Risk fades, value and quality outperform

Something interesting happened in March this year – the dominant theme that has been driving relative stock performance has reversed.

In the previous 12 months, the stocks that outperformed the most have tended to be companies with the greatest volatility. The stocks that were the most negatively impacted by the pandemic were also typically those that exhibited the most volatility. These companies have also generated the largest returns from the lows, as investors re-rated these companies as they become more comfortable about a return to normal and pre-pandemic economic conditions. Think energy, consumer discretionary, materials and financials.

But, in March this trend reversed.

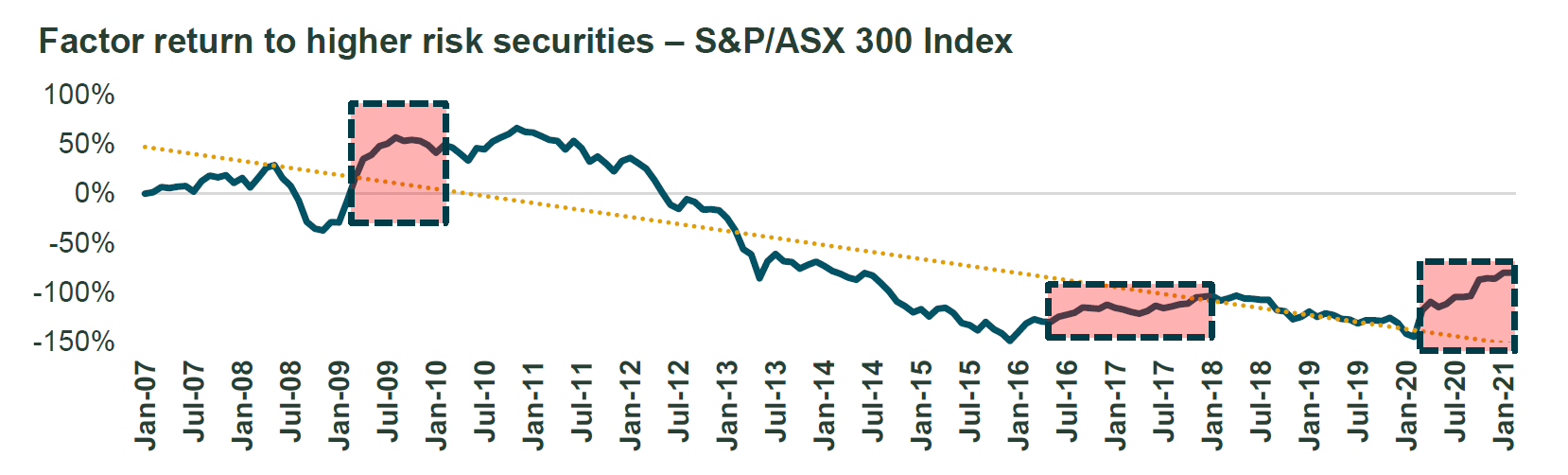

Figure 1 below places the recent risk rally in a historical context. We have highlighted in red boxes the three major risk rallies that have occurred since 2007. The first after the Global Financial Crisis in 2009, the second from June 2016 as the outlook for global growth improved significantly and the third most recent one after the equity market bottomed in March 2020. These risk rallies have tended to be fast and short-lived. As Figure 1 highlights, other than these few episodes, owning more risky securities has been suboptimal.

Figure 1: Risk Rallies in an Historical Context

Source: SSGA, Factset, S&P/ASX 300 Index as of 28 February 2021. The above chart represents the performance of high-risk companies versus low-risk companies, over time. It is calculated by ranking the S&P/ASX 300 Index constituents each month by highest to lowest risk. Each month we calculated the performance of the most risky (Top 20%) minus the least risky (Bottom 20%). When high-risk companies outperform low-risk companies the line will go up and when low risk outperforms high risk the line will go down. Past performance is not a reliable indicator of future performance. Index returns are unmanaged and do not reflect the deduction of any fees or expenses.

