The big squeeze: why Australia is facing a persistent housing shortage

The effects of a persistent undersupply of properties is already being felt by renters, who face soaring rental costs.

Regardless of short-term economic movements, Australia has a significant and persistent underlying housing gap. Population growth was averaging around 1.5% annually in the years leading up to COVID-19 and fell significantly as borders closed. However, the rate of overseas migration is recovering, and population growth along with it (now just under 1%, as at March 2022)1.

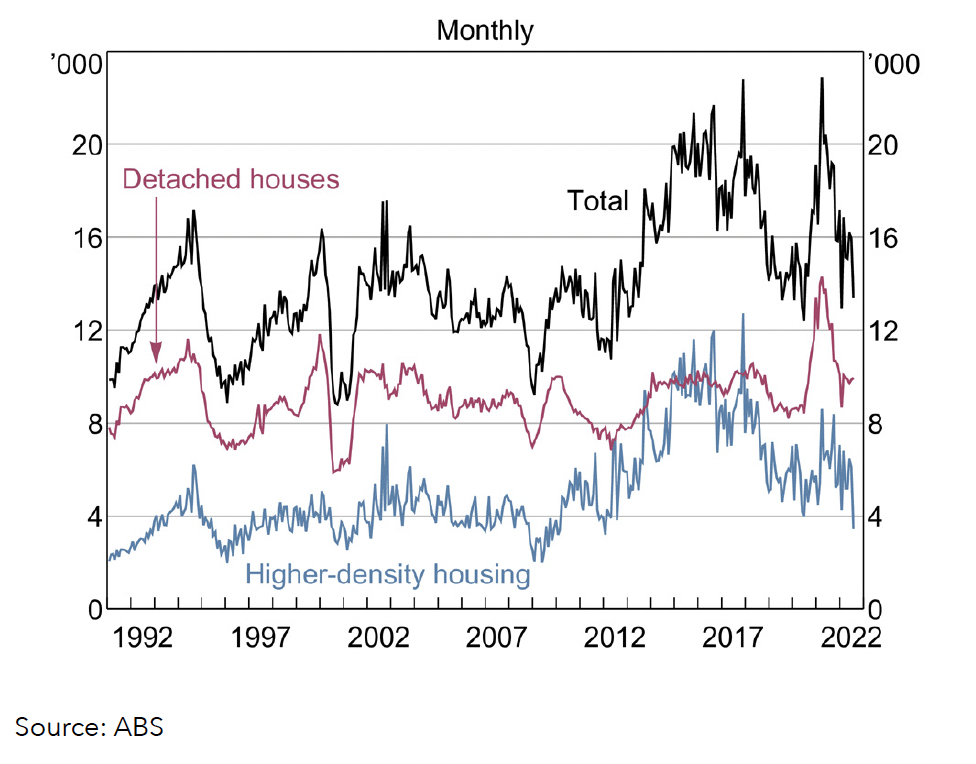

At the same time, dwelling investment, development starts and housing approvals are falling – suggesting a continued shortage in coming years. The chart below illustrates the decrease in the last two years.

And while the pandemic saw a short-term drop in the supply pipeline, its impact is likely to have a long-term effect. Research by Knight Frank showed there were just $4 billion worth of residential site sales in 2020, a 19.6 per cent fall from 2019 and well below the 2014 peak of $11.3 billion2.

The key point to bear in mind here is the length of the development cycle. The period from site purchase to building completion takes several years (especially for higher-density housing), so the impact of this reduced shortage will likely only emerge around 2024 and beyond.

Unfortunately, the effects of housing undersupply are also cumulative. A report into Sydney’s housing undersupply by the Property Council of Australia found that, "Each year that the dwelling targets are not met exacerbates this deficit. Crucially, the current targets do not incorporate the deficit into dwelling demand, meaning that there is an underlying deficit that can persist, even when dwelling targets are achieved3".

The outcome of this persistent shortage of housing and other property assets is that the long-term fundamentals make this sector attractive to investors. Regardless of short-term price movements, the market dynamics are strongly supportive of a robust property investment industry with decades of demand ahead of it.

Zagga’s latest white paper, 'Remarkably Resilient: Australian Real Estate in an Age of Inflation', explains how commercial real estate debt can tap into the current market conditions.

5 topics

.jpeg)

.jpeg)