S&P 500 tumbles as the Fed's preferred inflation gauge accelerates, ASX 200 set to fall

ASX 200 futures are trading 51 points lower, down -0.71% as of 8:20 am AEDT.

The US market records its worst weekly performance in two months, core personal consumption expenditure data comes in much hotter-than-expected, the likelihood of Fed rate cuts in the second half disappear, hedge funds are back to shorting risky tech stocks after a January short squeeze, Germany's GDP unexpectedly falls 0.4% in the fourth quarter and some key quotes from Warren Buffett's annual letter to shareholders.

Let's dive in.

S&P 500 SESSION CHART

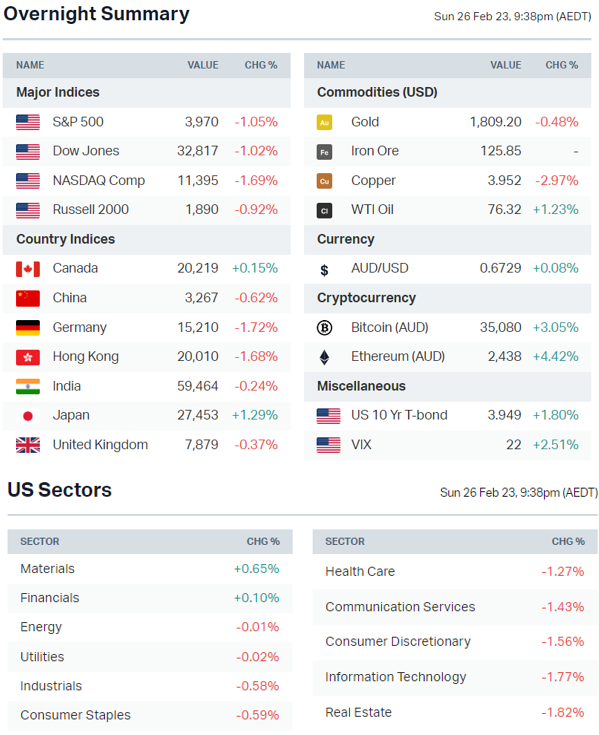

MARKETS

- Major US benchmarks declined but off worst levels after January core personal consumption expenditure data came in much hotter-than-expected

- Peak rate expectations hit ~5.40% and most rate cut expectations have been priced out

- Hedge funds back to shorting risky tech stocks (Bloomberg)

- Global bonds rally quickly reverses, spreads widen (FT)

- Rate repricing leads to highest correlation with growth and value since 2005 (Bloomberg)

- China's upcoming National People's Congress flagged as catalyst for stocks (Bloomberg)

STOCKS

- Berkshire Hathaway hit by US$53.6bn in unrealized losses on investments but Buffet focuses on record US$30.8 in operating earnings (NY Times)

- Amazon expanding ultrafast delivery options (Yahoo)

- Boeing temporarily halts deliveries of 787 Dreamliners (Bloomberg)

- Adobe’s Figma takeover set to be blocked by DoJ antitrust lawsuit (Bloomberg)

EARNINGS

Etsy (-5.7%): Gave back Thursday’s four-quarter earnings gains of 2.6%. The result beat analyst expectations but offered cautious guidance for the first quarter, anticipating sales to be between US$2.95bn to US$3.15bn compared to US$3.25bn in the previous quarter.

Autodesk (-12.9%): Fourth quarter revenue and earnings were ahead of expectations, first quarter guidance and FCF guidance for the full-year was light.

Carvana (-20.5%): Revenue and used car sales volume was weaker than expected, retail units sold fell -15% quarter-on-quarter and -23% year-on-year.

"From a short-term perspective, [2022] was clearly a very difficult year. After 8 consecutive years of annual improvement, it was the first year we stepped back on the key metrics of retail units sold, total GPU, net income margin & Adjusted EBITDA margin.” – CEO Ernest Garcia

ECONOMY

- Fed’s preferred inflation gauge accelerates, adding more pressure to hike (Bloomberg)

- Recession fears return after German economy falls 0.4% in Q4 (FT)

- German consumer sentiment improves for fifth month (Reuters)

- UK consumer confidence hits highest level since April 2022 (FT)

-

Japan core inflation rises further but below expectations for first time in a year (Reuters)

Deeper Dive

Quotes from Warren Buffett's annual letter

A few quotes from the legend's Berkshire Hathaway earnings day:

- Backing buybacks: "When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue."

