Thinking about the cycle

With expectations of a global recession caused by unprecedented interest rate increases, sentiment towards listed global real estate has soured. But what if there are other nuances at play, and the market is creating long-term opportunities for savvy investors?

High rates impacting REITs

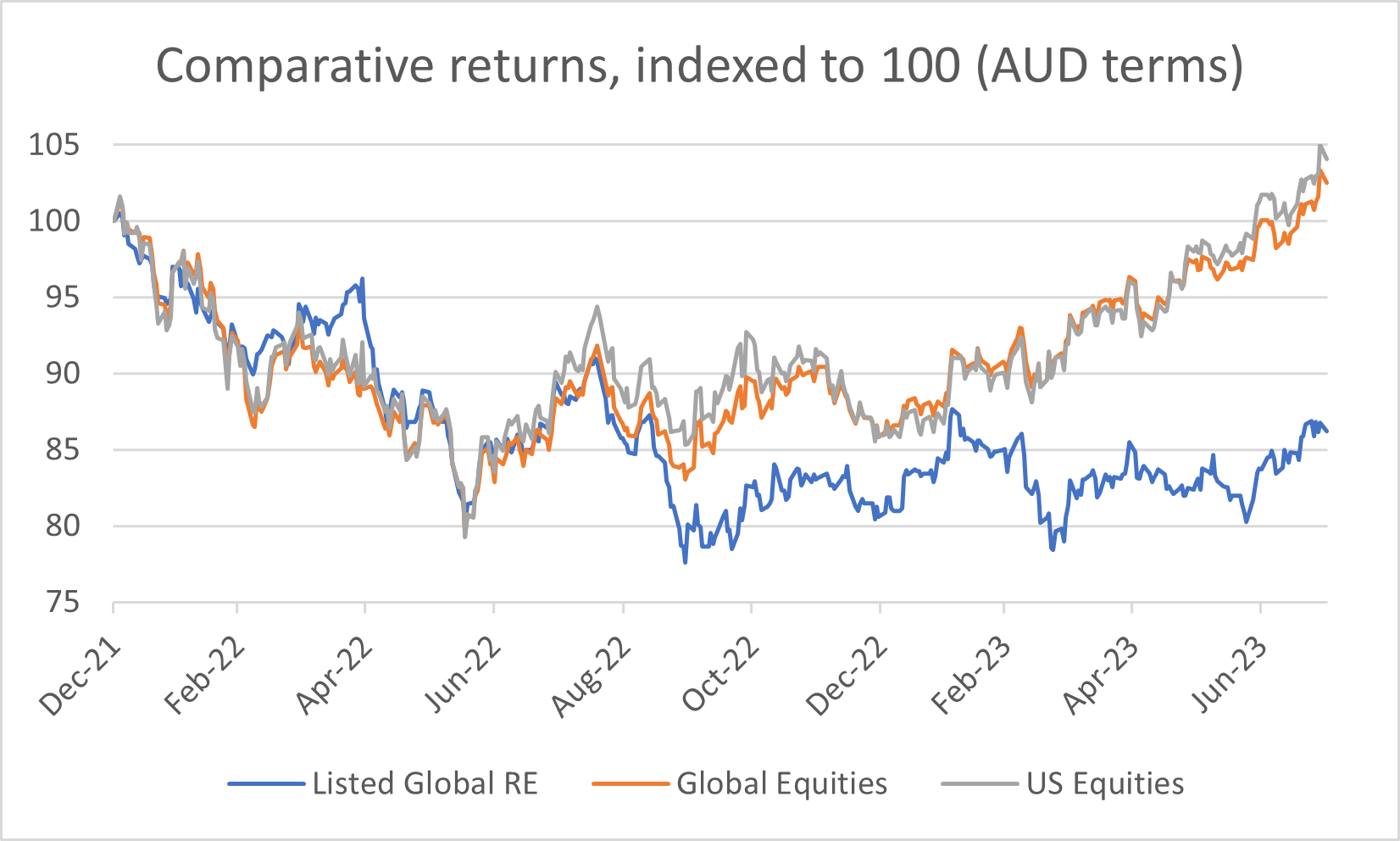

The Listed Global Real Estate Index peaked at the end of 2021. For unhedged Australian investors, it has since declined by approximately 14%, and underperformed global and US equities by 16% and 17% respectively.

These returns have corresponded with an interest rate hiking cycle kicked off by the Bank of England in December 2021, followed by the US Federal Reserve rate in March 2022. Most other central banks in developed markets around the world followed soon after in response to rising inflation.

