Like buying uranium stocks in 2020

At Tectonic we are always on the hunt for ‘hidden-gems’ and we believe we’ve found a particularly compelling one with Highfield Resources (ASX:HFR). Since sharing our investment case on this ASX-listed potash developer with Livewire readers in Right Commodity, right spot on the cost curve, right timing, and right price!, our conviction has only grown on the back of positive company developments and a strengthening potash market.

But while potash prices have almost tripled so far this year, ASX-listed potash stocks have barely twitched. The setup looks more and more to us like uranium in early 2020 when the commodity had nearly doubled while uranium stocks were still flatlining. We all know what happened next, with uranium equities having an absolutely massive 2021. It’s starting to look like we could see something like this again in the potash market, and if we do, we believe Highfield is the stock to own, as we set out in this wire.

Rather than rehashing our entire investment case we will instead focus on (1) potash market developments, and (2) takeaways from Highfield’s recent feasibility study (announced to the market in early December) as well as thoughts on valuation and where to from here.

The potash market - one of the top performers of 2021

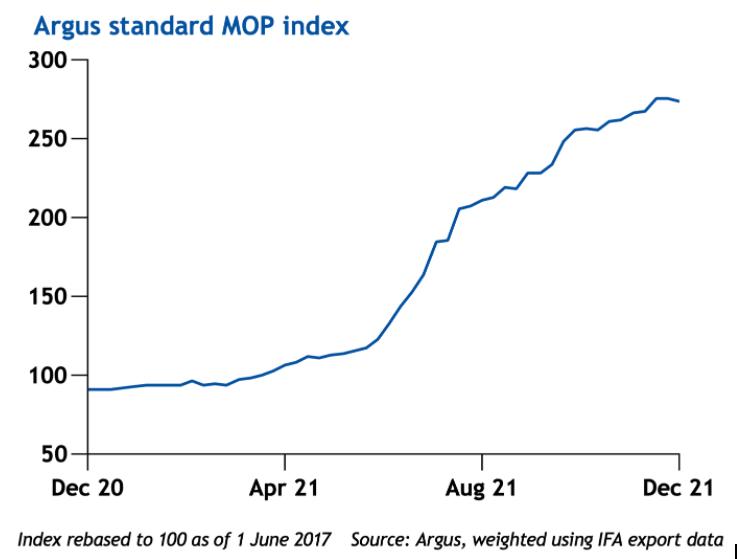

Since we published our last wire on Highfield, potash has marched steadily higher. There are different grade specs and different regional markets, but to take a wide lens, the ‘Argus Standard MOP index’ has climbed 7% over this time from 255 on 19th October to 273 in early December.

When 2021 is over (we are nearly there!) and the analysts review the commodities that performed the strongest over the year, potash is likely to have few rivals. It has nearly tripled so far this year, which is not the kind of move that you often see with commodities.

Three massive tailwinds: Inflation, geopolitics and demographics

One driver this year has been inflation. If you feel like your food bill is rising, or that there is less in the packets than there used to be, your hunch is right. The last headline CPI in the US was 6.8%, its highest level in decades. And if you look through the constituents of that, food prices were up by 6.1%.

What does this matter for potash? Well, these higher food prices incentivise farmers to increase crop production, and for this they need more fertilisers which means more potash!

The murky world of geopolitics has played a part as well. The US imposed sanctions on potash marketer Belarus Potash Company (BPC), after blaming the Belarusian Government for causing a migration crisis on the EU-Belarus border. With Belarus producing ~13 million tons annually, which is ~20% of global production, restricting that quantum of supply into the market will have obvious implications.

Taking a multi-decade view, however, which is more in line with the production profile of Highfield, potash is a commodity tied to the inexorable growth of the global population and urbanisation. More people and less land mean more crops need to be produced from less space. Without the increased use of potash (and other fertilisers), it is impossible to achieve that. Investing in potash is therefore investing in one of the most predictable of thematics - that of demographics.

So, potash demand is not going away any time soon, and in fact, as we highlighted last time, BHP singled it out as one of a few ‘future-facing commodities’ that it will focus on. And with macro and geopolitics at play, it has already been one of the top-performing commodities of 2021.