- Don't rely on expectations: "Beating “expectations” is heralded as a managerial triumph. That activity is disgusting. It requires no talent to manipulate numbers: Only a deep desire to deceive is required."

- Only a few good trades: "Our satisfactory results have been the product of about a dozen truly good decisions – that would be about one every five years ... Over time, it takes just a few winners to work wonders". The rest of his investments were viewed as "so-so" or losers.

- The secret sauce: "In August 1994 ... Berkshire completed its seven-year purchase of the 400 million shares of Coca-Cola we now own ... The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million. Growth occurred every year, just as certain as birthdays."

- Outlook: "... Berkshire will always hold a boatload of cash and U.S. Treasury bills along with a wide array of businesses. We will also avoid behavior that could result in any uncomfortable cash needs at inconvenient times....At Berkshire, there will be no finish line."

Yield gains and stock market pains

Equity markets are on the backfoot again after a euphoric January. Some recent data to support this view include:

- US inflation was 6.4% in January, above expectations of 6.2%

- US core inflation was 5.6% in January, above expectations of 5.5%

- US producer prices up 0.7% month-on-month in January, above the 0.4% expected

- US core PCE was up 0.6% month-on-month in January, above the 0.4% expected

The US 2-year Treasury yield is pretty much back at recent highs while the 10-year yield hit levels not seen since last November. Its worth noting the peak of the 10-year yield last year was when the S&P 500 was trading around 3,600 or a ~10% dip from current levels.

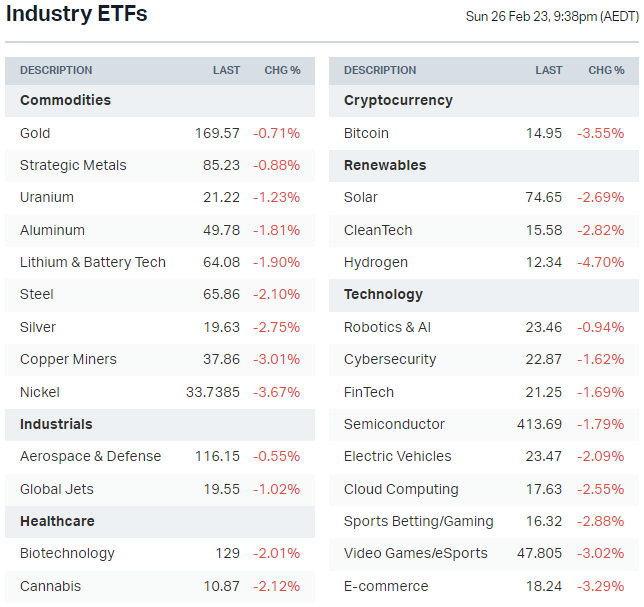

Sectors to watch

There's not a whole lot going on (unless your short). Hotter-than-expected inflation data and surging bond yields continues to weaken the disinflation and soft landing narrative.

The market is going full circle as it tries to price in the new path for yields, inflation and the Fed. Coming off a rather euphoric January, this path has so far been a painful one. The terrifying thing about this repricing and pullback is where exactly does the dust settle? Back to January levels? October lows? Or maybe an outsold bounce is on the horizon?

Most of the sectors on our ETF list fell around 2-3%. Copper (Global X Copper Miners ETF) was holding up relatively well but collapsed -6.3% in the past week. Other growth-y sectors like tech, lithium and uranium have also followed. Difficult times indeed.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Hansen Technologies (HSN) – $0.05, Bapcor (BAP) – $0.105, Aurizon (AZJ) – $0.07, Adacel Technologies (ADA) – $0.015, McGrath (MEA) – $0,01, Beach Energy (BPT) – $0.02, Fortescue Metals (FMG) – $0.75, Steadfast Group (SDF) – $0.06, Santos (STO) – $0.219

- Dividends paid: HomeCo Daily Needs REIT (HDN) – $0.02075

- Listing: None

Economic calendar (AEDT):

- 11:30 am: Australian Company Gross Profits

- 9:00 pm: Eurozone Economic Sentiment