Here’s what Warren Buffett bought and sold in the June quarter

Warren Buffett famously said, “never bet against America” and it seems he is putting his money where his mouth is, with Berkshire Hathaway’s recent 13F filings showing an US$800 million investment in three major US homebuilders.

Last week, Berkshire’s Class A shares climbed to all-time highs of US$556,117, up 15.7% year-to-date and exceeding its previous high from March 2022. The conglomerate reported US$10.0 billion in second quarter earnings, up 6.6% compared to the same quarter a year ago.

The 13F filing revealed some thematic changes to Berkshire’s portfolio, which we’ll highlight below.

Three new buys

The three buys were all homebuilders:

- Dr Horton (bought US$726.5 million)

- NVR (bought US$70.6 million)

- Lennar Group (bought US$17.2 million)

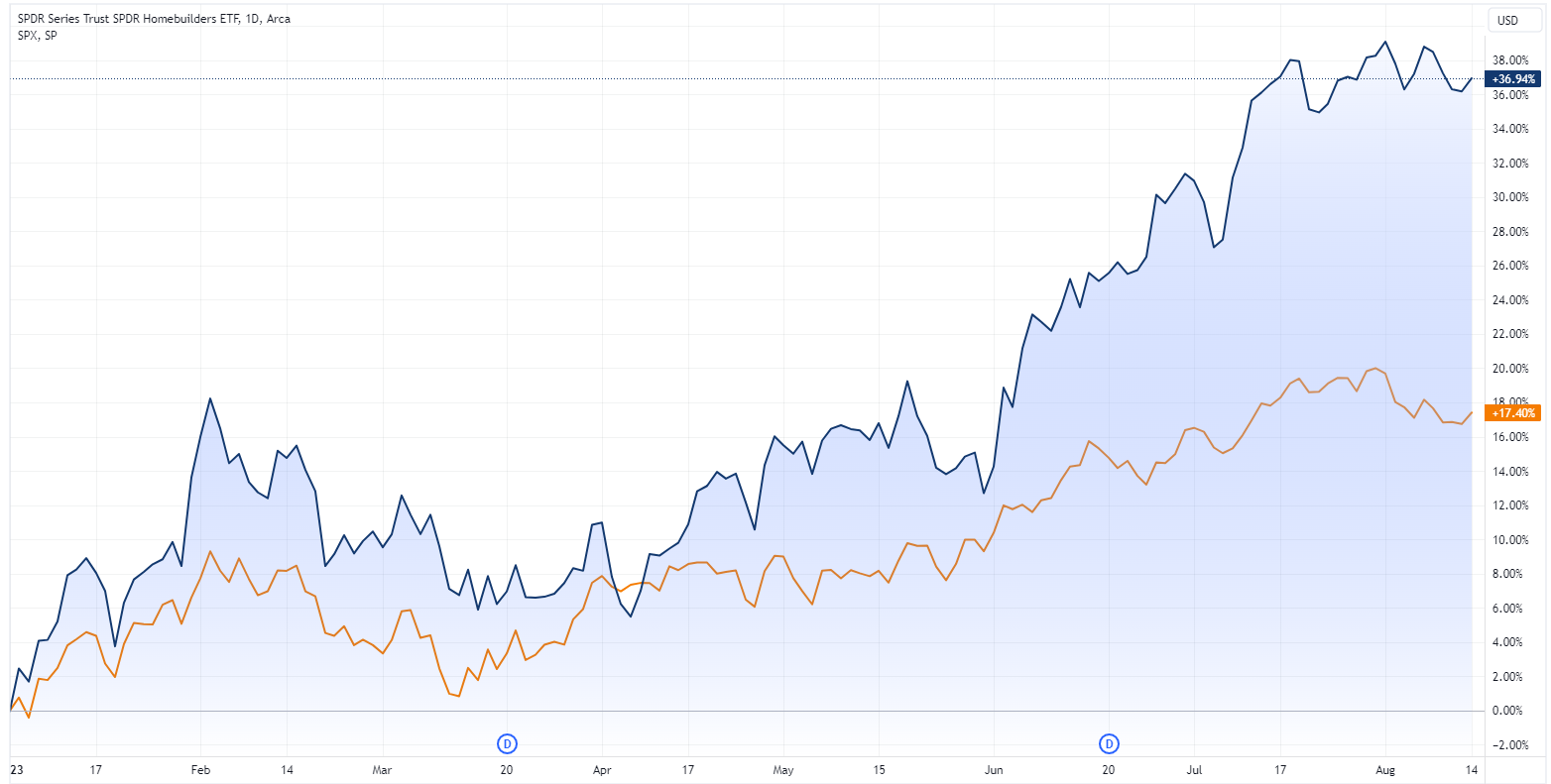

The SPDR S&P Homebuilders ETF is up 37% year-to-date as the sector benefits from tailwinds including tight housing supply, strong demand for new homes and a backlog of projects from the pandemic.

This theme has also played out for local building materials and construction stocks including James Hardie (ASX: JHX), Boral (ASX: BLD) and CSR (ASX: CSR) – which have rallied 79%, 76% and 24.6% year-to-date respectively.

Three exits

- McKesson Corp, a wholesale medical supplies, equipment and pharmaceuticals company (sold $815 million)

- Marsh & McLennan, a risk and insurance consulting company (sold for $67 million)

- Vitesse Energy, an oil and gas developer (sold $1 million)

Where Buffett is buying

Berkshire added to its position in Capital One Financial – a Virginia-based regional bank. Approximately 3.5 million shares were added over the quarter, bringing its stake to nearly 1.25 million shares or US$1.36 billion.

Shares in Capital One Financial are up 17.4% year-to-date and up 26% from May lows.

Berkshire continued to increase its stake in Occidental Petroleum, where it’s the largest shareholder. The conglomerate added more than 12 million shares, raising its stake to around 224 million shares or US$15.0 billion (or almost 30% of the company).

Shares in Occidental Petroleum are up 6.7% year-to-date.

Where Buffett is selling

Berkshire cut its stake in five stocks including:

- General Motors: Cut its stake by approximately 45% to US$750 million.

- Global Life: Reduced position by more than 60% to US$290 million.

- Activision Blizzard: Reduced its stake by 70% – Microsoft is set to acquire the video game maker for $95 per share.

- Chevron: Reduced its stake by 7% to 123.1 million shares.

- Celanese: Cut its exposure by 39% to US$666 million.

General Motors is arguably one of the more interesting moves. Shares in the automaker closed at $34.0 per share in November 2010 – its first trading day after re-listing following its Global Financial Crisis bankruptcy bailout. The stock closed at $34.07 on Wednesday, making it rather dead money for over a decade.

General Motors price chart (Source: TradingView)

Berkshire’s top holdings

- Apple (NASDAQ: AAPL): 51%

- Bank of America (NYSE: BAC): 8.5%

- American Express (NYSE: AXP): 7.5%

- Coca-Cola (NYSE: COKE): 6.9%

- Chevron (NYSE: CVX): 5.5%

- Occidental (NYSE: OXY): 3.7%

- Kraft Henz (NASDAQ: KHC): 3.8%

- Moody’s Corp (NYSE: MCO): 2.4%

- HP (NASDAQ: HPE): 1.0%

- Everything else: 10.2%

2 topics

12 stocks mentioned