Get More From Your Cash Allocation

For the last decade, the Australian cash rate was high enough that investors could allocate a portion of their portfolio to cash or term deposits and earn a reasonably healthy return. This is no longer the case. With the cash rate at a historical low and below the rate of inflation, allocating to cash may mean losing purchasing power.

The dramatic fall in interest rates to just 0.25% in March has put downward pressure on term deposits. With subdued loan growth, banks have not been growing their assets, so there is no need to increase the amount of savings they require to offset these loans. In addition, bank profits are under pressure and their net interest margins (NIMs) are coming down. This margin represents the difference between the amount of money they earn in interest on loans (mortgages, credit cards) and the amount they pay in interest on deposits (savings, term deposits). So there is downward pressure on the rates offered to savers to help preserve margins.

Yet many investors are holding too much cash, reducing their ability to meet return objectives — after all, too much cash can act as a drag on performance. While the returns on cash may be historically low, many investors are concerned about losing money, particularly given recent market volatility. But it is possible to maintain liquidity while also earning returns above the cash rate by using a concept called cash tiering. While liquidity needs and external factors are uncertain, a strategic framework for managing cash can help navigate a shifting landscape.

What is cash tiering?

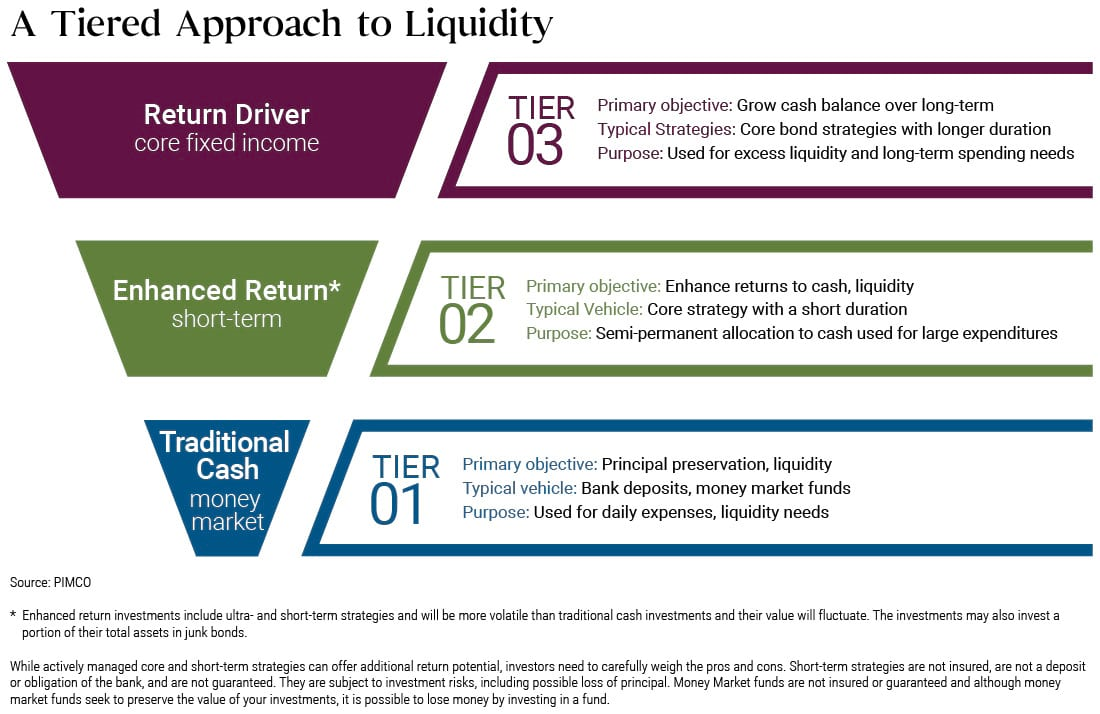

A cash tiering strategy may help investors gauge how much cash they may need in their portfolios based on their goals and objectives, and how much they should consider investing in higher-returning short duration strategies.

The basic idea is to differentiate cash into tiers based on timing and liquidity needs:

- Tier 1 tends to be the smallest and most liquid tier, generally reserved for immediate cash needs and daily expenditures.

- Tier 2 is larger than Tier 1 and represents a still-liquid portion of the portfolio, but for less immediate cash needs. Investors may consider actively managed short-term strategies to enhance return potential.

- Tier 3 is often the largest of the three and represents a longer-term portion of the portfolio, typically focused on growth of the cash balance and with a longer investment horizon. Dedicated return drivers, like core bond funds, can help investors achieve consistent income, outpace inflation and preserve purchasing power over the long term.

Both Tier 2 and Tier 3 come with modestly higher degrees of additional risk versus traditional cash investments.

The main focus in developing a cash tiering approach should be on identifying the portion of the overall portfolio needed for Tier 1 immediate liquidity. The majority of the potential return enhancement involves that initial “step out” from Tier 1 strategies. It is also important to recognise this is not a static process. A cash tiering approach may evolve over time along with portfolio objectives and market environments.

Why should I consider a cash tiering approach now?

Volatility can be concerning, but rather than sitting on the sidelines by over-allocating a portfolio to cash, investors may consider moving slightly up the risk-reward spectrum with a tiered approach. There is no one-size-fits-all approach, but an important first step is to establish a consistent framework that matches an investor’s objectives and risk tolerances.

Investing in diversified, actively managed short-term bond strategies in Tier 2 can help investors enhance return potential while still maintaining an attractive liquidity profile. And sticking with return drivers in Tier 3, such as actively managed core bond strategies with a global opportunity set, can help diversify equity risk and potentially generate the returns needed for longer-term spending needs.

Stay protected in times of volatility

We seek to provide all the benefits investors have come to expect from a core bond holding, including consistent income and low volatility, which can help stabilise portfolio returns. Find out more by click 'contact' below, or hit 'follow' to stay up to date with our latest Livewire insights.

1 topic