Rare earths are a big deal right now - but are they a buy?

One news topic keeps unfolding like a bad onion since China’s tit-for-tat tariff rally with the U.S, and it’s what China is holding ransom: limiting the export of rare earths.

And it certainly isn’t the first time China has used this trump card.

While the goalposts have changed yet again since we saw the U.S. and China reach a trade deal earlier this week, it's worth taking a brief science and history tour to provide some context to the drama, if you, like me, want to know more about what rare earths are, which companies are worth knowing about on the ASX, and how Australia is responding.

First, what is a rare earth?

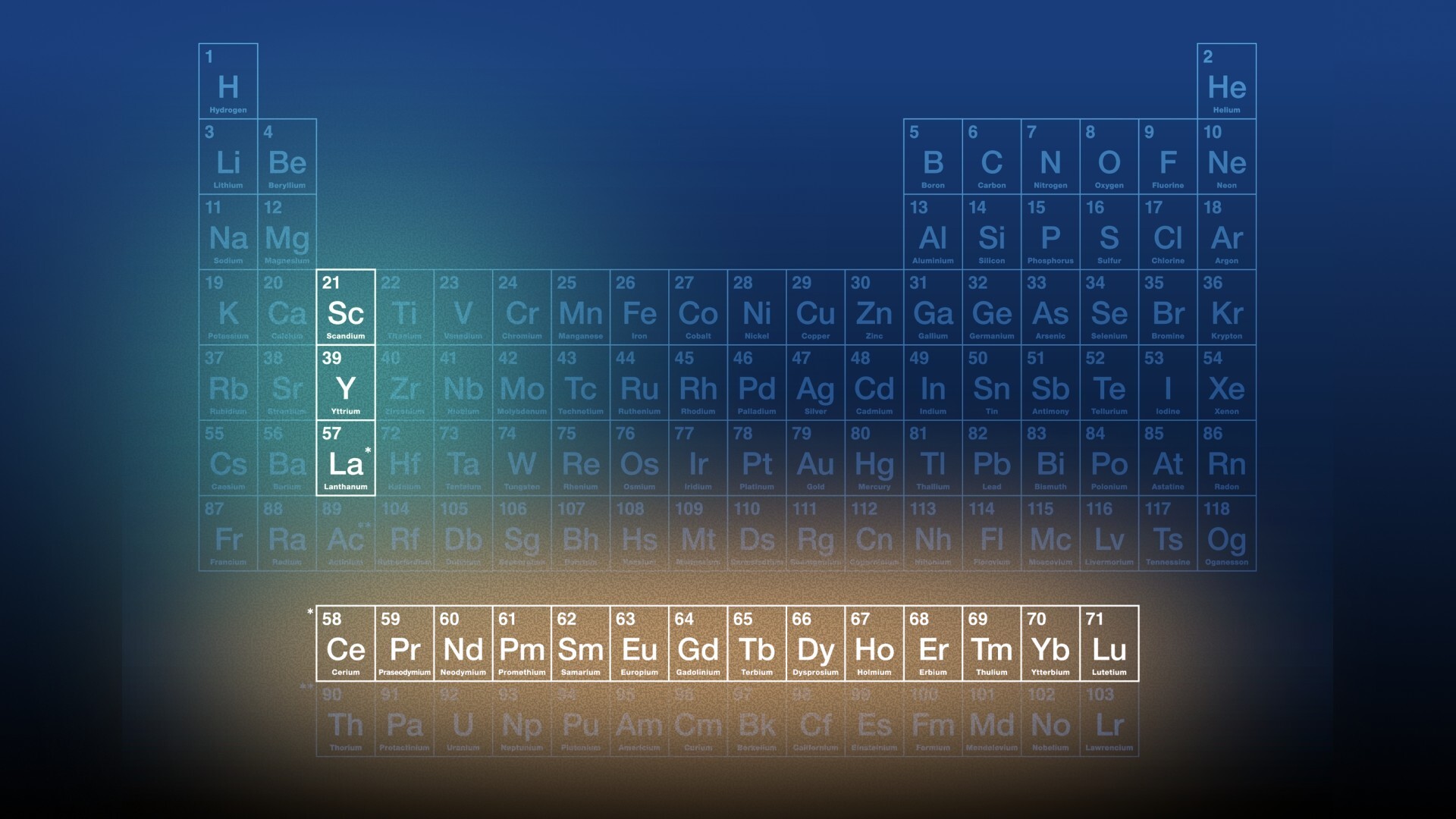

Rare earths, known as rare earth elements (REEs) are a group of 17 chemically similar elements in the periodic table. They are categorised into two types - light and heavy. More on the heavy types later.

You may not have looked at one of these since year 10 science class, so here’s where they sit on the periodic table:

.jpg)

They are malleable with high melting and boiling points, with unique magnetic and luminescent properties and come in pretty pastel colours, like a colour wheel at the nail salon.

Why are they so important?

They make everything smaller and lighter, and are probably in everything you switch on and off. That means things you use every day, like your mobile phone, your computer, and your TV.

In healthcare, they are used in MRIs, laser scalpels and some cancer drugs. In defence, they are used in satellite communications, guidance systems and aircraft structures. For the green tech that will support net-zero carbon emissions goals, they are used in wind turbines and electric vehicles.

Their unique characteristics allow them to enhance the performance of other metals and in most cases, result in a reduction of the amount of metal necessary for an application.

This is also what differentiates them from the battery metals, like lithium and nickel - they can convert the electricity that is stored in a battery into motion (like the wheels of an EV), and are also used to turn motion into electricity (for example, in a wind turbine).

Are rare earths…rare?

They’re neither rare, nor an earth.

They’re actually all considered metals and are, in fact, pretty abundant in the Earth’s crust. They are known as "rare" because it is very unusual to find them in pure form, and the term "earth" is simply an archaic term for a substance that can be dissolved in acid.

That's the science bit done. Now onto some economic history.

