How to access greater income in a low-rate world

Volatility and low yields are likely to persist over the next few years as the global economy recovers from the shock of the coronavirus. Navigating this environment will be difficult, particularly as returns from equities are likely to be lower after the strong rally of the past year. High yield bonds, which historically have tended to outperform equities in the years immediately following a recession, may be an attractive option for investors looking for yield in the post‑coronavirus economic environment.

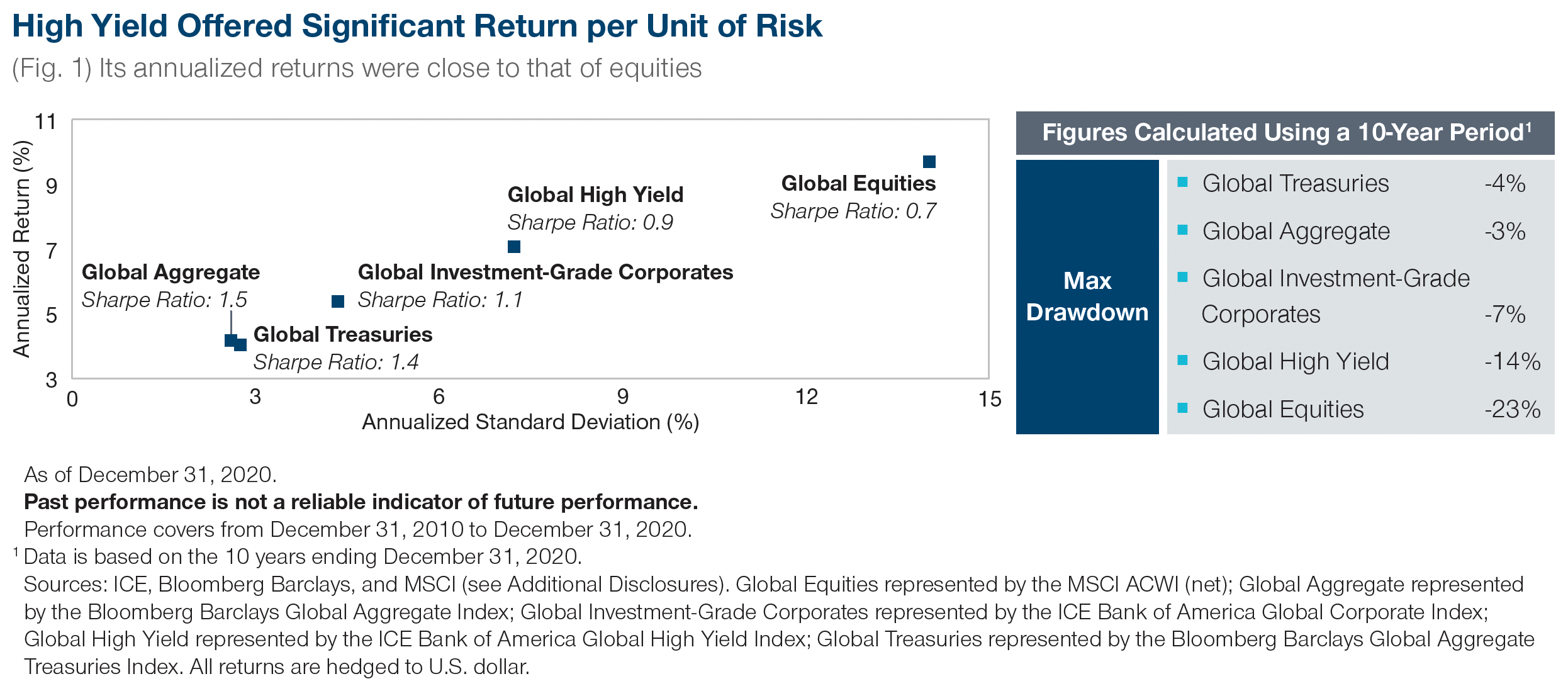

High yield debt is often overlooked by some investors as it is regarded as too volatile. This is something of a false perception, however. Over the past 10 years, both the annualized standard deviation and the maximum drawdown of the ICE Bank of America Global High Yield Index has been around half that of the MSCI All Country World Index (Figure 1).

