This company is on track to be the newest ASX nickel producer

It’s been a challenging environment for nickel where prices have slid 40% year-to-date to a two-year low, making it a rather difficult trade as investors juggle the near-term volatility against the otherwise upbeat and well-documented long-term outlook.

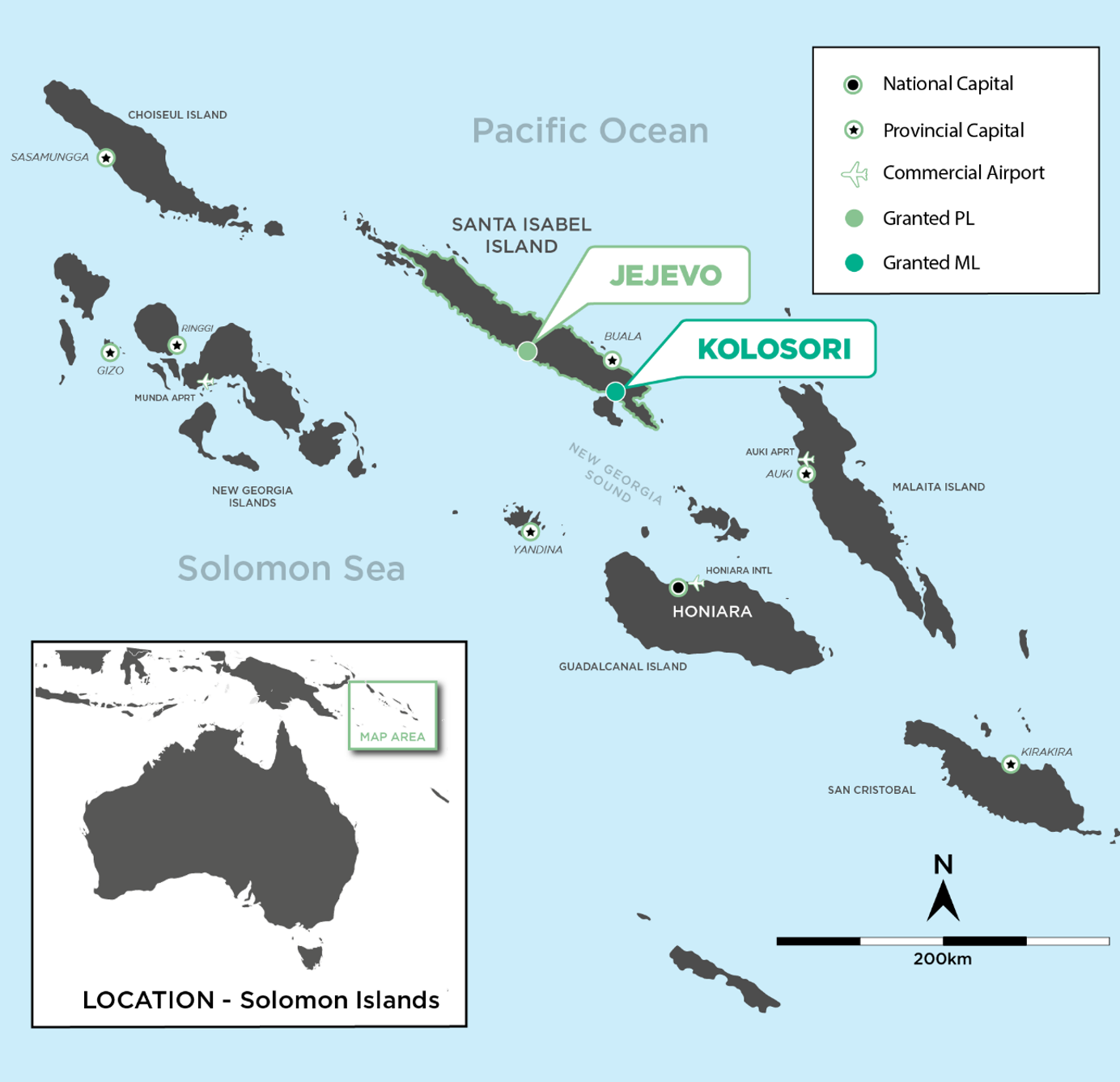

Pacific Nickel (ASX: PNM) has weathered the fundamental backdrop to bring its Kolosori Nickel Project in the Solomon Islands into ore production earlier this month and expects to make a maiden shipment of ore in November 2023.

Kolosori is a Direct Shipping Ore (DSO) operation with a high-grade nickel laterite Mineral Resource Estimate totalling 7.06 million tonnes at 1.57% nickel. Some of the project's key advantages include its proximity to the coast, no processing requirements and low capex.

The market has so-far rewarded the company for its transition from developer to producer, with the stock up around 8% year-to-date – A relative outperformance to peers ranging from the large cap Nickel Industries (-3.2% YTD) to small cap Panoramic Resources (-78% YTD).

As Pacific Nickel is knocking on the doors of its first cash flow, I spoke to CEO Geoff Hiller about the key drivers behind the smooth transition to production, project fundamentals and the Company’s second nickel project – Jejevo – that will follow the same development blueprint as the Kolosori Project.

Source: Pacific Nickel Mines

Bringing the Kolosori Nickel Project into Production

What were the key drivers behind the smooth transition from developer to producer, especially during a time when many projects are facing delays and upward revisions to capex?

The main driver for us was getting the right mining contractor.

