Ignore the FOMC dot plot, it's an uncertain environment

At its June meeting, the Federal Open Market Committee decided to keep its benchmark policy rate unchanged at 4.25%-4.50% as expected.

The new Summary of Economic Projections (SEP) showed a weaker economy in 2025, a marginal increase in the unemployment rate, and a higher inflation forecast, while the median dot plot remained unchanged at two rate cuts for this year. Yet, with Fed Chair Powell emphasizing the elevated state of uncertainty around their policy outlook (“With uncertainty as elevated as it is, no one holds these rate paths with a lot of conviction”), he essentially de-emphasized the dot plot.

The key takeaway from the June meeting came not from the SEP, but from Powell’s remark during the press conference: “For the time being, we are well-positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.” In essence, the continued strength of the U.S. economy gives the Fed room to pause and wait for clearer data before making any policy changes.

Current assessment

The U.S. economy has defied recession fears, with hard data cooling only slightly in recent months. The labor market is showing only modest signs of cracks, while inflation has surprised on the downside of late. Recent surveys suggest that firms are likely to pass through some or all of their tariff-induced costs, so an inflation boost is increasingly likely in Q3. Tariff uncertainty has likely peaked, but it has been replaced by growing fiscal and geopolitical uncertainty – creating a difficult environment for forecasters.

From Fed Chair Powell’s perspective, the continued robustness of the economy suggests that the current policy stance is only modestly restrictive, in turn indicating only a shallow cutting cycle is likely over the forecast horizon. He noted that while inflation is likely to move higher over the coming months as tariffs are passed along the supply chain, it is highly unclear if the tariff-driven inflation will be short-lived or persistent. Certainly, the risk that unanchored inflation expectations—even in the short-term—leads to persistent inflation is heightened, especially in an environment where overall price stability has not yet been achieved. Against that backdrop, the Fed has little reason to cut rates preemptively.

Updates to the Summary of Economic Projections

The new Summary of Economic Projections was also released today. In general, it showed the Fed moving further away from both parts of its dual mandate, underscoring the difficult dilemma the central bank currently faces.

• The GDP growth forecast for 2025 was revised down from 1.7% to 1.4%, from 1.8% to 1.6% in 2026, and was left unchanged at 1.8% for 2027.

• The unemployment rate forecast was revised up slightly, from 4.4% to 4.5% in 2025, and remaining there in 2026.

• The headline PCE inflation forecast for 2025 was revised up, from 2.7% to 3%. With headline inflation currently sitting at just 2.1%, the Fed is projecting a sharp increase in inflation over the coming months. Importantly, though, inflation is then projected to fall back to 2.4% in 2026, suggesting that the Fed expects the tariff impact on inflation to be fairly short-lived (transitory!)

The revised SEP forecasts for 2025 are very similar to our own. We expect GDP growth this year of 1.5%, inflation to reach 3.2%, and unemployment to rise to 4.5%.

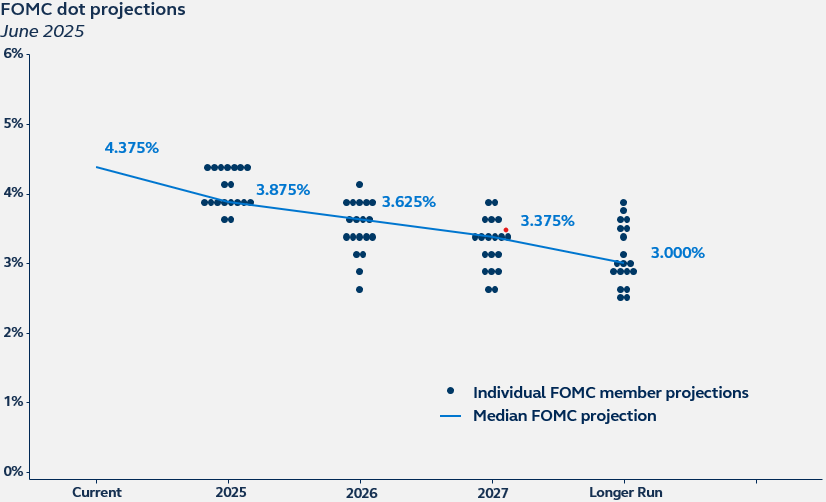

Despite the changes to the inflation forecasts, there was no change to the 2025 median dot plot, which still shows two cuts this year. The plot was finely split: 10 participants projected two or more cuts in 2025, and 9 participants projected one cut or no cuts. Overall, there was a slight hawkish shift in the distribution of dots for this year, with 7 of 19 participants now seeing no cuts this year, up from 4 participants in March.

The median dot now sees just one cut in 2026, down from two cuts in the March SEP, and one more cut in 2027, ultimately taking the Fed funds rate down to 3.375%. The median longer-run dot was unchanged at 3%.

Policy outlook

The unchanged median dot showing 50 bps of cuts for this year despite the higher inflation outlook is somewhat surprising. Yet, any change in this year’s dot plot may have been interpreted as a signal that the Fed has a clear understanding about its future policy path. As Powell clearly conveyed throughout the press conference, with the economic outlook still very much shrouded in uncertainty, the Fed is still unsure of how things will pan out.

With inflation already running above target and economic data still looking resilient, the current environment of persistent uncertainty is ripe ground for a policy misstep. The wisest decision for the Fed is to simply stand still – both on its current policy rates and its dot plot. Our view is that the Fed will remain on hold until late Q4, with just one 25 bp cut this year.