The same setup as uranium in 2020

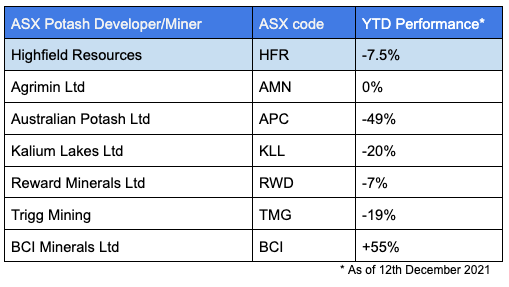

Yet, you’d never know it, looking at potash stocks. Owning a potash stock right now is a fairly lonely place to be. While the potash price has roughly tripled this year, resource investors haven’t noticed, judging by the volume and price action of potash stocks. The opportunity is as clear as day, but Mr Market hasn’t read the memo yet. While Highfield’s share price is off its lows in the past two months, the share price is still down -8% since 1st January 2021.

The year-to-date performance of the other ASX-listed potash miners/developers (MOP and SOP) has been just as disappointing with only one exception - BCI Minerals which recently announced taking a c. 7% stake in Highfield:

The setup looks a lot like the uranium market 18 months ago. Back then uranium had climbed by 89% from its low of $18/lb to quietly reach $34/lb. But uranium equities had long been out of favour and were stagnant, despite a near doubling in the commodity price. Then in late 2020, uranium stocks suddenly woke up one day, knocked back a double espresso, and went for a massive run. It seems to us that it is not a matter of ‘if’ this will happen to the potash sector, but purely a matter of ‘when’.

Takeaways from updated Feasibility Study:

Highfield published an updated feasibility study for its flagship Muga project on the 8th December which reconfirmed the project’s robust economics with a net present value (NPV) of EUR 1.89 billion using an average potash price of EUR 440/ton (based off long-term forecasts by independent research group CRU Group). At the current spot price of EUR 575/ton the NPV of the project is even healthier at EUR 2.8 billion, equivalent to $4.45 billion. Compare this to Highfield’s current market capitalisation of $230 million (at 64c a share) to start to understand just how undervalued this ‘hidden-gem’ really is.

The feasibility study also forecasts that the Muga mine is expected to generate around EUR 400 million of EBITDA (earnings before interest, tax, depreciation and amortisation) per annum once at full production. The Canadian-listed potash producer Nutrien Ltd trades at 12.5 times its current EBITDA, so once Highfield moves Muga into full production even a heavily discounted multiple still points to a valuation of several billion dollar, i.e. multiples of the current market capitalisation.

The feasibility study confirmed that the Muga project will be at the very bottom of the global cost curve (with a C1 cost of EUR 76/ton) making it one of the highest margin potash mines in the world. In addition the Stage 1 capex figure was confirmed at EUR 398 million with almost all of the procurement costs now locked in with signed contracts.

We believe the market is looking for certainty around how Highfield will fund this Stage 1 capex and that concerns around a dilutive capital raising needed in Q1 2022 may explain why the share price is trading at a fraction of the company’s intrinsic value. The feasibility study announcement went a long way to addressing this concern for us by indicating that Highfield is in term sheet discussions with international lenders for around EUR 300 million of debt for the Muga project (as opposed to the EUR 185 million project finance facility it previously had approved).

Furthermore, Highfield hinted at discussions underway with 'strategic investors' that have shown interest in funding a portion of the remaining funding required. Taking that into account together with the company's current net cash balance ($27 million as of 30 Sept) we estimate the likely equity raise required early next year to fund construction will be a lot lower than the market has been anticipating.

Where to from here?

While we have seen Highfield's share price begin to wake up from its slumber we are still in the very early stages of a significant re-rating. We see a number of near-term catalysts for the company including:

- Finalisation of the debt term sheet for the construction financing;

- Award of town hall construction licenses;

- Further details on strategic interest in financing the project;

- Announcement of binding offtake agreements for Muga's full capacity.

In addition, we anticipate a more general re-rating of potash equities once investors wake up to the current potash market supply/demand dynamics.

Highfield remains a conviction holding for us at Tectonic - a company focused on the right commodity, at the right-end of the cost-curve, with quality management/directors (who are themselves buying shares), and still trading at an absurd discount to its intrinsic value. Our fund has been further adding to our position in the company over the past week.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

1 topic

8 stocks mentioned