The structural trends underpinning listed infrastructure in 2024

Last year was an important and interesting year for the Global Listed Infrastructure sector in the context of inflation and rising interest rates.

Inflation was passed through to households and businesses, despite its high levels. In this context regulatory and legal constructs were upheld with minimal government intervention.

In terms of rising interest rates, infrastructure balance sheets were relatively well positioned. Which meant that earnings and earnings growth were more or less at (or even above) historical levels. Additionally, on a valuation perspective, there is evidence that the higher cost of capital is being reflected in a higher level of capital return.

“Pleasingly on both fronts I think infrastructure passed the ‘true to label’ test” said Resolution Capital Global Listed Infrastructure Portfolio Manager Mark Jones.

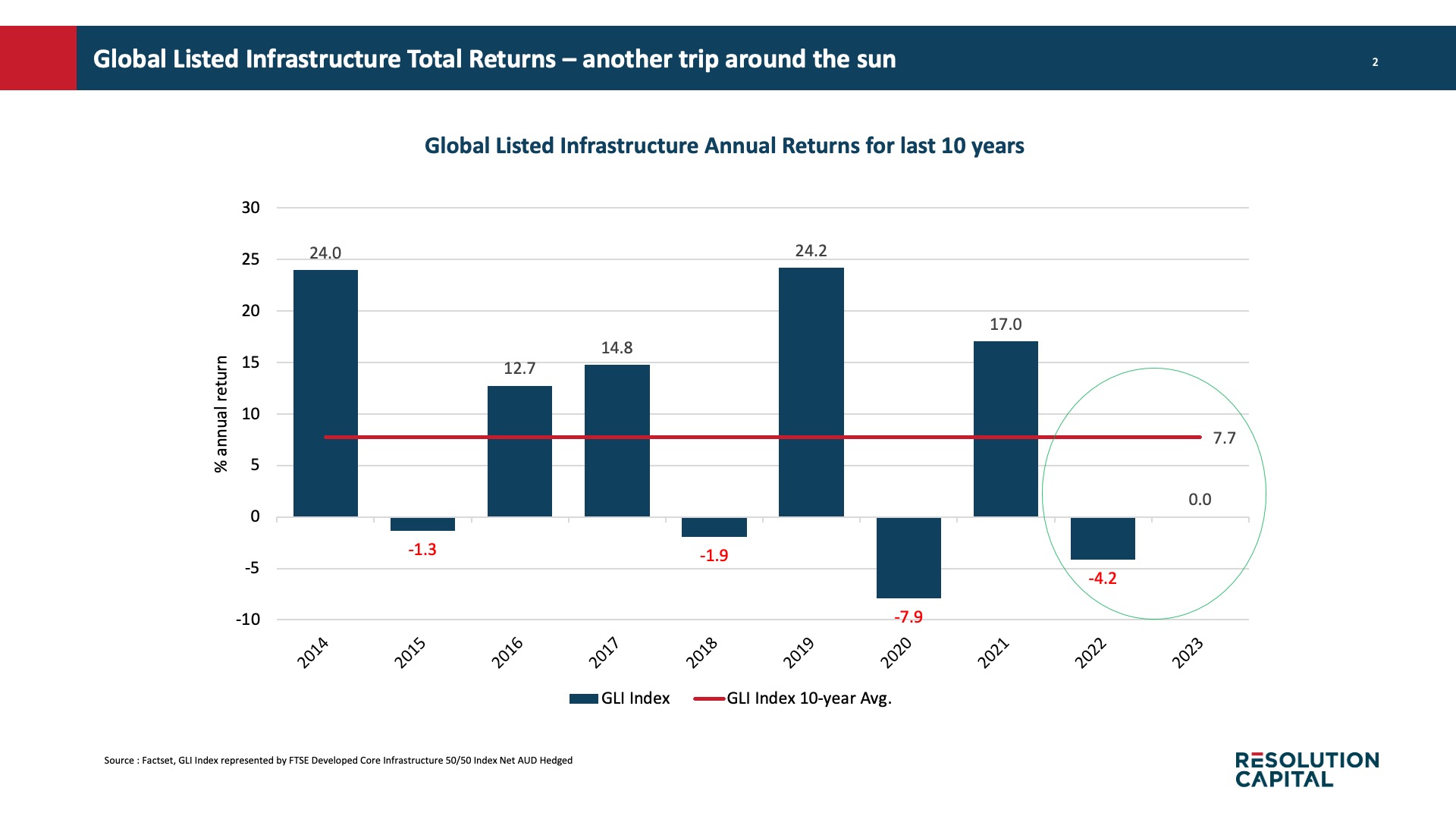

When we look at asset class returns for GLI however, for the second year in a row infrastructure has underperformed relative to the long run average.

“I would qualify this by saying this is a point in time mark-to-market – rather than any underlying impairment to the asset class,” said Jones.

What this says is that Infrastructure is now cheaper than what it was two years previous. And if we look forward to 2024 with potentially a global economy slowing, I think actually infrastructure is very well positioned given that it's exposed more to structural trends rather than cyclical trends.

