Three key LIC take-outs from 2017

The Listed Investment Company (LIC) sector has been one of the great success stories in recent years, growing at 15% last year to 105 LIC now listed on the Australian Securities Exchange (ASX), accounting for $37.1 billion dollars in market capitalisation. Bell Potter Listed Investment Company specialist Nathan Umapathy shares his three key learnings from the year.

1) Bonus options are over

A bonus option issued at IPO has generally been offered to investors to compensate for the issue cost reflected in the Net Tangible Asset (NTA). The option holder thereafter receives a right - but not an obligation - to purchase additional shares of the LIC at a fixed price (strike price) until a specified date (expiry date).

Investors that seek to purchase these securities in the secondary market, need to be cautious of the potential dilutionary impact on the NTA of in-the-money options, as option expiry nears. What is perhaps less understood is that the person who exercise these options, is not diluted as they have received the benefit of the lower exercise price. As a result, bonus options can be at times view negatively amongst shareholders.

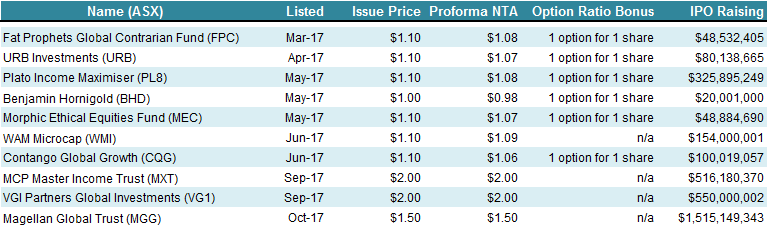

This year, an increasing number of LICs came to market without an option attached, removing the overhang that is cast around a LIC close to option expiry. We anticipate this trend will continue in 2018.

Table 1: LIC IPO’s - 2017

2) Trading at Net Tangible Asset (NTA) from day one is important

Historically, the cost of a LIC IPO – generally a fee of 2-3% - was transferred to the shareholder at listing. As a result, for a $1.10 IPO, this will see an opening NTA of $1.06-$1.09. In late 2017, we saw a shift where LICs came to market with a proforma NTA in line with its issue price. Managers of MGG and VG1 absorbed the issue cost associated with its IPO, while MXT had its issue cost paid via a loan, which will be amortised by shareholders over the next 10 years.

This enabled shareholders of MGG, MXT and VG1 to access these LICs at NTA on day one. We believe this is great practice for the sector and has set a precedent for future LICs.

3) The LIC structure is superior

LIC are close-ended funds with a fixed number of shares on issues, which means they are not directly exposed to capital inflows (new capital) and outflows (redemption). In contrast, Managed Funds, Exchange Traded Managed Funds (ETMF) and mFunds are structured as open-ended funds. This means these vehicles will be exposes to capital inflows and outflows.

The closed-ended structure of a LIC allows the investor to buy and sell the LIC on the ASX without affecting the LIC’s underlying portfolio. We view the closed-ended nature of LIC favourable product amongst financial establishments as the portfolio manager of a LIC can purely focus on long term investment performance without the fear of redemptions.

Finally, with $3.5 billion dollars raised from LIC IPO this year, we still anticipate strong investor demand for high calibre managers with solid investment performance coupled by effective communication skill. We expect more LICs to come to market in 2018 providing sophisticated investment solutions to investors as the sector continues to mature in comparison to the unit trust industry.

5 stocks mentioned