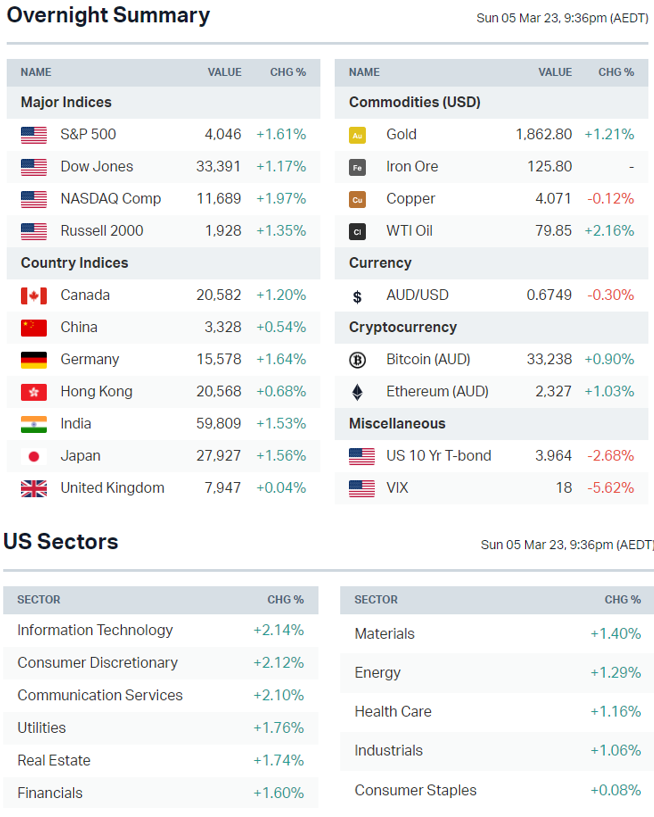

S&P 500 snaps 3-week losing streak as yields ease, ASX 200 set to rally

ASX 200 futures are trading 63 points higher, up 0.87% as of 8:20 am AEDT.

The S&P 500 rallies as the US 10-year yield falls back below 4.0%, China's service sector expanded at the fastest pace in six months in February, the RBA is set to hike rates by another 25 bps to 3.60% on Tuesday and a look at how equity markets perform in March.

Let's dive in.

S&P 500 SESSION CHART

MARKETS

- S&P 500 extends gains, up 2.4% in the last two sessions after an almost 5% sell off since the beginning of February

- Bond yields eased after the 2-year rallied as high as 4.97% and both the 10 and 30-year yields briefly pushed over 4.0% on Thursday

- Rate repricing remains the biggest headwind for markets, a 25 bp hike in March is the consensus but a pivot lower has been pushed back to March 2024

- Fed officials warn they may need to lift rates to a higher peak (Bloomberg)

STOCKS

- Apple supplier Foxconn to invest $700m in new plant in India (Bloomberg)

- Meta lowers Quest VR headset prices to lure customers (Reuters)

- Blackstone defaults on €531m bond backed (Bloomberg)

EARNINGS

Broadcom (+5.7%): First quarter revenue and earnings beat and issued a strong outlook.

- “First quarter performance reflects continued strength in infrastructure demand across all our end markets.” – CEO Hock Tan

- “We are confident our growth will be driven by sustained leadership in next generation technologies across all of our core markets.”

Costco (-2.2%): Earnings beat but revenue miss. Here are a few key quotes from management.

- “We continue to see some improvements in many items. Commodity prices are starting to fall not back to pre-COVID levels and some examples but continue to provide some relief.” – CFO Richard Galanti

- "We ended the second quarter with 68.1 million paid household members and 123 million cardholders, both up more than 7% versus a year earlier. At Q2 end, we had 30.6 million paid executive memberships... Executive members now represent 45% of paid members and about 73% of worldwide sales."

Zscaler (-11.1%): Earnings and revenue beat, raised full-year and billings outlook but several analysts noted the billings guide as a sign of weakness.

