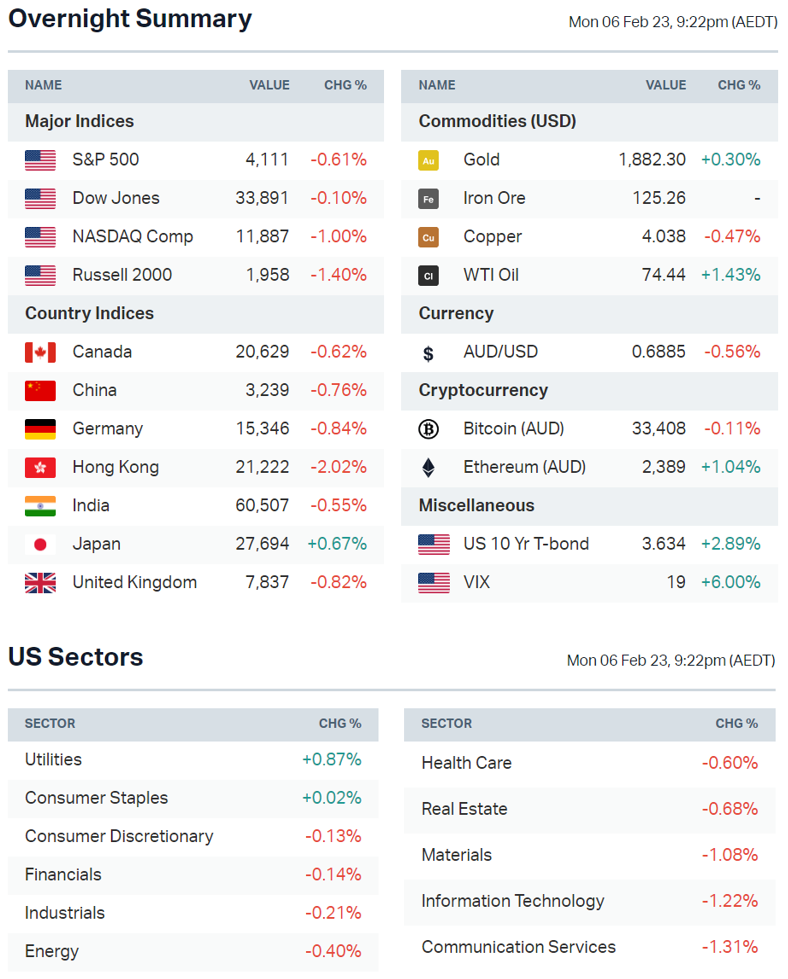

S&P 500 extends pullback, ASX 200 performance on rate hike days

ASX 200 futures are trading 1 point higher, up 0.01% as of 8:20 am AEDT.

The S&P 500 fall for a second-straight session, US hedge funds are aggressively covering their short positions, Goldman Sachs cuts its recession odds, Australian retail trading volumes posts largest non-pandemic fall in 12 years and how does the ASX 200 perform on interest rate decision days?

Let's dive in.

S&P 500 Session Chart

MARKETS

- Risk off start to the week amid a bounce in bond yields, dollar strength, overbought conditions and heightened geopolitical risks

- Strong US jobs data flips Fed rate path risk to the upside says BoFA

- US jobs data reflects a goldilocks moment, with strong payrolls growth alongside improving economic growth and disinflation says JPMorgan

- Hedge funds covering short positions at faster pace than 2021 meme stock frenzy (FT)

- Binance temporarily suspends US dollar withdrawals (Axios)

STOCKS

- Dell cuts over 6,000 jobs due to plunging PC sales (Bloomberg)

- Tesla raises price of Model Y in US in response to strong demand (CNBC)

EARNINGS

Key stats about US fourth quarter earnings, according to FactSet:

- 50% of the S&P 500 has now handed down results.