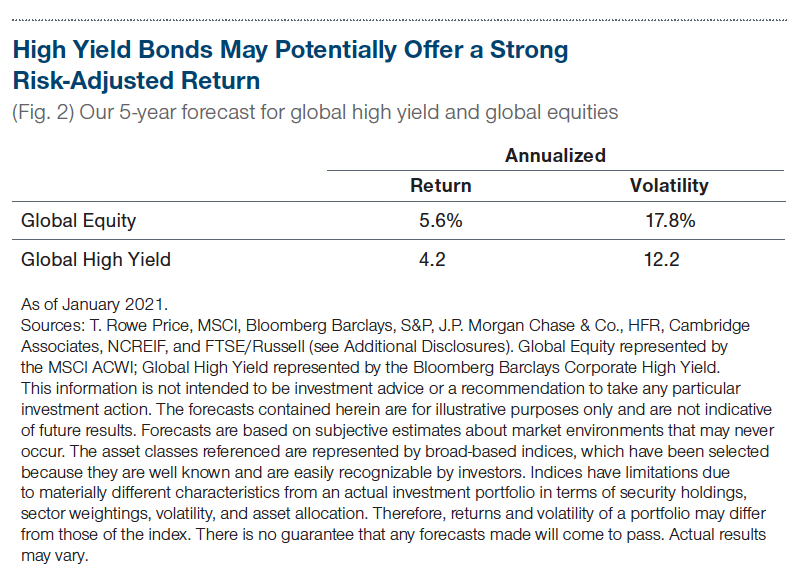

Crucially, this reduced risk does not come at the expense of a major loss of return. Over the past 10 years, global high yield delivered an annualized return of around 7% compared with around 9% for global equities. So overall, global high yield has carried around half the risk of global equities over the past decade while it may potentially offer a stronger risk/return trade-off (Figure 2).

Volatility is set to remain elevated

In a low‑yield world, investors need to cast a wider net for income. High yield bonds have a strong track record in delivering good income during periods when it is unavailable elsewhere. As high yield sits above equity in the seniority of any capital structure and typically has multiple securities to invest in, it may allow investors to take more selective credit risk while knowing that they are still likely to receive a decent level of income.

These features of high yield debt are likely to be very useful during the period ahead if volatility remains elevated— and we believe there is every reason to think that it will. Government and investment‑grade bond yields are low— and in some cases negative—while the rally in stocks that began last March has left prices stretched, potentially meaning lower returns over the next few years. At the same time, the prospect of many countries exiting lockdowns and kick‑starting their economies at the same time has led to growing concerns over inflation. This combination of low yields and potentially rising inflation means that continued volatility is highly likely.

We believe the next few years will be characterised by a battle between the underlying economic fundamentals that drive companies and their opportunities versus technical market factors, such as concerns over inflation. While technical factors will inevitably have an impact on prices in the near term, we believe it is better to focus on companies with strong fundamentals that look well placed to benefit from the more stable economic environment expected over the next few years. Investors who are able and willing to look beyond near‑term volatility and focus on longer‑term fundamentals should be more likely to capture strong medium‑term returns.

Lower‑rated firms are well placed to benefit from a recovery

The search for yield has attracted a growing number of investors to high yield debt who have little or no previous experience of investing in the asset class. For such investors, it is essential to truly understand the risks they are taking on— and whether the pricing of those risks means they are likely to achieve a good return.

High yield investments are sub‑investment‑grade corporates and are at the weaker end of the ratings spectrum. Companies with lower ratings are likely to benefit more from the economic recovery than those with higher ratings, particularly if they have already survived 2020 and have balance sheets that are stable and sustainable to get them through the period ahead. If such firms are trading weakly at the moment, they may represent a good opportunity once the post‑coronavirus economic recovery is in full swing.

A number of sectors have suffered heavily during the coronavirus pandemic, particularly those—such as entertainment and transport—that are dependent on footfall. However, companies within those sectors that have strong balance sheets, have managed their debt well or even repaired it during the pandemic, and whose liquidity forecasts indicate that they are well placed to survive into 2022 may be among those who can perform very well during the post‑coronavirus economic recovery. Many of these types of firms are currently undervalued and, as such, represent good opportunities.