The real meaning of “rare” is to find the elements in quantities sufficient to support a mine. And it's a dirty, difficult job to extract them.

With lower labour wages and lax environmental laws, by 2000, slowly, strategically and surely, China had gained control of the rare earths market and was responsible for more than 95% of the world’s REE mining.

And quite frankly, no other country, including America, could keep up.

With great power comes great….leverage.

In 2010, a Chinese fishing boat collided with Japan’s Coast Guard. After Japan arrested the Chinese vessel’s captain, China responded by unofficially pausing the export of rare earths to Japan for nearly two months, which was resolved only when Japan released the Chinese fishing boat captain.

In the movies, this is called foreshadowing.

The Japanese government, alarmed, moved quickly to address its Achilles heel. Within a month, it had put together a package of measures to enhance its own rare earth supply chain and stop relying on China so much. (At the time, it was at 90%.)

One of these measures was to develop mines and acquire interests in rare earth mines in Australia and elsewhere. Enter Lynas (ASX: LYC), the only Australian producer of rare earths, and the largest producer of rare earths outside of China.

Since 2000, mining locations have diversified; however, the International Energy Agency (IEA) estimates that China accounts for about 61% of rare earth production and 92% of their processing.

So, regardless of where the critical minerals are mined…it’s more than likely it’s still going to China for processing.

REEs deep into 2025

China began imposing restrictions on the exports of seven rare earth minerals - most of which are known as the "heavy" rare earths, which are crucial to the defence sector due to their use in missiles, radar, and magnets - and seen as a direct retaliation to Trump's tariff measures.

They are less common and are harder to process than "light" rare earths, which also makes them more valuable.

The re-elected Albanese government plans to create a national stockpile of critical minerals, which could also be used in potential tariff negotiations with the U.S.

Labor’s Critical Minerals Strategic Reserve would be up and running by mid-2026, which the PM says would ensure Australia could deal with trade and market disruptions “from a position of strength”.

Lynas hit back at the announcement, with the CEO claiming Albanese will be undercutting the company, setting itself up as a competitor and potentially propping up unfeasible projects.

