J.P. Morgan’s 2025 outlook on equities, bonds and alternatives

Despite a wall of risks in the first half of the year, equity markets have held up well. That resilience reflects the willingness of investors to look through near-term noise and shifting trade dynamics.

According to J.P. Morgan Asset Management’s Global Market Strategist, Kerry Craig, markets are walking a narrow path: slower near‑term growth, a temporary tariff drag, and then an eventual fiscal lift.

U.S. exceptionalism isn’t over - it’s just less exceptional

Craig argues that U.S. exceptionalism isn’t over, but it is moderating.

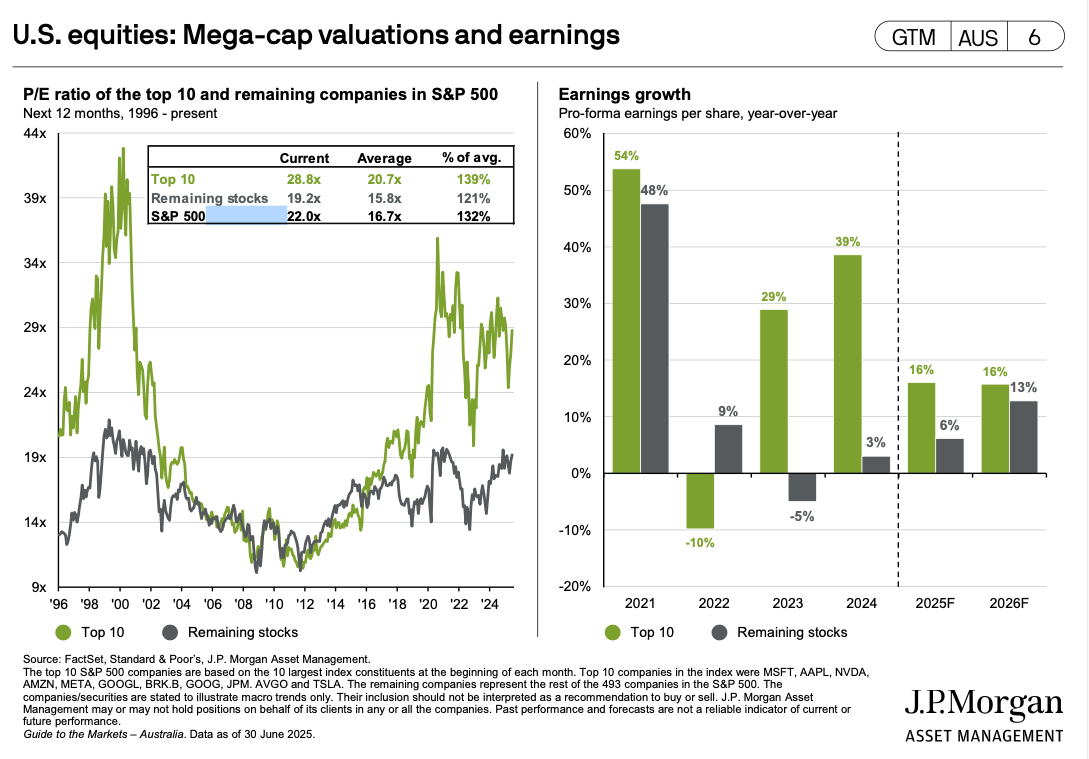

The mega-cap tech and AI names remain the key drivers of growth, with earnings for the top 10 S&P 500 stocks still expected to grow in the mid-teens through 2025.

In contrast, the rest of the market is expected to face single-digit growth and a weaker earnings outlook.

This divergence, Craig says, explains why U.S. equities remain attractive for quality and secular growth exposure, particularly in AI and defensive large-cap sectors, but it also makes a case for greater diversification into global equities.

“Europe is obviously the other focus for us because it is one of the silver linings that we've seen come out of the US policy changes,” says Craig.

Trade tensions are bad, but not catastrophic

One of the biggest risks this year has been trade policy. Tariff fears initially shook markets, but the reality has been less severe than the worst‑case scenarios.

While U.S. effective tariff rates could climb to around 15%, well above historic norms, this is still significantly down from the 30–35% figures previously floated.

In terms of the real-world economy, tariffs will act as a tax on U.S. consumers and businesses, likely dragging on growth and adding a one-off bump to inflation. But Craig stresses they are unlikely to cause a deep or lasting economic hit, or recession.

“Markets aren’t complacent,” he says, they’re simply pricing in a slowdown, followed by a modest consumption boost as front‑loaded fiscal measures, like tax deferrals and household benefits, flow through in 2025–26.

New opportunities in Europe, Japan and emerging markets

Craig highlights the appeal of Europe, where fiscal activism is kicking in.

Defence spending, debt rule relaxations, and broader infrastructure commitments are driving earnings upgrades and narrowing the discount to U.S. markets.

While defence stocks have already rallied hard, he sees opportunities in European industrials, materials, and financials.

The same diversification logic applies to Japan and select emerging markets, which benefit from weaker currencies, easing monetary policy, and structural reforms.

Fixed income - an insurance policy worth holding

Craig views fixed income as an essential portfolio “insurance policy.”

With government bond yields range‑bound (around 4.2–4.3% in the U.S.), he prefers shorter duration for now but would look to extend duration if yields push higher.

High‑yield credit remains attractive, supported by low default rates and a healthy corporate sector.

