The Federal Reserve will cut rates 4 times before August 2024

- 4 Fed cuts by Aug, with the RBA likely to go in August and November

- Australia will not only avoid recession, it will likely accelerate sequentially through 2024.

- I am forecasting GDP growth of 2.25% (vs consensus @ 1.5%), for bond yields to finish 2024 at 4.0%, and the $A/$US to reach 74c

We think the Fed goes early and goes pretty hard - four (4) rate cuts by August is now our base case. History suggests that once they start, they tend to surprise on the downside and this time around the starting gun will be fired upon the combination of three factors. In this video and the following summary, I also explain how the Fed bringing forward its rate cut profile will affect investment markets and Australia.

Summary

In simple terms, real interest rates will suddenly appear too high for the current economic conditions and we expect rate cuts in March, May, June and August in the US.

Moreover, the Fed will likely declare an end to QT much sooner than most suspect. Somewhere between April and May looks likely to me. It simply makes little sense to be stimulating via cutting interest rates and then undermining its impact by simultaneously continuing down the path of QT.

Look for the Fed discussing the likelihood of a higher terminal size of its balance sheet as the first shot across the bow of an early end to QT over the coming weeks.

What could realistically stay the Fed’s hand? In truth, very little.Wages and core services inflation are the most focussed upon and the two are intrinsically linked. Yet wages have been moderating in trend terms for many months and the same forces that are cooling investment will continue to cool wage growth.

Indeed, measures of slack in the labour market are rising, in particular, the number of people voluntarily leaving existing employment for a new job is declining consistently.

This is indicative that a shift is occurring in the labour market and excess wage gains are increasingly unlikely in 2024. We remain very comfortable with our view that services inflation will ease materially through 2024 and with it will fall the last waves of resistance to rate cuts.

What does all this mean for investment markets?

In our prior two quarterly outlooks, we called for a flat to negative 3Q and a solid bounce in Q4 for equity markets and what a bounce it was. After a -0.8% September quarter, the ASX200 returned 8.4% q/q in the December quarter and a very respectable 12.4% return over 2023.REITs were the star performer of the quarter, rising 14.4%, and if you hedged the Australian Dollar’s 5.9% rise in the quarter international equities returned a very solid 11.4% q/q in the December quarter. Within the commodity space, it was gold that stood out with an 11.6% rise.

Q1 has so far gotten off to a bumpy start, with the ASX200 returning -0.9% MTD (as of 10 January 2024). A strong(ish) payroll print in the US and weak Chinese risk sentiment contributed to the decline thus far, however, we expect that this is merely profit-taking.

Our risk sentiment indicators suggest the period of overly stretched risk sentiment has largely normalised and as the Fed’s tone shifts then so too will risk sentiment. We expect the SPX to rise ~2% in 1Q24 and the ASX200 will mostly go along for the ride.

What about the rest of the world?

It is also important not to lose sight that the rest of the world is staging an ongoing recovery. EM is leading the way, which commenced their recovery in economic activity before mid-2023 and importantly this momentum has continued to build into the concluding months of the calendar year providing a good platform for 2024.Indeed, the recovery has been so impressive, led by India, Vietnam, Mexico and parts of emerging Europe, that the emerging markets have driven a sizeable recovery in global production at a time when the developed markets are acting as a small net drag.

It's also important to remember that the US will not be the only economy easing interest rates in 2024. If the US commences its easing in March, then the Euro Zone and the UK will likely commence an easing cycle in 2H24 and Canada will likely be somewhere in between – easing rates at either of the Bank of Canada (BoC) meetings in April and June.

What are the implications for Australia?

Turning to Australia’s prospects, we continue to suggest that not only will Australia avoid a recession it will likely accelerate sequentially through 2024, with the improving global backdrop acting as a tailwind. Nobody should be disputing that 2023 likely felt like a recession for many Australians.A per capita recession and a negative income shock for those with high debt and young families have cascaded into weak discretionary spending as high interest rates met with surging insurance, utilities, rates, education and food prices. Nevertheless, economic growth was held up by several unusual features in this economic cycle vis-à-vis prior cycles:

- Commodities: Prior commodity price strength continued to underwrite double-digit nominal economic growth and profitability.

- Backlogs: Much has been made of the backlog of work in housing construction that has nullified the typical cyclical shock that is transmitted via the housing construction sector during rate hiking cycles. Approvals and affordability are at very poor levels, yet the level of home building has barely declined at all.

