The numbers are in: ETFs outstripped managed funds for the first time in 2023

Those with even a passing interest in retail finance will be aware of the popularity of exchange-traded funds (ETFs). Anecdotally, ETFs have seemed to be more popular than unlisted, open-ended funds for a long while now. This is despite regular predictions of a resurgence of active stock-pickers, including during the COVID crash of 2020. During this period, even the top 20 stocks in the portfolio of lauded equity investor Warren Buffett’s Berkshire Hathaway fell around 35%.

However, the much-anticipated golden period for active funds never emerged. Many fund managers have delivered impressive returns but figures from both the US and Australian markets indicate more investor dollars are flowing into passive funds than active.

For the first time, the total assets under management in passive funds in the US outstripped active funds in 2023 – albeit narrowly. Passively managed funds – including ETFs and index funds – held US$13.29 trillion at the end of 2023, versus US$13.23 trillion held in active funds.

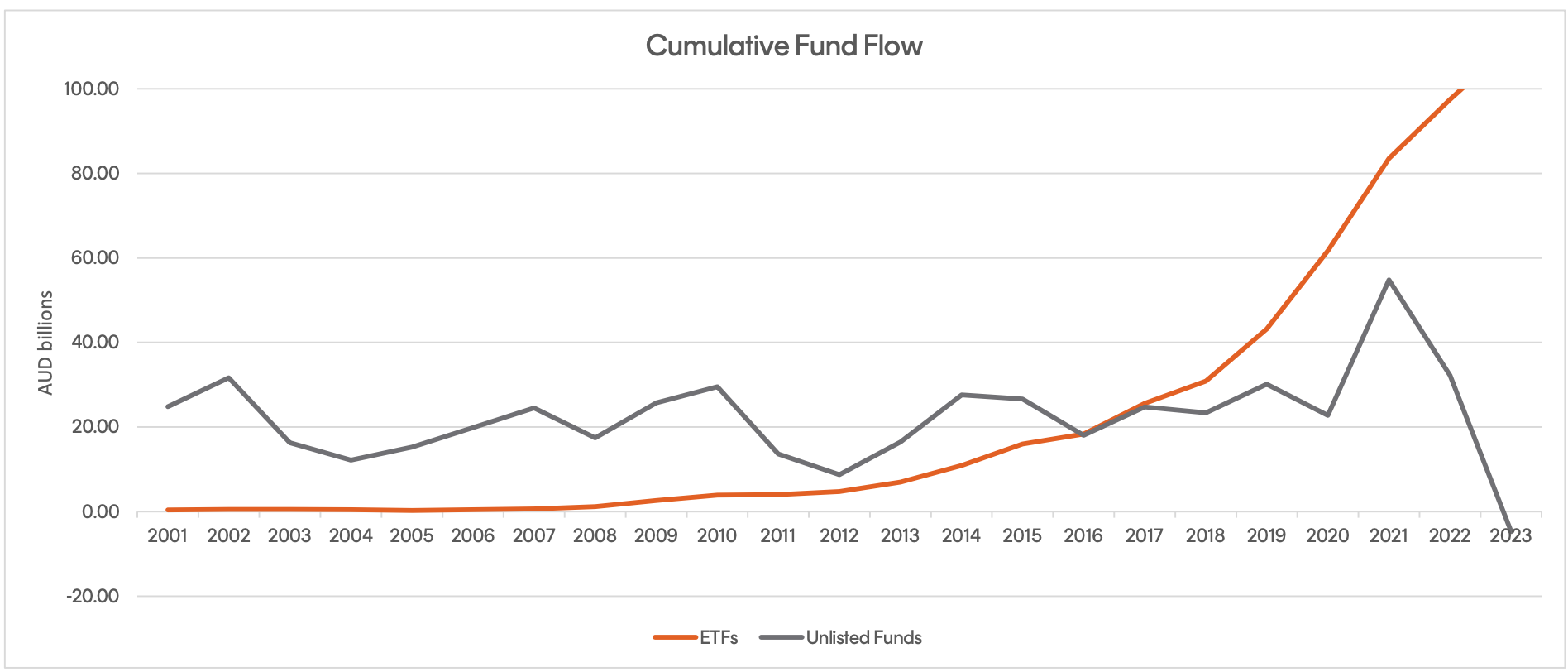

A similar trend occurred in the Australian retail market last year, where $15 billion flowed into ETFs, versus a -$36.9 billion outflow among active funds.

