How to buy a LIC at the right price

Five key factors to assess

While this is not an exclusive list, here are some factors to start with when you assess a LIC.

-

Strategy

Understand the objectives, assets and investment style that is used for the LIC and how it might fit in your portfolio. -

Performance

While past performance doesn’t guarantee future performance, it’s still worth considering. There are two performance measures to look at. The portfolio performance (performance of the underlying investments held by the LIC) and the total shareholder return of the LIC itself. -

Volatility and drawdowns

A LIC’s performance can be volatile, depending on the assets held and investment style. It’s worth understanding how volatile the LIC is likely to be to assess whether it will fit in your portfolio and your own level of comfort with potential movements. -

People and investment managers

The stability of the team managing a LIC can support performance over time. Where the investment team also has aligned interests with the LIC, such as ownership within the structure, this can also support their likelihood to remain with the business as well as their focus on the results. -

Size and liquidity

The ideal LIC is not too big and not too small. Smaller LICs may have a high cost load because some costs of managing a LIC typically don’t change according to size. Smaller LICs may also be less liquid (hard to trade). On the flip side, larger LICs may have a cost advantage through scale but may find it harder to outperform because they may be restricted to certain types of investments by the size of capital they need to invest.

Buying a LIC at the right price

The concept of Net Tangible Asset Value Per Share (NTA) and trading at a premium or discount is very important to LIC investors.

NTA is the total value of the assets held by the LIC divided by the number of shares on issue. LICs can trade at a premium or a discount to their NTA for a range of reasons such as performance, market interest, liquidity, or market cycles.

There are three NTA figures usually given. NTA before tax, NTA before tax on unrealised gains/losses and NTA after tax. In most cases, we believe the most appropriate value to use is the NTA before tax on unrealised gains/losses. This reflects the position after allowance for tax payable on current year earnings and capital gains, but before any deferred tax on the remaining investment portfolio.

If a LIC has stated an intention to wind-up or otherwise dispose of all or a substantial portion of its portfolio, it may be more appropriate to use the NTA after tax.

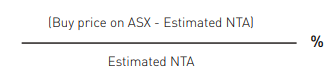

The below formula helps you assess whether a LIC is trading at a premium or a discount.

A positive result means a premium, whereas a negative will indicate a discount.

While it may sound like buying at a discount is a good deal, this isn’t always the case.

One of the key factors we take into account is the price and NTA history. If we can, we prefer to study how a LIC has traded historically relative to its NTA. This data is sometimes published by the LIC itself or may also be available through your broker research. If you can buy at a price below the average discount/premium calculated over a reasonably long period, this can be a good indicator of value.

Some other factors to take into account are: historical performance, size, liquidity, underlying assets, portfolio concentration, investor confidence and market performance.

Like all investments, it’s best to do your homework properly before buying any LIC. We suggest you consider only quality LICs with proven managers who have performed well in the past. Ensure those LICs hold assets you like and have an investment strategy you understand, with an appropriate management structure in place. Understand how an LIC will fit into your portfolio and how you expect it to assist you in achieving your investment goals. Most importantly, try to buy at the best possible price you can, relative to the value of the underlying assets and the trading history of the LIC.

FAQs

What is a LIC’s NTA?

NTA is the total value of the assets held by the LIC divided by the number of shares on issue.

Why do LICs trade at a premium or at a discount to NTA?

LICs can trade at a premium or a discount to their NTA for a range of reasons such as performance, market interest, liquidity, or market cycles.

How do you calculate if a LIC is trading at a premium or a discount to NTA?

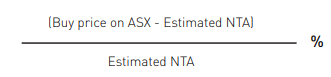

The below formula helps you assess whether a LIC is trading at a premium or a discount.

A positive result means a premium, whereas a negative will indicate a discount.

This information is an extract from Affluence Funds Management guide to LICs. You can request a copy via our website.

2 topics