Three sectors, four stocks and one ETF to play a slowing economy in 2024

As always at MPC Markets, we start at the top with the macro environment. The countless indicators predicting a recession – or at minimum, a slowdown – has motivated us to look at defensive and non-cyclical stocks for 2024

Higher rates and a high chance of a recession this year are pushing us towards companies that produce “needs” rather than “wants”. That’s because, when companies and consumers make cuts, prioritising needs ahead of luxuries is the instinctive choice.

The 2024 economic outlook

As we advance into 2024, the economic narrative at MPC Markets is shaped by an anticipated slowdown beginning in Q2. This slowdown is expected due to the lagging effects of monetary policy tightening and its broader impact on demand. The Australian economy, in particular, is poised for subdued growth as rising interest rates and ongoing cost-of-living pressures continue to influence domestic demand.

Global growth, too, is forecast to remain below historical averages, with adjustments in major economies echoing across international markets.

Inflation, while showing signs of easing, is likely to stay above optimal levels throughout the year, contributing to this decelerating trend. In response to these economic conditions, we anticipate the potential for rate cuts by central banks, possibly in Q4 2024 or Q1 2025, to revive economic momentum and counteract the slowdown.

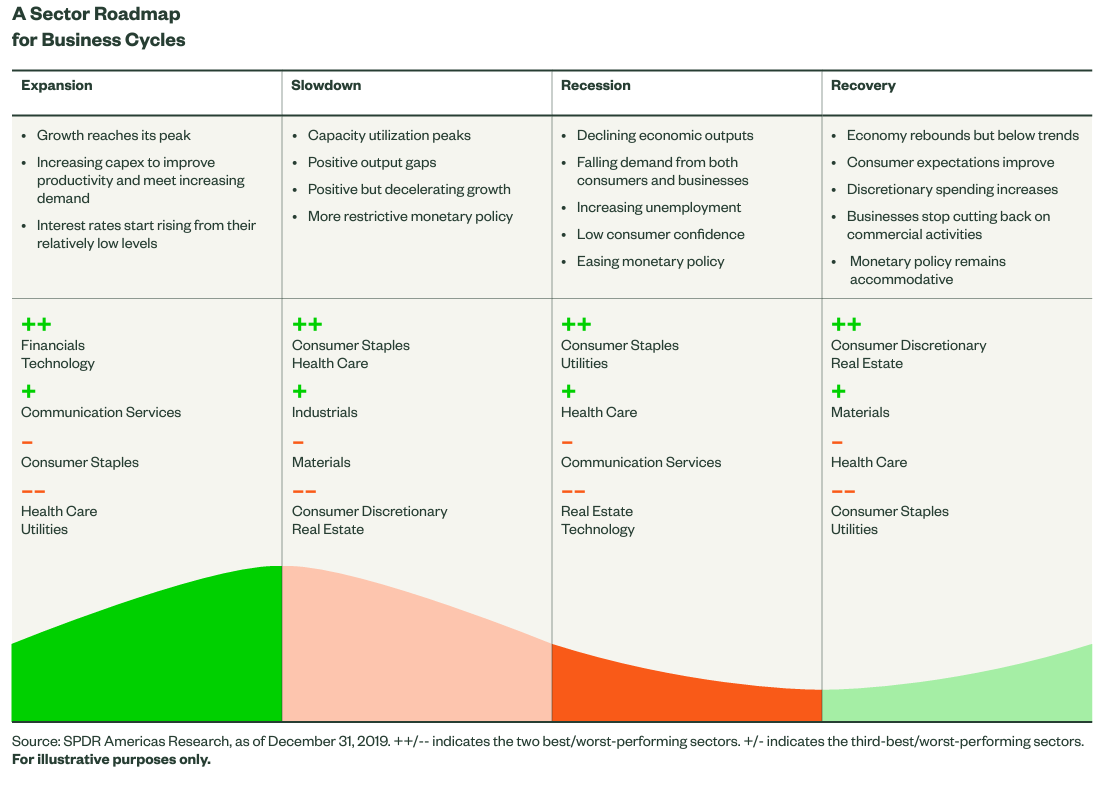

Within this economic framework, certain sectors are expected to navigate the slowdown more effectively. Essential services, healthcare, and consumer staples typically demonstrate resilience in slower economic times, as demand for these necessities remains steady. Conversely, sectors heavily reliant on discretionary spending, such as luxury goods and non-essential retail, or companies with high PE’s like in Tech, may face more significant headwinds.

With this in mind, we are looking at being overweight the Healthcare and Consumer Staples sectors and reducing our exposure to consumer discretionary and Real estate, with a view to revisiting those sectors later in 2024.

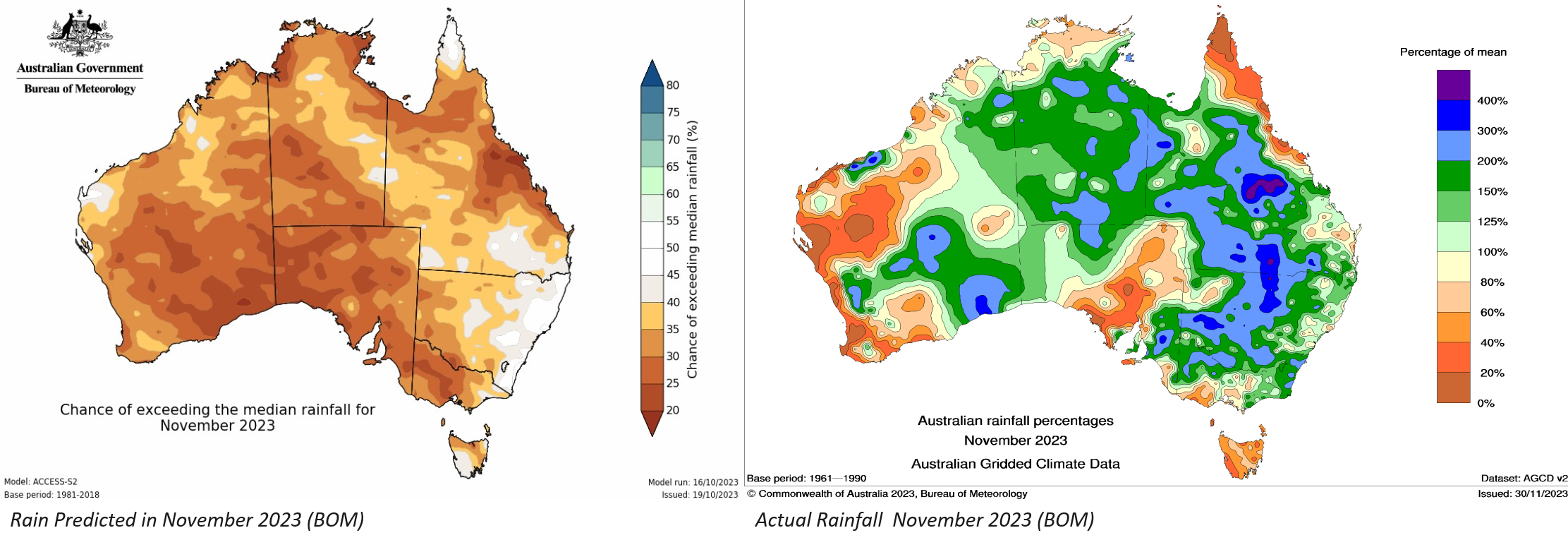

Thankfully, the market is presenting great opportunities in these sectors, with the GLP-1 frenzy dragging down some of the best quality healthcare names. There’s also the false start from the Bureau of Meteorology (and investors), who predicted a lengthy drought due to El Nino, with extensive November rainfall in cropping regions securing summer crops.