For investors, Craig recommends sticking with quality U.S. growth, diversifying globally, and balancing equity exposure with income‑generating bonds and credit.

Why alternatives are vital in 2025 portfolios

Joanna Rowe, Head of Private Wealth Alternatives South Asia, believes that if there was ever a time for alternatives to shine, it’s now.

Speaking on the role of private markets in portfolios, she outlined why periods of public‑market volatility often create the best vintages for private equity and why 2025 could be one of them.

More than just a diversifier

A traditional 60/40 portfolio (equities and bonds) has served investors well, but adding a 20% allocation to alternatives can materially lift returns and reduce volatility.

“It’s not about bashing the 60/40,” she said, “but complementing it.”

Alternatives spanning private equity, infrastructure, real assets, and more give investors access to different sources of return. They provide exposure to companies and assets that don’t move in lockstep with listed markets, while tapping into opportunities not available in the public sphere.

Private equity - higher returns, broader exposure

For Rowe, private equity’s role in portfolios comes down to three pillars:

1. Higher return potential than public markets.

2. Reduced volatility, given the longer‑term holding and less correlated nature to public markets.

3. Greater equity diversification, tapping into a private company universe that dwarfs public markets.

According to Rowe, companies are also staying private for longer, now averaging 12 years compared to just five years in 2020.

Is 2025 a good vintage?

History suggests that some of the best‑performing private equity vintages emerge after economic downturns or dislocation, as seen in 2001 and 2009.

While median returns have dipped in recent years, top‑quartile managers have maintained consistently strong performance, underscoring the importance of partnering with the best general partners (GPs).

Rather than trying to time the market, Rowe recommends committing capital annually to build vintage diversification and riding out the natural “J‑curve” of private equity, where exits typically occur 3–5 years after capital is deployed.

IPO droughts and the rise of secondaries

The IPO market showed “green shoots” early in 2025, but public‑market volatility has since pushed many listings to late 2025 or 2026.

Rowe also flagged secondary markets as an area of increasing interest, where LPs (limited partners) are using the opportunity to rebalance and reprice portfolios.

Secondary transactions have become a vital exit route for GPs (general partners), with activity rebounding strongly from 2021 levels.

Where capital is flowing

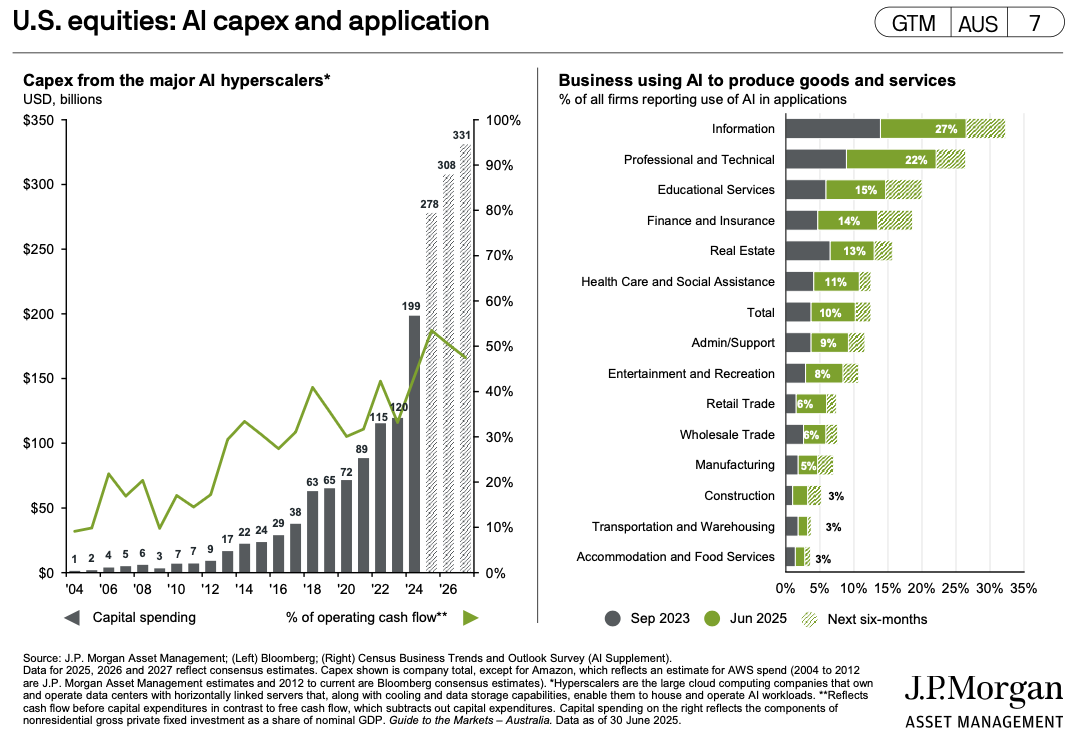

Rowe sees private equity playing a major role in funding AI adoption, calling the opportunity “14 times larger than traditional tech spend.”

The adoption of AI business practices in the US remains relatively low, with surveys indicating a potential productivity uplift over the next six months.

Globally, uptake varies by sector and region.

Defence, especially cybersecurity, is also back on the table for investors, reflecting shifting mandates amid rising geopolitical risks.

Notably, more capital is flowing into Europe, where collective responses to tariffs and increased fiscal activism are opening new private‑market opportunities.

3 topics

2 contributors mentioned

.jpg)

.jpg)