ECONOMY

- China Feb services activity jumps sharply as demand recovers (Reuters)

- Eurozone PPI falls more than expected in January (Reuters)

- Tokyo inflation falls from 42-year peak (Reuters)

-

German trade surplus jumps after rebound in exports (Reuters)

Deeper Dive

Enter March: The stronger month for equities

February has historically been a choppy month for equities. Seasonality is now back in our favour from March through to May.

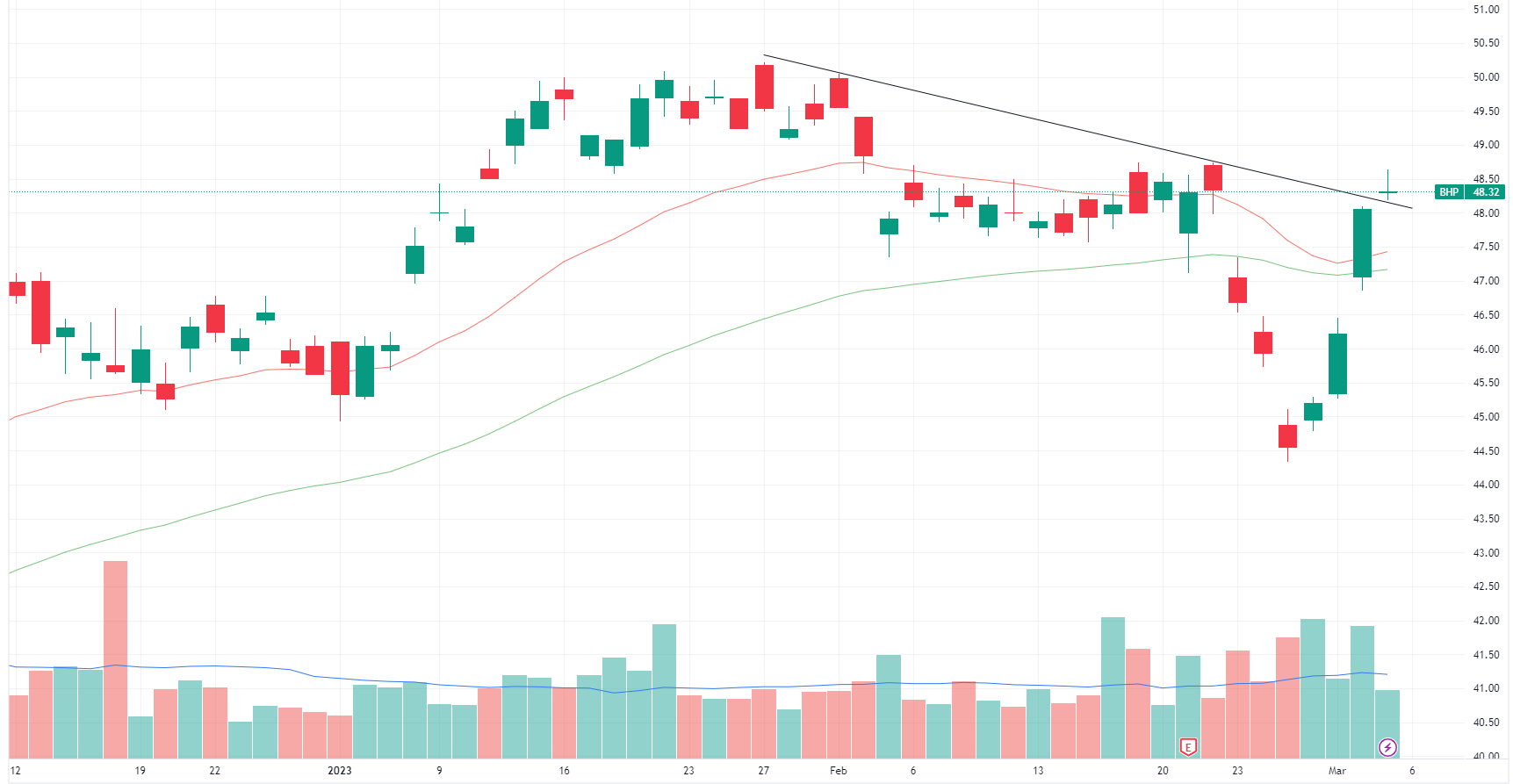

Talking Technicals: Finding support

The ASX 200 managed to bounce after the panic-like selloff last Monday and off the key trendline. Could Monday mark a shakeout low? Or is this just another bounce from oversold levels?

