Insider Trades: Directors double down on this ASX 200 company after a 20% selloff

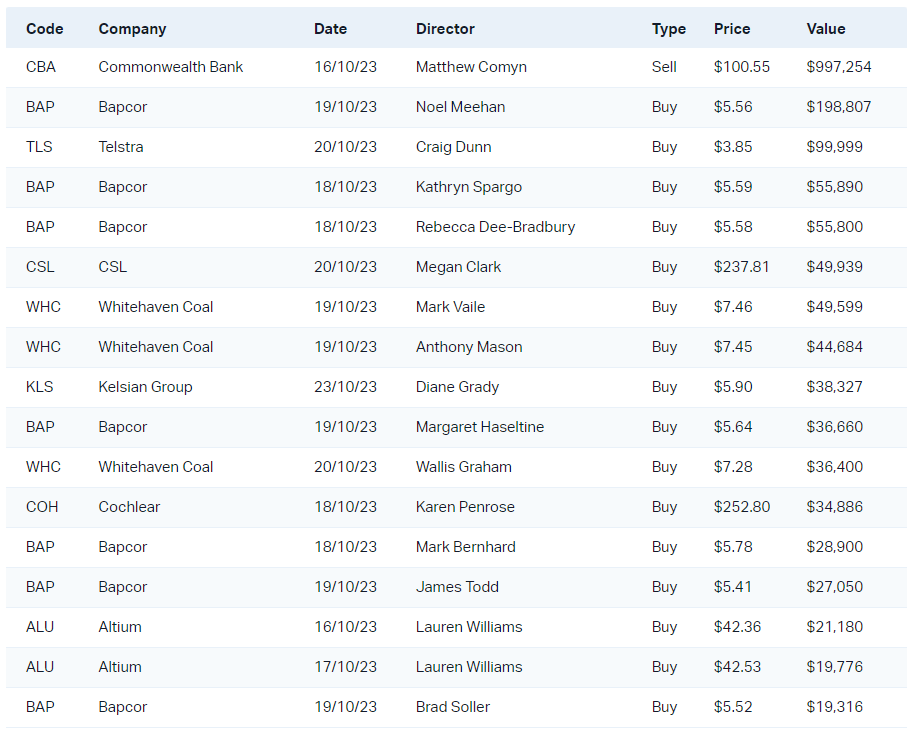

Welcome back to the Insider Trades Series – A summary of on-market ASX 200 director transactions valued at more than $10,000 between 16 and 23 October.

Top ASX 200 Director Trades

Bapcor Insiders Buy the Dip

Shares in Bapcor (ASX: BAP) sold off almost 20% between 17-18 October after a trading update flagged a tough start to FY24. In summary:

- "Shorter-term macroeconomic headwinds have led to a more moderate growth profile in our Trade and Wholesale markets, and a further deterioration in the Retail sector."

- "Challenges compounded by short-term margin pressures from cost inflation and increasing payroll taxes; as well as investments in capability, depreciation and amortisation costs and higher interest."

- "Year-to-date Pro-Forma net profit after tax at the end of September is behind expectations we had at the beginning of the year, with the shortfall to our plans being in the mid-single digit millions of dollars."

The selloff dragged the stock to levels not seen since May 2020, which is now down around 17% year-to-date.

During the selloff, seven different directors bought a combined $422,400 worth of shares around the $5.56 level.

The insiders include:

- Chief Executive Officer and Managing Director Noel Meehan

- Executive Chairman and Director Margaret Haseltine

- Four Non-Executive Directors

Despite the recent buying, Bapcor shares have drifted a little lower to $5.41 on Thursday.

Interestingly, Mr Meehan bought approximately $300,000 worth of shares on-market about a month before the downbeat trading update.

Quite clearly, insiders love the company no matter the price.

Brokers have maintained a cautious stance due to moderating growth across the company's key segments.

"We attended Bapcor’s AGM ... and consider the trading update as disappointing as it revealed deteriorating trends across key segments (ex NZ), given this category is generally perceived as relatively non discretionary," Citi analysts said in a note dated 16 October.

"We see potential for high-single digit % consensus FY24 NPAT downgrades. We remain cautious on the short term outlook but see potential upside from Trucking acquisitions."

"We expect that even if trading improves, we still see meaningful cons downgrades and earnings skew more to 2H24," warned Morgan Stanley analysts.

Citi maintained a Neutral rating with a $7.00 target price while Morgan Stanley is Underweight with a $6.20 target price.

This article was first published on Market Index.

2 topics

1 stock mentioned