Structural growth trends driving Resolution Capital’s GLI portfolio

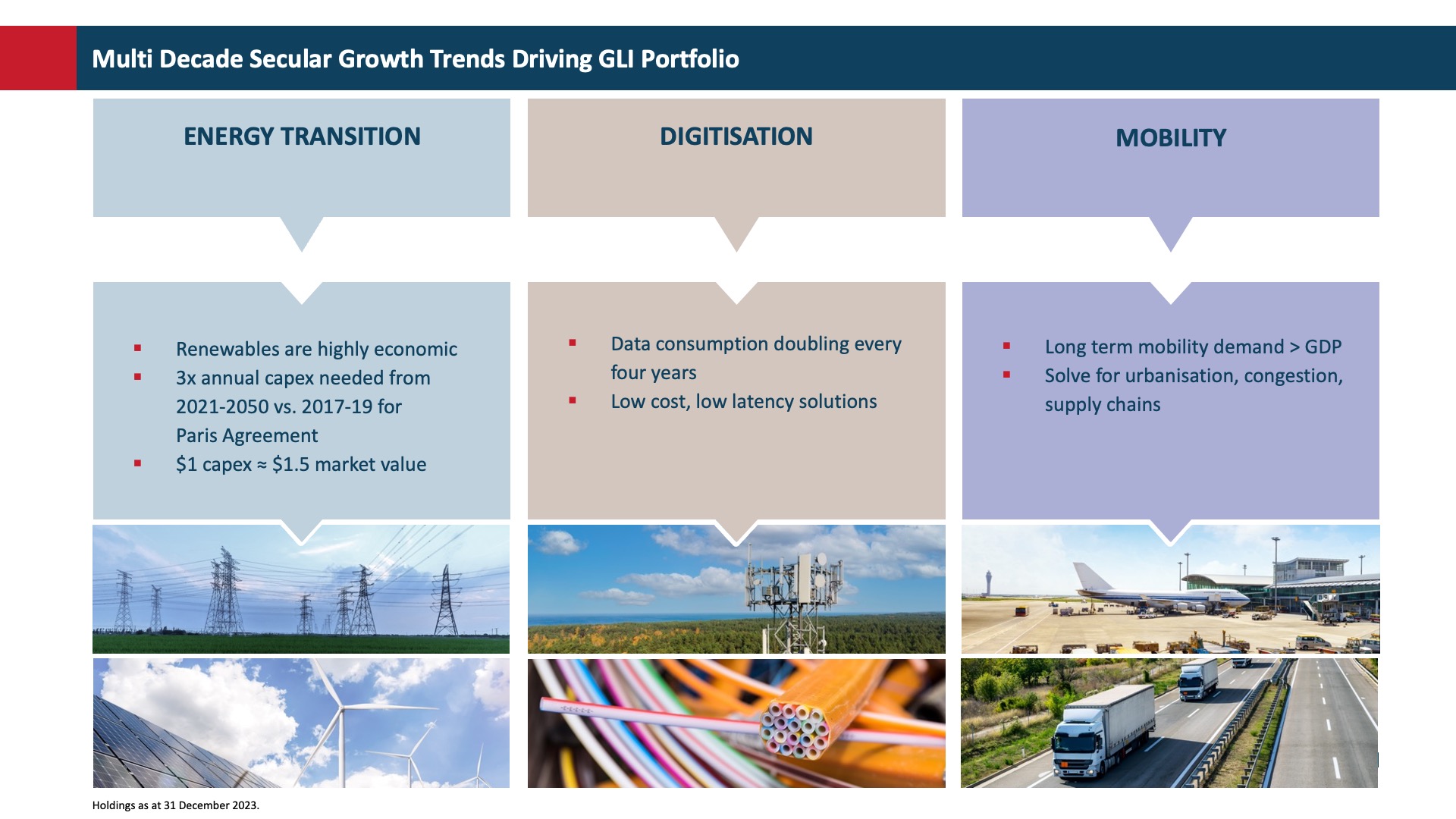

The Resolution Capital Global Listed Infrastructure Fund focuses on companies which own physical assets or concessions which provide essential services. This may include water and electricity utilities, renewables, airports, toll roads, ports, railroads and telecommunications infrastructure. Further the portfolio is unambiguously positioned to three structural trends:

- Decarbonisation – Energy transition

- Digitisation

- Mobility

“Pleasingly across those structural trends within the portfolio, we had outperformance in electric utilities, we had outperformance in mobile towers, which is exposed to digitalisation, and we had outperformance in toll roads,” said Jones.

Keys to the infrastructure sector outlook

Continuing on the theme of threes, there are three key points as we head into another reporting season. The first is that, as previously mentioned, infrastructure is exposed to structural, not cyclical, trends.

“So as the economy slows, we actually feel that infrastructure will be a beneficiary of this.”

Secondly, post-covid government balance sheets are universally even more constrained than what they were before.

“Governments need private entities to invest in infrastructure, to invest in roads and rail and electricity networks, so they will incentivise private players to continue to invest,” said Jones during a recent investor update.

Lastly, we see an ongoing valuation differential between what unlisted pays for infrastructure assets versus the share price implied valuation for infrastructure. So the valuation gap remains.

Watch Resolution Capital's latest GLI investor update

Access a portfolio of critical global infrastructure assets

The Resolution Capital Global Listed Infrastructure Fund is focused on companies which own physical assets or concessions which provide essential services. This may include water and electricity utilities, renewables, airports, toll roads, ports, railroads and telecommunications infrastructure. These assets typically have high barriers to entry, require significant capital investment as well as generate long dated and predictable cashflows.

Learn more about the Fund here.

1 topic

1 fund mentioned

1 contributor mentioned