Insider Trades: Directors bought and sold shares in these 16 ASX companies last week

Welcome back to the Insider Trades Series – A summary of on-market director transactions valued at more than $10,000 that have taken place between 24 and 28 November.

The volume of director transactions has taken a pause, possibly due to the recent quarterly reporting and AGM season. This week's data includes both small, mid and large caps.

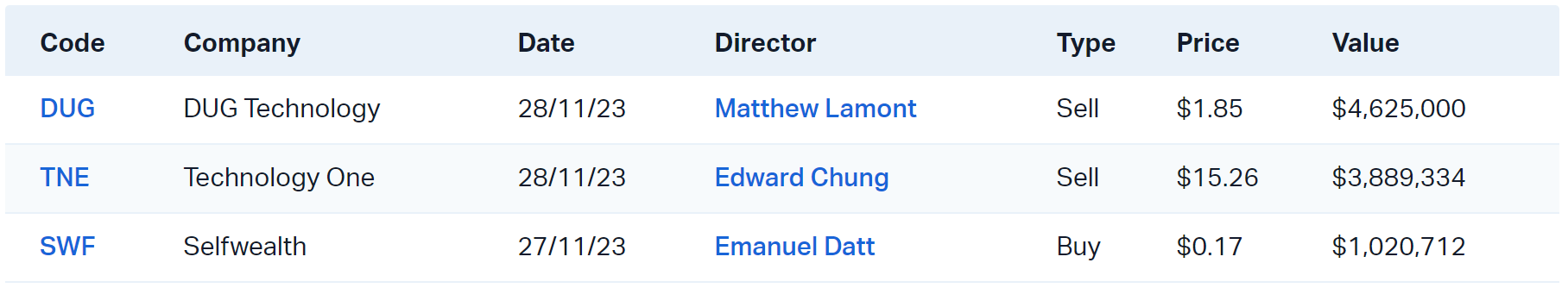

The Big Hitters

Dug Technology (ASX: DUG) is a provider of high-performance computing cloud services and data analytics services. It's HPC cloud platform provides scientists and researchers with the computing power they need to run complex simulations and analyse large data sets.

The stock rallied around 370% between December 2022 and November 2023 (the chart basically goes from the bottom left of your screen to the top right). Its FY23 results also put out some upbeat numbers, including 51% revenue growth to US$50.9 million and 153% net profit growth to US$4.9 million.

On 28 November, the company advised that the spouse of co-founder and Managing Director Matthew Lamont had sold 2.5 million shares to 'retire debt'. By 30 November, the stock had sold off another ~18% to a 3-month low.

%20Share%20Price%20-%20Market%20Index.png)

Technology One (ASX: TNE) CEO Edward Chung sold approximately a quarter of his direct holdings earlier this week. This was met with a relatively muted reaction, with the stock up around 1.2% since the sale.

On November 21, the company reported its full-year results, where brokers noted low churn, strong cash flow generation, and UK growth as highlights. That said, the average price target across nine sell-side analysts was cut by 4.3%, to $16.35.

%20Share%20Price%20-%20Market%20Index.png)

Technology One 12-month price chart (Source: Market Index)

Top ASX Director Trades

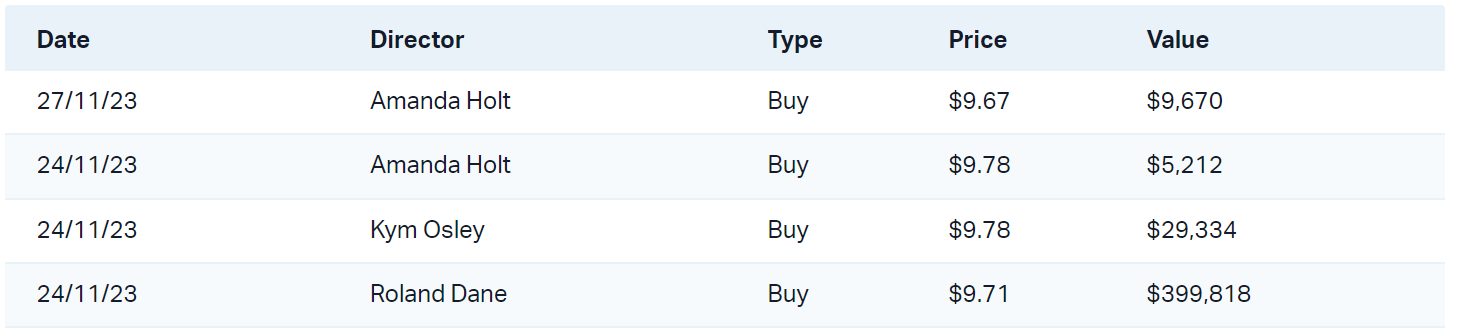

PWR Holdings (ASX: PWH) has had a few Non-Executive Directors nibble in recent weeks. The company manufactures cooling solutions for leading race categories and teams such as F1, NASCAR and V8 Supercars.

A few recent data points and headlines of interest include:

- Shares down 6.7% year-to-date and down 14% in the past twelve months

- FY23 revenue up 17.1%, to $118m and net profit up 4.4%, to $21.7m

- October AGM noted expectations of more moderate growth in FY24 for motorsports

- Also noted expectations for aerospace and defence segment to emerge as an important contributor to growth in FY24 and beyond (revenue for this segment rose 48% to $10.5 million in FY23)

- Over the past two years, PWR has been supporting the development of battery cold plates for a high-volume electric vehicle program that is due to commence production in 2026 for a period of five years

1 topic

2 stocks mentioned