How to buy the new hydrogen economy

When I was growing up – and had not yet realised my distaste for advanced calculus – I wanted to design cars. I would spend hours drawing sketches, imagining a large Mercedes logo acting as a wind turbine, not yet realising that I was setting myself up for the thankless career of mechanical engineer.

It was during this time that I first saw a program about hydrogen and Honda’s recently announced FCX concept (now known as the Honda Clarity), a hydrogen fuel-cell car which was being tested in California.

Being then, as now, a science nerd, this made perfect sense: hydrogen is the most abundant element in the universe and, more importantly, it explodes with the best of them (see the Hindenburg for reference).

Non sequiturs about my failed ambitions of being an academic aside, the Honda Clarity will always represent the birth of my personal interest in the new hydrogen economy, an idea which is gathering momentum and experimentation around the world.

In a world grappling with the risk of energy crises and climate change disaster, hydrogen may represent one of the most exciting and varied opportunities to expand our renewable energy grid, and transform the way we power everything from vehicles to towns.

Today we will examine the current hydrogen market, the proposed applications and potential scale of the newer, greener technology, and how an investor might gain exposure to the element which makes up 90% of all the atoms in the known universe.

Current hydrogen market

The current demand for hydrogen is almost exclusively within the industrial refining and agricultural sectors.

According to research house MarketsandMarkets, the global hydrogen market was worth approximately $130 billion USD in 2020, with a projected growth rate of 9.2% per annum out to 2025. This would place the market at approximately $200 billion USD.

Around 95% of the hydrogen produced in the world is known as “grey hydrogen”, which uses a method known as “steam methane reforming”, using either natural gas or coal seam gas.

This is a dirty, but cheap process which produces on average 10kg of carbon dioxide per kilogram of H2 (source: CEFC). This has resulted in approximately 830 million tonnes of carbon dioxide per year at current production rates.

For this reason, hydrogen is mostly used by dirty industries today, at least at scale. As of 2018, 51.6% of global hydrogen demand went to the chemical processes used in petroleum refining, and 42.5% went to ammonia production for fertiliser (source: IEA). On the fringe sat “niche applications”, such as the development of hydrogen fuel cells.

Looking only at the commercial-scale figures at the moment, you may be forgiven for assuming that hydrogen was doomed to forever be a dirty, relatively small industry.

But that is not the case and - appropriately enough for a potential fuel source - there are catalysts waiting just over the horizon to completely transform how we view hydrogen in the coming decades.

The future of the first element

From a structural point of view, there is an increasing demand for energy production and long-term storage – the entire world is not yet industrialised, and beyond that, the entire world is certainly not employing the most efficient methods of power generation.

Consider for a moment the below heat values of various fuels – this is the amount of heat released during its combustion, a highly important statistic when considering the merit of a fuel source.

Chart 1: Heat value of fuel sources

Source: Mason Stevens, World Nuclear Association

Looking at these figures alone, it’s a no-brainer that hydrogen should form a much larger part of our global energy mix. However, the explosive nature of the gas, as well as the carbon-intensive nature of current production, have limited this prospect.

As an aside, interesting to see that firewood has a higher heat value than brown coal.

Enter green hydrogen, produced using renewable energy (currently proposed to be solar and wind) to power electrolysis – the chemical process for splitting the oxygen and hydrogen atoms apart in water using electric currents.

Whilst in European markets (currently some of the most developed for hydrogen), “grey” hydrogen costs around £1-2/kg, green hydrogen currently costs anywhere from £3-8 /kg, making the economics challenging. The main barrier to lowering costs is access to low-cost renewable energy, so green hydrogen is in a symbiotic relationship with the global push towards renewables.

According to a recent study by PwC, Australia, the US and the Middle East have lower potential costs of production for green hydrogen due to our higher volume of low-cost renewables (around £3-5/kg).

Their chart on the demand for global hydrogen by 2050 is a fantastic illustration of two dynamics at play; the ability to develop and implement sufficient infrastructure to make hydrogen applications viable, and how seriously we take temperature targets.

The grey line is driven by keeping a global temperature rise below 1.8 degrees Celsius, orange between 1.8-2.3 degrees, and red above 2.3 degrees.