Kolosori is a Direct Shipping Ore operation, so your main costs and deliverable is associated with the mining contract. The process is to mine the ore, stockpile, load into barges and then on to a ship. Through that process, the main operating costs are the mining contractor – who look after all the phases.

We engaged HBS PNG, a well-credentialed mining contractor out of Papua New Guinea, who have extensive mining experience from operations in PNG. We brought them on early as part of the Definitive Feasibility Study (DFS). Through that process, we managed to work out what we needed from a mining perspective, what the costs were and more importantly, how we could deliver it in an appropriate time frame.

We had the game plan with the right mining contractor so we weren’t stuck with having long-lead times for mining equipment that had to be sourced from outside the country. We had everything ready to go.

The Kolosori Project is located approximately 1 km from the barge. How much of an impact has this had on factors such as margins and project economics?

It’s certainly improved our economics and given us the flexibility to have smaller and locally sourced barges.

It’s cheaper to find a local contractor who can provide the barges for 3,000 to 4,000 tonnes as opposed to hiring more expensive barges from outside of the country that cater for 8,000 tonnes to do the same thing. The shorter haul means it's quicker with less costs.

Source: Pacific Nickel Mines

Glencore Backing and Nickel Pricing

Glencore has provided Pacific Nickel with both financing (US$22m loan facility) and offtake (100% of Kolosori’s production over six years). What has their backing meant for the company?

We received interest from a number of global trading groups but Glencore happened to be the best from our perspective. They offered to buy the product FOB (free on board) and fully debt fund the project.

Once we got them on board, they went through a proper due diligence process through the whole project, including the political side of things. It was a major tick of approval for both our contractors, shareholders and stakeholders, which are the traditional landowners and the Solomon Islands government.

The offtake is priced at 1.5% DSO nickel benchmarks. Does this have any advantages over the widely observed futures price?

You’ve got a little bit of a disconnect between the price from the LME (London Metals Exchange) versus the ore side of things. From our side of things, it’s more stable and hasn’t gone up or down as much.

We’re mining a product called nickel saprolite and at the moment, it’s mainly going towards the stainless steel side of the market. When the nickel price strengthens there is that optionality for the buyer of the nickel ore to convert into a battery grade material.

Cash Flows and Next Steps

Pacific Nickel is set for its maiden shipment of ore in November 2023. What kind of cash flows can investors expect?

The Definitive Feasibility Study shows the operating margins we can expect and that is what we will be focusing on.

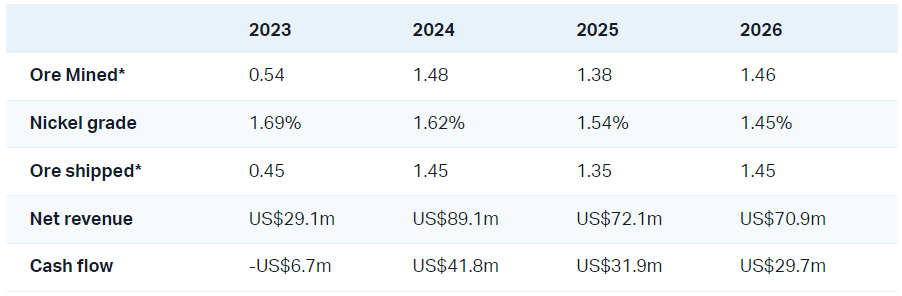

The below table refers to the expanded cash flow case for the Kolosori Project. For context, PNM has a market cap of $38 million.

Source: Pacific Nickel Mines Kolosori DFS. Ore Mined references million wet metric tonnes (Mwmt)

From our perspective, we’re looking for a value uplift when we begin shipments and demonstrating the cash flows that are in our DFS.

Drilling is currently underway to enhance Kolosori’s economics. How are exploration efforts going and what can investors expect under an expanded case?

The recent drilling is more around grade control as opposed to increasing the resource. In the exploration drilling that we have done, we had a fairly high success rate in converting inferred resources into measured and indicated resources.

On the basis of that, we’ve identified some more inferred resources that we’d like to convert into that higher category. Once the project ramps up, we will certainly change our focus into exploration to increase mine life and increase the category of those resources.

This will most likely happen next year. We have three or four good years of knowing what we’ve got ahead of us. After that, we’ll target some more inferred resources and exploration targets. We’re confident in proving up additional resources with further exploration.

Not far from Kolosori is the Jejevo Nickel Project. What does the next couple of months look like for this up-and-coming project?

For context, the Jejevo Project is located approximately 70 km to the north west of Kolosori. The project is expected to follow the same blueprint as Kolosori and possess a similar Mineral Resource Estimate of 7.8 million tonnes at 1.46% nickel (Kolosori has 7.08 million tonnes at 1.57% nickel).

We’ve always said let’s get one project going and then focus on the second. We’re in a country where you’ve got to demonstrate that you can get one done to move through to the second.

We’re looking to get a mining lease as soon as we can and then develop the project next year similar to what we’ve done with Kolosori. We haven’t delivered a feasibility study on Jejevo yet so I won’t go into much, other than it looks similar in size and scale.

What would be the one major lesson from Kolosori’s development that you’d apply to Jejevo?

The big lesson we learned was the amount of ground we needed to stockpile the ore. Flat space was a bit of a premium around Kolosori and we started with one place and then had to find additional areas.

Going into Jejevo, we will certainly look at where we’re setting up our project site, knowing we need a fair bit of flat ground around us. We should also be a lot quicker in terms of financing the project development for Jejevo.

This article was first published for Market Index on Friday, 13 October 2023.

1 topic

1 stock mentioned