Over the same period, bonds also started selling off. In the US, the 10-year treasury yield, the benchmark risk-free rate rose from 1.4% to the current rate of 4.0%, peaking as high as 4.3% along the way.

The impact to REITs through a higher discount rate applied to the valuation of the cashflows has been immediate. Adding to the sentiment has been the expected reduction in levered cashflows as higher rates make their way through the P&L. As interest rates are used as a tool to cool the economy, the inference is that tenant demand (and therefore market rent growth) should follow suit, further tempering the expected outlook.

While this rationale is entirely sensible, sometimes the market playbook doesn’t follow suit.

The mismatch between supply and demand

We recently toured North America, the UK and Europe, and met with 50+ listed real estate management teams across many sectors. Given the general share price malaise, and the magnitude and pace of rate hikes, it would not be unreasonable to expect a tempered outlook. However, observations ‘on the ground’ were in stark contrast, and most sectors had a positive outlook. And while focus is often on demand, a reoccurring topic of the discussion was supply – or more specifically, lack thereof.

Supply has been falling across many sectors for similar reasons. There was a general pause during Covid due to supply chain disruptions, labour shortages and general uncertainty. This is impacting deliveries today, while new development, and thereby future supply, is being impacted by construction cost inflation combined with a restrictive financing environment.

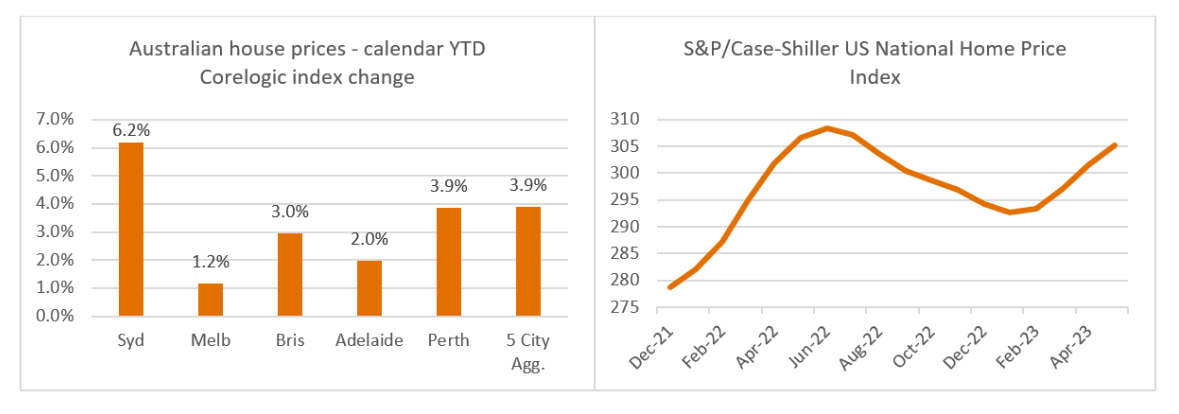

Nowhere is this dynamic more obvious in Australia right now than in the local residential market, which is now steadily rising despite higher interest rates. It’s also the same in the US. This ‘supply shock’ in the face of steady demand, which is playing out in higher residential prices, will also play out across many sectors around the world in higher rents.

If you are an existing landlord with a sensible balance sheet, the future is looking quite rosy.

It’s not just in residential markets where the effects of a mismatch between supply and demand are being felt.

The effects on rents

Senior housing in the US and Canada is an example of how both demand and supply are playing out favorably. Baby Boomers are fast approaching their 80s, which is the average age of residents’ entry into assisted living senior housing.

Demand from this cohort is strong and growing. In addition, rising construction costs, higher financing costs and Covid disruption has meant that there has been a lack of construction over the last three years, with inventory growth now at the lowest level since NIC MAP Vision, a provider of senior housing research, began reporting data in 2006. With a benign supply outlook and growing demand, vacancy rates are declining and rents are growing. We believe the sector is now on the cusp of a multi-year period of outsized rental growth.

The theme of lack of supply is also being felt in the retail sector.

Since the GFC, for a variety of reasons, supply has been on the decline. In fact, it has been well documented that many malls in the US have been shut as vacancy grew in the period post the GFC and prior to Covid. This was due to general weak demand, competition from internet retail, retailer bankruptcies and historic oversupply. However, since the significant stimulus introduced by governments in response to Covid, retail sales have boomed. The outcome has been a reversal in fortunes for retail landlords, with occupancies surging and cashflows returning to growth.

