S&P 500 lower, Newcrest accepts Newmont's takeover, ASX 200 futures flat

ASX 200 futures are trading 7 points higher, up 0.09% as of 8:30 am AEDT.

S&P 500 modestly lower last week while the Nasdaq finished a bit higher, Apple's market cap is now bigger than the entire Russell 2000, Newcrest enters into a binding scheme implementation deed with Newmont, US consumer sentiment falls to a six month low while long-term inflation expectations hit a 12-year high and the ASX 200 remains in a tight range: Will it sink or swim?

Let's dive in.

S&P 500 SESSION CHART

MARKETS

- S&P 500 lower but off worst levels of -0.76%

- US Dollar Index up 1.3% in the last two sessions, weighing on gold

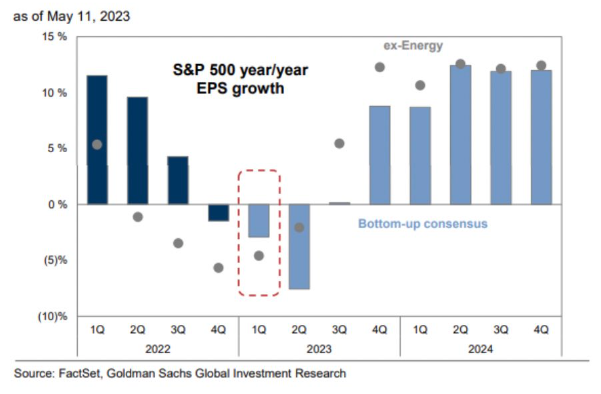

- Bullish focus points – BofA noting that 2023 S&P 500 EPS has started to bottom, NFIB survey did not reveal any signs of new credit strains from small businesses, Fed Senior Loan Officer Opinion Survey did not see any notable change amid recent stress among regional banks

- Bearish focus points – Lack of market breadth, Wells Fargo notes 48% of S&P 500 stocks are negative year-to-date, banks stocks continue to tank, US initial jobless claims at highest level since October 2021 and core inflation still firmly above 5.0%

- Money market assets hit new all-time high (Bloomberg)

- Cross asset correlations drop sharply as Fed's iron-grip over markets begin to fade, earnings in focus (Bloomberg)

- Fund managers have the lowest exposure to stocks relative to bonds since 2009, supportive for stocks (WSJ)

STOCKS

- Google AI event sends stock higher for second straight session (CNBC)

- Tesla raises US prices for all vehicles except the Model 3 (Reuters)

