The ‘bubbliest’ housing market in the world starts to crumble

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - +0.99%

- NASDAQ - +1.36%

- CBOE VIX - 23.11 (-3.22%)

- FTSE 100 - +0.09

- STOXX 50 - +0.31%

- USD INDEX - +0.07%

- US 10YR – 2.882% (-5.07%)

- GOLD - +1.02%

- WTI CRUDE - - 3.30%

The Calendar

The Charts

It seems there isn’t much the Kiwis can’t beat us at these days, from the sporting field to raising rates our mates from across the ditch appear to be a step ahead.

The Kiwis even managed to trump us on crazy gains in the property market! For context, annual price gains in the nation were close to 30% in 2021, leading Bloomberg Economics to last month rank it as the world’s bubbliest real estate market.

However, what goes up must come down and it looks like the RBNZ’s aggressive rate hiking cycle is starting to kick in.

Official interest rates in New Zealand are leading the pack higher with 2.25% percentage points of hikes since October last year. The official rate now sits at 2.5% and there are signs that the property market is rolling over.

The median sale price was down 8.1% in June from the peak in November last year to NZ$850,000, according to the Real Estate Institute of New Zealand. It is a trend that the RBA expects to continue into 2023.

Could this be a sign of things to come for the local housing market?

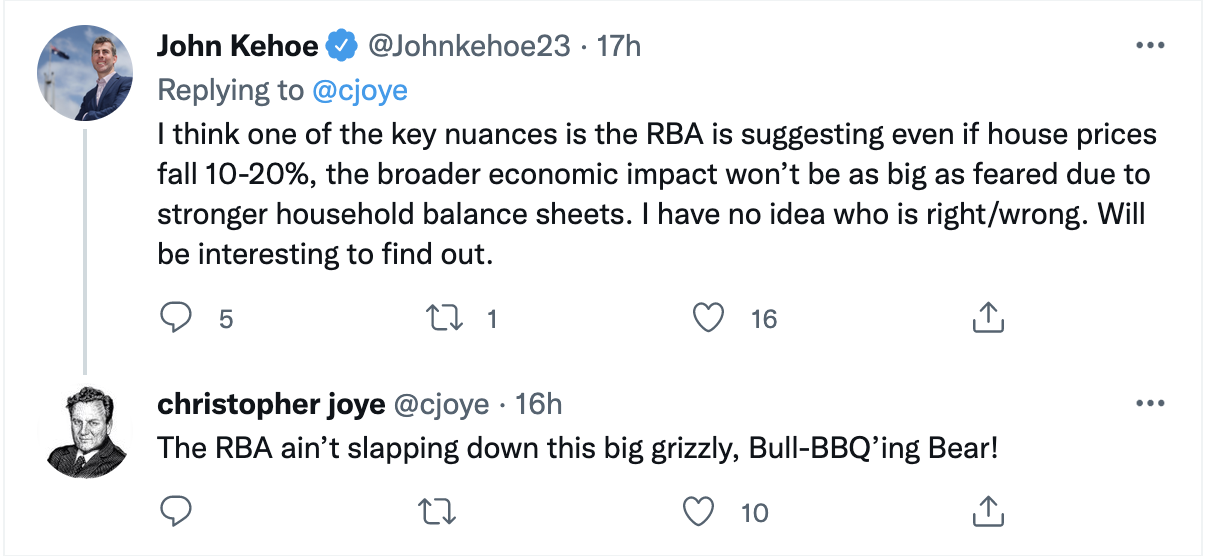

Chris Joye of Coolabah Capital took to twitter yesterday rebutting claims from the RBA that pessimistic forecasts about the Australian housing market were too bearish.

He then thought it was time to fire up the BBQ ...

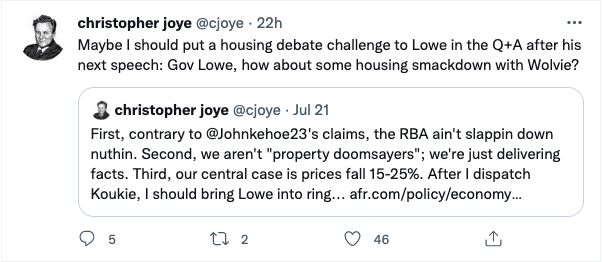

And challenge the RBA Governor to a debate...

Stocks to watch

In our latest episode of Buy Hold Sell, Ally Selby asked our two guests to nominate a stock that has been beaten down and was looking for a rebound. IML’s Hugh Giddy pitched Mirvac Group (ASX:MGR)

Most of the value is in the company's office portfolio. And they are also known for their residential development, but I think that's going to be a little bit trickier, given we have had a bit of a housing boom. It's on a 5% yield. The NTA is going to come down because offices are valued too highly. And as interest rates go up, that NTA will fall. But the share price has already taken that into account. So I think there might be an opportunity for people here.

You can watch the full episode below.

.jpg)

The Tweet

One of the big stories this week has been Elon Musk’s Tesla offloading of a large chunk of its Bitcoin holdings. If you’ve been accumulating Bitcoin in the past few months it turns out there is a pretty decent chance you’ve been buying from Musk.

Today's report was written by James Marlay

GET THE WRAP

We're trying something new around here - a daily market preview with a fun twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

1 stock mentioned