NSW Treasurer shocks markets announcing he will repay $11 billion of taxpayer debt using rainy-day fund, as we'd recommended...

In a huge development yesterday, NSW's brilliant Treasurer Dominic Perrottet shocked financial markets with the news that he will use proceeds from the $11.1 billion sale of WestConnex to repay an equivalent amount of NSW government debt, as Coolabah had long advocated. No other analysts or investors that we know of expected this outcome, which had the immediate impact of crushing the interest rate spreads that NSW government bonds pay above Commonwealth government bonds, reducing its previously elevated cost of capital back towards other States. Writing in the AFR, John Kehoe reports:

NSW has surprised financial markets by announcing $11 billion from the WestConnex privatisation will be used to repay state debt, backflipping on ambitions to grow its sovereign investment fund to $90 billion over a decade.

NSW Treasurer Dominic Perrottet announced the debt retirement plan on Monday after a series of stories in The Australian Financial Review warned that taking on greater debt to grow the $15 billion NSW Generations Fund (NGF) had raised concerns among credit rating agencies, bond investors, Labor and public finance experts. “We are taking a balanced approach to paying down debt and investing where it is needed to get our economy firing again,” Mr Perrottet said.

In NSW's media release, Mr Perrottet explained that although the WestConnex sale proceeds had to be technically invested in the NSW Generations Fund's Debt Retirement Fund, they would be then used to repay NSW government bonds:

“Net proceeds from the sale will be invested in the NSW Generations Fund (NGF) – the State’s sovereign wealth fund - as required by legislation – before being used to retire an equivalent amount of debt”

This is the first time in history that the NGF's $26 billion Debt Retirement Fund has been used to repay debt since its establishment in 2018. And it represents extremely prudent fiscal management on the part of Mr Perrottet, who presciently created the Debt Retirement Fund back in 2018 to build-up a "rainy-day" savings buffer that could be used to retire debt in future crises when the NSW budget plunged into deficit.

Credit rating agency Moody's responded very positively, with analyst John Manning telling the AFR that debt retirement would "support the state’s AAA credit rating". "As a result, the state’s borrowing requirements will materially reduce over the next two-three years," Manning said.

When Mr Perrottet established the NGF's Debt Retirement Fund in 2018, the NSW budget had recorded a surplus of almost $4 billion and net debt was negative. The Debt Retirement Fund was seeded with reserves from the budget surpluses and the $7 billion sale of the first-half of WestConnex.

Yet as a result the 1-in-100 year pandemic that hit the NSW economy in March 2020, State debt surged to over $100 billion. This crisis was exacerbated in June 2021 when NSW shocked financial markets by announcing debt issuance that was about double what participants had expected despite a FY2021 budget deficit that was some $12 billion smaller than what NSW and many analysts had forecast (Coolabah had consistently projected a much skinnier deficit).

The driver of this sudden increase in debt issuance was an entirely unanticipated proposal to incur between $20 billion and $47 billion of additional taxpayer debt over the forward estimates to funnel State revenues/income into the NGF's Debt Retirement Fund and other related investment funds. These vehicles are managed by NSW's debt issuance and investment arm, known as TCorp.

The hope was that by investing what by 2031 would become more than $90 billion of NSW capital in equities and other very risky asset-classes, NSW might earn returns that would exceed its cost of debt in what was akin to a huge levered equities carry trade. It only worked in a world where interest rates remained low and the sharemarket always went up. In alternative scenarios in which, for example, inflation forced interest rates higher, and these discount rates in turn compelled equities lower, the levered carry trade that was the NGF's Debt Retirement Fund would dramatically increase the State's net debt (as equities declined) at the worst possible time. And with interest rates at 100 year lows and equity valuations at all-time highs, the timing was not ideal.

In numerous articles (see also here, here and here) and briefings, Coolabah argued that this unannounced scheme, which we were the first to decode, was in direct conflict with the 2018 legislation that governs the NGF's Debt Retirement Fund. These laws require the Debt Retirement Fund to provide funding to reduce, not increase, the gross debt of the State (taking on more gross debt to direct revenue to the NGF does the opposite), and to be managed in a way that maintains NSW's AAA credit rating, which was lost in December 2020, and lowers the cost of public debt, which had soared as a result of the news that NSW was proposing to de facto debt fund the NGF.

