Sector earnings decline reinforces the need for a benchmark unaware approach

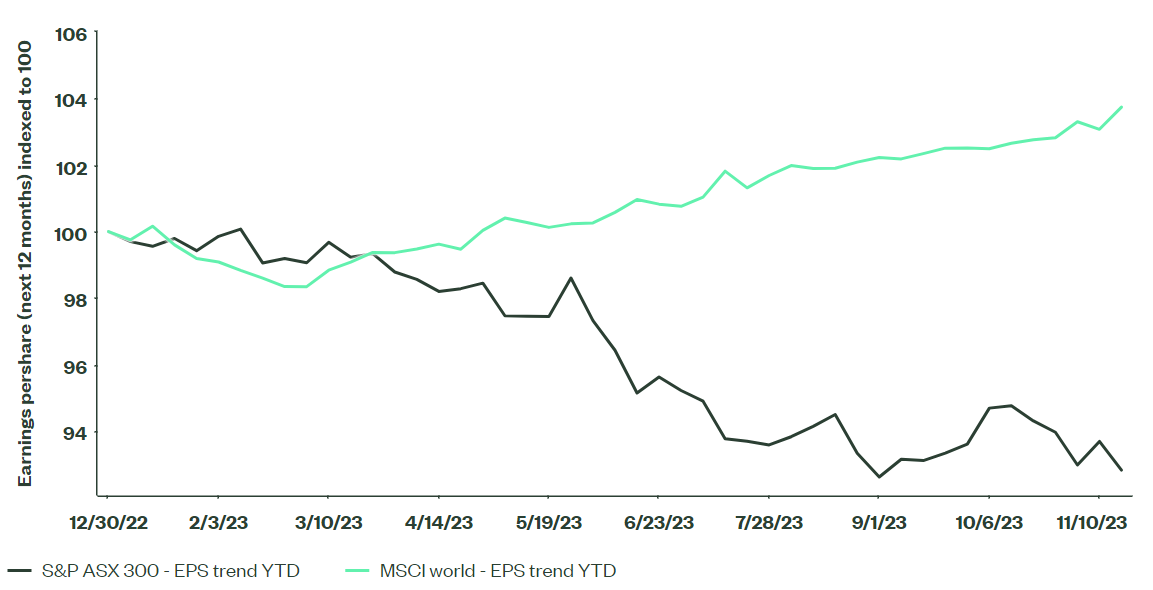

The Australian market has seen earnings downgrades of -7.2% in 2023 heavily influenced by the top 10 index weights. The downgrades in financial and material stocks have had a large impact on the overall Index due to the highly concentrated nature of the benchmark. In contrast the MSCI World Index (MSCI World) has seen small upward revisions of +3.7% in 2023 also driven by the top 10 mega cap names. Much has been written about the concentrated nature of the MSCI World but less has been discussed about the even more concentrated Australian market driving these outcomes.

Figure 1. Earnings Per Share MSCI World & S&P ASX 300

Source: Factset, State Street Global Advisors, analysts estimates’ for earning per share for the next 12 months (NTM) in local currency for both the MSCI World and the S&P ASX 300 Index. Both have been rebased to 100 at 31 Dec 2022. Past performance is not a reliable indicator of future performance. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable. All the index performance results referred to are provided exclusively for comparison purposes only. It should not be assumed that they represent the performance of any particular investment.

“The large weights to Financials and Material companies have contributed to the negative earnings trend in 2023”