And it’s not just the in the US where lack of supply is helping rents to grow.

In the UK student accommodation sector, The Unite Group recently gave an update stating that they expect rental growth to be around +7% for the upcoming academic year. This compares to a long-term rate of 3-3.5% and a period during Covid when they were shuttered. Driving this uptick is strong demand, surpassing pre-Covid levels, from students and universities seeking accommodation combined with an acute shortage of available beds and supply that cannot keep pace.

A similar scenario is playing out in manufactured housing, single family homes and coastal apartment markets in the US, as well as many other sectors across other geographies. There are, however, exceptions where outsized development margins meant supply wasn’t deterred by higher costs and restrictive financing. Examples include industrial, life science offices and sunbelt apartments, and all were considered beneficiaries of Covid.

Within these markets where supply is constrained, all else being equal, until rents and/or values rise to levels that support new development, supply will continue to remain low. In the meantime, as demand continues to grow, rents will also grow. Depending on the sector and construction lead times, it could take years for supply to respond.

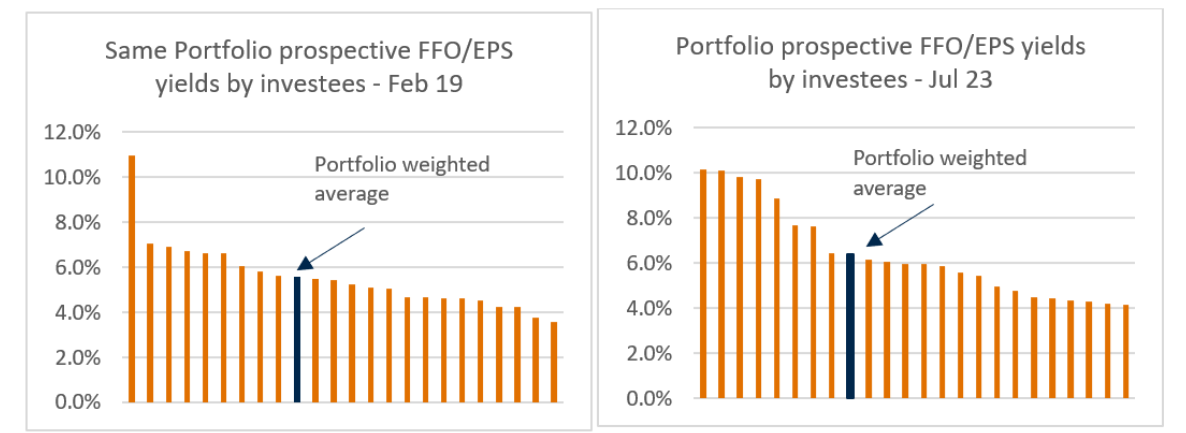

The earnings growth opportunity

For our investees, this is translating into meaningful earnings growth. Since 2019, the average prospective earnings per share growth for the Quay Global Real Estate Fund (Unhedged) on a same stock basis, has increased by +20% (4.5% annualised). This is not a bad outcome considering Covid disruptions and 18 months of unprecedented interest rate rises. What’s more, for the current year, we expect this rate of growth to accelerate to 5.5%.

The negative returns in listed global real estate have been widespread, and we too have been caught up in these losses despite earnings that have been growing. Over the same period, since returns tended negative, the average FFO yield of the portfolio has increased from 5.6% to a current 6.4%, or a 16% derate. Combined with average earnings that are 20% higher, this is a 36% de-rate.

To us, it would seem that recent returns have been driven by nothing more than market sentiment. The fundamentals have been solid.

Concluding thoughts

Economists and commentators have expressed surprise at the resilience and recent strength of residential markets.

In the local market, not only do the dire 30% falls from peak now seem unlikely, but based on current trajectory, new highs in the market could be probable by early 2024. This has been no surprise to us, as we spoke about in our recent Investment Perspectives article, Is the Aussie residential market bottoming? Ultimately, both demand and supply matter.

But the ‘supply shock’ driving residential property prices is also a global phenomenon across many sectors for largely the same reasons. Most new developments simply don’t stack up due to rising construction costs, difficult access to funding and uncertain transaction markets.

As such, so long as tenant demand remains in place, the solid earnings fundamentals across many geographies and sectors we have enjoyed since 2019 are expected to continue, driving earnings growth, valuation and (for the patient) asset price performance. It’s happening in both the local property market and globally.

3 topics

1 fund mentioned