The market remains in a choppy place and below the 50-day moving average. Let's see how the week plays out.

RBA: Watch the data

The ASX 200 rallied from session lows of -0.45% to around breakeven last Wednesday after inflation eased to 7.4% in January from 8.4% in December and well-below economist expectations of 8.1%. GDP data was also soft, coming in at 0.5% in the December quarter compared to expectations of 0.6%.

The RBA is set to hike rates by another 25 bps to 3.60% on Tuesday at 2:30 pm AEDT. However, it's worth noting that Australia has missed employment, wages, GDP and inflation prints, making us dead last in the economic surprise ranking for the G10. Will this prompt any dovish views from the RBA?

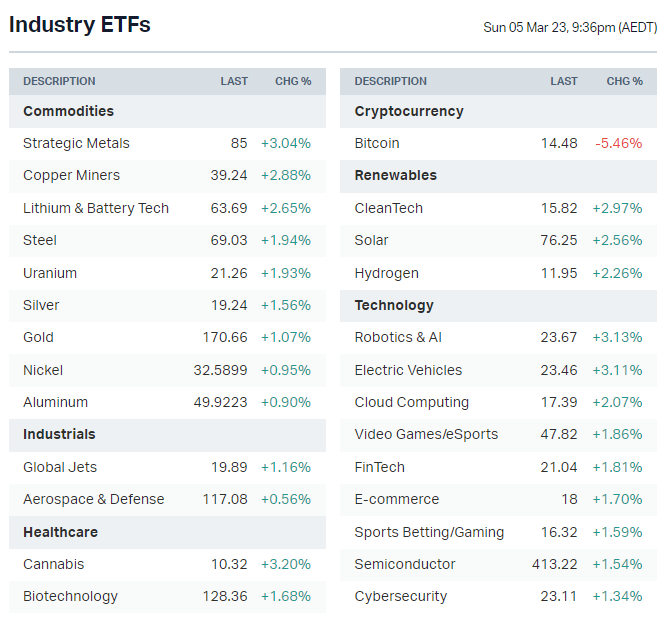

Sectors to Watch

Tech: Best performing sector on the S&P 500 last Friday. Risk barometers like ARKK ETF rallying back up into recent bases. Does this see some positive flow for local tech names like Xero, Altium and NextDC?

Resources/Copper: The Global X Copper Miners ETF rallied 10% last week after falling as much as 13% since the beginning of February. We're seeing strength come back into not just copper but the broader resources space thanks to better-than-expected economic data from China. The problem is that many resource-related stocks have staged a V-shaped recovery, back into previous ranges.

Gold: Bond yields retreated from key levels last week and the US dollar eased. Gold reclaimed the US$1,850 level after a brief touch of the 200-day. ASX-listed gold names are also trying to stablise, although its a rather selective market. There's been more pronounced buying for mid-term names like Ramelius and Perseus.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Australian Finance Group (AFG) – $0.066, Cleanaway (CWY) – $0.025, Qualitas (QAL) – $0.02, QBE Insurance (QBE) – $0.30, Nick Scali (NCK) – $0.40, Altium (ALU) – $0.25, Sims Metal (SGM) – $0.14, REA (REA) – $0.75, Mader Group (MAD) – $0.024, Iluka (ILU) – $0.20, Helloworld (HLO) – $0.02, Nickel Industries (NIC) – $0.02, Bendigo and Adelaide Bank (BEN) – $0.29

- Dividends paid: None

- Listing: None

Economic calendar (AEDT):

No major economic announcements for Monday.

Today's Morning Wrap was written by Kerry Sun.

1 contributor mentioned