Infrastructure set to target returns above the long-term average

In 2023, increasing earnings and strong fundamentals were not enough to keep infrastructure valuations from falling due to the rise in real bond yields, and the strategies underperformed. Real yields in the US rose 1% in 2023 (as of November 30, 2023), resulting in a contraction in price/earnings multiples for utilities from 19x to 17x.

Utility and wireless tower companies in the S&P 500 Index sold off roughly 10.5%, creating a challenging environment for infrastructure portfolios built around these steady, defensive and income-producing businesses.

At the same time, we believed this would be a shorter-term phenomenon, and accordingly, we saw infrastructure’s inflation pass-through working well, supporting earnings across the asset class. It can take anywhere from a few months to a few years for inflation to come through in infrastructure companies’ financials.

A toll road, for example, can increase its prices along with inflation generally every quarter but at minimum every year, while a US utility must wait until it negotiates rates with its regulator, which may not be for a year or two, and then the price increase arrives a year after that. Given these dynamics, we expect allowed returns to increase, even if for most of 2023 we saw some valuation compression for infrastructure due to this variable lag.

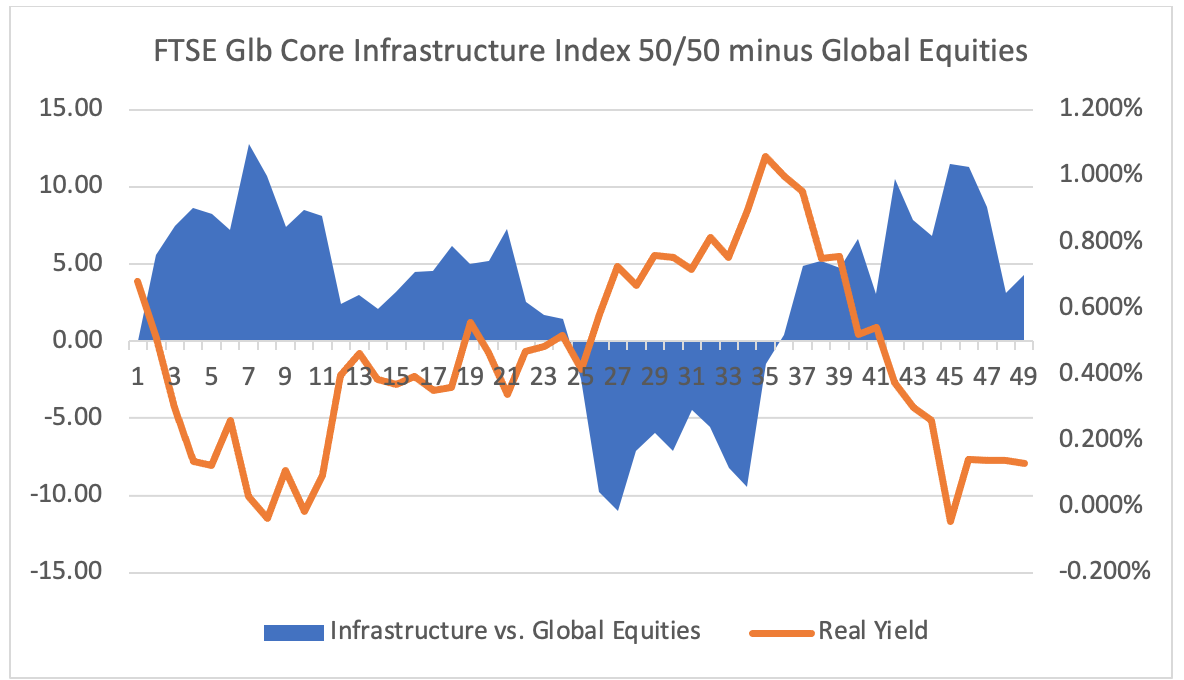

We have seen this yield-driven volatility before. As in 2023, in 2018 infrastructure returns relative to equities declined as real bond yields increased (Exhibit 1). Nonetheless, as rates began to decline after October 2018, infrastructure returns outperformed. If 2023’s spike in real bond yields fades, we expect a significant uptick in the valuations for infrastructure companies in the next year or two.

Exhibit 1: Infrastructure has outperformed as real yields have fallen

Infrastructure’s diversification benefits could be timely

Importantly for 2024, markets are now pricing a US recession at odds of around 15%, which is extremely low for this point in the cycle — that is, amid the fabled “long and variable lag” period following an unprecedented rise in cash rates.

We believe a recession is still a strong possibility and with higher than normal concentration in equity markets, infrastructure provides a significant (and cheap) diversifier within a portfolio.

The past year has been dominated by the Magnificent Seven, but infrastructure should continue to add ballast to a portfolio, generating strong returns over the longer term.

Any slowdown in economic activity in 2024 puts corporate earnings broadly at risk. However, we continue to see positive earnings revisions for infrastructure companies, particularly utilities, based on that pass-through of inflation and growth in their underlying asset bases as the energy transition continues. We expect to enter 2024 with positive earnings revisions for infrastructure just as broader equities begin to see negative earnings revisions.

2024 defined by strong fundamentals and favourable valuation backdrop

Against this backdrop entering 2024, infrastructure is trading at historically attractive valuations given the growth prospects of infrastructure companies. Much of this growth will be driven by the energy transition as the world addresses its need to build out the networks of poles and wires to connect all the renewable facilities generators. We expect the tailwind of public policy to strengthen in 2024, given it will be an election year in many jurisdictions. There is also significant spending to improve the resilience of networks to storms and natural disasters. That is all flowing into growing asset bases, which leads directly to growing earnings profiles for infrastructure companies.

We continue to see excellent opportunities across the infrastructure spectrum, and contracted valuations in 2023 have increased our return expectations. On an internal rate of return basis — which we use as our primary valuation metric — we’re seeing a five-year compound annual return total return basis in local currency of roughly 16%, which is nearly 400 basis points above the historical average.

Infrastructure asset examples

We have recently increased exposure to NextEra Energy (NASDAQ: NEE), a bellwether US utility that has a significant regulated “poles and wires” business (its Florida Power and Light utility is earning a return on equity in excess of 11%) and is one of the largest renewable developers in the US with a multiyear pipeline of projects. NextEra Energy will be a key beneficiary of the IRA public policy tailwind.

Also in the utility sector, United Utilities, a U.K.-based water company, will settle its next five-year regulatory agreement in 2024. This will likely see an 8%–9% compound annual growth in its asset base over the 2026–30 time period and, we expect, a 6%–8% real return on regulated equity. The stock is currently trading at approximately 8% premium to its regulated asset base, whereas the recent trading range has been a 15%–25% premium. We have been increasing exposure to the U.K. water sector, including United Utilities.

We expect that even a slowing US economy will outgrow most of the developed world. It is likely that as markets digest any slowdown and look forward to reaccelerating growth, transport infrastructure (such as roads, rail, ports and airports) will benefit from increasing activity and earnings estimates. This may provide an opportunity to rotate the portfolio toward more growth-sensitive infrastructure, reducing exposure to the more defensive utility names.

In sum, from a fundamental perspective, infrastructure companies are in great shape: they are passing through higher bond yields into higher allowed returns, which is flowing down to improving earnings profiles. We expect this to continue through 2024 and into 2025. On the valuation side, if real yields stabilise from here we expect the valuation discount caused by 2023’s sharp rise in yields to close up, creating catalysts for both utilities and growth-sensitive transport infrastructure as the year plays out.

1 topic

1 stock mentioned

2 funds mentioned