Here’s what Warren Buffett bought and sold in the third quarter

Warren Buffett’s Berkshire Hathaway revealed a subtle retreat from a broad set of stocks while maintaining its focus on core positions like Apple and Coca-Cola, according to its latest 13F filings.

Berkshire’s 13F Summary

The below data was obtained from Whalewisdom:

- Market value – US$313 billion versus US$348 billion in the previous quarter

- New purchases – 4 stocks

- Additional purchases – 0 stocks

- Sold out of – 7 stocks

- Reduced holdings in – 7 stocks

- Top 10 holdings – Account for 91.9% of the portfolio

- Top 10 holdings – Held for an average of 30.6 quarters

Top Five Holdings

Berkshire is holding tight on its core positions.

- Apple (NASDAQ: AAPL) – 50.04%

- Bank of America (NYSE: BAC) – 9.03%

- American Express (NYSE: AXP) – 7.22%

- Coca Cola (NYSE: COKE) – 7.15%

- Chevron Corp (NYSE: CVX) – 5.93%

A subtle retreat

Berkshire exited stakes in seven companies and trimmed several others.

According to its September quarter result, the firm held a record US$157.2 billion in cash and cash equivalents, up from US$147.4 billion in the previous quarter.

The exits include:

- Activision Blizzard – 14.6 million shares

- General Motors – 22.0 million shares

- Celanese Corp – 5.3 million shares

- Johnson & Johnson – 327,000 shares

- Mondelez International – 578,000 shares

- Procter & Gamble – 315,400 shares

- United Parcel Services – 59,400 shares

The seven exits were worth around 0.8% of the portfolio.

The trimmings include (reduction vs. prior weighting):

- Amazon – Reduced exposure by 5.2%

- Aon PLC – Reduced exposure by 5.4%

- Chevron Corp – Reduced exposure by 10.5%

- HP Inc – Reduced exposure by 15.2%

- Markel Group – Reduced exposure by 66.9%

- Global Life – Reduced exposure by 66.9%

The selling was worth around 1.08% of the portfolio.

New additions

Liberty Media – A US mass media company – popped up as a new addition in the 13F. But this was due to the reclassification of its shares into three new stocks: Sirius XM, Liberty Formula One and Liberty Live.

The only new addition was the US$8 million stake in the Atlanta Braves Major League Baseball Team.

There are reports that the conglomerate asked the US Securities and Exchange Commission (SEC) to omit some data from the 13F. It’s unclear whether or not this relates to new or existing positions.

A similar instance occurred back in 2020, where the firm built stakes in companies including Verizon, Chevron and Marsh & McLennan.

Insight #1 – Is Buffett bearish?

Berkshire trimmed pretty much everything consumers use – from vehicles to soft drinks, eCommerce to laptops, freight services to hotels.

While they aren’t aggressively selling stocks, the firm was a net seller of approximately US$5.3 billion during the quarter.

It also has no exposure to several sectors including Industrials, Real Estate, and Utilities.

Insight #2 – The secret sauce

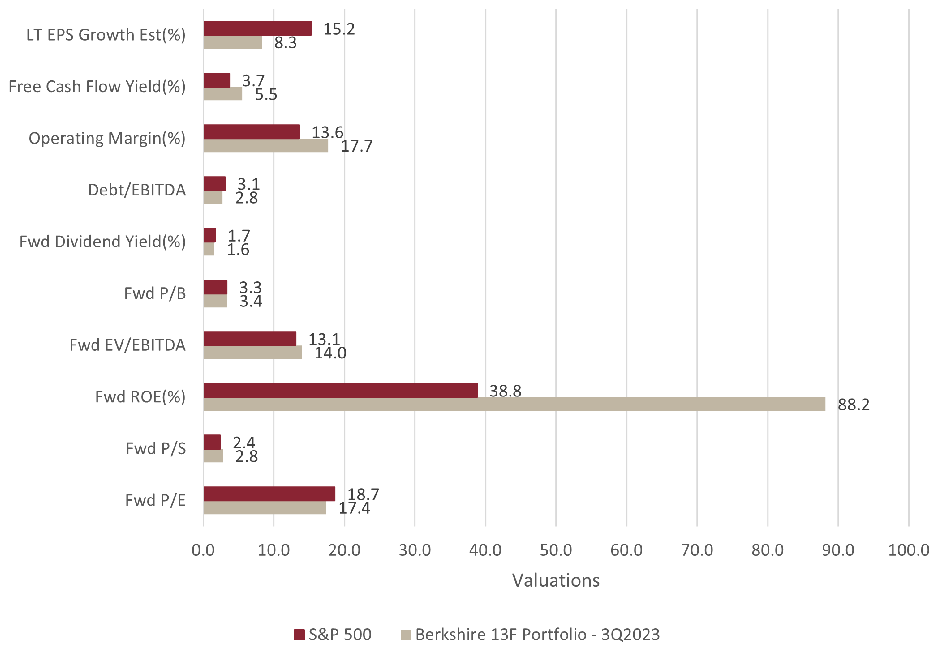

The below chart from Forbes looks at Berkshire’s portfolio across several key metrics including 12-month forward price-to-earnings, free cash flow yield, forward return on equity and more.

In summary: The portfolio has a slightly cheaper price-to-earnings ratio than the S&P 500, with lower long-term growth estimates but significantly higher cash flow and profitability metrics such as return on equity and operating margins.

2 topics

5 stocks mentioned