Chart 2: Forecast global hydrogen market demand

Source: PWC

We will touch on some potential use cases in a moment, but it is likely that there will be one key catalyst to accelerate the investment thesis for the new hydrogen economy: policy support.

There are some existing initiatives already in place, however a global effort towards decarbonisation will be the ultimate driver of developing the technology and infrastructure needed to unlock hydrogen’s true potential.

- The US Secretary for Energy came out earlier this year to commit to the Hydrogen Earthshot program, with the goal of green hydrogen at a cost of $1/kg USD by 2030. This follows a $33 million USD funding plan to support hydrogen fuel cell R&D proposed in December 2020

- In Q1 2021, the EU proposed to establish a Clean Hydrogen Partnership, under which the EU would provide £10 billion of funding, which industry partners would also match, to further the production, distribution and storage of green hydrogen

- South Korea finalised their carbon neutrality roadmap last week, proposing for 97% of their vehicles to be powered by hydrogen-fuel cells or lithium-ion batteries by 2050

- Ineos, a major UK chemicals company, announced plans to invest $2.3 billion USD in green hydrogen production across Europe between now and 2030

- Hydrogen fuel cell development is anticipated to be part of China’s recent 2021-25 Five Year Plan goals, as part of the “future industries” targets

The wheels appear to be in motion to begin building out our hydrogen capabilities, and the breadth of policies/initiatives across the globe is encouraging to see, as scale can be achieved from multiple policy regimes simultaneously.

As we develop our green energy infrastructure, the use cases for hydrogen balloon out far in excess of only dirty industrial applications:

- As hydrogen fuel cell technology continues to improve (both in stability and capacity), it will be more viable for hydrogen refueling stations to be created to fuel heavy transport and commercial cars with this eco-friendly gas.

- From the heat value graph above, the potential for energy production is clear. Hydrogen currently represents a compelling option for a renewable energy source which can be stored - being kept in reservoirs to be used on-demand rather than waiting for the wind or the sun for power. Hydrogen mixed with ammonia is currently the leading strategy, which can be used in gas turbines and be a supplement to our existing power infrastructure as we seek a baseload source to replace coal-fired power stations.

- Green hydrogen can be integrated into existing industrial processes, further enabling the push towards green agriculture and green steel. This is particularly relevant as costs of production decrease below even that of grey hydrogen – potentially having deflationary impacts on these industries in the long run.

- In city infrastructure, hydrogen gas can be connected to existing natural gas infrastructure to provide gas to homes, commercial buildings, and industrial complexes, which is not even touching on the potential for industrial-scale hydrogen fuel cells to provide power sources to buildings.

The end result would be a more flexible power grid, operating at a lower cost, with a fuel source which has a higher energy capacity and is more on-demand than our current renewable profile.

Buying the new hydrogen economy

We have a growing global market, developing policy demand, and a long runway of potential use cases that are not so far off our current technological capabilities to be considered “moonshots”.

How do we as investors get exposure to such a market? In an emerging theme such as hydrogen, it’s often the safest pick to take a diversified, sector-wide approach.

There are ETFs listed globally which offer some variation of exposure to hydrogen, however, for a domestic investment, there is the ETFS Hydrogen ETF (HGEN:ASX), which looks to track 30 companies from developed markets with a focus on pure-play hydrogen businesses. The ETF has around $41.5 million AUD under management since its recent launch at the start of October.

