Trump is giving newborns a US$1,000 investment account - why won't Australia follow suit?

As part of his “Big Beautiful Bill”, US President Donald Trump is giving all US children born between 2025 and 2028 a US$1,000 tax-deferred investment account that tracks the performance of the US stock market.

The child's guardian can also make additional annual contributions of up to US$5,000.

According to Trump, the policy is “a pro-family initiative that will help millions of Americans harness the strength of our economy to lift up the next generation”.

The policy has also received backing from many of the US’s business leaders, including the CEOs of Uber, Dell and Goldman Sachs.

The policy makes a lot of sense.

If we take the “time in the market” adage to heart, what could be better than a state-mandated and tax-free investment account that not only gets young people automatically invested into the stock market, but hopefully teaches them the importance of investing and also gives them a direct stake in the future of the economy?

Other countries are already offering something similar.

In the UK, everyone has access to investment and savings accounts known as ISAs (individual savings accounts).

The beauty of an ISA is that it lets anyone invest up to £20,000 per financial year and never pay any tax on the profits.

It’s a tax-exempt investing account that you can withdraw from at any time.

Individuals are free to put their allowance towards a classic savings account, stocks and shares account, peer-to-peer lending or a combination of all of them.

Junior ISAs (JISAs) allow parents to invest up to £9,000 a year which is then locked until the child turns 18.

Japan also launched its own ISA program in 2014.

Singapore has a Baby Bonus Scheme where the government matches contributions made by parents into what is effectively a government-sponsored trust fund.

Meanwhile in Australia, parents need to lodge a tax return if they buy shares on behalf of their child and if they earn more than the princely sum of $416.

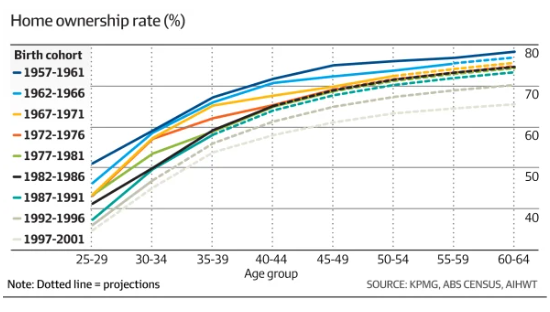

It’s also no surprise that the closest Australia has come to incentivising young people to invest all revolve around property, despite home ownership already being out of the reach of many young Australians and likely to stay that way.

Outside super contributions, first home buyer grants, stamp duty discounts and first home buyer super schemes, are the only tax-based investing incentives on offer for young Australians, and all have the (almost certainly-intended) impact of pushing property prices up.

And that’s before we even mention the Coalition’s hare-brained policy that allowed young Australians to withdraw money from their super to put towards buying property.

If it’s not going to prop up the property market, successive Australian governments of both stripes have shown no interest in throwing a bone to young Australians.

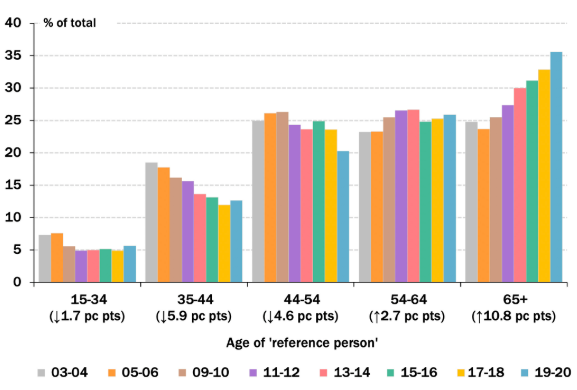

Australian household wealth by age group

And not only are there effectively no dangled carrots to encourage them to invest money in the stock market, there’s a complete lack of education too.

As the generational wealth gap grows, it’s more important than ever to be encouraging young people to invest.

Australia is falling behind.

3 topics