S&P 500 snaps 4-day losing streak, Apple shares soar on earnings beat, ASX to rise

ASX 200 futures are trading 64 points higher, up 0.88% as of 8:30 am AEDT.

US equities rallied and closed near best levels, Apple posted better-than-expected earnings and approved an additional US$90bn buyback, WTI crude bounced 4% but logs a weekly decline of 7%, US unemployment unexpectedly ricks down to 3.4% and lithium prices turn positive for the first time since November 2022.

Let's dive in.

S&P 500 SESSION CHART

MARKETS

- S&P 500 snaps four-day losing streak and closed towards session highs

- S&P 500 still finished the week -0.80% lower

- WTI crude rallied 4% but fell almost 7% for the week

- Bullish focus points: 13th straight surprise in US non-farm payrolls, loosening labour market conditions with a decline in March job openings, Fed tweaked forward guidance to signal a pause, first quarter earnings beat metrics well-above one-year averages

- Bearish focus points: Renewed bank stress, Powell said inflation outlook does not warrant interest rate cuts, debt ceiling stalemate, more scrutiny around market breadth

- US money-market funds reach record US$5.3tn on Fed hike (Bloomberg)

STOCKS

- Microsoft working with AMD on expansion into AI processors (Bloomberg)

- Tesla hikes prices of Model S and X in China by roughly $2,750 (CNBC)

- Berkshire Hathaway holds annual shareholders meeting (CNBC)

- Apple sales growth to come from emerging markets (Bloomberg)

EARNINGS

The blended earnings growth rate for Q1 S&P 500 earnings currently sits at -2.2% compared to analyst expectations of -6.7%, according to FactSet.

Apple (+4.7%): Double beat, revenues fell 3% to US$97.3bn, strong iPhone revenue was offset by weaker-than-expected Mac and iPad sales, raised quarterly dividend and authorised an additional US$90bn buyback. Here are some interesting quotes from its conference call:

- Mac and iPad underperformance: "Similar to Mac, iPad revenue performance was impacted by macroeconomic challenges foreign exchange headwinds and a difficult compare with last year.” – CEO Tim Cook

- Emerging markets are booming: "iPhone reached a March quarter revenue record, thanks to very strong performance in emerging markets from South Asia, and India to Latin America, and the Middle East.”

- Subscribers doubled: "Paid subs showed strong growth, we now have more than 975m paid subscriptions across the services on our platform, 150m during the last 12 months and nearly double the number of paid subs, we had only 3 years ago"

- iPhone supply is improving: "We did see the iPhone performance accelerate relative to the December quarter. The production levels for the whole quarter where we wanted them to be so as supply was not an issue during Q2.”

Lyft (-19.3%): Revenue in the first quarter rose 14% to US$875.6 million but losses still sat at US$187.6 million, active riders lighter-than-expected with management saying deterioration in margin was entirely driven by lower revenue per ride, flagged a wider-than-expected loss for the upcoming quarter of US$1.0bn.

BANKING CRISIS

- PacWest, First Horizon and Western Alliance lead renewed slide in US regional lenders (IrishTimes)

- Pressure grows for regulatory intervention as US bank rout deepens (Reuters)

- Fed emergency loans plunge after First Republic seizure (Bloomberg)

- Credit risk gauge highest since March amid string of regional lender failures (Bloomberg)

- Bank buyers expect sweeteners as US government sets new bar (Reuters)

ECONOMY

- US economy set to have added jobs at slowest pace since 2020 (FT)

- US labour market defies rate hikes, posts strong job gains (Reuters)

- China services sector expands for a fourth month, but activity slows (Bloomberg)

- Western companies warn of hit from China's slow recovery (FT)

- Markets bet ECB will pause hikes soon as economy feels rate pinch (Reuters)

-

RBA cuts GDP, inflation forecasts as rate hikes cool activity (Bloomberg)

DEEPER DIVE

Market Mood

Every time the markets pull back on fears (whether that be the Fed, regional banks, earnings etc) it gets a reason to rally again. Apple was a major worry for markets last week but just like most other mega caps, it beat expectations. The market is finding its footing again but at the same time, it feels like we're always one headline away from another selloff. Difficult times indeed.

Sectors to Watch

Most of our US-listed sector ETFs were up 2-3% overnight. Every US sector was green and commodities were generally higher.

Lithium: VanEck Rare Earth/Strategic Metal ETF rallied 3.8% overnight and Chinese lithium prices bounced for the first time since November 2022. There was already a relatively strong response from local names on Friday, with Allkem and Pilbara Minerals up 3.75% and 4.0% respectively.