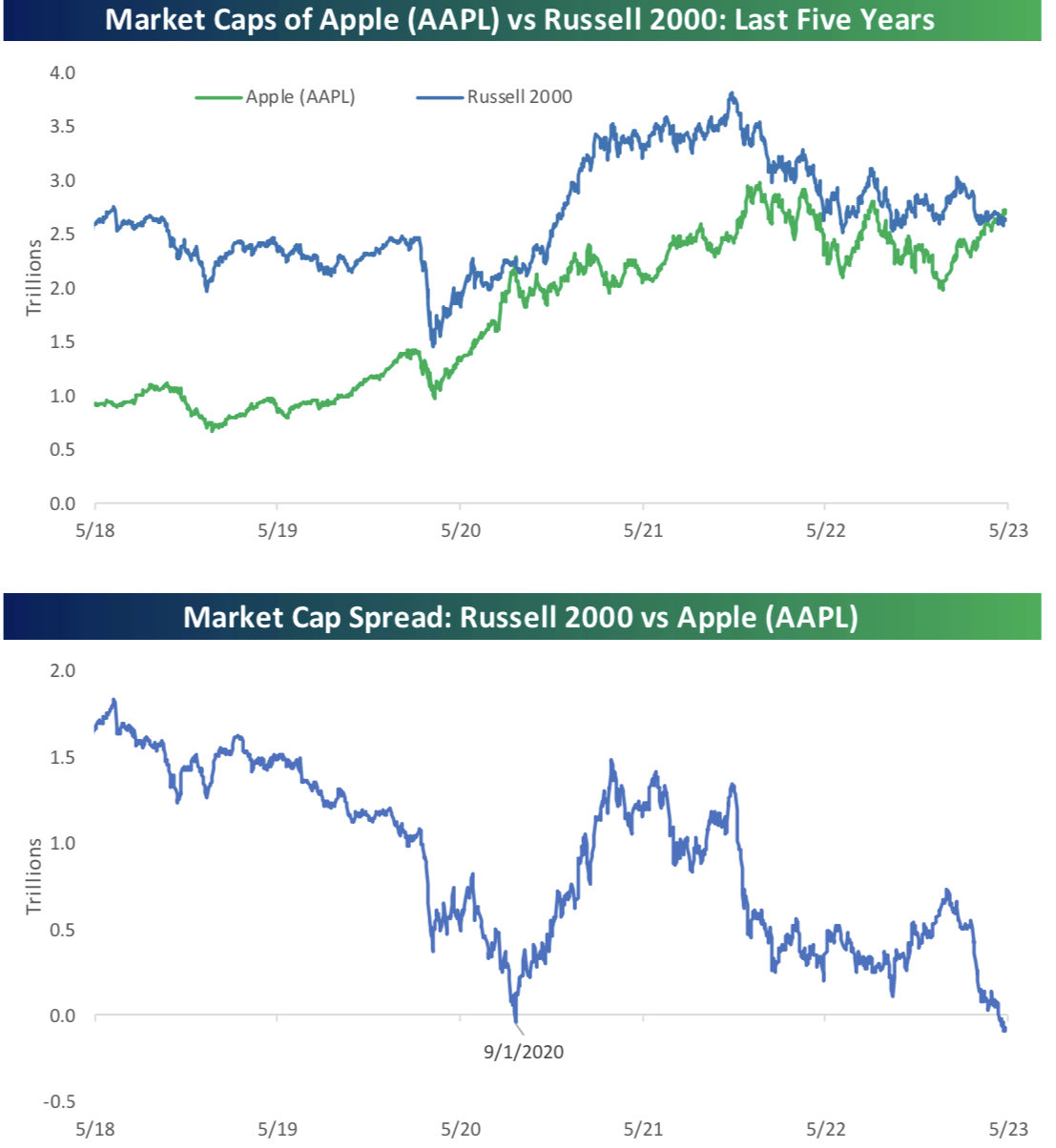

- Apple now bigger than the entire Russell 2000 (Bespoke Investment)

- Newmont enters into binding agreement with Newcrest (Bloomberg)

- General Motors recalling ~1m vehicles due to faulty air-bags (Reuters)

Earnings

- Blended earnings growth rate for first quarter S&P 500 is currently -2.5% compared to expectations of -6.7%

- Of the 92% of S&P 500 companies that have reported, 78% have beaten EPS expectations, above the 73% one-year average and 77% five-year average

- 75% have beat revenue expectations, above the 70% one-year average and 69% five-year average

- Consumer in focus this week, with several high-profile retail stocks including Target on Thursday and Walmart on Friday

ECONOMY

- US consumer sentiment drops to six-month low in May (Reuters)

- US consumer long-term inflation expectations hit 12-year high (Bloomberg)

- UK GDP data shows unexpected contraction in economy last month (Bloomberg)

- New Zealand inflation expectations fall sharply (Reuters)

- Debt ceiling talks postponed to next week, mixed takeaways (Bloomberg)

- China's housing rebound fizzling shows risks to economic recovery (Bloomberg)

-

National Oceanic and Atmospheric Administration says El Nino forming quickly could be a "significant" event (Axios)

Deeper Dive

Market Mood: Another Tight Range

The ASX 200 is down 0.27% in the last four sessions, which reflects some of the tightest price action we've seen since September 2021. In each of those sessions, the market managed to bounce from intraday lows.

An inflection point is brewing as the ASX 200 continues to form a tight range, will it break out or break down?

Charts of Interest

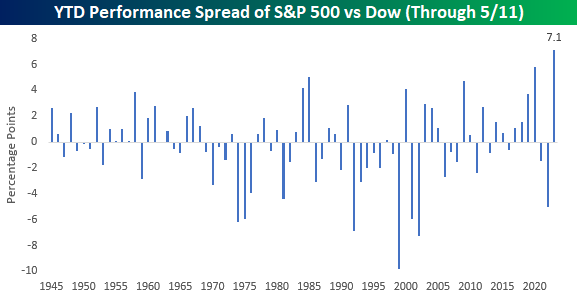

The Dow has never underperformed the S&P 500 by a wider margin on a year-to-date basis, according to Bespoke.

Apple's market cap has topped the Russell 2000. The last time this happened, it didn't last long, according to Bespoke.

"First quarter 2023 earnings season proved to be much better than feared ... Margins in every sector surprised to the upside ... We believe the worst of the 2023 negative earnings revision cycle is now behind us," said Goldman Sachs.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: WAM Capital (WAM) – $0.077, ANZ (ANZ) – $0.81, Macquarie Group (MQG) – $4.50

- Dividends paid: Charter Hall Long WALE REIT (CLW) – $0.07

- Listing: None

Economic calendar (AEST):

- 4:00 pm: Germany Wholesale Prices

- 7:00 pm: Eurozone Industrial Production

- 10:30 pm: NY Empire State Manufacturing Index

This Morning Wrap was first published for Market Index by Kerry Sun.

1 contributor mentioned