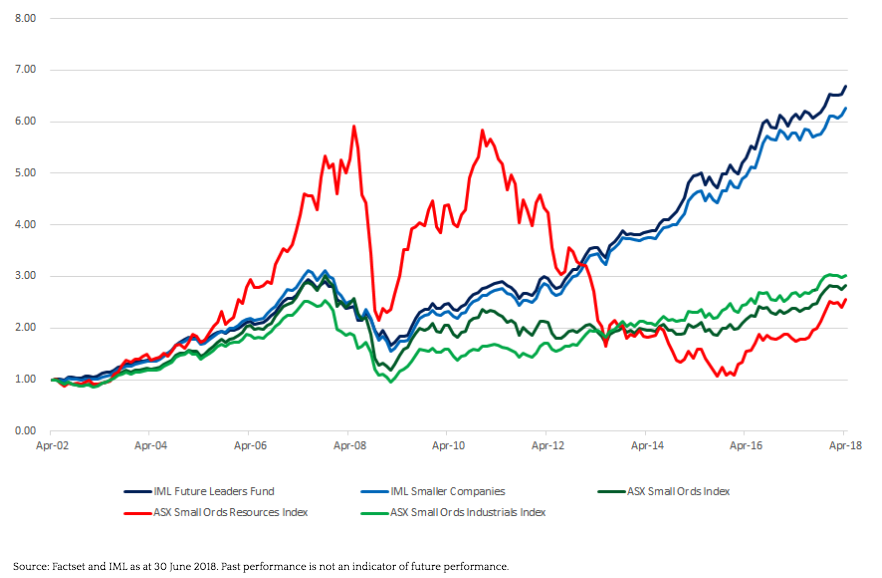

History tells us that discipline is key

The current valuation disconnect in the small cap sector is something we have seen before. While market fads come and go, investment discipline remains the key to sustainable performance. Chart 4 below highlights the benefits of a portfolio of quality industrials over the long term.

Chart 4. IML v Small Industrials v Small Resources

As we have for the last 20 years, IML offers investors the ability to invest in a portfolio of quality companies which we believe are reasonably priced, have recurring earnings a sustainable competitive advantage and are run by good management.

On these measures, companies that feature in IML Small Cap and Future Leaders portfolios like Pact Group, GWA, Sky City, Spark Infrastructure and Southern Cross are companies we find attractive in a market which has become very thematic and momentum based. We believe all these well managed companies are well placed to do well over the next 3-5 years with many of the stocks we hold in our portfolios trading on price earnings ratios of 14 to 15 times 2019 earnings and most of them paying healthy sustainable dividend yields.

Want to find out more?

We believe that markets are not fully efficient and there will be times that a company’s share price will not reflect what we believe to be that company’s true underlying value. Find out more here