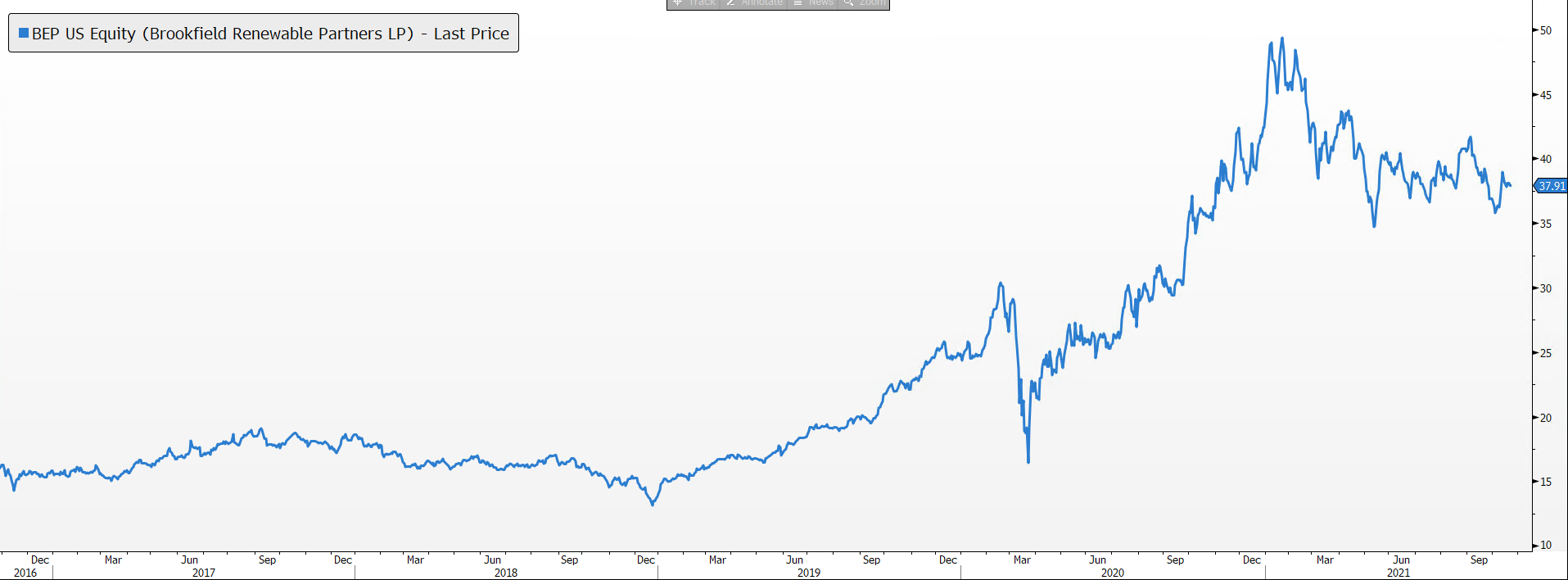

Brookfield Renewable Partners (BEP:NYSE) are another stock that we have mentioned before in relation to green energy. Their recent partnership with Plug Power (PLUG:NASDAQ) adds hydrogen fuel cell assets to the Brookfield portfolio, with the addition of a green hydrogen power plant which could seamlessly tap into Brookfield’s existing renewable energy assets.

Source: Bloomberg

There are single-stock exposures in three categories; upstream (producers), midstream (transportation, storage) and downstream (fuel cells, industry applications). Each industry has merit and given the early stages of this investment theme, careful attention should be paid to individual names as many are developing companies with an inherently higher level of risk than an established producer.

As an example of some equities with either pure-play or key hydrogen assets:

- Woodside Petroleum (WPL:ASX): announced plans this week to construct a $1 billion ammonia and hydrogen plant in Perth

- ITM Power (ITM:LON): owns and operates the largest electrolyser manufacturing facility in the world, strategic partnerships with Shell, Linde Engineering and Snam

- CIMIC Enric (3899:HK): world leader in gas equipment and liquid tanks, specialising in hydrogen equipment and well-positioned to capitalise on China’s growing energy needs and growing appetite for green hydrogen

- Plug Power (PLIG:NASDAQ): leading developer of hydrogen fuel cells

Explosive opportunity

Hydrogen is an exciting industry, simultaneously providing a way to improve our power capabilities and versatility, while also working towards a global effort of decarbonisation.

Given the breadth of applications and near-term viability of the technology, it seems likely that demand will grow rapidly in the next few decades, creating opportunities for investors to get exposure to an emerging sector or some key players within it.

Perhaps in 30 or 40 years, there will be children being taught in chemistry that we finally managed to tap the most abundant resource in the universe and see an ad for a concept car that heralds yet another wave of new energy technology.

Until then, I still have Honda and their discontinued hydrogen car to thank.

2 topics