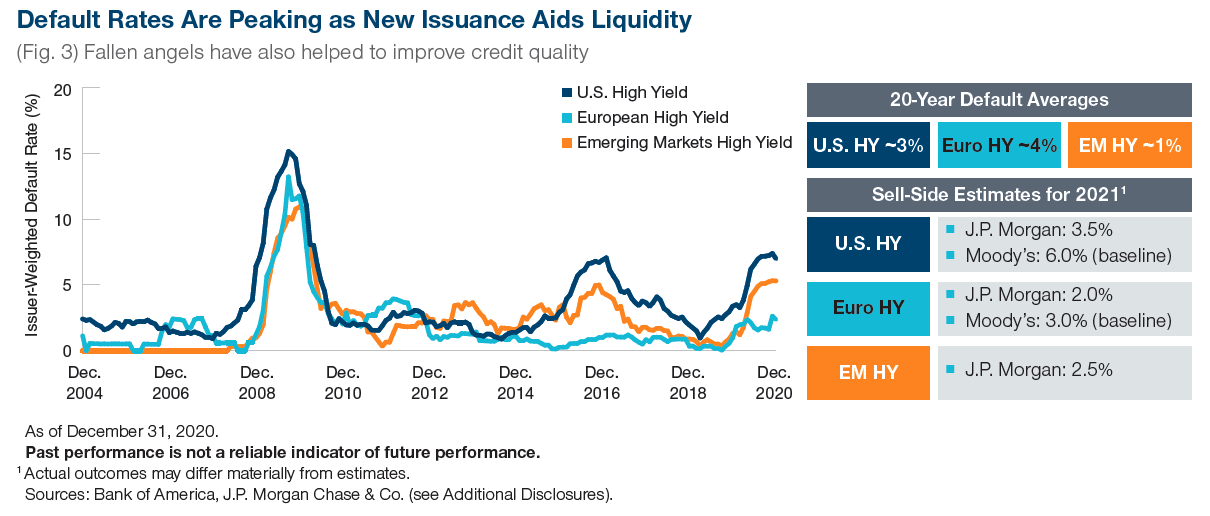

Fallen angels have lowered default rates

Fallen angels—companies whose debt was formerly investment grade but which has been downgraded to high yield—have further enriched the high yield opportunity set. There was a record amount of fallen angel debt last year— almost USD 250 billion worth—in the global high yield market. The presence of so many fallen angels within the high yield space has improved the credit quality of the asset class: A decade ago, some 40% of the ICE BofA Global High Yield Index was BB-rated (the upper end of asset class’s rating scale); today, that figure is more like 60%.

As the average rating of high yield debt has increased, overall default risk has fallen. A year ago, we were expecting 2020 high yield default rates of around 10% in the U.S. and 4.5% in Europe; in reality, those figures were around 7.5% for the U.S. and less than 3.5% for Europe. This year, we’re expecting those rates to be halved. This indicates that a combination of balance sheet repair and the arrival of a large number of fallen angels should significantly reduce the risk of default among high yield issuers.

Moreover, the amount investors receive if a company defaults has also increased significantly and currently stands above 50%, according to J.P. Morgan Chase & Co.1 Take European high yield for example, if the default rate is 2% and the amount received from companies that have defaulted is 50%, the overall loss is 1% or 100bps. Given that the spread of high yield debt returns over the risk‑free rate is currently around 390bps, the overall potential return is just under 300bps when default risk is factored in.

Defensive areas can offer some of the best opportunities

In our view, some of the best current high yield opportunities exist in defensive areas that can add ballast to portfolios. The cable industry, for example, would appear to have solid prospects as the shift toward working from home is likely to continue beyond the coronavirus pandemic, bringing greater demand for data transfer. While the leading names in the industry may no longer offer a great deal of value, they can potentially provide very strong income and a degree of stability.

Another area worth considering is food retail and in particular supermarket chains. This sector offers similar potential stability to the cable industry and can offer some compelling opportunities when there are changes of ownership, as recently occurred when the UK supermarket group ASDA was bought out. Buyouts result in changes in the capital structure and potentially increased leverage, which means greater risk—and potentially some very good opportunities.

Riskier opportunities can be found in industries that are undergoing significant change. The automotive sector, for example, is in the process of a major secular shift toward electrification but at a pace that is not entirely within its control as attitudes toward the traditional internal combustion engine vary considerably around the world. There will inevitably be winners and losers within the industry. Firms with the intention and capacity to fully embrace electrification, particularly those large enough to offer a wide range of debt to invest in, are worth taking a closer look at.

Overall, then, although yields are lower than they have been in the past, we believe high yield investors are able to benefit from both the supportive fundamental environment and potential for lower volatility than other high‑returning asset classes. To make the most of the opportunities available, we think that investors should avoid trying to chase the market as a whole and be highly selective when choosing which high yield bonds to invest in. Finally, it is worth noting that because of its track record of delivering consistent returns, high yield debt works most effectively when included in a permanent asset allocation model in order to benefit from compounding interest over time.

Invest with confidence

T. Rowe Price focuses on delivering investment management excellence that investors can rely on—now and over the long term. Hit the 'follow' button below for more of our investment insights

1 topic

1 contributor mentioned