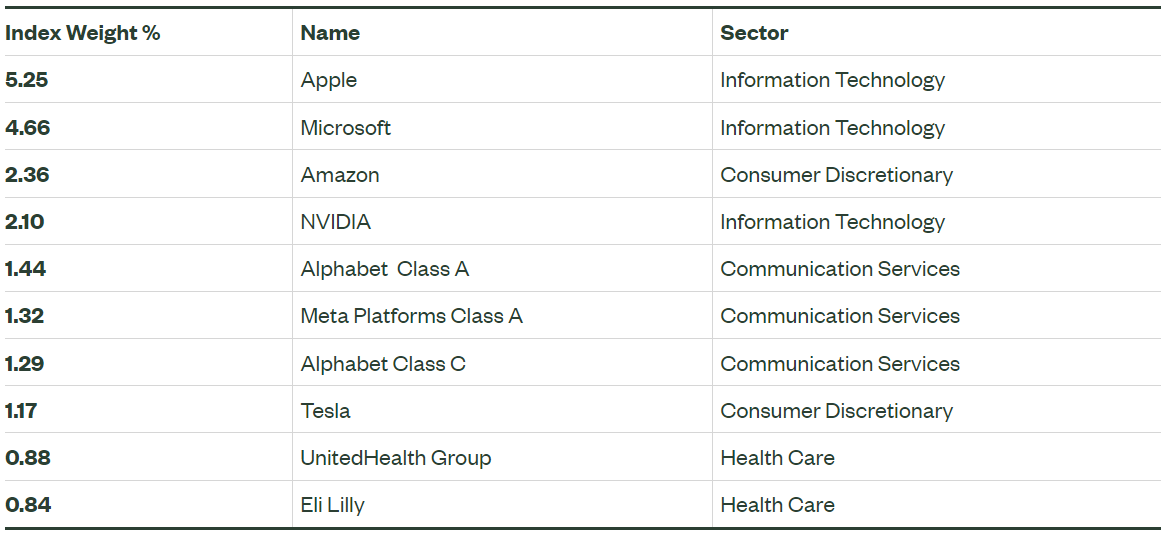

The top 10 names in Australia make up 46% of the S&P ASX 300 Index while the top 10 in the MSCI World only account for 21% of the market1. On this measure the Australian benchmark is more than twice as concentrated than the MSCI World. Moreover, this comes at a time when the MSCI World is more concentrated than it has been for at least the last 3 decades. The extent of the Australian concentration is further exacerbated by the lack of sector diversification across the 10 largest securities. Financials and Materials dominate the top index weights in the S&P ASX 300 Index. Shown in Figure 2, this means that when Financials and Materials are doing well, and the index is well placed, but equally when they face headwinds so too does the broader Index.

Figure 2 below provides a breakdown of the top 10 names for the S&P ASX 300 Index and for the top 10 names for the MSCI World Index.

Figure 2. Market concentration comparison Australian Vs MSCI World Index

Top 10 names for S&P ASX 300 represents 47% of the Index

Source: Factset, S&P ASX 300 Index weights as at 22 Nov 2023.

Top 10 names for MSCI World represents 21% of the Index

Source: Factset, MSCI World Index weights as at 22 Nov 2023.

In contrast, the mega caps in the US have seen significantly positive earnings revision especially in Technology, Communication Services and Consumer Discretionary. The dominance of the mega caps has hidden many of the more negative trends which have been occurring across the rest of the index.

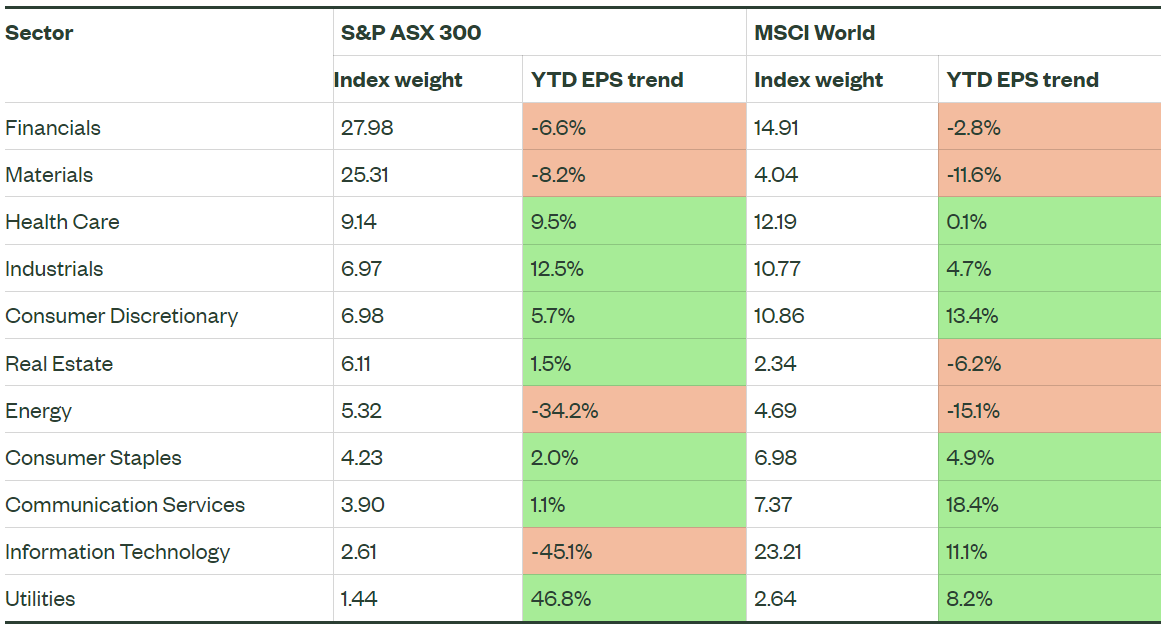

In Figure 3 we compare the trends across sectors for both the MSCI World Index and for the S&P ASX 300 Index. The theme of negative EPS (Earnings Per Share) trends YTD for Financials, Materials and Energy have been consistent in both Australia and in the developed markets. Figure 3 highlights the strong Earnings Per Share (NTM) revisions for the developed markets across Communications, Discretionary and Technology.

Figure 3. Global and Australian Sector Earnings Trends YTD

Source: Factset, State Street Global Advisors, Index weight as at 22-Nov-2023, Year to date % change in analysts’ estimates for earning per share estimates for the next 12 months (NTM) from 31 Dec 2022 to 17 Nov 2023 in local currency for both the MSCI World and the S&P ASX 300 index.

The Bottom Line

Australian equity market has seen a negative earnings trend in 2023. The majority of this negative earnings trend is attributed to the concentrated weight in the domestic Banks and the Materials sector which have seen negative revisions this year. This highlights why a diversified, active and benchmark unaware approach has more relevance in the forward environment in Australia.

In contrast, returns from the MSCI World have benefitted from concentration in the mega cap Technology and Discretionary sectors.

Regardless of your geographic equity preferences, in an environment where the risks are rising it’s important to have a bias to quality and a decent exposure to defensive sectors which demonstrate more resilience in volatile equity markets as we approach 2024.

1 fund mentioned

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.