Last year's return to pubs and clubs spells profit for this company

In the not-so-distant past, Australians dreamed of their release from lockdown and a return to licensed venues to socialise with friends. You could call 2022 the great return to pubs and clubs.

Australians flocked back to entertainment pursuits and the same companies that languished in lockdown flourished. Tighter financial conditions were no barrier for a country desperate to rediscover freedom.

It's hardly a surprise, therefore, that Endeavour Group (ASX: EDV) announced particularly strong half-year results for FY23 today. The operator of hotels, stores and products such as ALH Hotels, Dan Murphy's and Pinnacle Drinks saw its net profits jump 17% to $364m on last year. It also announced a tidy jump in earnings for investors by 16.7% to 20.3c per share.

The result bodes well for full-year results according to Henry Hill, Deputy Portfolio Manager for Wavestone Capital.

"The outlook is positive. I think you're seeing signs of a positive inflection for sales for the retail business and costs are clearly being managed very well. We know the hotel business is booming and I think that will continue for a bit longer given the experiences of hotel groups in the Northern Hemisphere," says Hill.

Read on to learn about Endeavour Group's latest earnings report, the risks that could be on the horizon, as well as why Hill believes the group is a buy even in tighter financial conditions.

Note: The interview took place Monday 13 February 2023. EDV is a holding in both WaveStone Australian Share Fund and the WaveStone Dynamic Australian Equity.

Endeavour Group H1 Key Results

- Earnings before tax $644m, up 15.8%

- Net profit after tax $364m, up 17%

- Sales $6.5b, up 2.6%

- Operating cash inflow $643m

- Capital expenditure $205m

- Dividend per share 14.3c, up 14.4%

- Earnings per share 20.3c, up 16.7c

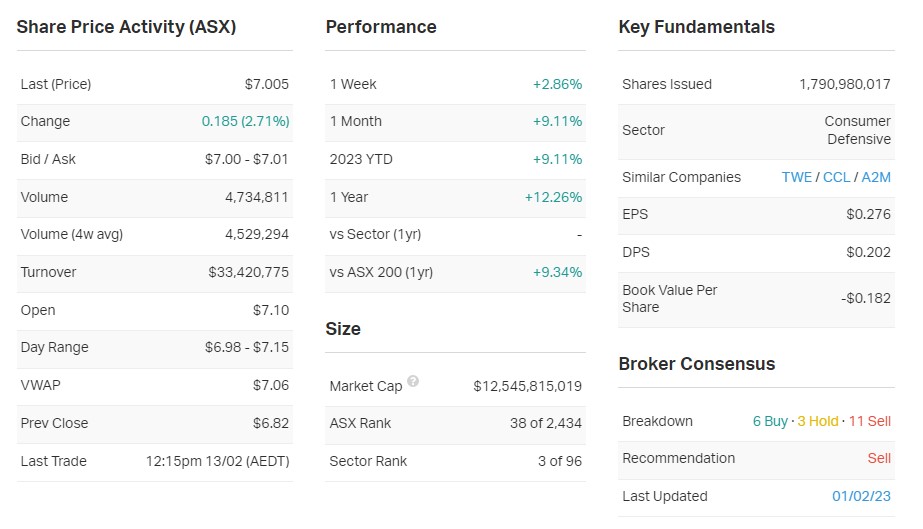

Key company data for Endeavour Group

What were the key takeaways from Endeavour Group's results? What surprised you the most?

I think the key takeaways for me in terms of surprises were on the positive side in terms of the cost controls and productivity benefits in a tough sales environment for retail. On the negative side, I thought the margins in the hotel business were going to be a bit better given the strength and underlying demand conditions.

I think the overall takeaway is that Endeavour Group has emerged from almost three years of covid impacted conditions with higher margins, more aligned and a better overall business.

What was the market's reaction to this result? Was it an overreaction, an underreaction or appropriate?

I think the market reaction has been a bit underwhelming. The stock has been up about 4% but the earnings beat was 8-10%. I think there were positive signs for retail margins moving forward and improved sales momentum coming out of covid.

I think the hotels business continues to perform very strongly and is a better run business than it was prior to covid. It is definitely more focused. People like to nitpick the stock at the moment, but some of this creates the appeal for us in Endeavour Group.

Would you buy, hold or sell Endeavour Group on the back of these results?

Rating: BUY

I would definitely buy on the back of this result, particularly given the relatively muted stock price reaction on what I thought was a pretty good result and based on the recent share prices over the last 5-6 months.

What's your outlook on Endeavour Group and its sector over 2023?

The outlook is positive. I think you're seeing signs of a positive inflection for sales for the retail business and costs are clearly being managed very well. We know the hotel business is booming and I think that will continue for a bit longer given the experiences of hotel groups in the Northern Hemisphere.

Are there any risks to Endeavour Group and its sector that investors should be aware of given the current market environment?

I think the big risk for the business is gaming reform, particularly around pokies. That's mainly a NSW issue and Labor is paying $1.16 to win the March election - they're a lot more friendly in that regard. I think a lot of that has been priced. We'll have a lot more clarity at the end of March.

The other risk is more broadly in the consumer sector as the cost of living starts to bit and sees people trade down. Given where Endeavour Group is positioned in the liquor retailing market as the cheapest and best offering, I think they'll benefit from a broader sector trade down.

From 1 to 5 where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or cautious about the market in general?

Rating: 3

I don't usually like to take a view on whether the market is over or under valued. I think our job is to make money regardless of that so I'm going to answer three.

I'm warier about the market than I was a month ago because there was such a strong start to the year. I think a goldilocks scenario is starting to be priced in, certainly across January, and that may or may not occur. The more it gets priced in, the higher your risk.

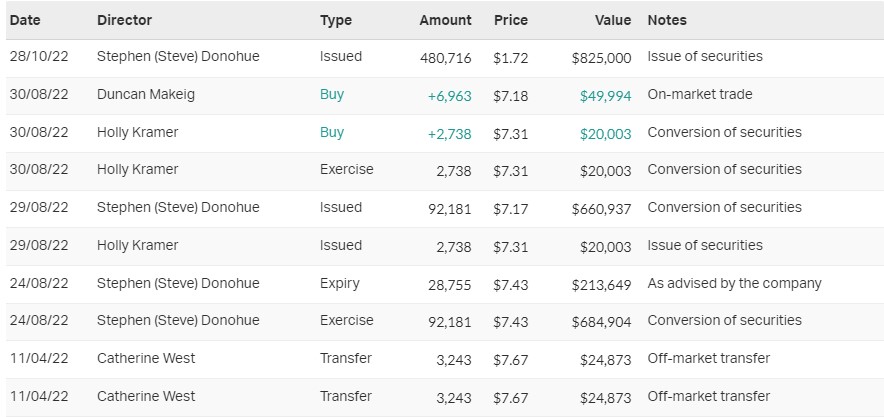

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

4 topics

1 stock mentioned

2 funds mentioned

1 contributor mentioned