Insider Trades: 14 director buys including a Geoff Wilson spree (and 3 sells)

Over at marketindex.com, we run weekly summaries of market data, which are compiled using some of the many Stock Scans that are freely available on the website.

This article was compiled using the Director Transactions Stock Scan. It’s one of the most popular on the site, and with good reason - few people have more skin in the game than directors when it comes to company performance. Directors have a better understanding (or at least, they should) than anyone else about their business and its future growth prospects.

Of course, scans like this alone don't provide a sound basis for any specific investment decisions. But uncovering who’s buying and selling shares in their own company can add a further dimension to your research, perhaps alongside fundamental and technical analysis.

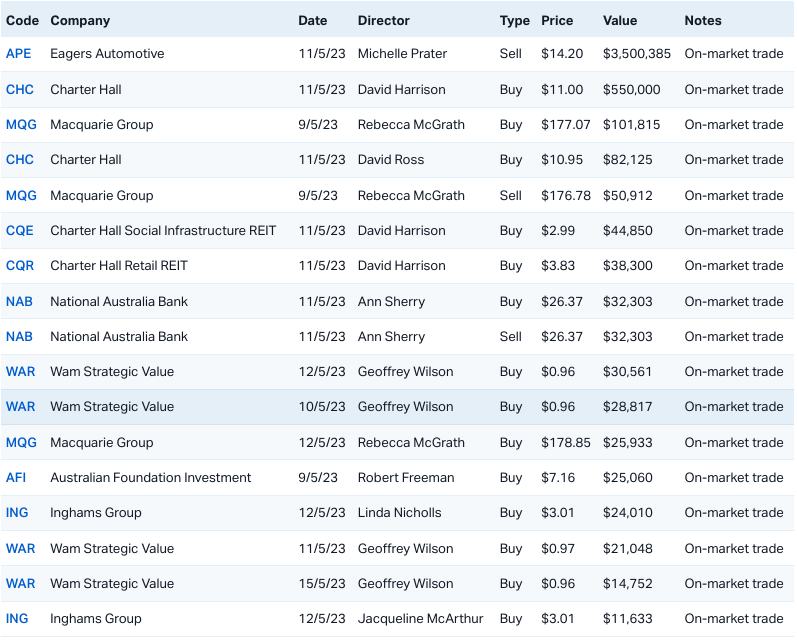

This time around we’ve found 17 transactions – including only three sells.

Eagers Automotive: The sale of more than $3.5 million of stock by a non-executive director and Board member Michelle Prater was easily the biggest director transaction during the period. The largest in its category, Eagers’ stock appeared on another of our screeners recently. Its $14.80 share price on 9 March marked its 52-week high point. It has since retraced slightly, trading at $13.60 as of the latest close, and the stock is up 26% in 2023 so far.

WAM Strategic Value: On something of a WAR-path (sorry for the bad pun), Wilson Asset Management founder Geoff Wilson made six buys totalling a touch over $220,000 during the month. The LIC, which targets underperforming investment vehicles with a view to executing turnarounds, is trading at 96 cents a share – a 17% discount to its NTA as of 11 May 2023.

Charter Hall Group: The company itself made the second-largest transaction of the week, with director David Harrison buying $550,000 worth of stock. David Ross scooped up a little over $82,000 of stock. Harrison also bought $38,000 and $44,000 of stock via two Charter Hall REITs.

Macquarie Group: Last week saw two share buys from Rebecca McGrath – totalling $127,000 – and one $50,000 sell. The diversified investment bank and financial services behemoth was called out in a recent episode of Livewire’s Buy Hold Sell for its ongoing strong earnings potential.

This article was originally published on Market Index.

This article was altered on 23 May 2023 to correct the 11 May Eagers Automotive (APE) share price and Michelle Prater's transaction size.

2 topics