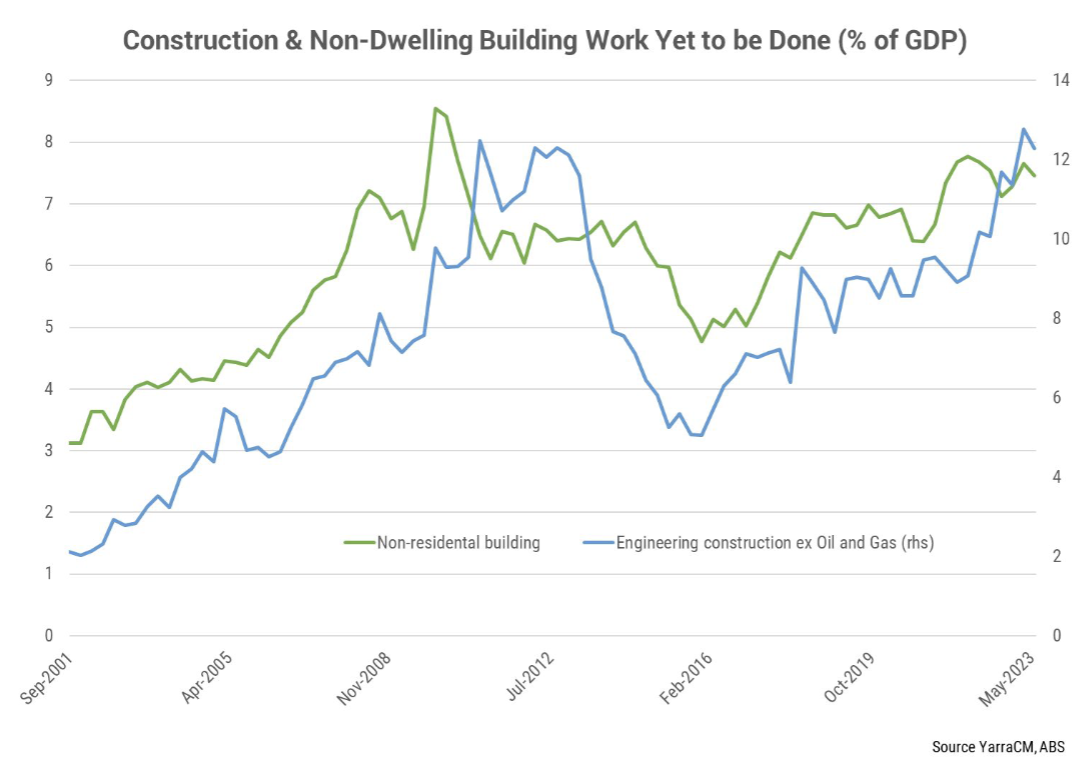

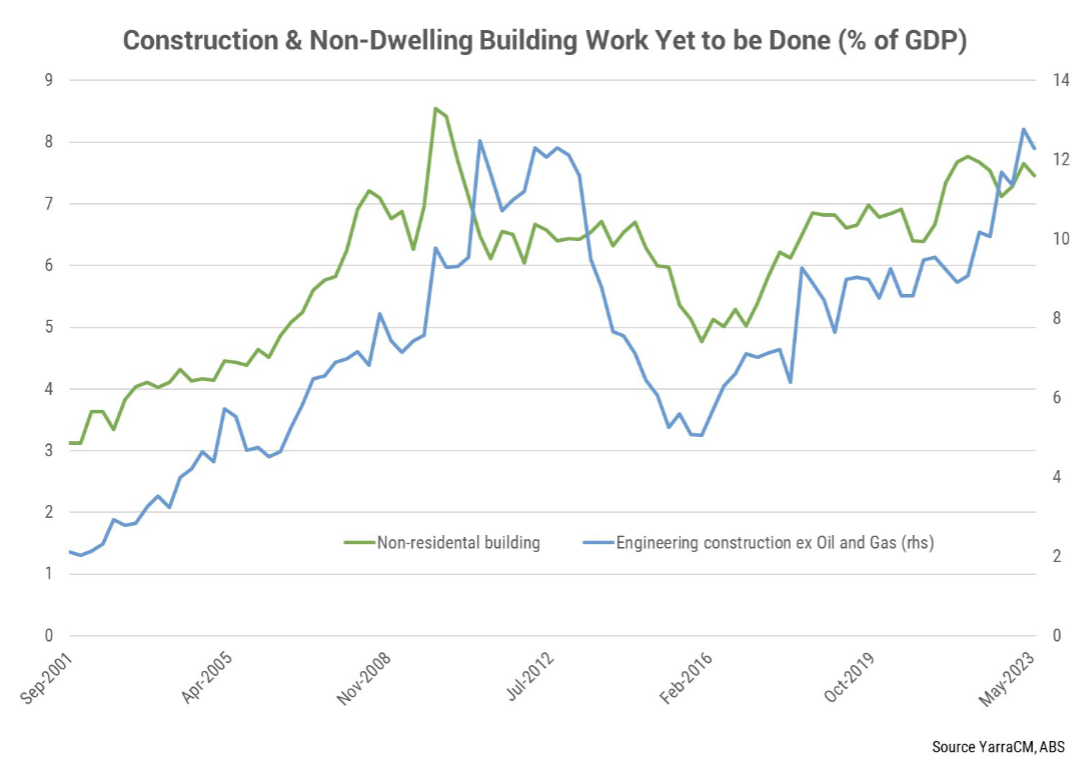

- The backlog in work yet to be done is now peaking at a very high level suggesting we shouldn’t be looking at the housing sector as a source of new economic growth, but equally, we shouldn’t be expecting a precipitous collapse in 2024. That may come in 2025 if interest rates remain at current levels, but that is not our expectation. But less has been made of the backlogs in non-residential buildings (led by offices, warehouses, health and transport) which equates to 7% of GDP and the backlog of engineering construction (led by roads, railways, electricity and mining which equates to 16% of GDP) (refer chart). This enormous backlog of work has kept upward pressure on the labour market and input prices at a time when typically a global slowdown would have seen investment tumble between 10-15%.

- Buffers and Asset Prices: Newly indebted households without other forms of income-producing assets feel the full force of rate hikes. However, the economy-wide impact of interest rates is diluted the more that growth in income-producing assets outstrips the growth in debt. The rising trend in net household assets as a share of income over time means that income from term deposits, financial assets and investment property ownership have all risen over time and all produce an income stream which even after 13 rate hikes this cycle is still more than the rise in interest payments on the outstanding debt.

- This explains the bifurcated nature of spending growth. Older asset-rich households are largely impervious to the rate hikes and as such luxury spending categories remain strong whereas younger indebted households' cash flow has turned negative and spending is being seriously challenged. In aggregate, a rate hike packs less of a punch compared to prior cycles but the young and indebted are taking a disproportionate beating.

- Population pump-priming: Net immigration has surged well through government projections taking population growth close to 2.5% y/y growth in H2 2023. Quite simply, it is very hard to record a recession with that type of population growth at your back. We do expect net migration to slow in 2024 as the government seeks to tighten up some education programs and entitlements, yet the risk remains that the flood of people entering Australia surprises on the upside until a more material rise in the unemployment rate is realised.

