Traders vs titans – the $2.8 billion lithium bet

Mining magnates and traders are facing off in a $2.8 billion bet on where lithium stocks should be valued.

On one side, you have the mining magnates, WA Billionaires Gina Rinehart, Chris Ellison, and Tim Goyde, all with long-term track records in mining. On the other side, we have the traders, basing their huge, short positions on the nosedive in Lithium futures contracts.

The traders have been here before, and it didn’t end well. In April this year, Liontown (ASX: LTR) announced an approach from Albemarle (NASDAQ: ALB) causing the stock to gap open 30% higher, finishing up 67% on the day wiping a rumoured $200 million-plus from short sellers' balance sheets.

But instead of licking their wounds, the short sellers have doubled down, with three of the top five most shorted stocks on the ASX being lithium stocks. As of 13 December, short positions across just 4 lithium miners totalled $2.861B with

- Pilbara minerals (ASX: PLS) 20.68% ($2.45B),

- Liontown (ASX: LTR) 7.54% ($264m)

- Core Lithium (ASX: CXO) 12.29% ($84m) and

- Sayona Mining (ASX: SYA) with a 9.11% (64m).

But yesterday's $ 1.7 billion bid for Azure Mineral (ASX: AZS) from Gina Rinehart and SQM, must have the traders nervous, particularly so soon after the skirmish in LTR earlier this year.

Around 10% ($1.2B) of the short in Pilbara has been initiated since October below the current price of $3.90

The rationale of the short sellers

The case for short sellers is based on speculation of an impending supply glut and a reduced demand for Electric vehicles. Both are thin arguments and subject to swings in the global economy, but the confirmation bias traders are getting from “underlying futures prices” is what gives them the confidence to take on the market.

The “underlying” Futures price - Many vocal shorters are basing their position on a nosedive in Lithium futures contracts. But increasingly, the validity of the futures move is being questioned, as prices realized by producers like PLS were only down 31% for the year in October, versus futures prices reflecting a 70% fall. Mineral Resources (ASX: MIN) executives have also raised questions about the Guangzhou futures market, saying they are being manipulated by battery chemical makers to negotiate better prices with suppliers, as there was “nothing fundamentally wrong with demand”

Lithium futures have only been around for a couple of years and the most liquid contract on GFEX has only been listed since July. This is very young for a derivatives market. GFEX contracts have a maximum daily limit up/down move regularly on a whim. Even the exchange itself recently voiced its concerns about short positions in the deliverable contract, increasing the daily move limit from 7% to 13% and scrambling to secure warehouses to secure the physical.

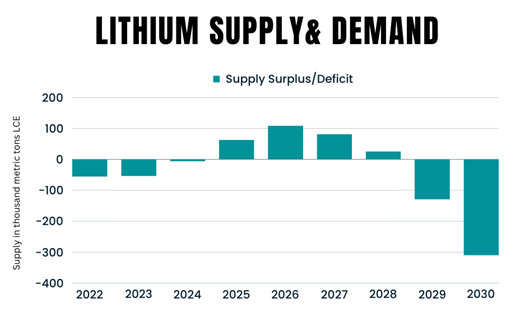

The supply glut – while there is a projected surplus of supply coming from 2025, it is predicted to only last three years, and then the supply deficit gets ugly.

International Lithium expert, Joe Lowry, told a conference in Singapore in April “based on estimates that we will need 3.7 million tonnes of lithium by 2030, That would take 25 world-class brine projects to come online in three years. I promise you that is not going to happen"

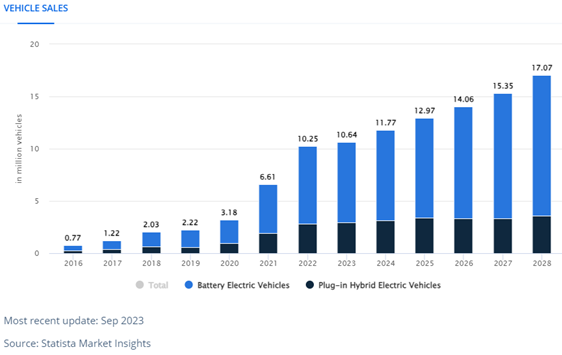

EV demand is waning – while the breakneck percentage speed of growth may not be projected in the coming years, the headline numbers are big. Next year will see around the same EV’s sold as the three years leading up to 2021 combined and most car manufacturers are setting record sales numbers.

The rationale of the Mining Titans

Mining Titans Gina Rinehart, Chris Ellison, and Tim Goyde have done it all before and are very good at what they do. The fact that Lithium isn’t particularly rare would be of little concern to these Titans as they have long track records in running profitable mining operations in literally the most abundant mineral on the planet, Iron Ore.

Long-term demand - The miners aren’t looking at the next 3 years, they are looking at the next 3 decades and want to position themselves early in the next essential mineral while diversifying their portfolios. Rio Tino recently commented on lithium being an attractive place to invest, saying “Market fundamentals for lithium remain strong as EV adoption continues to rise on supportive government policies and supply shortfalls requiring further investment”

Government support is in abundance - with the US “Inflation Reduction” Act and the Australian government's “Critical Minerals Strategy” the financial support is flowing, and these established players were already well-connected

Mines take a long time to build – These seasoned miners know that it’s a long road from discovery to production and the 2-3 year window for a “supply glut” may not turn out to be as gluttonous as predicted with new lithium mines taking longer than expected to hit production

Who to bet on?

So from an investor perspective, who do you back? Well, that depends on your timeframe and willingness to wear any potential pain caused by lower lithium prices. If your timeframe is less than a year, it's probably best to stand back and watch the show, but if you have confidence in the long-term prospects of lithium, now is a good time to start dollar-averaging

For us at MPC Markets we are more than happy to be invested in the safety of producers for now and look at the explorers once the current clash between traders and the real market continues. For us, Pilbara is easily the pick of the bunch, with $3.3 billion in cash, one of the lowest production costs, and the potential for a short squeeze of epic proportions.

Founded by Investors for Investors

MPC Markets' mission is to empower every investor with the knowledge, tools, and guidance necessary to unlock their financial potential. Find out more.

4 topics

7 stocks mentioned