Stock Pick #1 – ResMed (ASX: RMD)

Our first stock pick of 2024 is ResMed is a notable player in the healthcare sector, particularly in the manufacturing of sleep apnoea devices. With recent developments in weight-loss solutions such as Ozempic and Wegovy drawing significant attention, we believe the market reaction is very overhyped.

ResMed has been a solid performer for many years, and its position in the market is expected to remain strong, despite recent fluctuations in share price. Notably, only a fraction of sleep apnoea sufferers (18.5%) may benefit from the GLP-1 RA weight-loss drugs. With a significant portion of the market still untapped, ResMed is well-positioned to gain market share. Furthermore, the availability of GLP-1 drugs is limited, and their high cost compared to ResMed's treatments – which are about a tenth of the cost – makes ResMed's offerings more accessible and appealing.

Stock Pick #2 – GrainCorp (ASX: GNC)

To see the real value of ASX agricultural companies, you must start by Ignoring the lazy investor analysis. Companies such as GrainCorp and Elders have transformed themselves in the last decade and are far less cyclical and weather-dependent.

Despite the worst drought in history for the Murray Darling basin[1] between 2017-2019 and then COVID in 2020, GrainCorp managed to maintain an 8% ROE over the last seven years. During this period, it has developed business lines outside of grain. GrainCorp now has six growth areas spanning:

- biofuels/Agri-energy,

- animal nutrition,

- grower services,

- digital and Ag Tech, and

- alternative proteins.

Personally, I speak to around a half dozen farmers with cropping and grazing businesses, I don’t bother with analysts' calls from offices in the “big smoke“ whose simplistic view of agricultural businesses led to a sharp sell-off when El Nino was declared.

Unfortunately for those who sold, good results came from ELD, NUF and GNC in November, coupled with solid rainfall that has occurred Australia-wide, making for good conditions for GNC (and Australian Agriculture) for 2024.

Even after the recent rally, the stock remains cheap at a 6.6 P/E, a deceiving yield of 3.74% (which is actually 7.2% with fully-franked special dividends, and a price-to-assets ratio of 1.15.

Stock Picks #3 – Commonwealth Bank of Australia (ASX: CBA) and Macquarie Group (ASX: MQG) – but not yet

This is more a strategy than an outright pick. Financials hold their ground in recessionary periods, but you don’t have to take outright company risk at the beginning of the cycle.

Using Bank Hybrids is a good way to lock in yield at the top of the cycle, while still having some skin in the game in the banks, who traditionally don’t do well in a contracting money supply. Particularly, we like the diversified listed vehicle, Betashares Australian Major Bank Hybrids Index ETF (ASX: BHYB). This ETF offers a compelling yield above 7% after franking, which is only marginally lower than the average annual return of the indexes. Its diversified nature effectively smooths out the risks typically associated with holding positions in major financial institutions like the big four Australian banks.

At the same time, we're keeping a keen eye on Macquarie Bank and Commonwealth Bank. These two banks are the best in the sector and have been great performers when you “buy the dip”. Our strategy includes holding BHYB for its steady yield while being prepared to pivot back into CBA and MQG when their respective share prices fall below $90 and $150, which we expect to see during the late stages of the economic recovery phase. Financials are by far the most consistent performers when the economy restarts its expansion.

Embracing defence over offence in 2024

In a year likely to be more about defensive strategy than offensive manoeuvres, opting for more defensive investment options may not be as glamorous as high-risk plays. However, it's important to remember the fundamental principle: capital saved is as valuable as capital gain.

However, with the market presenting cheap prices in defensive plays, it makes it an easy choice to opt for safety in what will be an uncertain year for the global economy.

Founded by Investors for Investors

MPC Markets' mission is to empower every investor with the knowledge, tools, and guidance necessary to unlock their financial potential. Find out more.

2 topics

5 stocks mentioned

1 fund mentioned