Whereas Iluka, the beneficiary of $1.65 billion in government loans to build Australia’s first fully integrated rare earths refinery, has welcomed the move to force the release of China’s stranglehold on the market.

What do the brokers think?

While we sit back with our popcorn and rare-earth dependent smartphones to see how this all unfolds, let’s look at what the brokers say about three key rare-earth ASX-listed companies.

1. Lynas Rare Earths (ASX: LYC)

Lynas is the only producer of separated rare earth materials outside of China.

Broker consensus on Lynas Rare Earths is mixed. Citi is cautious with a Sell rating and $5.50 target, pointing to weak demand, overvaluation, and falling earnings.

Macquarie sits in the middle with a Neutral rating and $7.30 target, seeing both risks and opportunities.

Canaccord Genuity is optimistic, rating it a Buy with a $8.80 target, highlighting Lynas’ key role in building a rare earths supply chain outside China.

| Broker | Rating | Target Price | Notes |

|---|---|---|---|

| Citi | Sell | $5.50 | Overvaluation, weak pricing and volumes cited. |

| Macquarie | Neutral | $7.30 | Balanced view, cautious outlook despite strategic positioning. |

| Canaccord Genuity | Buy | $8.80 | Focus on pricing bifurcation, strategic value outside China. |

| UBS | Buy | $~9.00 (est.) | Strong bullish stance; ex-China supply chain development emphasised. |

2. Iluka Resources (ASX: ILU)

Iluka is an international critical minerals company with exposure in exploration, project development, mining, processing, marketing and rehabilitation.

Brokers have a mixed but cautiously optimistic view on Iluka Resources.

Goldman Sachs is most positive, rating it a Buy with a target price of A$6.50, citing strong zircon demand and rare earths potential.

Morgan Stanley and UBS are more neutral, with targets of A$3.65 and A$5.30, respectively, noting near-term sales and pricing challenges but long-term value in rare earths.

Citi also rates ILU Neutral with a A$4.40 target, seeing government support for critical minerals as a potential boost, though risks around project execution remain.

Overall, brokers see long-term opportunity, especially in rare earths, despite short-term market softness.

| Broker | Rating | Target Price | Notes |

|---|---|---|---|

| Goldman Sachs | Buy | $6.50 | Positive on zircon demand and rare earths; sees strong long-term upside. |

| Morgan Stanley | Equal-weight | $3.65 | Cautious on short-term sales/pricing; sees stable zircon contracts. |

| UBS | Neutral | $5.30 | Q1 weakness seen as seasonal; positive on rare earths amid global trends. |

| Citi | Neutral | $4.40 | Notes gov’t support for critical minerals; cautious on project execution. |

3. Meteoric Resources NL (ASX: MEI)

Meteoric is an Australian exploration company focused on mineral tenements in Brazil, Western Australia, and the Northern Territory.

Broker consensus on Meteoric Resources (MEI) is cautiously positive.

Canaccord Genuity has a Speculative Buy rating with a $0.35 target, pointing to strong progress at the Caldeira project and upcoming resource updates.

Macquarie also sees high risk but high reward, noting MEI's early stage but strong upside if key milestones are hit.

Ord Minnett is aligned with a Speculative Buy and a more conservative $0.20 target, noting solid resource growth but flagging funding risks and weak market sentiment for rare earth explorers.

Overall, analysts like MEI’s exposure to Brazil’s rare earths sector, but see execution, permitting, and financing as key risks.

| Broker | Rating | Target Price | Notes |

|---|---|---|---|

| Canaccord Genuity | Speculative Buy | $0.35 | Strong view on Caldeira project; high-grade resource; upcoming PFS a key catalyst. |

| Macquarie | Outperform | $0.36 | Positive on strategic value; PFS and EIS approval noted as near-term catalysts. |

| Ord Minnett | Speculative Buy | $0.20 | Sees upside but flags funding risks and weak market sentiment for REE juniors. |

Are you investing in rare earths, or planning to? Let me know your thoughts in the comments below.

3 stocks mentioned

.jpg)

.jpg)