It's very clear who Aussie equity investors should be supporting in State of Origin

It's game on. At 8.05pm tonight, the eyes of the sporting world will turn to Brisbane to see the mighty New South Wales Blues take on the Queensland Maroons.

For the uninitiated, State of Origin is an annual best-of-three rugby league series played between representative teams from New South Wales (NSW) and Queensland (QLD), Australia’s two traditional rugby league heartlands. Players are selected based on the state in which they first played senior rugby league, creating one of the sport’s fiercest and most passionate rivalries.

The series is widely regarded as the pinnacle of rugby league.

Of course, as investors, it is important for us to analyse the hard and soft data to determine if their is any relationship between the winners of State of Origin and Australia equity market returns. Apart from having a real and immediate impact on consumer sentiment, could the winner of State of Origin act as a lead indicator to calendar year returns?

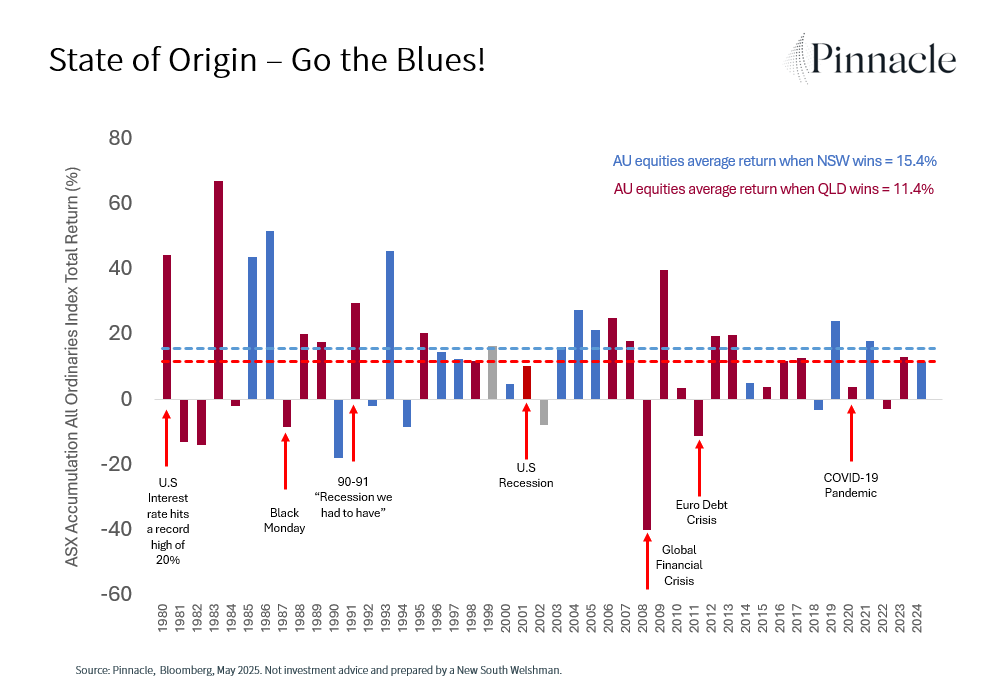

Having analysed the annual total returns of the Australian equity market, and the annual winner of State of Origin, it is very clear who investors should be supporting tonight. The average calendar year equity market return when NSW wins has been 15.4%, compared to Queensland at 11.4%. On the two occasions of a drawn series, the average return was -4%, and clearly nobody wants that outcome.

This is extremely important. A $1,000 investment compounded at 15.4% annually for 45 years (State of Origin started in 1980) would be worth $629,885.19 today. This is $501,109.59 more than the 11.4% p.a. return which came to $128,775.60.

I've also noticed that from a macro standpoint, major economic shocks tend to occur in years when Queensland win the series. The evidence is clear - everyone should be supporting NSW* tonight.

*Not investment advice. Analysis prepared by a proud New South Welshman.

4 topics

1 stock mentioned