India takes leadership, both on and off the field

Yesterday we saw India’s cricket team defeat Australia at the Gabba despite all odds. Most so-called experts called for a 4-0 drubbing, especially after the first test was over in three days and the Indian captain departed. Despite significant adversity (including multiple injuries), the Indian team overcame them and then landed a knockout blow by winning yesterday and removing the response of “it was a drawn series anyway”.

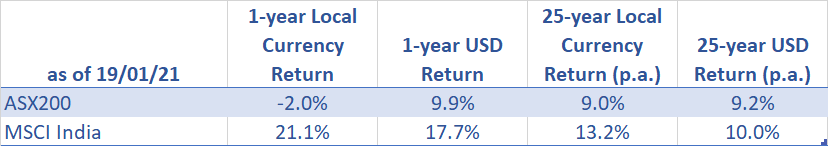

But it is not just on the cricket field where India has produced better results despite ill-fated perception from foreigners. It is also via their stock market as well. Typically, economies which have strong fundamentals for growth not only perform better over the long term but tend to rebound from adversities much quicker given the right direction, growth and economic policy and reforms in place. I am sure we can see the parallels with the Indian cricket team.

It is our view that over the last year Australia as a nation has been far more complacent, Australia’s has dealt with COVID-19’s health issues, but not necessarily used it to refocus on GDP growth, economic evolution and pivot required to channel it towards growth in the upcoming decade. Reliance is again largely pinned on a recovery in real estate related activity and commodity cycle. Given our population’s lack of size and scalability, we have not sought to develop industries which can be globally competitive and less cyclical, Additionally, over time and we have given up on manufacturing and become reliant on a handful of countries for exports.

Given Australia’s favourable economic landscape over the last 30 years has been favourable with receding interest rates, a commodity super cycle and a boom in real estate construction and prices, the term “lucky country” has remained aptly chosen. Going ahead, it will be important to choose the right concoction of politicians, development industries and create value-add economically.

Our general view in Australia is that we are the fortunate country from a lifestyle perspective, and we look up to the achievements of the USA, UK, Euro and China (albeit sometimes mockingly). However, achievements of other nations (particularly emerging ones) are sometimes written off as lucky, insignificant, or untrue.

Emerging market economies with size and scale are likely to emerge as winners faster than we know it despite the attention-seeking headlines. The global supply chain and competitiveness within in will be critical as will the speed and adoption of technology. COVID-19 was the perfect time to attempt to pivot the economy towards the future. India has the luxury of strong demographics, significant scalability, rising productivity and a customer base which every global company wants to access as illustrated by significant ongoing investments made by Amazon, Google, Facebook, Intel, Walmart etc.

India’s share market composition also favours growth industries with a large weighting to Technology, Pharmaceuticals, Consumption which bodes well for less volatile earnings and better results going forward. Resilience and daring to be bold by pivoting to the future, is not just on the cricket field, but also economically and by corporates.

For now, India wins the series on the cricket field and retains the Border-Gavaskar trophy. It also holds greater interest from global equity investors (its market capitalisation recently cross US$2.5 trillion) and is an investment destination neglected by those who choose to hold onto the past. A strategic, long-term weighting would place most ahead of the curve.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics