L1 Capital sees catalysts in these 4 companies

Last week, James Hawkins, Partner and Head of the L1 Capital Catalyst Fund, provided an update to investors about the fund’s performance through the September quarter and its thinking on four key positions.

The aim of the L1 Capital Catalyst Fund, which was launched in 2021, is to find high-quality, fundamentally undervalued companies that have clear, recognisable catalysts to help drive investor returns.

Applying a hands-on, ‘owner’s mindset’, the portfolio is typically highly concentrated – usually made up of around 10 stocks.

The session touched on Hawkin’s observations from reporting season as well as updating investors on the fund’s thinking about four of its key positions: Santos (ASX: STO), Aurizon (ASX: AZJ), Mineral Resources (ASX: MIN) and Qantas (ASX: QAN).

Priced to perfection

According to Hawkins, the current market, particularly at the large-cap end of the ASX 20, is priced to perfection.

“I think when you combine that fact with a higher volume of algorithmic trading, small misses can result in material share price reactions”.

This was on show during August’s reporting season period, where many stocks saw outsized share price moves, particularly those that disappointed the market, such as James Hardie (ASX: JHX), CSL (ASX: CSL), Woolworths (ASX: WOW) and IDP Education (ASX: IEL). The Catalyst Fund benefitted from not being in any of those names.

Shareholder rights in company transactions

Hawkins also took the time to comment on shareholder rights.

This has been something that has become more topical recently, most notably due to James Hardie’s takeover of Azek, where investors were denied a vote on a deal which, amongst other things, led to significant dilution of existing shareholders' positions.

Hawkin’s was clear in his position that in some notable recent transactions, investors have not been given an adequate say.

“At the end of the day, shareholders own these companies, and they should have a say in relation to these transactions”.

On top of providing its opinion on the market, L1 Capital also provided an update to four key positions it discussed back in July.

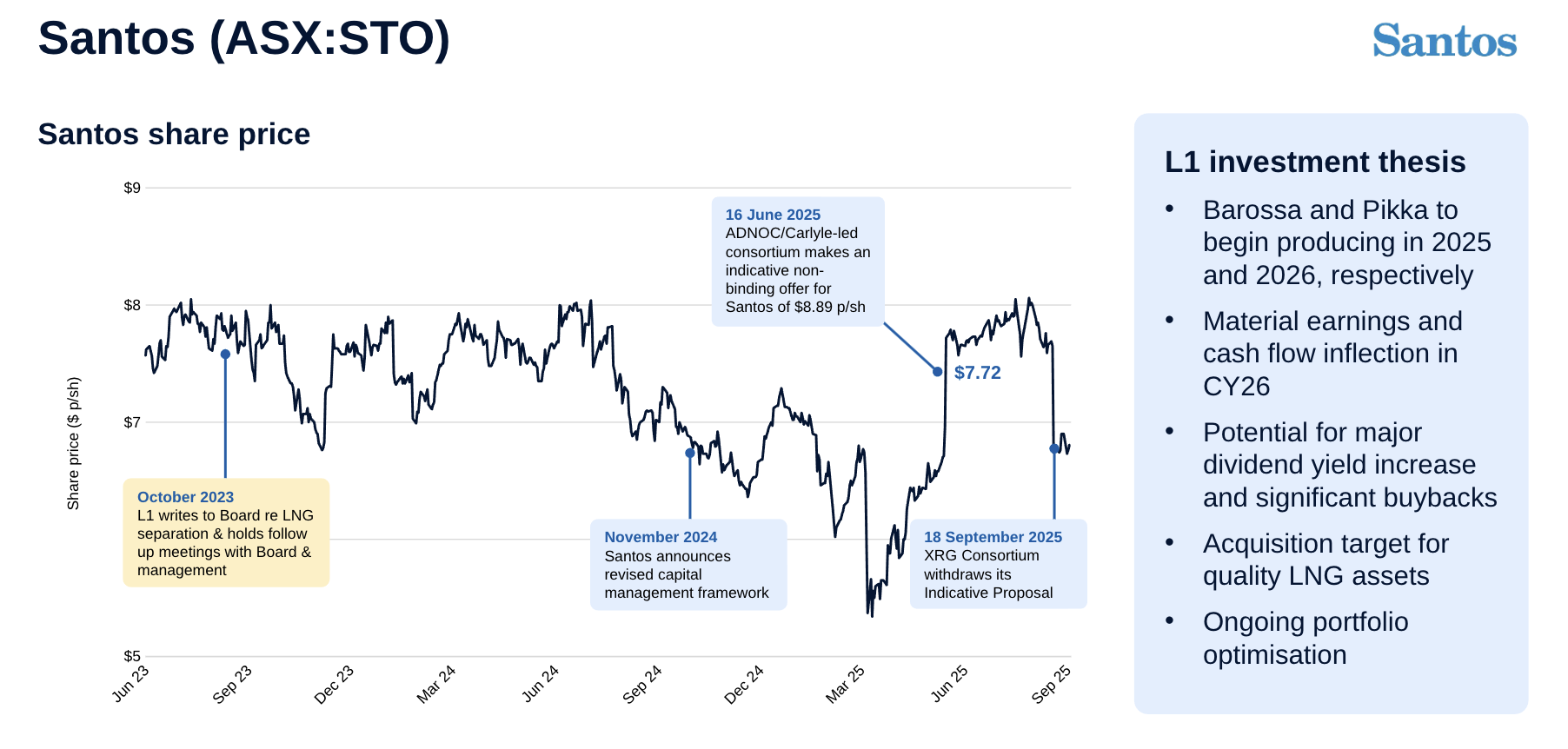

Santos (ASX:STO)

In mid-June, a consortium comprising ADNOC and Carlyle submitted a non-binding cash offer for the gas producer. At the time, L1 Capital saw this as vindication of the strategic appeal of Santos’ LNG assets.

In September, this offer was withdrawn, which led to Santos’ share price falling as the takeover premium disappeared. However, Hawkins continues to see positives in the business.

“Whilst we lost a potential strategic buyer, what remains unchanged is that Santos’ future cash flows are now materially derisked with the Barossa project now online and the Pikka project now scheduled to come online six months early at the start of calendar 2026”.

In Santos, Hawkins sees a company that, following a multi-year period of investment, is now approaching an important cash flow inflection point. He believes that over the next 12 months, Santos should see a material uplift in earnings alongside a step down in capital expenditure, benefitting the company’s return and dividend profile. This should place Santos well to deliver attractive returns compared to the broader market and its peer group.

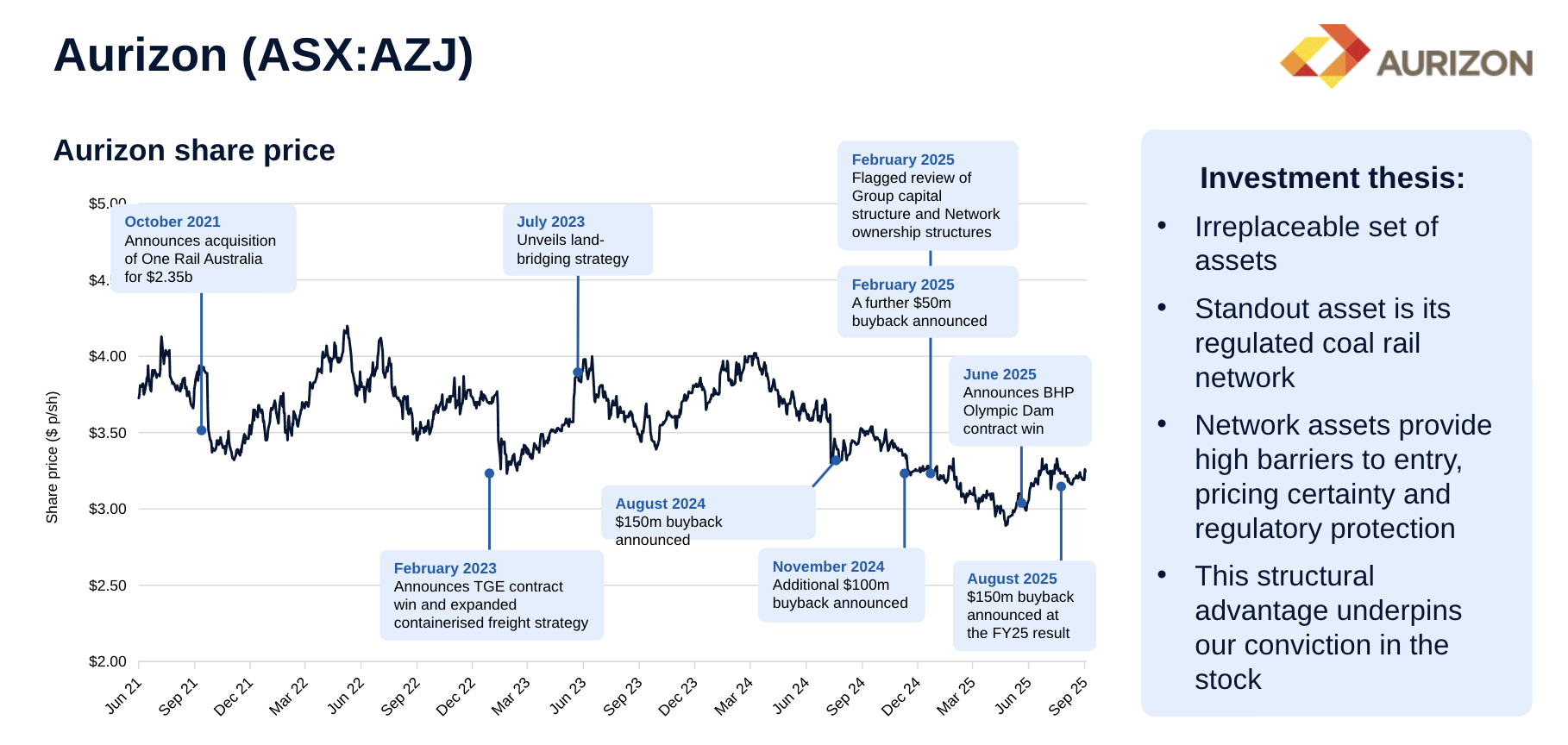

Aurizon (ASX:AZJ)

According to Hawkins, Aurizon is a company built around a portfolio of irreplaceable assets, particularly its regulated coal rail network. These assets have high barriers to entry, pricing certainty and regulatory protection.

One key event was the recent Aurizon announcement of a landmark contract win for its bulk division, which will see it become the rail haulier for BHP’s Olympic Dam operations and other adjacent BHP mines.

“This is a long-term growth contract with a high-quality counterparty that will bring additional scale to its bulk central operations and highlights Aurizon’s strong competitive positioning in that corridor”.

Hawkins believes that Aurizon remains materially undervalued by the market and that its regulated networks business remains materially underappreciated, and that the freight operator should continue to generate solid returns for shareholders via both dividends and buybacks.

