Mortgage security | The bedrock of real estate credit

The previous era of moderate inflation and low interest rates has rapidly given way to a new era of macro and financial market volatility. Major asset classes have hit the reset button and investors across the board have pulled back.

The transition to a new world calls for a different asset allocation mindset with a sharper sense of the suite of risks likely to dictate the investment landscape.

The cyclical and structural case for investing in the private market alternative of real estate credit is strong. As part of a diversified portfolio, it offers reliable and inflation-adjusted income return. Equally important is the defensive strength and clear line of sight for downside capital protection provided by the security attached to its underlying investment – the first ranking mortgage.

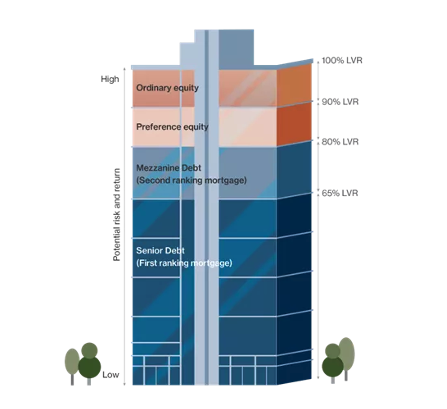

Real estate credit capital tower

Critical in understanding the strength of the downside capital protection real estate credit delivers is the underlying mix of equity and debt used to finance an asset – its capital structure.

Think of the capital structure as a building, with the riskiest position at the top, and the least risky and most stable at the bottom of the building.

Equity holders occupy the top-end of the tower – the riskiest position.

Ordinary equity sponsors manage or control the asset/entity in what is known as the ‘first-loss’ position. An income return, or dividend, is not guaranteed and if the saleable value of the asset decreases, equity funds are the first to be reduced or lost.

Next floor down in the risk/return pillar is preference equity. Installed at the discretion of the sponsor’s partners or syndicate of lenders, this debt/equity hybrid is an optional level that is generally paid a fixed percentage of dividends payable. It sits in a ‘second-loss’ spot after ordinary equity holders.

The capital foundation | First-ranked mortgages

Further down the risk capital tower is the debt (or real estate credit) foundation.

Topping the debt base is ‘mezzanine debt’, usually secured by a second ranking mortgage over the asset and positioned above any equity holders in repayment.

Real estate credit issued as ‘senior debt’, secured by a first-ranking mortgage over the asset, occupies the solid, stable, and safest location within the capital tower. The position gives the lender (investor) the right to repayment from the value of the asset ahead of any other creditor or the borrower.

Critically, a registered first ranking mortgage also gives the lender the right to control the property if the borrower defaults. In the hands of an experienced manager, this added security ensures lender’s (investor’s) capital can be managed prudently if the loan covenants are breached.

Typically, real estate credit loans are relatively short in duration, the maximum loan term is generally 24 months. The shorter-term loan reduces exposure to individual borrowers, sectors or securities and cyclical movements and also ensures the initial due diligence remains relatively current, providing a further protection against capital loss.

Weathering the storm

Population estimates indicate Australia may experience growth rates of up to 1.4% p.a. by 2024-25, outpacing many regions in the developed world.1 Population growth helps create a balance between labour demand and supply, contributing to a stable, growing economy.2 Increasing activity in the credit (debt) sector of the capital stack will be necessary to fund critical housing and real estate development.

Additionally, as financial markets remain highly volatile investors may look to secure an increasingly defensive capital position. The underlying asset in real estate credit (the first-ranked mortgage) is not the only protection offered from the turbulent conditions ahead. Shorter-duration loans (maximum of two years) and low loan-to-value ratios (LVR) combine to further bolster the defensive shield in the event of declining value in the underlying asset.

Accessing real estate credit

An expanding suite of real estate credit investment products are available in Australia.

Accessing real estate credit is open to institutional, wholesale and retail investors through open and closed-end funds, bespoke mandates, partnerships, and separately managed accounts.

Diversified funds typically employ open-ended structures. With a minimal initial investment, open-ended real estate credit funds allow investors in and out of the fund during its life. Distributions are paid on a regular, typically monthly or quarterly, basis and target returns can be linked to official interest rates in line with a floating rate structured loan portfolio. Investments are selected and held at the discretion of the manager.

Real estate credit provides a defensive investment with regular income and low downside capital risk through the security and control attached to the structure of the underlying investment, the first ranked mortgage.

Access a defensive strategy designed for investors seeking monthly income

The MA Secured Real Estate Income Fund aims to provide investors with monthly cash distributions and a compelling risk-adjusted return through exposure to a range of first mortgage loans secured by Australian residential and commercial property, by investing directly or indirectly via third-party originated special purpose trusts.

To learn more about the fund, visit the MA Financial website here.

3 topics

1 fund mentioned