In what was an unrelenting activist ES'G' campaign ('G' in the sense of governance), Coolabah proposed that NSW should draw-down on the $15 billion in the Debt Retirement Fund---which will increase to $26 billion following the sale of the second-half of WestConnex---to reduce NSW's deficits and debt, thereby mitigating the fiscal risks faced by both current and future generations of taxpayers, precisely as Mr Perrottet had originally intended...

A number of other important voices, including the experienced former NSW parliamentary budget officer Dr Stephen Bartos, the AFR's Economics Editor John Kehoe, and the NSW Shadow Treasurer Daniel Mookhey, one of the most impressive young politicians in the land, expressed similar points of view in multiple media forums.

Following Mr Perrottet's media release yesterday, TCorp have confirmed that the $11 billion will be "progressively applied to debt retirement in the short to medium term", which means this money will be "fully deployed over approximately 24 months". This could take the form of the NGF buying-back NSW government bonds and/or subscribing for new NSW government debt issues.

There remain two key outstanding questions on this important topic, which has been a key driver of the interest rates on all State government bonds since June 2021. They include:

- What is NSW going to do with the circa $20 billion of State government revenue that it had proposed to divert to the NGF (and related investment funds) this year and over the forward estimates? We have argued that it would make a great deal of sense to re-divert this revenue back to the NSW budget until it returns to surplus following the maxim outlined by Peter Costello in respect of the Future Fund (ie, you only funnel reserves into sovereign wealth funds when the budget is in surplus). If NSW does not do this, it would be de facto debt funding these investments, which would just open-up the Pandora's box again; and

- What will NSW do with the $15 billion or so that remains in the NGF’s Debt Retirement Fund, which includes the $7 billion of sale proceeds from the first half of WestConnex plus some historical revenue appropriations? Mr Perrottet promised to use all the WestConnex sale proceeds for asset recycling. The NGF should, therefore, be able to allocate capital to new (in addition to existing) NSW government bond issues to allow the State to fund further infrastructure investments, such as the $5 billion WestInvest commitment that was also announced yesterday.

While these questions will have to be addressed, the initial $11 billion of debt repayment is a terrific result for NSW taxpayers, the Treasurer Dominic Perrottet, and for activist ESG campaigners.

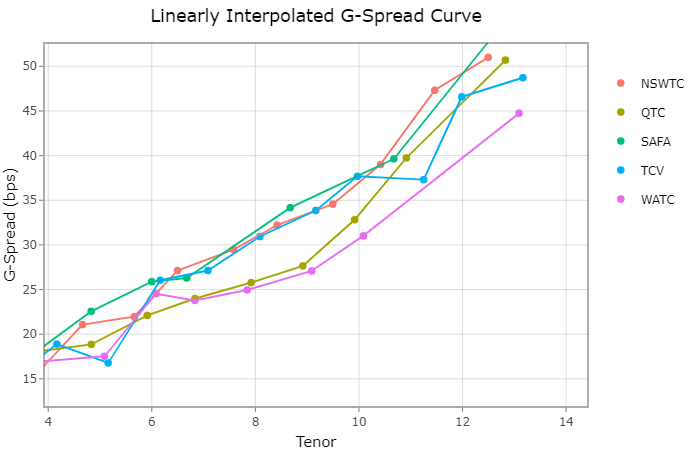

We have already seen interest rates on NSW government bonds, which had been trading materially above all the other States since June, compress back to the pack. The chart below shows the interest rate spread above Commonwealth government bonds (vertical axis) that the NSW government (red line) pays for different bond maturities, expressed in years (horizontal axis). This red line used to be noticably above the other States. Yesterday it started converging inside South Australia and in line with Victoria.

The original NSW debt funding shock in June 2021 forced both NSW and all other State government bond spreads some 30 basis points wider from about 15 basis points over 10 year Commonwealth government bonds to 45 basis points over in September.

Combined with two other key developments, namely (1) the RBA buying approximately $30 billion of State government bonds as part of its third round of quantitative easing and (2) APRA's recent decision to close the $139 billion Committed Liquidity Facility, which will force banks to replace it with an equivalent quantum of State and Commonwealth government bonds, we expect that NSW's decision to use the Debt Retirement Fund to retire government debt to reduce the spreads on its debt securities back towards the levels last observed in May 2021. This dynamic will be further reinforced should NSW decide to stop diverting revenue/income to the Debt Retirement Fund, which would substantially reduce future debt issuance needs.

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income and over $7 billion in FUM, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 14 analysts and 5 portfolio managers. Click the ‘CONTACT’ button below to get in touch.

2 topics