Is recession around the corner?

Ellerston Capital

"Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves." Peter Lynch

Whilst economic data in the last half was broadly expansionary, clearly equity returns were not as great. For this Outlook section, let’s take a step back and firstly talk about the most common phrase heard amongst the bears: “the flattening yield curve means recession is near”. Heck, they’ve even got the Federal Reserve weighing in.

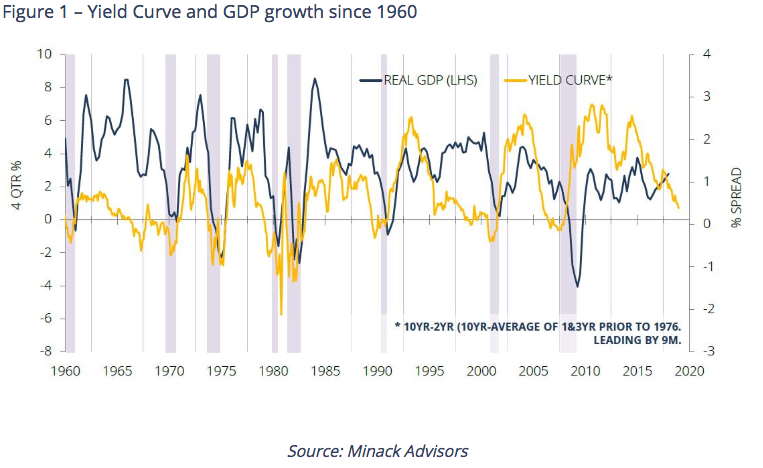

So, what exactly is a flattening yield curve? The most common description refers to spread or gap between what an investor receives on a 2-year government bond and a 10-year government bond. When the interest rate on 2-year bonds is above the 10-year bonds rate, the curve is said to be “inverted” and this has often – though not always – been a predictor of a recession (Figure 1). The saying in markets is that “bonds lead you into recession and equities lead you out”.

More to the curve than meets the eye

With the spread at a lowly 0.4%, the lowest since 2009, one can see reasons for the fear of a recession. Yet, as is often the case, things in life aren’t so simple.

The curve can stay flat for an extended period. In early 1998, the curve went to a gap of 0%… and then stayed in a range of 0-0.5% until early 2000. In 2005, it hit zero and traded near there until the end of 2006.

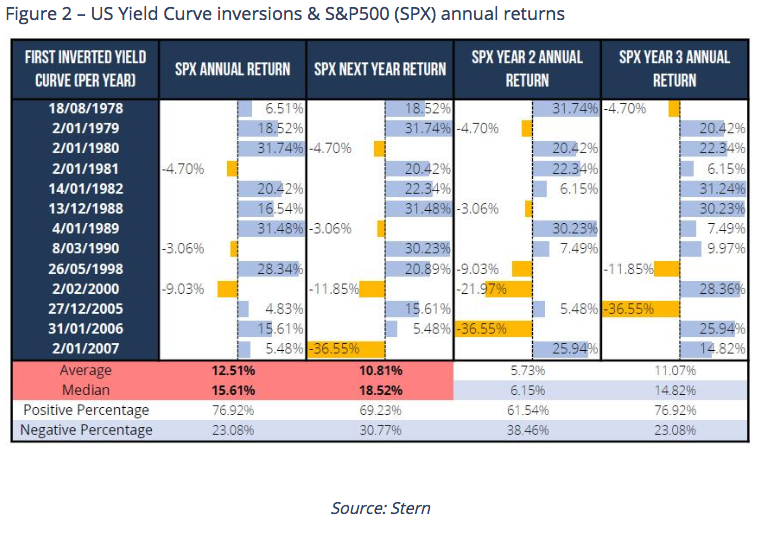

In each case, no immediate recession eventuated and equity markets did well as Figure 2 shows.