Other reasons to be optimistic

- Commodity prices are rising again: A falling USD and stronger global demand have seen commodity prices rising in Q4 which will provide a fillip for profits, tax revenue and nominal economic growth.

- Fiscal support and tax cuts: Despite pressure for change, Stage 3 income tax cuts remain an election commitment of the ALP. The cut is equivalent to 1.1% of disposable income and skews to higher income households which under our analysis suggests over 50% of the tax cuts will be saved. Nevertheless, with the Federal Budget in surplus, the RBA rate cycle likely complete and an election looming in 2025 it is likely that additional fiscal support will be announced in 1H24 to support lower and middle-income households.

- Inflation moderation to drive rate cuts: We expect inflation to move into the top of the RBA target band before the end of 2024, setting up the prospect of the RBA easing in August and again in November 2024. While we are expecting a relatively shallow rate easing cycle in Australia, it will likely come earlier than most expect. Importantly, the RBA has renewed firepower to drive a more powerful economic recovery should inflation surprise on the downside.

- CAPEX intentions have lifted: We were pleasantly surprised to see that the ABS measure of investment intentions rose through H2 2023 and now suggests business investment will rise 10% in 2023-24 – well above the RBA’s 1-2% forecast. Indeed, not only has business investment been robust, but there are signs it is accelerating.

As a consequence, we are relatively optimistic about the outlook for the Australian economy and constructive on the equity market outlook for 2024.

We expect economic growth to average 2.25% vs a consensus forecast of 1.5%, bond yields to finish the year at 4.0%, the AUD/USD to reach 74c, and Australian equities to return 10% in large caps and 15% in small caps.

From a top-down perspective, we believe equity markets have entered the ‘early’ phase of the investment cycle, suggesting that Industrials, Materials, Financials, Tech and REITs will tend to outperform the more defensive sectors.

Q1 will hopefully make the first tentative steps towards these forecasts and now, perhaps more than ever, so much of the forecast is dependent upon the actions of the Fed. Good luck for Q1 and for 2024.