Lies, lies and GDP statistics

The recent US GDP number is misleading you, me and everyone else…

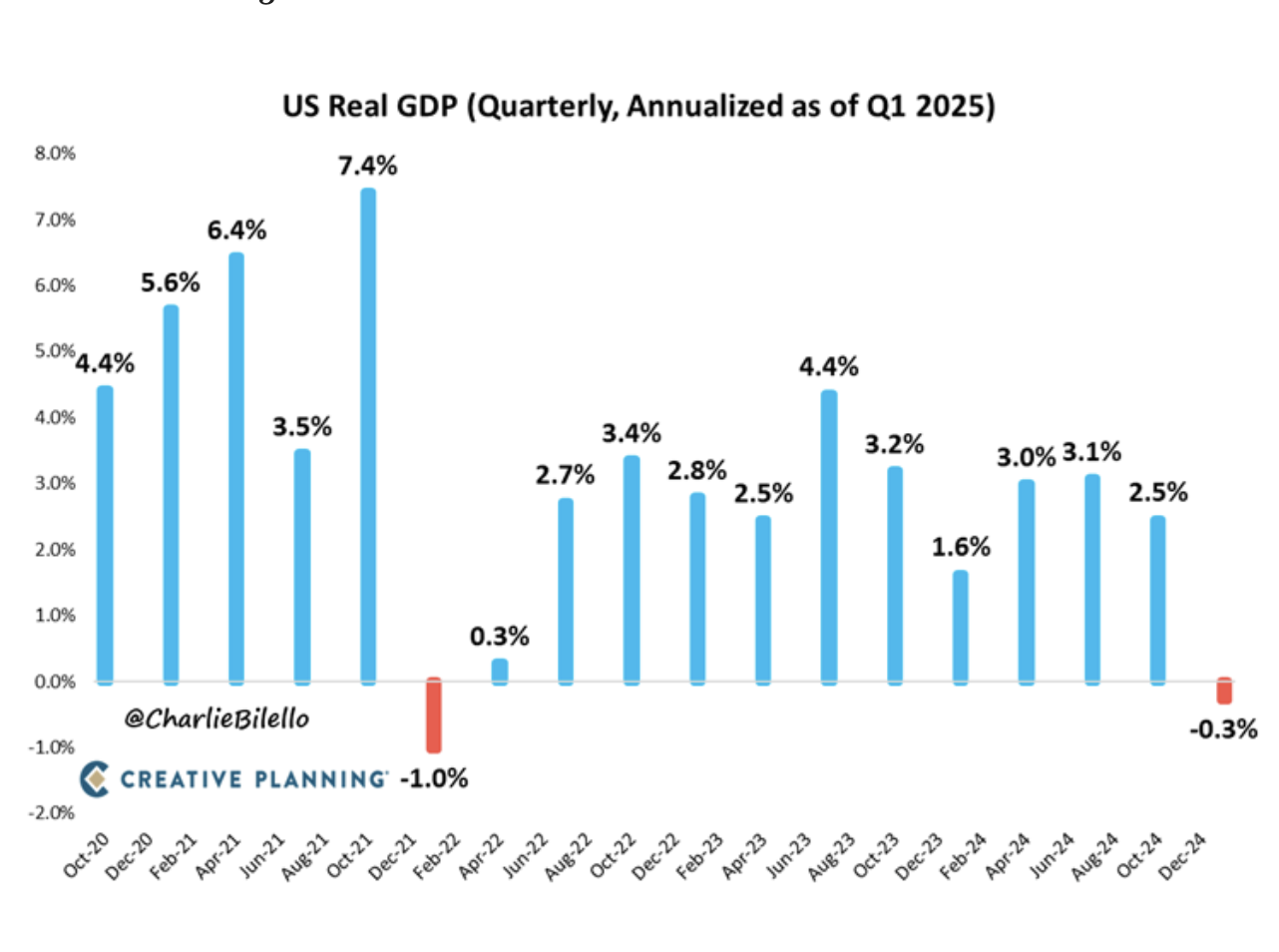

You might’ve seen a bit of chit chat about how US GDP fell in the first quarter. Yes? No? You can see it visually on this chart:

This is a “worry” for some.

If the second quarter comes out negative too, then the USA would be in a “technical” recession. That’s two quarters of negative GDP.

Yawn!

Here are two reasons why this kind of thing can be misleading when it comes to the share market.

The first reason? The recent drop in net exports – because of the mad rush to import before the tariffs – distorted the headline number.

The second point is that there’s something called “core GDP.” This just measures consumer spending and private investment. This came in super strong.

The headline number obscures this.

Let’s be honest. GDP chat is boring.

However…

If you’re wondering why the US stock market is bouncing so hard since the big dip, this is a big reason why.

However… *again*

Trump’s tariffs are now eroding this US economic strength.

The market is saying that the current stand off can’t last, and assumes a deal happens. Don’t let uncertainty around this stop you from acting now.

Consider…

Tariffs: a win for Aussie beef farmers

Old Trumpy might be popular in Queensland right now.

Aussie beef prices are back up at 2 year highs thanks to Chinese buyers coming into the market. US beef is being displaced.

However, it’s not all about tariffs. Good rain is important too.

That reminds me of an Australian Financial Review story that appeared in early 2024. Have a read of this…

“Melbourne hedge fund Farrer Capital is betting that Australian cattle prices will soar next year.

“Adam Davis says the return of the La Nina weather pattern in the months ahead will boost domestic cattle prices by 50 per cent as major cattle producing countries such as Brazil, the United States and Australia rebuild their herds, setting up a bullish environment (puns aside) for beef markets.”

I’m not sure if the price is quite as high now as this gent thought it might be, back then. But he’s certainly got the weather and the general trend right.

Certainly, Queensland is the place to invest right now.

Fund manager Matthew Kidman from Centennial Asset Manager is thinking along the same lines.

One of the points he made in the Financial Review this week is that, by contrast, business in Victoria is a major weak spot for the country right now.

Do make sure to check if any share you own has a heavy weighting down here. Plenty of retail chains have a good chunk of their stores in Victoria, for example.

Firms weighted toward WA and Queensland are a better bet.

By the way, check this out…

On April 9 I told readers of my advisory, Australian Small Cap Investigator, to “hold their nose and buy”. I gave several suggestions. I won't mention the names out of respect for my paying subscribers. It's a general point, no more.

Here’s how they’ve done over the last month…

Stock |

One Month Return |

A |

43% |

B |

20% |

C |

22% |

D |

3.6% |

E |

10% |

F |

-13% |

Not bad.

It’s never easy stepping in during times like last month. Charlie Bilello makes this point this week...

“The index has advanced 18% from the April lows, illustrating once again that the biggest rallies tend to occur after the biggest short-term declines.”

One to remember for the next time.