On average, stocks return above their long-term average at this point in the cycle. How about after the curve inverts? Still pretty good, although the 2-year returns are much less compelling, suggesting that once the curve has inverted investors are on “borrowed time”.

Three major risks to a bullish positioning

A reader could however point out that Morphic has been bullish this year and thus far wrong. To prevent what behavioural economists call “anchoring” and harsher critics might describe as “intellectual stubbornness”, we spend a lot of time thinking of counterfactual arguments and there are three areas we would identify as a risk to this thesis.

- “The yield curve signal doesn’t work”. The basis of this argument is that with the Quantitative Easing (QE) and bond buying in this cycle, the curve isn’t as good a predictor as it once was.

We have two issues with this argument: firstly, the curve has proven to work through this cycle. It was dismissed in 2016, 2014 and 2012 by some of these bears when QE was ending. Their form on this is not great.

- “Politics now matter”. One of the defining characteristics of the last 40 years has been the convergence of opinions amongst the political class that there was an agreed way forward: openness; globalisation; capitalism. As such, investors in Developed Markets could largely ignore which party was in power, unlike in Emerging Markets. Arguably, the rise of Trump has overturned this and Developed Markets will now trade more like Emerging Markets. The implications are twofold: investors may demand a discount to own equities (lower P/E) and returns to capital may fall.

Whilst Trump is undeniably a break with the past, we would suggest caution calling the end of such a long trend just yet. US Mid-term elections are just four months away and could deliver a completely different political mix; Macron was elected in France and is implementing reforms; Millennials would seem to have strong preferences for the characteristics of globalisation, at the margin.

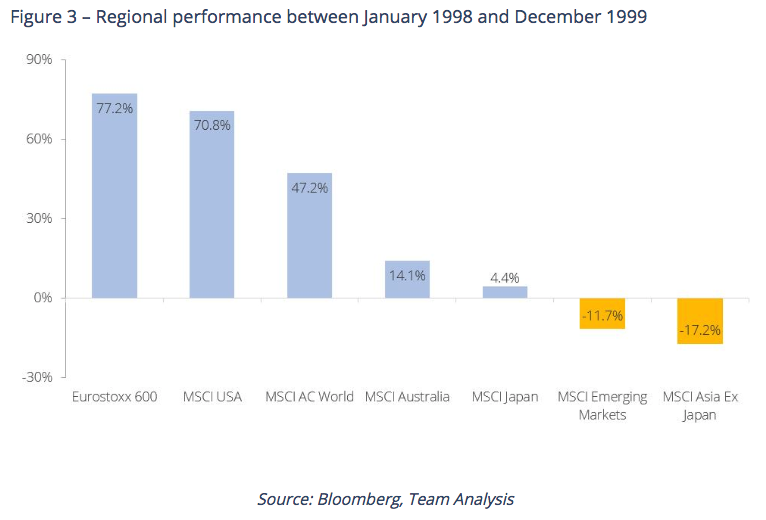

- “The US is not the world”. One wrinkle is that what works in the US may not work in the rest of the world. In the late 1990’s, US stock market returns were excellent, but the tighter monetary policy of the USA arguably caused both the Asian crisis and the Russian default, leaving Emerging Markets investors with no net returns through the end of the cycle (Figure 3).