Looking over a longer timeframe, stretching back to 2001 when the first local ETFs became available, the cumulative net flows into Australian unlisted managed funds are now negative – a point emphasised by ETF provider Betashares in its latest 2023 ETF Review.

“This clear investor preference for ETFs, plus the increasing ‘conversion’ activity we’re seeing of unlisted managed funds into Active ETFs, represents a significant ‘changing of the guard’ in the Australian asset management industry,” said Betashares' Ilan Israelstam recently.

The Australian ETF industry ended the year at an all-time high, with a total industry market capitalisation of $177.5 billion as of the end of 2023. The 33% growth, which saw ETFs' fund under management (FUM) grow by $43.7 billion year-on-year, also set a new record.

Last year was the biggest year for new ETF products, with an additional 56 funds listed, up from 52 in 2022. Many of these were active ETFs – exchange-traded managed funds – as the trend for asset managers to launch listed versions of their managed funds continued.

ETFs' grassroots popularity on display

The appeal of ETFs has long been evident among our audience here at Livewire Markets. These investment vehicles are often a big feature of the successful portfolios held by readers we speak to as part of Livewire’s Meet The Investor editorial series.

For example, Stefan built up a portfolio comprised primarily of ETFs, using dollar-cost-averaging to establish his holdings. Some of the ETFs he held at the time of publication were:

- Vanguard Australian Shares Index ETF (ASX: VAS)

- Betashares Nasdaq 100 ETF (ASX: NDQ)

- iShares Core MSCI World Ex Aus ESG Leaders ETF (ASX: IWLD)

- Betashares Global Robotics ad Artificial Intelligence ETF (ASX: RBTZ)

- Spotify Technology (NASDAQ: SPOT)

One of these, the Betashares Nadaq 100 ETF, featured in our recent wrap of top-performing ETFs of 2023.

A similar passive-led strategy is pursued by another Meet The Investor interviewee, Pete, who described his successful approach as “Boring, passive, low-cost, diversified.”

And another, a warehouse worker named Dave, said: “To describe the strategy now: it’s essentially a small group of relatively boring and diversified investments, with a focus mostly on the yearly cash flow it spits out.”

Then there's 25-year-old investor, Jackson, who started dabbling in passive investing while he was still a high school student. His portfolio leans heavily on broad-market index funds.

Alongside a couple of those mentioned by Stefan, his portfolio also included iShares S&P 500 ETF (ASX: IVV)

“For balance, I will note that active management can have benefits for portfolio construction and as a way to act on short-term themes, alongside other rationales,” Jackson said.

“However, over the long term and for the majority of investors in Australia, simply doing the average thing over a long enough timeframe, can have extraordinary benefits.”

Yet another young investor who was featured in Meet The Investor, Stephanie, outlined why thematic ETFs are her preferred investment vehicles.

“As a young investor, I'm working with a relatively small portfolio, which means that brokerage fees can significantly impact my returns. Therefore, actively managing a diversified portfolio of individual stocks would likely be unprofitable,” she said.

Some of Stephanie's biggest investments included:

- Global X Semiconductor ETF (ASX: SEMI)

- Global X Battery Tech & Lithium ETF (ASX: ACDC)

- Vanguard Diversified Growth Index ETF (ASX: VDGR)

- Vanguard Diversified High Growth Index ETF (ASX: VDHG)

Will passive's dream run continue?

We've seen it happen countless times in the investment space – hubris has a habit of catching up with even the most successful fund managers. The seemingly inexorable rise of ETFs among the retail investor audience could come to a halt for any number of reasons: unforeseen performance issues, malpractice, regulatory changes – or even just shifting investor preferences. Only time will tell whether the popularity of ETFs will continue.

Do you invest in ETFs?

Get in touch via the comments below to tell us what you think of exchange-traded funds and any favourites from your own portfolio.

10 stocks mentioned

8 funds mentioned