"Lithium spot prices are bouncing after a 5-month selloff, as sentiment is improving, midstream inventories have fallen and actual supply growth has disappointed so far this year," Morgan Stanley said in a note last Friday.

Gold: The yellow metal continues to struggle to hold above the US$2,035 area. It sold off 1.7% last Friday from US$2,050 to US$2,015. Will we see some weakness follow through for local names? And does this mark a near-term top for gold once again?

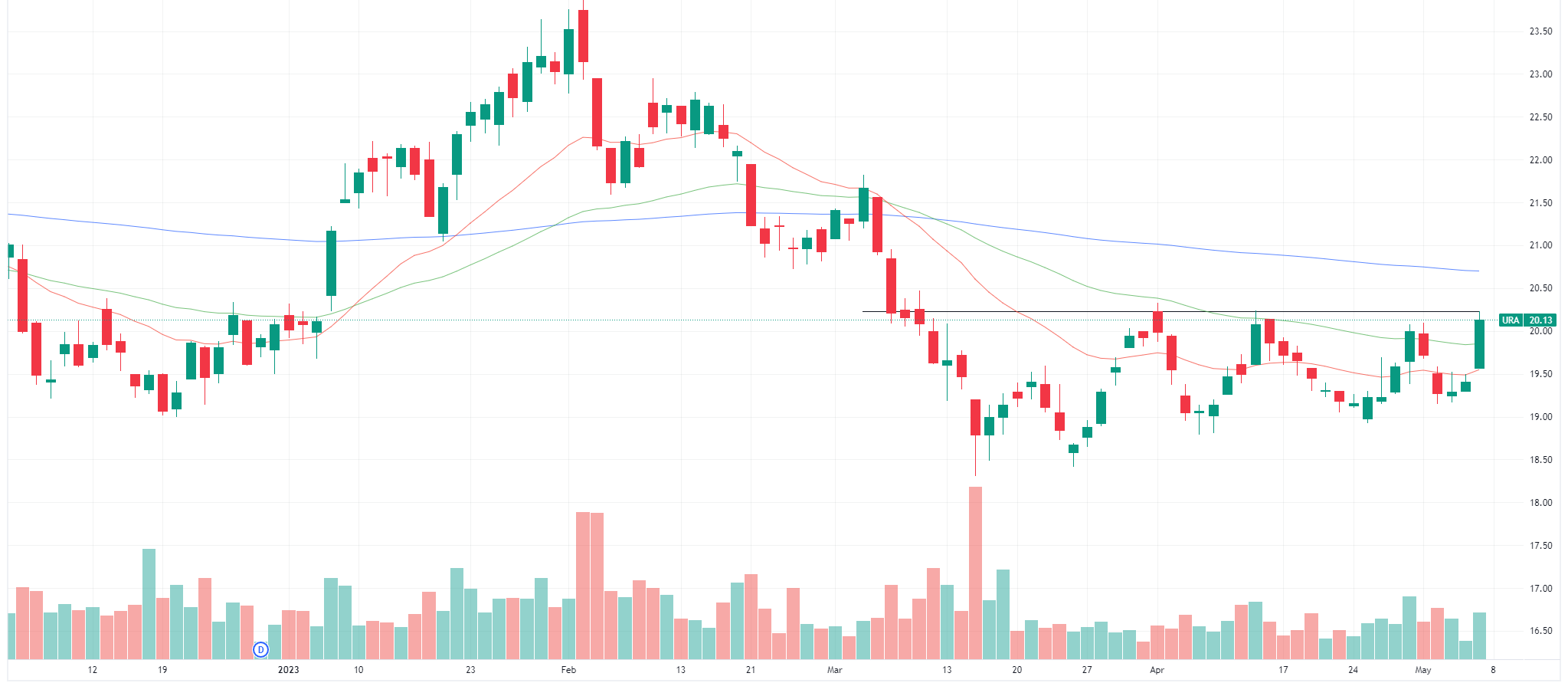

Uranium: Uranium has a bullish backstory and an army of loyal believers. Unfortunately, most uranium names have gone nowhere for more than two years. It's a sector that seems to have a few 'breakthrough' moments, prices rally but then whipsaw back into longstanding trading ranges. The Global X Uranium ETF rallied 3.7% overnight and trying to push this key $20 level.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Naos Ex-50 Opportunities (NAC) – $0.015, Naos Small Cap Opportunities (NSC) – $0.013

- Dividends paid: None

- Listing: None

Economic calendar (AEST):

- 11:30 am: NAB Business Confidence

- 11:30 am: Australia Building Permits

This Morning Wrap was first published for Market Index by Kerry Sun.

1 contributor mentioned