SPAC Capital Raisings

New investments in the Forager International Shares Fund were made at a rapid rate during the quarter. Two of them were thanks to the huge level of activity in the Special Purpose Acquisition Company (“SPAC”) market. SPACs are publicly-traded vehicles formed to raise capital for the purpose of acquiring a single business down the track. It’s like raising money for an Initial Public Offering (IPO) before you know what the investment will be.

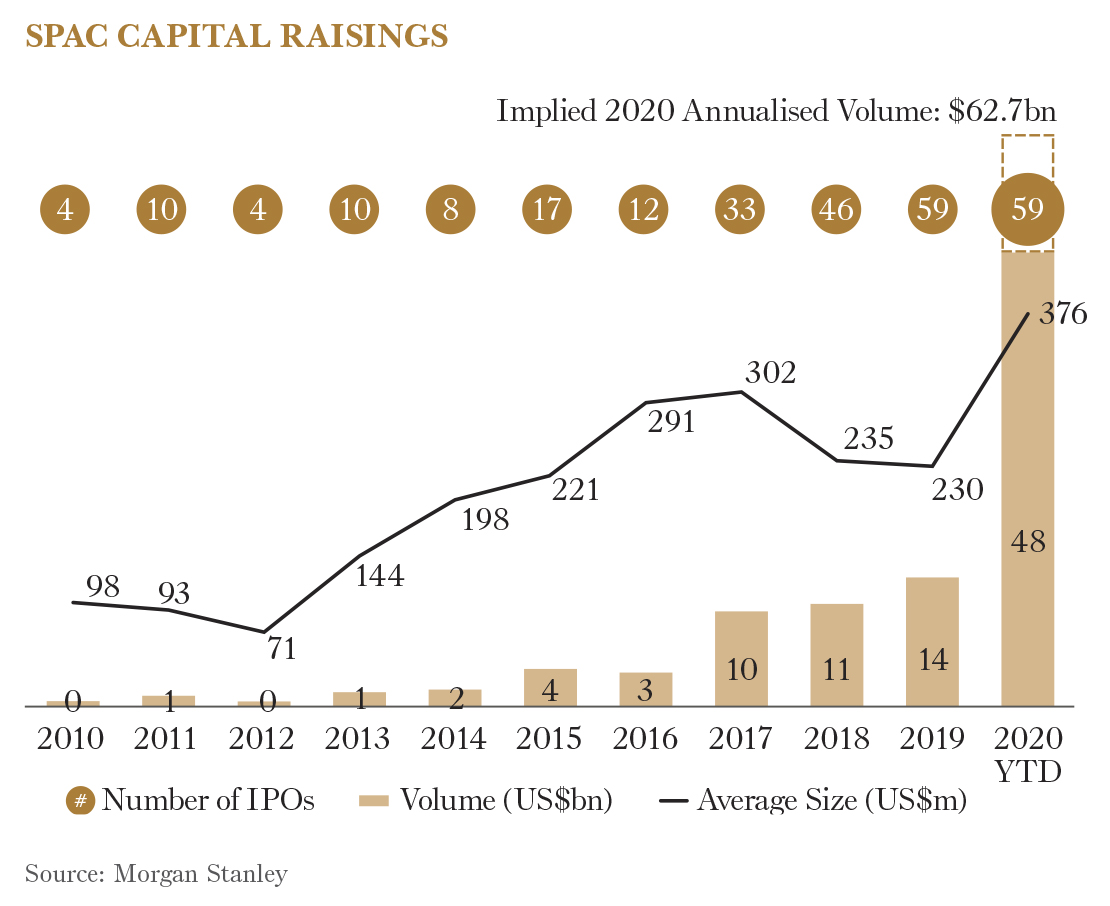

Investors park their capital for up to two years while the managers go looking for targets, in exchange for downside protection (redemption rights) and additional upside (fractional warrants). SPACs have been extremely active this year, with $48bn raised in 2020 to date—more than double last year’s total volume— and there is currently more than $54bn of SPAC cash seeking acquisitions in the market.

There have been a number of highly successful SPAC transitions this year, such as DraftKings (NASDAQ:DKNG) and Virgin Galactic (NYSE:SPCE). Over 40% of IPOs this year have been through this avenue rather than the traditional public offering route. We haven’t any interest in putting in money blind, but Forager has invested in a few of these vehicles after the deal had been done, including Open Lending (NASDAQ:LPRO) and APi Group (NASDAQ:APG).

Navigating through a landscape of companies with limited public market history and only a few years of financials can sometimes be a minefield. It also allows funds such as Forager to get an edge versus the broader market and buy some high quality businesses at very attractive prices before the herd discovers them.

Open Lending owns a technology platform that provides lending enablement and risk analytics solutions to credit unions, regional banks and auto lenders in the United States. Their solutions include loan analytics, risk-based pricing, risk modeling and default insurance to help ensure profitable auto loan portfolios for financial institutions.

The US auto loan market has historically been bifurcated—you are either a prime customer and get very attractive interest rates or you are sub-prime and find yourself paying sky-high rates. There is a whole cohort of “near-prime” customers that have low default risks but are being charged sub-prime rates. It is these potential customers that Open Lending allows loan providers to target.

Open Lending has facilitated more than US$7bn automotive loans and currently serves over 300 automotive lenders. The company generates revenues through program fees that are paid by lenders as well as profit share and claims administration service fees paid by insurance partners. We were drawn to the business due to its high margins, explosive revenue growth (expected to double in 2021) and a potential rebound in auto loan originations post COVID-19.

We expect the accelerated revenue growth to be sustained over the mid-term given a large US$250bn addressable market and secular growth driven by increased auto sales and the expansion of the near-prime customer market. In addition, its proprietary risk-based pricing model, based on more than 15 years of data and a fully integrated, cloud-based platform, provide a moat around the business. More importantly, when we first bought the shares a few days after the SPAC transaction closed at US$15, our entry price implied a price-to-earnings multiple of only 16 times, highly attractive for a business with these kinds of growth prospects.

APi Group is a slightly less exciting business, but its maintenance services in the fire safety, utilities and telecommunications sector provide predictable revenue and profitability, and its capacity to buy and improve smaller companies in the same sectors provides a long runway for growth. In fact, the company has grown revenues at an annual rate in excess of 12% over the past decade. APi also trades at an attractive valuation of just 12 times earnings. We feel this is far too low given the secular growth that it is exposed to.

These opportunities are COVID-related, with the SPACs able to make their acquisitions at attractive prices. The window is closing fast, though, and with so much money sloshing around it is almost certain to end in tears for investors that don’t tread carefully.

Stay up to date with my latest wires

Hit the 'like' button if you enjoyed this wire. 'Follow' my profile to be notified when I publish new wires.

3 topics

.jpg)

.jpg)