- Of these, 70% of S&P 500 companies have reported a positive EPS surprise and 61% of S&P 500 companies have reported a positive revenue surprise

- Blended earnings decline for the S&P 500 at the moment is -5.3%. If this holds, it will mark the first time the index has reported a year-over-year decline in earnings since Q3 2020

- For Q1 2023, 37 S&P 500 companies have issued negative EPS guidance and 6 S&P 500 companies have issued positive EPS guidance

Big tech has failed to impress, notably:

- Netflix, and Google have all announced layoffs while Microsoft’s disappointing revenue forecast fell flat with investors

- Meta also reported a disappointing result but Zuckerberg also used that as a chance to initiate a $40 billion share buyback. Cue 23% pop

- Bigger takeaway is the re-rate in earnings estimates from the sell-side

ECONOMY

- German factory orders improve in December (Bloomberg)

- Fed's Daly sees rates at 5.1% due to sticky inflation and strong jobs (Reuters)

- ECB 's Holzmann says risk of over-tightening policy dwarfed by risk of doing too little (Bloomberg)

- BoE's Mann says next move likely to be another 25bp hike (Bloomberg)

- Goldman Sachs cuts recession odds on labor-market strength, improvement in business surveys (Bloomberg)

These are all US-listed ETFs. Last year, I wrote an explainer for our ETF table. You can check it out here.

DEEPER DIVE

Data Insights: ASX 200 on rate hike days

The RBA interest rate decision is at 2:30 pm AEDT for a widely expected 25 bp hike. In Monday's Evening Wrap, I looked at how the ASX 200 performed on rate hike days in 2022.

Sectors to watch

There wasn't anything too exciting overnight as US stocks continue to turn after a very strong January. Several ETFs that slumped on Monday extended declines, including Nickel (-3.27%), Rare Earth/Strategic Metals (-2.7%), Fintech (-2.35%) and Uranium (-1.9%).

Quick bites

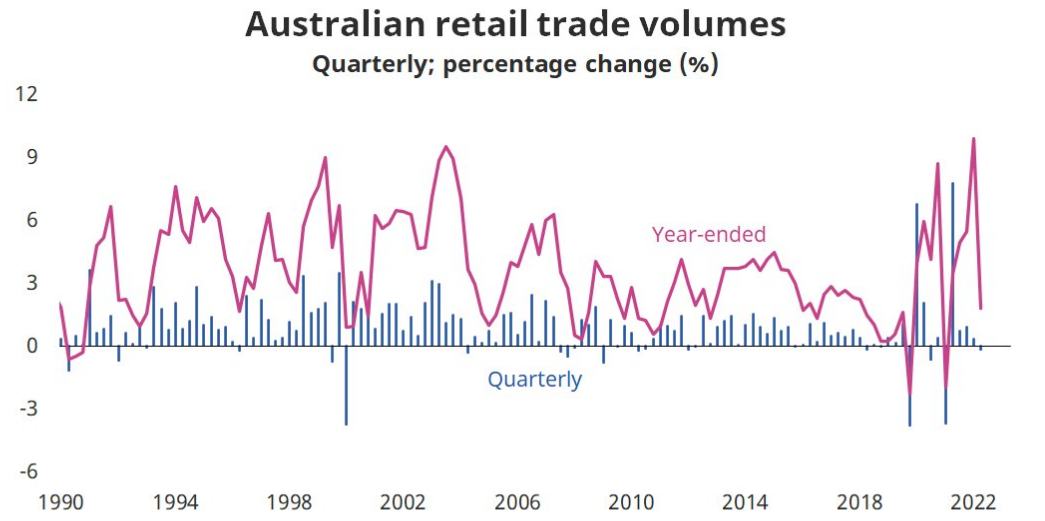

Today’s quick bites is dedicated to yesterday’s local retail sales data. Retail volumes fell by 0.2% in the December quarter. On any other data point, a 0.2% fall is peanuts. But the 0.2% fall in retail volumes is the largest non-pandemic fall in 12 years.

What does it prove? The RBA’s rate hikes are definitely having an effect on the consumer wallet. And the concerns about a retail recession (or at least, major downturn) may be completely warranted.

Today's good reads

So are consumer staples any better than their discretionary counterparts given the above? Livewire’s Glenn Freeman has explored that question alongside Morningstar’s Johannes Faul in this sector deep-dive worth reading.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: None

- Dividends paid: Perpetual (PPT) – $0.35, Advanced Share Registry (ASW) – $0.005, New Energy Solar (NEW) – $0.135

- Listing: None

Economic calendar (AEDT):

- 11:30 am: Australia Balance of Trade

- 2:30 pm: RBA Interest Rate Decision

2 contributors mentioned