Course of action for 2H 2018

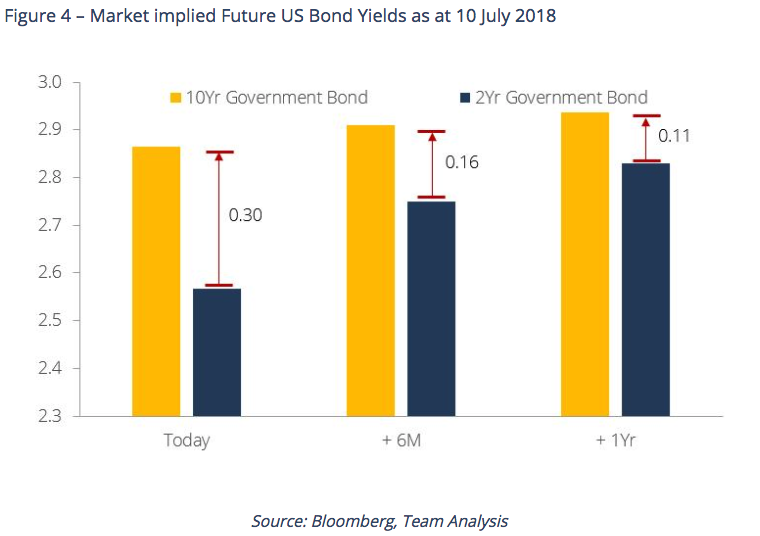

Positioning for a recession today based on a flat yield curve is unlikely to be a fruitful course of action for equity investors on a 1-year view. Bond market indicators continue to suggest the curve may invert in 2019, setting the US economy up for recession in 2020. Figure 4 shows the date of the curve inverting based on futures pricing.

This would make sense as rates would have risen substantially with a further 4-6 rate hikes from now.

We anticipate a typical late cycle rally into equities through to then, with our conviction tempered by the concerns we raised earlier. Our optimism about Emerging Markets leading equity returns has been reduced by the reality of the last six months.

We thought the period of underperformance was done (circa 1997-98 in Asia) when we wrote in early 2018.

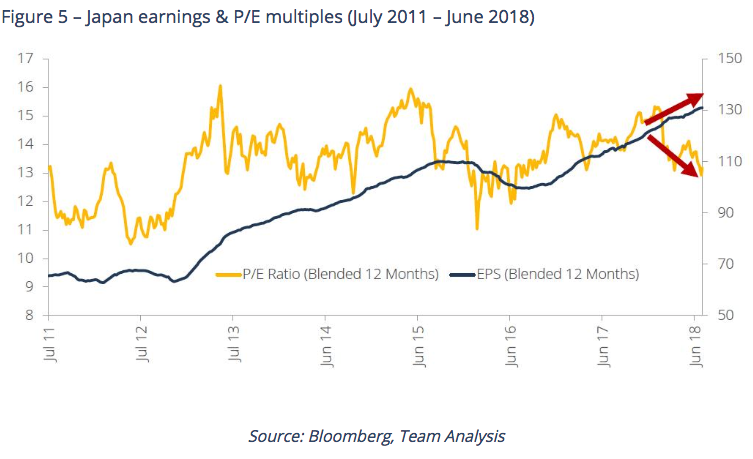

A focus on more market neutral positions with less region risk in Asia is arguably the best way forward in this scenario. Valuations in Japan are undemanding and companies continue to guide higher suggesting that as yet, they are not seeing changes in the economic landscape.

In Figure 5, one can see that the sell-off year-to-date has been driven by “Fear” rather than fundamentals. At a P/E of 12.9x, this is the level that Japan for example has found buying support in this cycle. We continue to find companies that are open to change on both fundamental and ESG levels.

And for the US Dollar, it will come down to whether the market thinks the Federal Reserve is “behind the curve” or “in front” on rate hikes and whether economies outside the US are growing faster or slower than the US. Chairman Jay Powell thus far has preferred to be in front (i.e. aggressive). We would thus say dollar strength is probably largely done, but without the conviction to call weakness just yet.

This outlook is part of our latest Half Year report published in July.

You might also be interested in watching Morphic’s latest quarterly update.

Want to know more?

For more information and additional insights from Morphic Asset Management, please click here.

Chad co-founded Morphic Asset Management in 2012. As a stock picker Chad is also a generalist but has strong regional knowledge of Europe and the Americas. He has also been awarded the CFA Charter.

Expertise

Chad co-founded Morphic Asset Management in 2012. As a stock picker Chad is also a generalist but has strong regional knowledge of Europe and the Americas. He has also been awarded the CFA Charter.