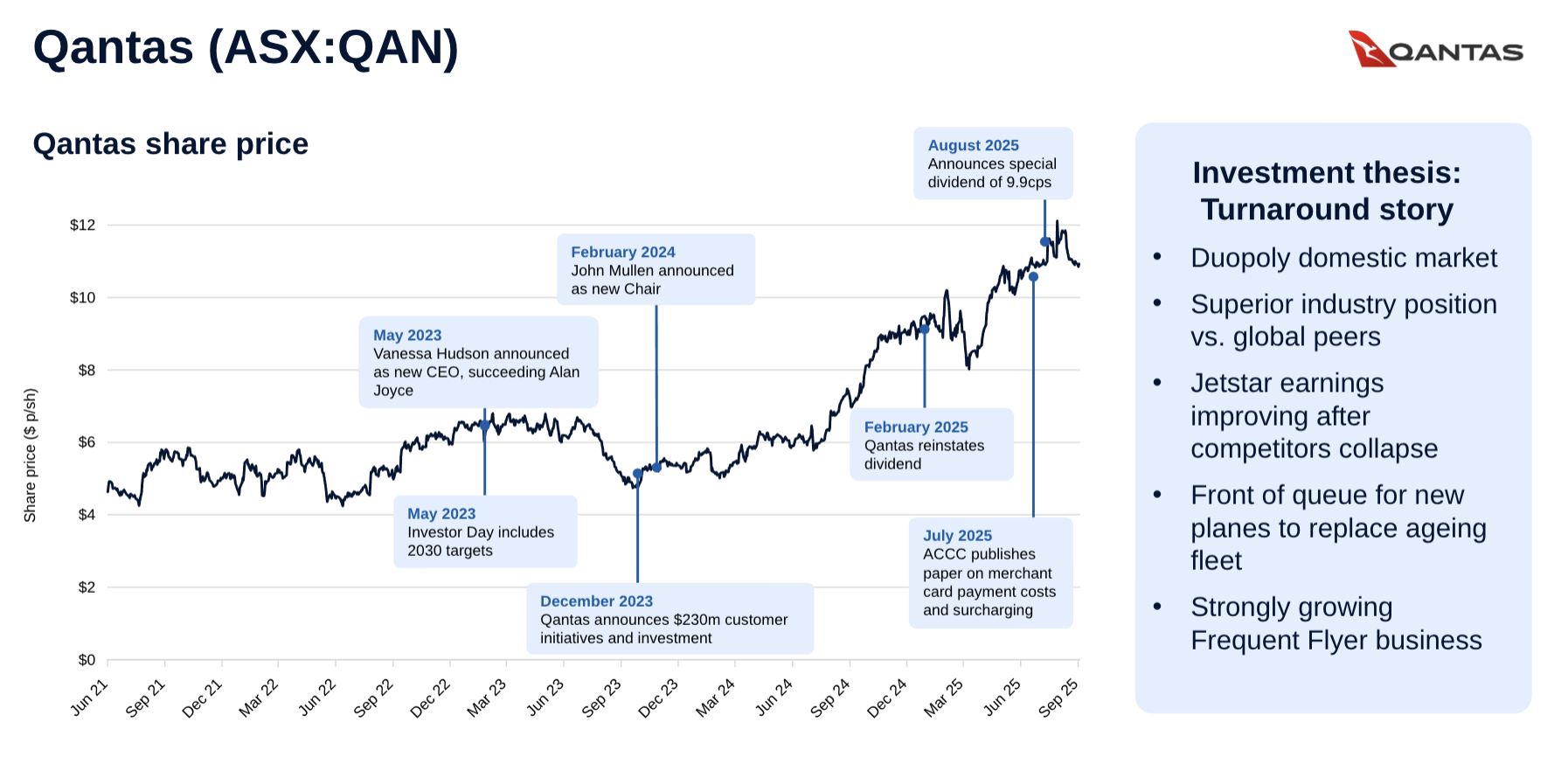

Qantas (ASX:QAN)

Hawkins continues to see Qantas’ turnaround taking shape.

On top of reaffirming 2030 targets at its recent results, Hawkins sees a very supportive industry backdrop for global airlines with supply constraints post-COVID. Boeing and Airbus are struggling to ramp up production, with reduced aircraft utilisation due to aging fleets and the grounding of a large number of A320 aircraft due to maintenance issues.

“Against the backdrop of constrained airplane supply, the consumer demand for travel remains robust, which is supportive of higher yields”.

According to Hawkins, Qantas is proving it can deliver operationally across both the Qantas and Jetstar businesses. It also anticipates further improvement in its fleet renewal program and its Project Sunrise initiative, which will enable passengers to fly directly to London and New York from Sydney and Melbourne.

With a PE ratio of just under 9x and a dividend yield of nearly 4.5%, Hawkins believes Qantas' fundamental valuation to be attractive and expects Qantas to continue to grow earnings over time.