The risk rally fades in March

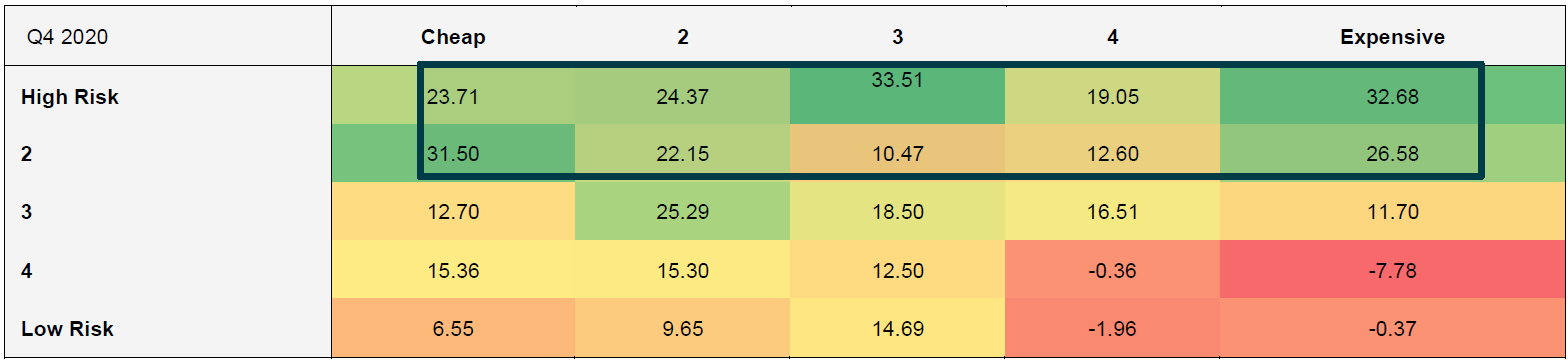

In Figures 2 and 3 below, we compare the returns to the different segments of both risk and value to better understand what parts of risk and value dominated the rotation within markets over these periods.

In Figure 2 we look at the performance of the different segments of the S&P/ASX 300 Index broken down by value (cheap or expensive) and risk (high risk to low). We choose the period of Q4 2020 as it represents the period in which the positive vaccine news was the most dominant and in which markets rallied the most. In Q4 2020 (after the positive vaccine news) the most risky parts of the S&P/ASX 300 Index rallied the most. As can be seen in the highlighted box in Figure 2 below, risk was more important than Value. High risk cheap outperformed and high risk expensive outperformed. In March this reversed.

Figure 2: Risk was the Dominant Theme Especially in Q4 2020

Source: State Street Global Advisors, Factset as of March 31, 2021. The above table represents the average performance (%) securities in the S&P/ASX 300 Index which have been equally weighted and ranked by value (Cheap to Expensive), then each value bucket has been ranked by High Risk to Low Risk. Past performance is not a reliable indicator of future performance. Index returns are unmanaged and do not reflect the deduction of any fees or expenses.

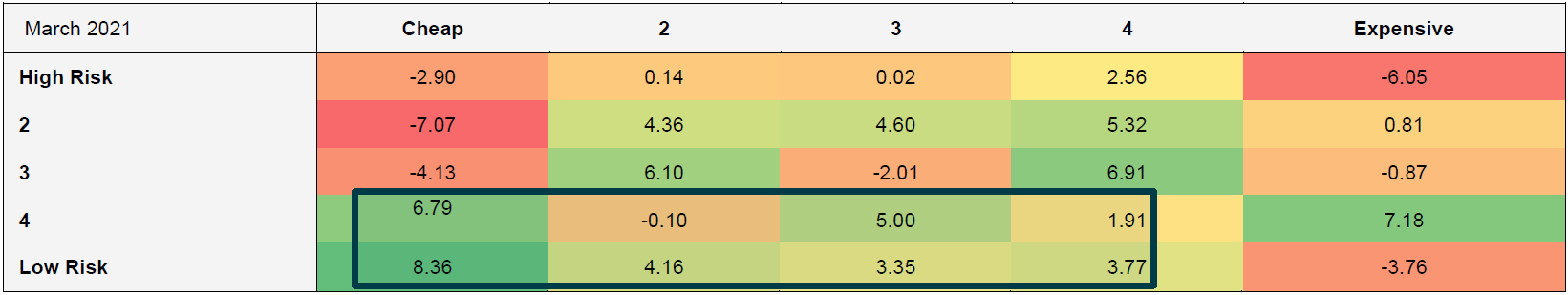

As can be seen in Figure 3 below, low risk dominated with the S&P/ASX 300 Index. The highlighted box in Figure 3 shows that low risk outperformed high risk and indeed cheap low risk was one of the sweet spots. Not shown here but consistent with these results, higher-quality companies also outperformed in March. Indeed the combination of better quality lower risk and better value was optimal in March. We typically expect better quality companies that are less expensive to outperform over the longer term and we observed a return to this pattern in March.

Figure 3: Less Risky Companies Outperformed in March 2020 – the Sweet Spot was “Cheap and Low Risk Companies”

Source: SSGA, Factset as of March 31, 2021. The above table represents the average performance (%) securities in the S&P/ASX 300 Index which have been equally weighted and ranked by value (Cheap to Expensive), then each value bucket has been ranked by High Risk to Low Risk. Past performance is not a reliable indicator of future performance. Index returns are unmanaged and do not reflect the deduction of any fees or expenses.

The Bottom Line:

The most dominant theme in the market since the lows in March 2020 has been the atypical outperformance of more risky securities over less volatile securities. In March we observed a reversal of this trend and a return to what we would expect is more normal investor security pricing. Less expensive companies outperformed and indeed the less risky better quality companies outperformed in March.

Never miss an insight

Stay up to date with our latest thoughts by clicking follow below and you'll be notified every time we post content on Livewire.

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.