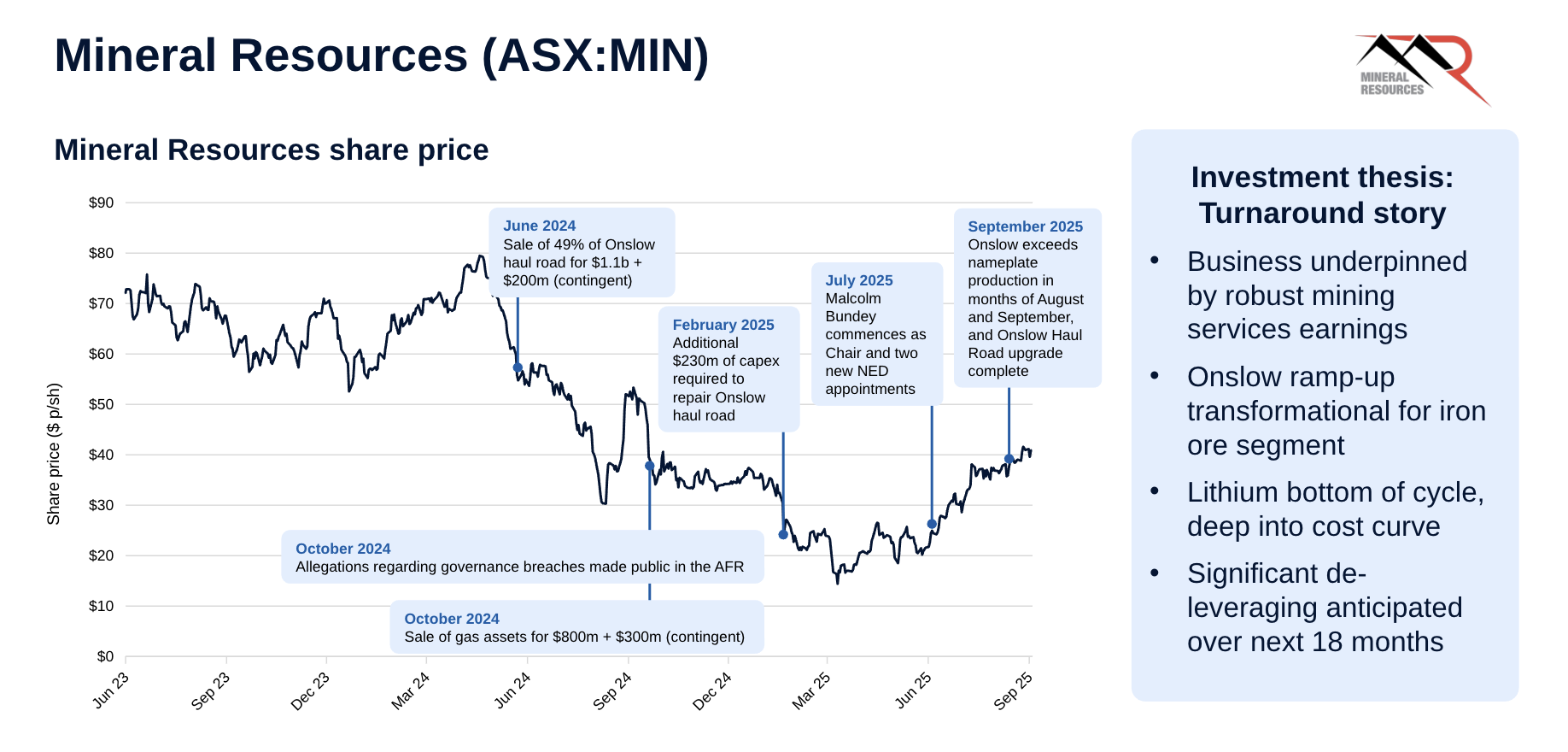

Mineral Resources (ASX:MIN)

Qantas is not the only turnaround story that is on Hawkins' radar. He sees parallels with Mineral Resources now and Qantas of late 2023.

During the September quarter, MinRes shares rose over 90% as commodity prices recovered and the company successfully completed its Onslow iron ore project, but lithium price volatility continues to be an area of focus for the market.

Hawkins, however, called out two key points regarding the business. The first was in relation to governance.

Malcolm Bundey has recently joined the board as Chairman and has appointed four new non-executive directors.

Second is the positive progress of its Onslow iron ore project.

“Even prior to the haul road being complete, the project managed to exceed targeted nameplate iron ore shipments of 35mtpa in August and September”.

Hawkins believes that maintaining this momentum should underpin a material uplift in earnings for the company and also accelerate deleveraging. This, combined with increased diversification in the business, which means it is better able to manage the commodity cycle, and a potential recovery in lithium prices, makes him optimistic that the business will continue to grow over time.

What is L1 Capital looking for now?

So, what type of companies are piquing the interest of Hawkins and the team at the L1 Capital now?

Their focus continues to be on companies that they believe offer idiosyncratic value over the next 12 to 18 months, be it through a combination of consistent growth in earnings and cash flow, as well as strong and attractive valuations.

“We’re not paying up for thematic growth”, says Hawkins.

As a core part of the fund’s strategy, it is seeking earnings resilience, especially in a macro environment that still has a lot of uncertainty and volatility.

Finally, as the fund’s name implies, L1 Capital wants to see a well-defined catalyst that can drive value realisation in the near term.

5 topics

4 stocks mentioned

1 fund mentioned

1 contributor mentioned